Logistics Automation Market Size, Share, Trends and Forecast by Component, Function, Enterprise Size, Industry Vertical, and Region, 2025-2033

Logistics Automation Market Size and Share:

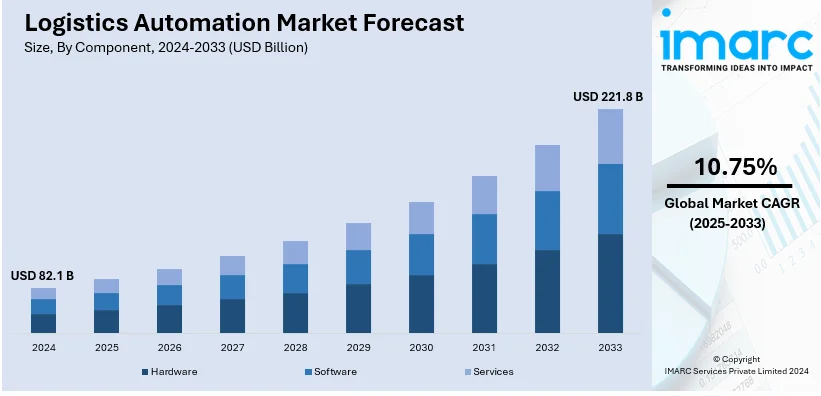

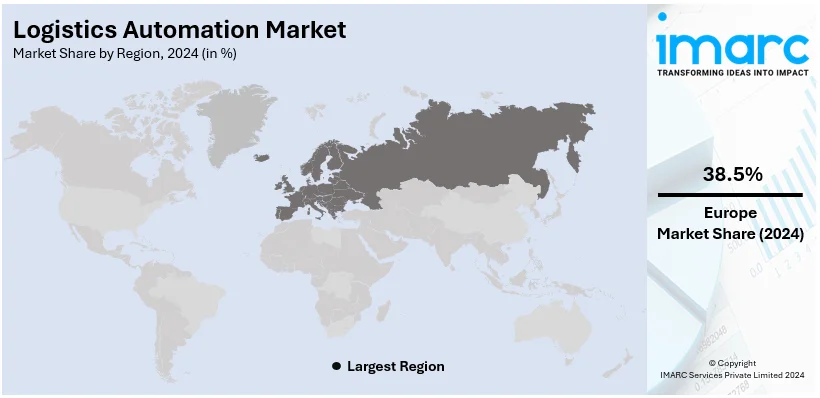

The global logistics automation market size was valued at USD 82.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 221.8 Billion by 2033, exhibiting a CAGR of 10.75% from 2025-2033. Europe currently dominates the market, holding a market share of over 38.5% in 2024. The growth of the European region is driven by sophisticated logistics systems, rising e-commerce engagement, and the swift embrace of automation technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 82.1 Billion |

| Market Forecast in 2033 | USD 221.8 Billion |

| Market Growth Rate (2025-2033) | 10.75% |

The rising popularity of online shopping is driving the need for efficient logistics operations. Companies are automating processes like inventory management, order fulfillment, and last-mile delivery to meet the high volume and rapid delivery expectations of online shoppers. Automation reduces errors, speeds up processes, and ensures client satisfaction. Moreover, continuous innovations in robotics, artificial intelligence (AI), and machine learning (ML) are transforming logistics. Automated guided vehicles (AGVs), robotic sorters, and AI-powered route optimization tools enhance efficiency and reduce operational costs. These technologies enable real-time decision-making and predictive analytics, making supply chains more agile. Additionally, the growing need for real-time tracking and end-to-end visibility in supply chains is encouraging the adoption of automation solutions. Technologies like the internet of things (IoT), radio frequency identification (RFID), and cloud computing enable seamless integration and tracking, improving operational transparency and efficiency.

The United States plays a crucial role in the market, driven by the ongoing labor shortages in the logistics sector and increasing wages. Automated technologies such as robotic sorting, packing, and picking assist in decreasing reliance on human workers while ensuring high standards of productivity and accuracy. In addition to this, the partnership among industry leaders is fostering innovation in logistics automation, with companies prioritizing the improvement of supply chain efficiencies. Collaborations focused on incorporating autonomous technologies into warehouse operations are tackling significant issues such as labor shortages and demands for efficiency. In 2024, KION North America and Fox Robotics announced a strategic partnership to manufacture and assemble FoxBot autonomous trailer loaders/unloaders (ATLs) at KION’s site in South Carolina. This collaboration aims to enhance Fox Robotics' supply chain and meet the growing demand for automation in loading dock operations at warehouses. The FoxBot ATL improves safety, efficiency, and comprehensive warehouse automation.

