Lobster Market Size, Share, Trends and Forecast by Species, Weight, Product Type, Distribution Channel, and Region, 2025-2033

Lobster Market Size and Share:

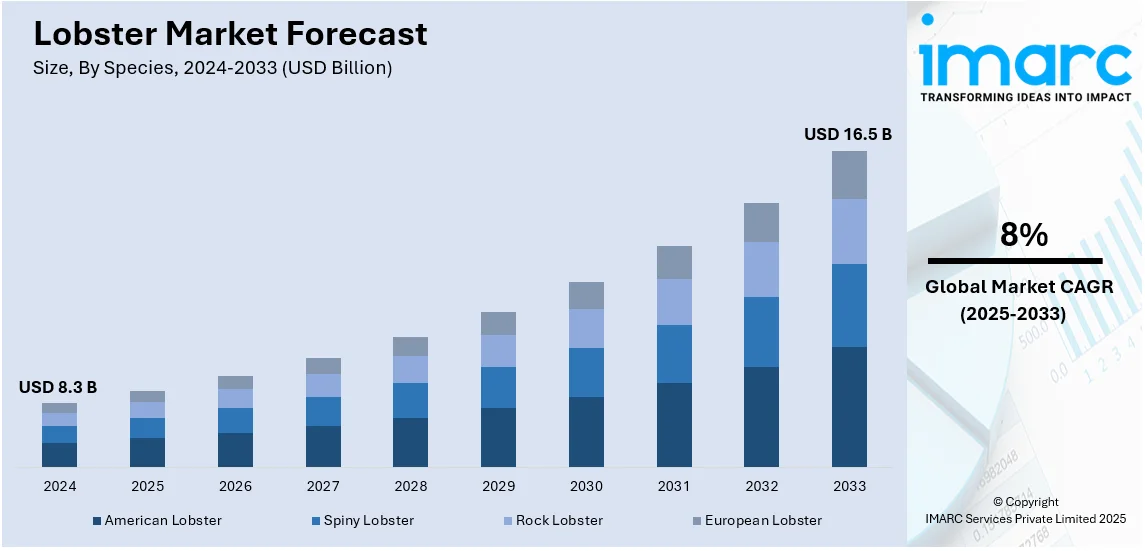

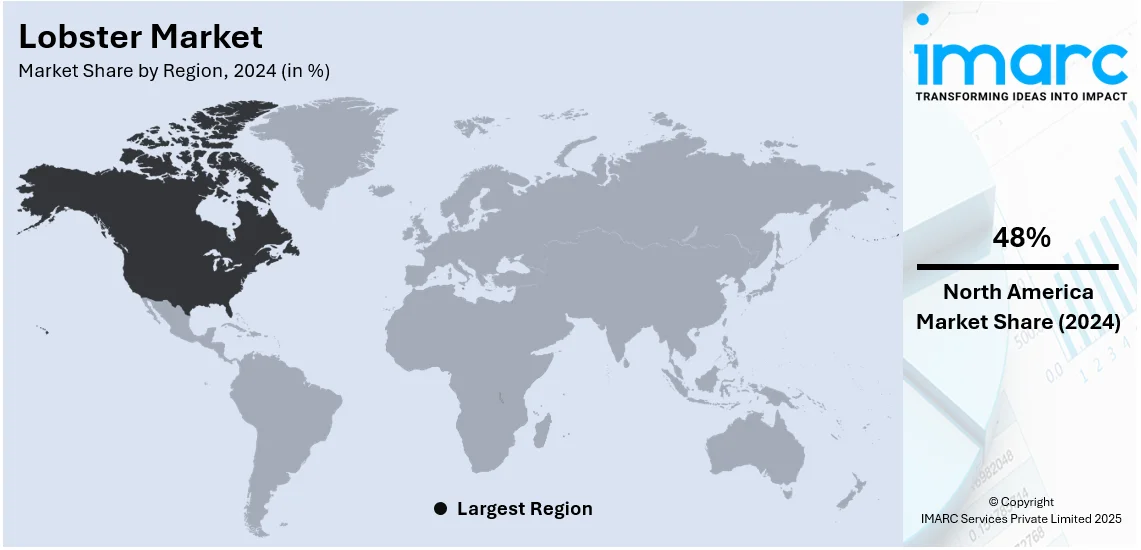

The global lobster market size was valued at USD 8.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.5 Billion by 2033, exhibiting a CAGR of 8% from 2025-2033. North America currently dominates the market, holding a market share of over 48% in 2024. The market is propelled by an increasing seafood demand, rising focus on sustainability initiatives and certifications to address concerns about overfishing, product premiumization and diversification, and several health benefits associated with the consumption of lobster.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.3 Billion |

|

Market Forecast in 2033

|

USD 16.5 Billion |

| Market Growth Rate 2025-2033 |

8%

|

The growing consumer demand for high-quality seafood, higher disposable incomes, and the proliferation of fine dining restaurants are propelling the lobster market growth. The lobster market is also driven by the popularity of high-protein, low-fat diets, as consumers look to eat healthier and more nutrient-rich foods. Lobster consumption is on the rise in the hospitality and food service industries, as restaurants and hotels are putting lobster on gourmet menus and in luxury seafood platters. Moreover, the growth of e-commerce and direct-to-consumer delivery of seafood services has enhanced market accessibility, and consumers can buy fresh and frozen lobster online. Sustainable fishing practices and certifications like Marine Stewardship Council (MSC) certification are also supporting the lobster market growth, as green consumers prefer seafood that is sourced responsibly. Furthermore, aquaculture and cold chain technology advances have further increased the availability and freshness of lobster to support global trade.

