Low Voltage Circuit Breaker Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Low Voltage Circuit Breaker Market Size and Share:

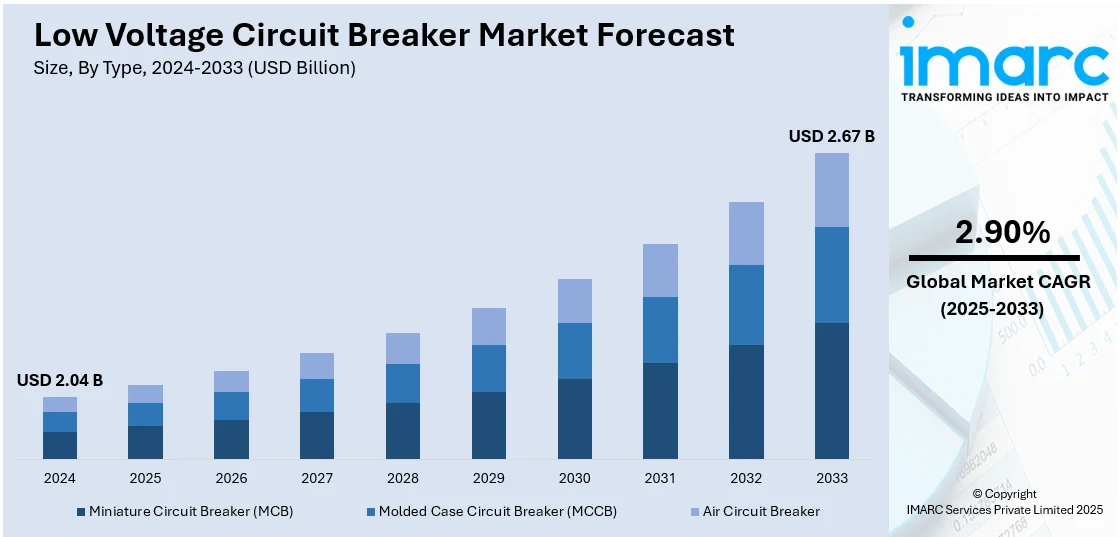

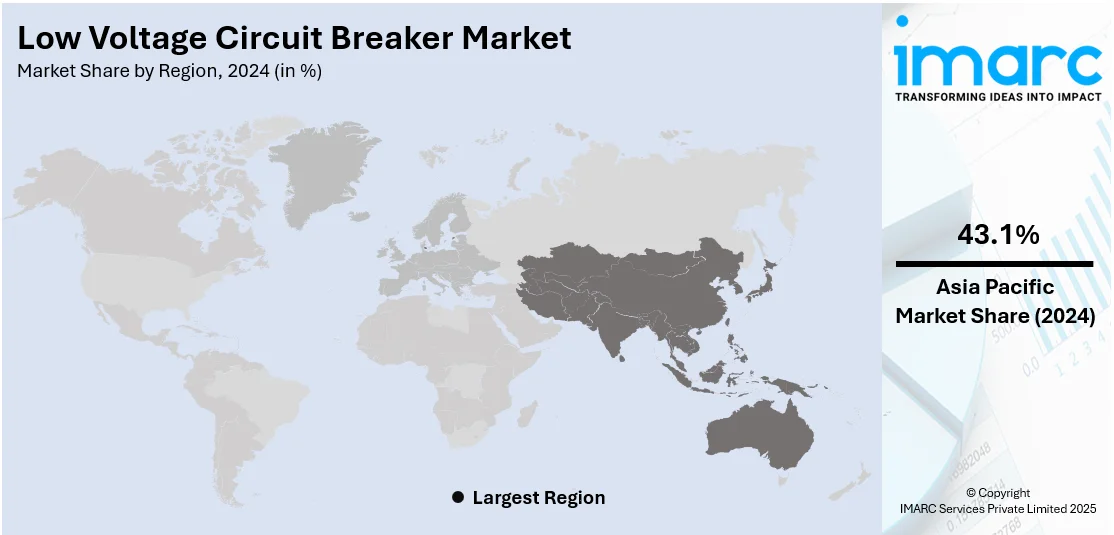

The global low voltage circuit breaker market size was valued at USD 2.04 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.67 Billion by 2033, exhibiting a CAGR of 2.90% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 43.1% in 2024. The market is majorly driven by the increasing requirement for dependable circuit protection devices in electrical distribution systems, along with rising electricity requirements across residential, commercial, and industrial domains. In addition to this, favourable governmental efforts regarding energy consumption are further propelling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.04 Billion |