Logistics Automation Market Trends:

Expansion of High-Speed Internet and Smartphone Penetration

The rising access to high-speed internet and the widespread use of smartphones are leading to the growing popularity of e-commerce platforms. As internet access broadens, people are increasingly encouraged to shop online, resulting in a heightened demand for effective and automated logistics systems to manage the increase in order volumes. According to the United Kingdom government, between 2020 and 2023, the proportion of homes and businesses in the UK with 'gigabit' internet access increased from 27% to 76%. This signifies one of the main elements influencing the market. This swift growth is improving the capacity of e-commerce platforms to offer quicker and more dependable services, fostering increased user interaction. The combination of improved internet infrastructure and the convenience of smartphone use allows people to effortlessly access e-commerce services, increasing the need for efficient logistics automation to meet delivery demands and effectively handle growing transaction volumes.

Increasing Investments in Warehouse Automation

The rising count of warehouses globally, coupled with the escalating investments in automation for these facilities, is fostering an optimistic market outlook. This trend is supported by the need for efficient warehousing and inventory management systems that reduce dependence on manual labor while improving operational costs. Automation solutions such as automated storage and retrieval systems (AS/RS) and robotics are being adopted to enhance efficiency, accuracy, and scalability in warehouse operations. To meet the growing demand for faster order processing, automated warehouses are crucial for managing high inventory turnover and enhancing efficiency. The IMARC Group states that the global warehousing and storage market size reached USD 523.8 billion in 2024. These developments emphasize the critical significance of warehouse automation in addressing the hurdles of modern supply chains and maintaining a competitive advantage in a dynamic market landscape.

Adoption of Advanced Robotics in Logistics Facilities

The incorporation of cutting-edge robotics into logistics centers is transforming supply chain processes, greatly improving efficiency and sustainability. Automated systems, like robotic picking technologies, are being implemented to enhance material handling and order fulfillment operations. These technologies significantly cut down processing times and lower energy use, supporting sustainability objectives. Logistics facilities powered by robotics can handle large order quantities with increased accuracy, guaranteeing smooth operations even in times of high demand. The implementation of these systems indicates the growing trend among businesses to invest in creative solutions that boost productivity, improve space usage, and lower operational expenses. These developments enhance supply chain efficiency and allow companies to gain a competitive advantage in fast-changing markets, showcasing a solid dedication to technological progress and user satisfaction. In 2024, Renault introduced a completely automated logistics center in Villeroy utilizing Exotec’s Skypod robots, setting a global precedent for automobile production. The facility enhances efficiency by decreasing processing time by six times and lowering energy usage by 30%, managing as many as 40,000 order lines each day. This collaboration emphasizes Renault's dedication to innovation and outstanding supply chain performance.

Logistics Automation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global logistics automation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, function, enterprise size and industry vertical.

Analysis by Component:

- Hardware

- Mobile Robots (AGV, AMR)

- Automated Storage and Retrieval Systems (AS/RS)

- Automated Sorting Systems

- De-palletizing/Palletizing Systems

- Conveyor Systems

- Automatic Identification and Data Collection (AIDC)

- Order Picking

- Software

- Warehouse Management Systems (WMS)

- Warehouse Execution Systems (WES)

- Services

- Value Added Services

- Maintenance

In 2024, hardware [mobile robots (AGV, AMR), automated storage and retrieval systems (AS/RS), automated sorting systems, de-palletizing/palletizing systems, conveyor systems, automatic identification and data collection (AIDC), and order picking] leads the market with a 54.2% share. Hardware commands the biggest market share, bolstered by the widespread utilization of advanced devices such as automated storage and retrieval systems (AS/RS), conveyor systems, and mobile robots. These technologies are crucial for optimizing warehouse activities, advancing material management, and ensuring accuracy in order processing. Automated sorting systems, along with de-palletizing and palletizing solutions, enhance efficiency by minimizing manual work and accelerating inventory management processes. Automated identification and data collection (AIDC) technologies like barcode readers, RFID, and IoT-enabled devices facilitate real-time monitoring and transparency, improving operational choices and reducing mistakes. Moreover, firms are employing sophisticated robotics for monotonous tasks, allowing workers to focus on activities that add value. The integration of these systems boosts overall supply chain efficiency, ensuring faster delivery times and greater accuracy.