The lobster market demand in the United States is mainly prompted by strong domestic consumption, favorable export demand, and well-established New England and Maine fisheries. For instance, in 2024, Cousins Maine Lobster announced expansion of its operations by adding 10 new food trucks across markets including New York, South Florida, and Rhode Island, with plans to introduce 10 more by year's end, totaling 20 new units for the year. This expansion reflects the company's strategic growth and increasing popularity in the seafood industry. Moreover, the growing trend of gourmet eating at home has also driven retail sales, as supermarkets and lobster suppliers provide pre-cooked, frozen, and live lobsters. The ongoing expansion of gourmet dining at home has spurred further retail sales of lobster, with supermarkets selling pre-cooked, frozen, and live lobster, alongside seafood suppliers. In addition, the collaboration between fisheries and large grocery retailers, restaurants, and online seafood marketplaces facilitate distribution, which helps to reach a wider customer base.

Lobster Market Trends:

Sustainability Initiatives and Certifications

The lobster industry is increasingly focusing on sustainability initiatives and certifications to address concerns about overfishing and habitat degradation. Organizations like the Marine Stewardship Council (MSC) play a crucial role in certifying sustainable fisheries, ensuring that lobster harvesting practices meet stringent environmental standards. According to NOAA (National Oceanic and Atmospheric Administration), sustainable seafood certifications have been steadily rising, with a notable increase in certifications for lobster fisheries in recent years. For instance, in 2020, 28 lobster fisheries in North America were MSC certified, covering a significant portion of the market and indicating a growing commitment to sustainable practices. These lobster market trends reflect a shift toward more responsible sourcing, as consumers become more conscientious about the environmental impact of their food choices, driving demand for sustainably sourced lobster products. It has been reported that consumers are willing to spend an average of 9.7% more on sustainably produced or sourced goods. Retailers and restaurants are responding by prioritizing certified sustainable options, that meet consumer expectations and support the long-term viability of the industry. Besides this, ongoing technological advancements in tracking and tracing systems also enhance transparency throughout the supply chain, allowing stakeholders to verify the sustainability claims of lobster products.