|

Market Forecast in 2033

|

USD 2.67 Billion |

| Market Growth Rate (2025-2033) | 2.90% |

The growing need for electrical safety in the commercial, industrial, and residential sectors is one of the factors propelling the Low Voltage Circuit Breaker (LVCB) market. The increased use of LVCBs to guard against overloads, short circuits, and electrical failures is due to the increased emphasis on sustainability and energy efficiency in electrical systems. The industry is further boosted by the need for sophisticated protection systems brought about by the growth of renewable energy applications like solar and wind power. Because circuit breakers are necessary for safe electrical distribution in new buildings and facilities, the growing infrastructure and construction sectors also increase demand. Innovations in technology, such as smart circuit breakers with remote integration and monitoring, improve their performance and fuel market expansion. Furthermore, the National Electrical Code (NEC) and other strict safety rules encourage the broad use of LVCBs.

The rising need for electrical safety in the commercial, industrial, and residential sectors is propelling the Low Voltage Circuit Breaker (LVCB) market in the United States. The increasing use of renewable energy sources, such as wind and solar, need improved electrical system protection. For instance, in September 2024, The Interstate Renewable Energy Council (IREC) and International City/County Management Association (ICMA) unveiled Energy Ready, a new integrated effort funded by the U.S. Department of Energy (DOE) that helps regional governments with free technical assistance and recognizes their improvements in zoning, planning, and for permitting distributed energy generation. Energy Ready unveiled at the annual ICMA Conference, expands on SolSmart's achievements in assisting communities in lowering obstacles to using solar energy. Since new facilities need circuit breakers for safe electrical distribution, growing infrastructure projects and building activities also support market expansion. The market demand is further increased by developments in smart LVCBs, which provide capabilities like integration and remote monitoring. The National Electrical Code (NEC) and other strict safety rules and laws encourage the extensive usage of LVCBs in a variety of applications.

Low Voltage Circuit Breaker Market Trends:

Rising demand for electricity and infrastructure modernization

The increasing demand for electricity across residential, commercial, and industrial sectors is one of the key drivers fueling the growth of the low voltage circuit breaker market. According to the International Energy Agency, the global electricity demand elevated by 2.2% in 2023. The demand for efficient electricity distribution networks increases as industrialization and urbanization continue to spread. This demand is compelling industries to invest in modernizing and upgrading their electrical infrastructure, contributing to the increasing demand for low voltage circuit breakers. Moreover, expanding efforts in replacing outdated circuit protection equipment with advanced low voltage circuit breakers that offer enhanced performance, reliability, and safety is strengthening the market growth. In addition to this, the growing need to accommodate higher power loads while ensuring uninterrupted supply is fueling the adoption of modern circuit breakers.

Stringent electrical safety regulations and standards

The market for low voltage circuit breakers is being greatly impacted by the implementation of stricter regulations and the increased awareness of electrical safety. Because low voltage circuit breakers can quickly interrupt faulty circuits, they improve electrical safety and assist organizations in meeting legal requirements. This is why governments and regulatory bodies are enacting guidelines to ensure the safety of electrical installations and appliances. Concurrent with this, the expanding product adoption across various industrial verticals, as mandated by regulatory standards, to prevent electrical accidents, fires, and other hazards is acting as another growth-inducing factor. According to Central Electricity Authority, during 2021-2022, the total number of electrical accidents occurred across India are 13855. Additionally, the market is expanding due to the growing need for circuit breakers that can quickly identify and react to electrical faults, preventing overloads, short circuits, and ground faults.

Technological advancements and smart solutions

The low voltage circuit breaker market dynamics have changed dramatically as a result of smart feature integration and technological improvements in circuit breaker design. Innovative technologies including microprocessor-based trip units, remote monitoring features, and Internet of Things integration are being used by manufacturers. For instance, in August 2024, Menlo Microsystems announced the development of a high-power MEMS technology-based circuit breaker for the U.S. Navy’s electrical systems, offering a more compact form factor, improved reliability, and quicker switching. These capabilities help users recognize possible problems and take preventative measures by enabling real-time monitoring, data analysis, and predictive maintenance. In addition, smart circuit breakers maximize the efficiency and uptime of electrical systems by offering insightful information about their performance and health. Additionally, the ability to remotely control and manage circuit breakers enhances operational flexibility and minimizes downtime. Furthermore, this fusion of technology with circuit breaker design is driving the adoption of these advanced solutions across various industries.