Analysis by Function:

- Warehouse and Storage Management

- Transportation Management

Warehouse and storage management dominate the market with 66.8% of market share in 2024. Warehouse and storage management is the largest segment, supported by the increasing demand for effective inventory control and smooth operations. AS/RS, robotics, and IoT technologies are extensively utilized to improve inventory precision, diminish dependence on manual work, and maximize warehouse efficiency. These sophisticated solutions allow for real-time monitoring, quicker picking and sorting, and effortless integration with supply chain management systems, promoting efficient operations and minimizing downtime. The growing intricacy of supply chains and the demand for swift order processing are rendering automation an essential investment for companies in all sectors. In addition, automated warehouses improve safety by reducing workplace accidents and enhancing ergonomics for employees. The need for scalability and flexibility is prompting companies to implement adaptable systems that efficiently manage varying inventory levels and seasonal peaks.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead the market with 75.4% of market share in 2024. Large enterprises dominate the market due to their extensive and complex supply chain operations, which demand advanced solutions to efficiently manage high volumes, diverse product lines, and multiple distribution channels. These organizations combine robotics, AI, and IoT-enabled systems to improve warehouse management, optimize transportation, and maintain high order accuracy levels. Large enterprises, equipped with substantial financial resources, invest significantly in innovative technologies like AGVs, AS/RS, and modern conveyor systems to enhance operational efficiency, lower labor expenses, and decrease mistakes. They also emphasize real-time data analysis and supply chain integration to achieve comprehensive visibility, allowing for improved forecasting, proactive decision-making, and quicker responses to changes in the market. Additionally, the scalability and adaptability of automation systems enable these businesses to respond to seasonal increases, worldwide operations, and changing user needs.

Analysis by Industry Vertical:

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast-Moving Consumer Goods (FMCG)

- Retail and E-Commerce

- 3PL

- Aerospace and Defense

- Oil, Gas and Energy

- Chemicals

- Others

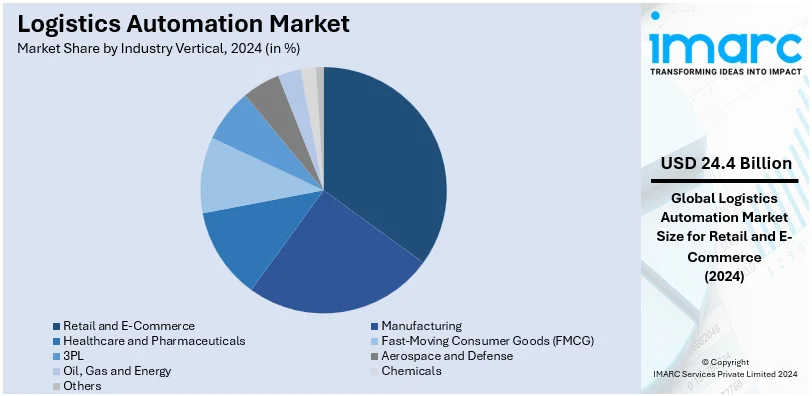

In 2024, retail and e-commerce accounted for the largest market share of 29.7%. The retail and e-commerce sector leads the market due to its high demand for fast, accurate, and efficient order fulfillment. The rise in online shopping continues to push companies toward advanced warehousing solutions, such as automated storage, sorting, and retrieval systems, capable of handling large inventories. Businesses are utilizing robotics, AI, and IoT technologies to boost last-mile delivery, enhance supply chain transparency, and guarantee real-time tracking. These solutions allow businesses to minimize mistakes, speed up delivery times, and improve individual satisfaction by increasing transparency and accuracy. The sector is also focusing on advanced analytics to predict demand patterns and optimize resource allocation. Additionally, the pressure to handle seasonal spikes and fluctuating order volumes efficiently is leading to higher investments in scalable automation systems, further solidifying the retail and e-commerce segment's dominance in the logistics automation market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share, reaching 38.5%. Europe leads the market because of its sophisticated supply chain systems, increasing e-commerce adoption, and focus on efficiency in operations. The area gains from robust technological implementation, as companies are incorporating robotics, IoT, and AI into their logistics operations to improve efficiency and precision. Regulatory structures promoting sustainable practices are leading businesses to implement energy-efficient automation systems, which boosts market expansion. Furthermore, the growing number of collaborations among major players and sector-specific companies improves operational efficiency, productivity, and client satisfaction. These partnerships enhance market visibility, foster regional development, and meet industry-specific needs, reinforcing Europe's status as a frontrunner in logistics automation. In 2024, GXO Logistics revealed a collaboration with Forum Sport to oversee two automated logistics hubs in Spain, enhancing supply chain functions through cutting-edge technology. This partnership seeks to improve efficiency, client contentment, and sustainability within the sports equipment industry. The deal enhances GXO's footprint in Northern Spain and fosters Forum Sport's expansion and operational efficiency.