Growth in Online Retail and Direct-to-Consumer Sales

The lobster market is experiencing significant growth in online retail and direct-to-consumer sales channels. This trend has been accelerated by technological advancements and changing consumer preferences, particularly in response to the coronavirus (COVID-19) pandemic. Government statistics from the U.S. Census Bureau show a substantial increase in online sales of seafood products, including lobster, with a notable surge during the pandemic period. For instance, online sales of seafood in the U.S. increased by 99% in 2020 compared to the previous year, highlighting the rapid adoption of e-commerce platforms for seafood purchases. Direct-to-consumer sales allow lobster suppliers and retailers to reach a broader audience beyond traditional distribution channels. It provides consumers with convenient access to fresh and premium lobster products, often delivered directly from coastal regions to doorsteps worldwide. This shift also empowers producers to showcase their products' quality and traceability, fostering consumer trust and loyalty. Moreover, online platforms enable real-time market insights and direct engagement with consumers, facilitating targeted marketing strategies and personalized shopping experiences. As a result, this growing e-commerce presence is expected to significantly impact lobster market share, driving further growth and innovation in the sector. As digital connectivity continues to expand globally, online retail and direct-to-consumer sales are poised to drive further growth and innovation in the lobster market.

Premiumization and Diversification of Lobster Products

The lobster market is witnessing a trend toward premiumization and diversification of product offerings to cater to evolving consumer preferences and culinary trends. Increasing disposable incomes and a growing appetite for luxury seafood experiences are driving demand for premium lobster products such as whole-cooked lobsters, lobster tails, and gourmet dishes. The European Union is a significant market for luxury seafood imports, including lobsters. In recent years, imports of live, fresh, or chilled lobsters into the EU have shown consistent growth, reflecting increasing demand for high-quality seafood products. In response to this trend, seafood suppliers and processors are expanding their product portfolios to include value-added options like pre-cooked lobster meat, frozen lobster tails, and ready-to-eat (RTE) lobster meals. These products appeal to busy consumers seeking convenience without compromising on taste or quality. Additionally, innovative culinary applications, such as lobster rolls and fusion dishes, are gaining popularity in both retail and foodservice sectors, further fueling market growth. The premiumization trend extends to international markets, where luxury seafood imports, including lobsters, are sought after as symbols of quality and indulgence. According to the Vietnam Association of Seafood Exporters and Producers (VASEP), in 2024, China’s lobster imports from Vietnam surged 39%. This shift presents opportunities for lobster-producing regions to differentiate their offerings based on taste profiles, sustainability credentials, and culinary versatility. As consumer preferences continue to evolve, the trend toward premiumization and product diversification is expected to shape the future landscape of the global lobster market, influencing lobster market size in the coming years.

Lobster Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global lobster market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on species, weight, product type, and distribution channel.

Analysis by Species:

- American Lobster

- Spiny Lobster

- Rock Lobster

- European Lobster

American lobster stands as the largest species in 2024, holding around 43.3% of the market. As per the lobster market overview, the American lobster (Homarus americanus) holds the largest share due to its widespread availability along the North American Atlantic coast and its reputation for superior taste and quality. According to the National Oceanic and Atmospheric Administration (NOAA), American lobsters are harvested extensively from Maine to North Carolina, contributing significantly to the total lobster landings in the United States. In recent years, landings of American lobsters have remained robust, supported by sustainable fisheries management practices and innovative harvesting techniques. The species' popularity is further bolstered by its versatility in culinary applications, ranging from whole lobsters served in fine dining establishments to processed products like frozen tails and pre-cooked meat, appealing to diverse consumer preferences. This combination of accessibility, quality, and culinary appeal positions the American lobster as a dominant force in the global market, driving its prominence among seafood enthusiasts worldwide.