Low Voltage Circuit Breaker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global low voltage circuit breaker market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Miniature Circuit Breaker (MCB)

- Molded Case Circuit Breaker (MCCB)

- Air Circuit Breaker

Miniature circuit breaker (MCB) stand as the largest component in 2024, holding around 52.2% of the market. According to the report, miniature circuit breaker (MCB) represented the largest segment. According to low voltage circuit breakers market insights, MCBs are the most popular type of circuit breaker worldwide due to their small size, improved safety features, and versatility. The compact dimensions of MCBs make them a popular option for installations with limited space as electrical systems become more complex and space-efficient, which bodes well for market growth. Additionally, their adoption is being fueled by their accurate protection against short circuits and overcurrents, as well as their quick reaction and reset capabilities, which improve the safety of electrical networks. Moreover, MCBs can be installed in commercial, industrial, and residential contexts and are environmentally adaptive. The demand for MCBs is also increasing due to the growing requirement for customized electrical solutions and their capacity to provide circuit-specific protection. Low voltage MCBs are an essential part of contemporary electrical systems because of their crucial function in averting interruptions and protecting equipment.

Analysis by Application:

- Energy Allocation

- Shut-off Circuit

- Others

Shut-off circuit leads the market with around 56.5% of market share in 2024. According to the report, shut-off circuit accounted for the largest market share. The shut-off circuit segment is expected to continue to dominate the global market, largely due to its vital function in preventing overloads and electric failures, according to the low voltage circuit breaker market forecast. Low voltage circuit breakers provide a precise and efficient solution in situations when quick circuit interruption is necessary for operational or safety reasons, such as emergency shut-off systems or protecting vital equipment. In addition, their quick-tripping system minimizes possible damage and downtime by ensuring that malfunctioning circuits are isolated quickly. Additionally, they are appropriate for a variety of shut-off circuit applications due to their adaptability in managing varied fault currents and compatibility with diverse load types, which supports the market's growth. Low voltage circuit breakers' reliable performance in quickly disconnecting circuits provides significant value to shut-off circuit configurations, driving their demand in these crucial applications as industries place a higher priority on operational efficiency and system protection.

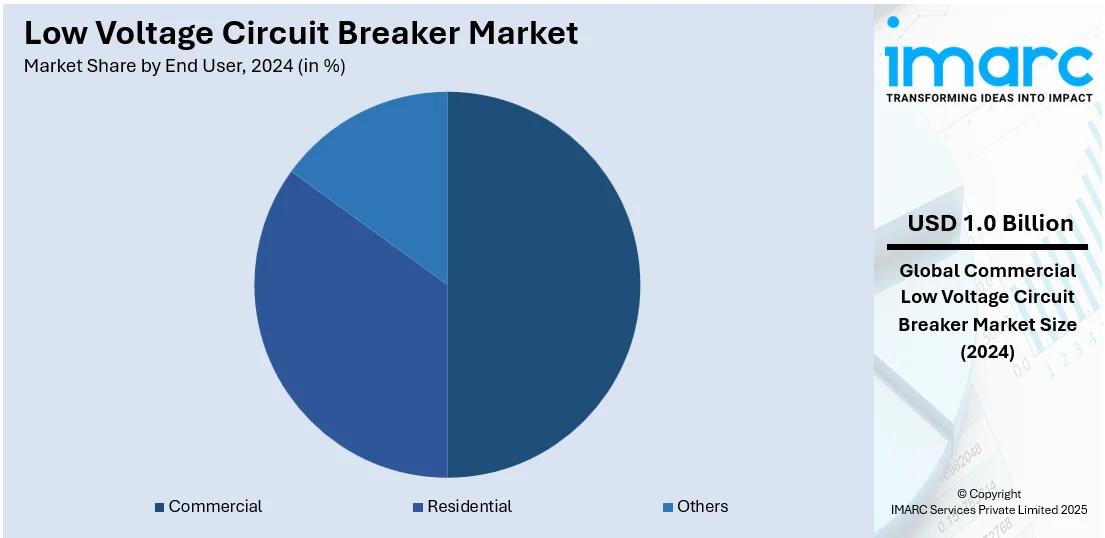

Analysis by End User:

- Residential

- Commercial

- Others

Commercial electronics leads the market with around 50.3% of market share in 2024. The expanding infrastructure projects and the rising need for efficient energy management in commercial spaces, office buildings, and retail establishments are the main drivers of the commercial segment of the worldwide low voltage circuit breaker market's notable expansion. Additionally, these circuit breakers guarantee a steady power supply, protecting delicate equipment from serious or minor electrical problems. Additionally, as more commercial buildings embrace automation and smart technologies, there is a noticeable rise in the need for dependable and modernized advanced low voltage circuit breakers to meet safety and energy efficiency requirements.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 43.1%. According to the report, Asia Pacific represents the largest regional market for low voltage circuit breaker. In the Asia Pacific area, rapid urbanization, industrialization, and population expansion are fueling rising power consumption across all industries. Asia Pacific is expected to consume half of the world's electricity by 2023, according to industry reports. This surge in demand necessitates efficient and reliable power distribution, leading to heightened investments in electrical infrastructure and subsequent adoption of advanced circuit protection technologies, fuelling the low voltage circuit breaker market growth in Asia Pacific. Strong electrical systems and safety measures are also necessary for the region's growing building activities, which include residential, commercial, and industrial developments. These factors support the market's expansion. Apart from this, enterprises are being pushed to implement contemporary low voltage circuit breakers to guarantee compliance and avert mishaps due to the existence of strict safety laws and an increased awareness of electrical hazards. Additionally, the demand for intelligent circuit protection solutions is being created by the spread of smart cities and infrastructure projects in countries, especially in China, India, and Southeast Asia. This is improving the market's growth prospects in the Asia Pacific region.

Key Regional Takeaways:

North America Low Voltage Circuit Breaker Market Analysis

The increasing need for dependable and effective electrical protection in the commercial, industrial, and residential sectors is one of the key factors propelling the Low Voltage Circuit Breaker (LVCB) market in North America. The need for LVCBs is increased by the growing use of renewable energy sources like wind and solar, which necessitate sophisticated electrical system protection measures. The market expansion is also fueled by the growing emphasis on energy efficiency and the requirement to safeguard electrical installations against overloads and short circuits. The growth of the infrastructure and construction industries also plays a part as new industrial facilities and buildings need LVCBs for electrical safety. The market is also being driven by technological developments in LVCB design that provide features like smart integration and remote monitoring. The extensive usage of circuit breakers is guaranteed by North American safety regulations and standards, such as the National Electrical Code (NEC), which emphasizes the necessity of dependable electrical protection systems in a variety of industries.

United States Low Voltage Circuit Breaker Market Analysis

In 2024, the United States accounted for the market share of over 86.10%. Due to a number of industry-specific variables, the Low Voltage Circuit Breaker (LVCB) market in the US is now expanding significantly. The need for dependable and effective circuit protection solutions is being fueled by rising energy usage in the commercial, industrial, and residential sectors. The U.S. Energy Information Administration reported that the country's energy consumption was 32% between January and July 2024. The need for sophisticated LVCBs that can ensure electrical safety and operational continuity is growing as a result of the expansion of infrastructure, including data centers, smart homes, and commercial buildings. More advanced circuit breakers are being required to handle intricate electrical grids and guarantee grid stability as a result of ongoing expenditures in renewable energy sources like solar and wind. The adoption of LVCBs across industries is also being aided by the U.S. government's significant emphasis on electrical safety regulations and energy saving. In order to draw in more clients, manufacturers are also creating circuit breakers with better capabilities like remote monitoring and connection with building management systems. LVCB use is also developing as a result of the increased focus on industrial automation and the growing trend of electrification in the transportation and automotive sectors. The market for low voltage circuit breakers is still experiencing high demand across a multitude of industries as the nation of America concentrates on updating its electrical infrastructure, which guarantees development prospects for major market participants.