Key Regional Takeaways:

United States Logistics Automation Market Analysis

In North America, the United States accounted for 91.30% of the total market share. The United States is becoming one of the leading regions in the logistics automation market due to the presence of major technology-driven companies, robust infrastructure, and ongoing investments in automation technologies. For example, in December 2024, the Massachusetts Institute of Technology Center for Transportation & Logistics (MIT CTL) and intralogistics leader Mecalux initiated a five-year partnership focused on speeding up the integration of self-learning artificial intelligence (AI) in logistics activities. In collaboration with MIT's Intelligent Logistics Systems Lab, the two organizations will investigate groundbreaking AI applications that could provide significant benefits to both companies and society. In accordance with this, the swift growth of e-commerce leaders such as Amazon and Walmart is driving the need for quicker and more effective logistics processes. According to reports, in 2022, sales of Amazon in the North American segment experienced a year-over-year growth of 13%, reaching a total of USD 315.9 Billion.

Europe Logistics Automation Market Analysis

Europe is becoming a notable region in the logistics automation sector, with countries like Germany, the UK, and France leading the way in adopting automated solutions. The European market displays a growing demand for advanced warehouse management systems, automated materials handling solutions, and autonomous vehicles. For example, Wayzim launched automated logistics services in the European Union market. In accordance with this, the European countries are progressively concentrating on lowering emissions and energy usage, leading to the implementation of green logistics technologies, like electric self-driving delivery vehicles. This, consequently, is driving the growth of the market. Moreover, the expansion of online shopping is significantly increasing the demand for faster, more efficient logistics solutions. According to the International Trade Administration, the United Kingdom had approximately 71.8 million internet users. Additionally, numerous European countries are embracing Industry 4.0, encouraging the integration of automated systems in logistics operations.

Asia Pacific Logistics Automation Market Analysis

The logistics automation market in the Asia-Pacific area is currently experiencing swift growth, backed by nations including China, Japan, South Korea, and India. The region is placing considerable emphasis on developing infrastructure, enhancing e-commerce, and promoting technological progress in logistics. According to the International Trade Administration, India's e-commerce sector is experiencing rapid growth, positioning it among the fastest expanding markets globally. Furthermore, in 2020, the market's worth reached USD 46.2 Billion. Additionally, numerous events such as trade fairs and exhibitions occur across the area, thereby enhancing market growth. For instance, in 2024, SICK India, a prominent player in the sensor technology sector, participated in the LogiMAT India 2024 exhibition. Organized by Messe Stuttgart India, the event served as a crucial center for the logistics automation field, bringing together industry leaders to showcase their latest innovations. Such marketing events greatly enhance the uptake of automation in the logistics sector, consequently benefiting market growth.

Latin America Logistics Automation Market Analysis

Latin America is gradually adopting logistics automation, with countries like Brazil, Mexico, and Argentina leading the way. However, the market is still being in the early stages compared to other regions. In line with this, the middle class is growing, and incomes are rising in countries like Brazil and Mexico, driving the demand for better logistics infrastructure. Moreover, due to growing urbanization the demand for logistics automation is also propelling. According to the CIA, in the year 2023, 87.8% of total population of Brazil lived in urban areas.

Middle East and Africa Logistics Automation Market Analysis

The Middle East and Africa region is witnessing steady progress in logistics automation, as nations like the UAE, Saudi Arabia, and South Africa are concentrating on improving their logistics frameworks to cater to the demands of swiftly expanding sectors such as oil and gas, retail, and e-commerce. The International Trade Administration states that the United Arab Emirates (UAE) is one of the world's top ten oil producers. Furthermore, in 2020, the UAE uncovered a major find of more than 80 Trillion cubic feet of natural gas reserves at Jebel Ali.