Europe Low Voltage Circuit Breaker Market Analysis

The continued use of renewable energy sources, particularly solar and wind power, is driving the Low Voltage Circuit Breaker (LVCB) market's continuous expansion in Europe. The UK government claims that in the second quarter of 2023, the amount of electricity generated by renewable sources rose by 19%. The need for LVCBs to effectively manage power distribution systems is growing as Europe moves more and more toward greener energy options. Manufacturers are concentrating on enhancing the dependability of circuit breakers and integrating them with smart grid technologies, which are becoming more popular in the area. The LVCB industry is being further stimulated by nations fortifying their energy infrastructure in order to comply with EU rules on power efficiency and safety. Additionally, the growing trend towards industrial automation and smart buildings is increasing the need for LVCBs to ensure safety and system continuity in residential, commercial, and industrial applications. The rise in construction activities, especially in renewable energy plants, data centres, and electric vehicle charging stations, is driving the demand for advanced electrical protection systems. Furthermore, ongoing technological advancements in LVCBs, such as enhanced thermal and overload protection, are encouraging their use in diverse sectors. Governments and utilities are also focusing on upgrading aging electrical infrastructure, promoting the adoption of more efficient and durable circuit breakers. Together, these factors are contributing to the rapid expansion of the LVCB market in Europe.

Latin America Low Voltage Circuit Breaker Market Analysis

Latin America's Low Voltage Circuit Breaker (LVCB) market is expanding significantly at the moment because of a number of important factors. Reliable electrical protection systems are becoming more and more necessary as a result of the growing urbanization in nations like Brazil, Mexico, and Argentina, which is fueling an expansion of residential, commercial, and industrial infrastructure. Eighty-seven percent of Brazilians live in cities, according to UN Habitat. LVCBs are becoming more and more necessary to maintain operational safety and efficiency in power distribution systems as a result of continued industrialization and the growth of renewable energy projects, especially solar and wind energy installations. Additionally, the increasing focus on electrical safety regulations and standards is prompting industries and utilities to adopt more advanced protection solutions. The rise in smart grid and automation technologies is also influencing the adoption of advanced low voltage circuit breakers, as these systems are integral to maintaining power distribution reliability and minimizing downtime. Furthermore, the surge in construction activities in key Latin American economies is resulting in higher demand for electrical products, including LVCBs, in both new buildings and retrofitting projects. Finally, governments and private enterprises are prioritizing investments in infrastructure upgrades, particularly in aging power distribution networks, which is fuelling the demand for modern circuit breakers capable of supporting higher loads and improving system resilience.

Middle East and Africa Low Voltage Circuit Breaker Market Analysis

The Low Voltage Circuit Breaker (LVCB) market in the Middle East and Africa is experiencing significant growth due to the ongoing surge in urbanization and infrastructure development across the region. About 67% of people in the Republic of South Africa live in cities, making it one of the continent's most urbanized nations, according to UN Habitat. Governments are investing heavily in smart cities and urban infrastructure, which is increasing the demand for reliable and efficient electrical systems. Additionally, the rapid industrialization in sectors such as oil and gas, manufacturing, and construction is pushing the need for enhanced electrical protection systems, which is driving the adoption of LVCBs. The increasing focus on energy efficiency and the integration of renewable energy sources, such as solar and wind, is also fuelling market growth, as LVCBs are essential for ensuring safe electrical distribution in these applications. Furthermore, the need for sophisticated circuit protection systems is being fueled by rising automation and digitization of buildings and industrial facilities. Furthermore, as regulations around electrical safety and energy efficiency continue to tighten, utilities and enterprises are upgrading their infrastructure, ensuring more widespread deployment of LVCBs. The demand for renewable energy systems, along with ongoing efforts to modernize the electrical grid, is steadily driving the market expansion in both commercial and residential sectors.

Competitive Landscape:

Major companies in the fiercely competitive Low Voltage Circuit Breaker (LVCB) market are strengthening their positions by concentrating on innovation, strategic alliances, and regional growth. The market is dominated by major firms like Siemens, ABB, Schneider Electric, and Eaton, who provide cutting-edge products like smart circuit breakers with integration and remote monitoring features. Regional companies also help by offering affordable, personalized goods. Growing R&D expenditures propel the creation of sustainable and energy-efficient LVCBs. Mergers, acquisitions, and partnerships aimed at diversifying product portfolios and satisfying changing consumer demands across industries further influence the competitive landscape of the market. For instance, in March 2024, Schneider Electric unveiled the MasterPacT MTZ Active, a revolutionary low voltage air circuit breaker designed to improve power distribution in vital sectors like data centers.