Competitive Landscape:

Major participants in the industry are concentrating on enhancing technologies to optimize supply chain processes and boost efficiency. They are investing heavily in research activities to enhance robotics, IoT integration, and AI-enabled solutions for real-time monitoring and predictive analytics. Additionally, there is a focus on reaching sustainability goals through energy-efficient solutions and green technologies. Utilizing advanced software tools and intelligent hardware technologies, main stakeholders seek to deliver comprehensive automation solutions, addressing the growing need across different industries. Strategic partnerships, mergers, and acquisitions are sought to enhance market position and technological expertise. These companies are also broadening their product lines with flexible and scalable automation solutions to address diverse industry needs. In April 2024, Netto entered into a strategic partnership with Cimcorp-a supplier of automated solutions better the efficiency of its logistic processes in Coswig and protect its supply chain for the future.

The report provides a comprehensive analysis of the competitive landscape in the logistics automation market with detailed profiles of all major companies, including:

- ABB Ltd.

- Beumer Group GmbH & Co. KG

- Daifuku Co. Ltd.

- Dematic (Kion Group AG)

- Honeywell International Inc.

- Jungheinrich AG

- Kardex Group

- Knapp AG

- Mecalux S.A.

- Murata Machinery Ltd.

- Oracle Corporation

- SAP SE

- Swisslog Holding AG (KUKA AG)

Latest News and Developments:

- December 2024: The Massachusetts Institute of Technology Center for Transportation & Logistics (MIT CTL) launched a five-year partnership with intralogistics leader Mecalux to advance the use of self-learning AI in logistics operations. With MIT's Intelligent Logistics Systems Lab, the two companies will investigate state-of-the-art AI applications that can bring significant benefits both to companies and to society at large.

- October 2024: Viettel introduced a very sophisticated logistics automation solution, which streamlines the entire process of supply chain, ranging from warehousing to delivery. This comprehensive solution was launched at Vietnam Innovation Day 2024 and marked a significant step forward for the logistics sector.

- July 2024: Mytra, a company created by former Tesla engineers that focuses on robotics, obtained USD 78 Million in funding to transform warehouse logistics. The company's robotic solutions driven by software emphasize automating the most critical material handling operations like item transport and storage for transforming the logistics sector.

Logistics Automation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Functions Covered | Warehouse and Storage Management, Transportation Management |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | Manufacturing, Healthcare and Pharmaceuticals, Fast-Moving Consumer Goods (FMCG), Retail and E-Commerce, 3PL, Aerospace and Defense, Oil, Gas and Energy, Chemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Beumer Group GmbH & Co. KG, Daifuku Co. Ltd., Dematic (Kion Group AG), Honeywell International Inc., Jungheinrich AG, Kardex Group, Knapp AG, Mecalux S.A., Murata Machinery Ltd., Oracle Corporation, SAP SE , and Swisslog Holding AG (KUKA AG), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the logistics automation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global logistics automation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the logistics automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Logistics automation refers to the use of technology and systems to streamline and enhance logistics operations, reducing manual intervention while improving efficiency, accuracy, and cost-effectiveness. It integrates hardware, software, and digital tools to automate processes across supply chain management, including inventory handling, warehousing, transportation, and order fulfillment.

The logistics automation market was valued at USD 82.1 Billion in 2024.

IMARC estimates the global logistics automation market to exhibit a CAGR of 10.75% during 2025-2033.

The global logistics automation market is driven by the rising e-commerce activities, the growing demand for faster and accurate order fulfillment, and advancements in robotics and IoT technologies. The increasing adoption of automated solutions to reduce labor costs and improve operational efficiency, along with the need for real-time supply chain visibility, is further supporting the market growth.

In 2024, hardware represented the largest segment by component, driven by the widespread adoption of robotics, automated storage systems, and material handling equipment to improve efficiency and reduce operational costs.

Warehouse and storage management lead the market by function owing to the growing demand for optimized inventory control, automated storage systems, and streamlined operations to meet the rising e-commerce and supply chain efficiency requirements.

Large enterprises are the leading segment by enterprise size due to their extensive operations, higher investment capacity, and need for advanced technologies to streamline complex supply chains and enhance operational efficiency.

Retail and e-commerce are the leading segment by industry vertical attributed to increasing online shopping trends, demand for fast order fulfillment, and the adoption of automated solutions to enhance efficiency and client satisfaction.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global logistics automation market include ABB Ltd., Beumer Group GmbH & Co. KG, Daifuku Co. Ltd., Dematic (Kion Group AG), Honeywell International Inc., Jungheinrich AG, Kardex Group, Knapp AG, Mecalux S.A., Murata Machinery Ltd., Oracle Corporation, SAP SE, and Swisslog Holding AG (KUKA AG), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)