The report has also analysed the competitive landscape of the market with some of the key players being:

- ABB Ltd.

- CHINT Group

- Eaton Corporation plc

- E-T-A Elektrotechnische Apparate GmbH (Ellenberger &poensgen Gesellschaft Mit Beschrankter Haftung)

- Fuji Electric FA Components & Systems Co., Ltd. (Fuji Electric Co. Ltd)

- Hager Group

- Hyundai Electric & Energy Systems Co. Ltd.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Schneider Electric SE

- Shanghai Delixi Group Co. Ltd.

- Siemens AG.

Latest News and Developments:

- February 2019: Masterpact MTZ, the next generation of high-power, low-voltage circuit breakers, was introduced by Schneider Electric to the Indian market. The market's first air circuit breaker, the Masterpact MTZ, offers customers improved performance, dependability, and safety.

- July 2023: Siemens, a well-known automation and technology business, unveiled improved versions of its air circuit breakers, expanding its 3WA circuit breaker series. The new Series 3WA3 is designed to improve reliability, digitization, and ease of use when combined with the existing systems.

- March 2024: MasterPacT MTZ Active is a new low voltage air circuit breaker from Schneider Electric, a leading energy management and digital automation company. It was created to enable real-time power measurement and monitoring to support decision-making, reduce downtime, and raise sustainability goals while ensuring business continuity.

- June 2024: Siemens Smart Infrastructure and BASF unveiled the first electrical safety device with components created from biomass-balanced polymers. Siemens SIRIUS 3RV2 circuit breakers, which are used in a variety of industrial and infrastructure applications, are now made with BASF's Ultramid® BMBcertTM and Ultradur® BMBcertTM, which substitute biomethane from renewable resources, such as agricultural waste, for fossil feedstock at the start of the value chain.

Low Voltage Circuit Breaker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Miniature Circuit Breaker (MCB), Molded Case Circuit Breaker (MCCB), Air Circuit Breaker |

| Applications Covered | Energy Allocation, Shut-off Circuit, Others |

| End Users Covered | Residential, Commercial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., CHINT Group, Eaton Corporation plc, E-T-A Elektrotechnische Apparate GmbH (Ellenberger &poensgen Gesellschaft Mit Beschrankter Haftung), Fuji Electric FA Components & Systems Co., Ltd. (Fuji Electric Co. Ltd), Hager Group, Hyundai Electric & Energy Systems Co. Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Schneider Electric SE, Shanghai Delixi Group Co. Ltd., Siemens AG., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the low voltage circuit breaker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global low voltage circuit breaker market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the low voltage circuit breaker industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

A Low Voltage Circuit Breaker is an electrical safety device designed to protect circuits from overloads, short circuits, and electrical faults. Operating within low voltage ranges (up to 1,000V), LVCBs automatically interrupt electrical flow when abnormal conditions are detected, preventing damage to electrical equipment, and ensuring system safety.

The global Low Voltage Circuit Breaker market was valued at USD 2.04 Billion in 2024.

IMARC estimates the global Low Voltage Circuit Breaker market to exhibit a CAGR of 2.90% during 2025-2033.

The key factors driving the Low Voltage Circuit Breaker market are the increasing demand for electrical safety, the growth of renewable energy sources, infrastructure development, and rising energy efficiency concerns. Technological advancements in smart circuit breakers and regulatory safety standards also contribute to the market's growth.

According to the report, miniature circuit breaker (MCB) represented the largest segment by type, due to their compact size, cost-effectiveness, and widespread use in residential applications.

Shut-off circuit leads the market by application due to their essential role in preventing electrical hazards and ensuring system safety.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Low Voltage Circuit Breaker market include ABB Ltd., CHINT Group, Eaton Corporation plc, E-T-A Elektrotechnische Apparate GmbH (Ellenberger &poensgen Gesellschaft Mit Beschrankter Haftung), Fuji Electric FA Components & Systems Co., Ltd. (Fuji Electric Co. Ltd), Hager Group, Hyundai Electric & Energy Systems Co. Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, Schneider Electric SE, Shanghai Delixi Group Co. Ltd., Siemens AG., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)