Analysis by Weight:

- 0.5 - 0.75 lbs

- 0.76 - 3.0 lbs

- Over 3 lbs

0.5-0.75 leads the market with around 42.4% of market share in 2024. This size range is often preferred by consumers and chefs alike for its tenderness, flavor, and versatility in culinary preparations. These smaller lobsters are particularly prized for their delicate meat, making them ideal for dishes like lobster rolls, pasta dishes, and other gourmet seafood entrees. Their popularity is also driven by their accessibility and affordability compared to larger lobsters, appealing to a broader range of consumers. Additionally, fisheries management practices in regions like Maine emphasize sustainable harvesting to ensure the long-term viability of lobster populations, thus generating a positive lobster market revenue.

Analysis by Product Type:

- Whole Lobster

- Lobster Tail

- Lobster Meat

- Lobster Claw

Whole lobster leads the market with around 72.8% of market share in 2024, due to its premium status and high demand in both domestic and international markets. According to the National Oceanic and Atmospheric Administration (NOAA), lobster exports from the United States alone reached $495 Million in value, highlighting its economic significance. Consumers prefer whole lobsters for their freshness and culinary versatility, driving up their market share. Additionally, restaurants and seafood retailers often feature whole lobsters prominently, appealing to consumers seeking high-quality seafood experiences and interest in developing taste. This preference is contributing significantly to the whole lobster segment's dominance in the market and creating a favorable lobster market outlook.

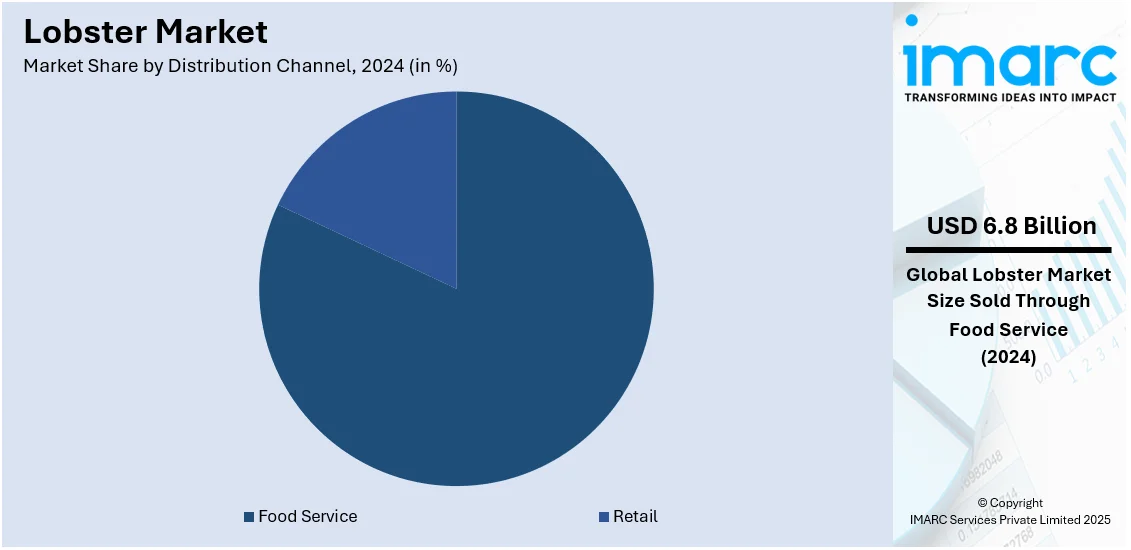

Analysis by Distribution Channel:

- Food Service

- Retail

Food service leads the market with around 81.7% of lobster market share in 2024, owing due to the high demand from fine dining restaurants, luxury hotels, and seafood-oriented establishments. Lobster is a high-end ingredient in gourmet dishes; hence it is a regular feature in high-end menus, buffets, and specialty seafood restaurants. Growth in hospitality and tourism industries has also fueled consumption. Moreover, collaborations between wholesale seafood suppliers and food service operators guarantee a consistent supply of fresh, frozen, and pre-cooked lobster. As chef-driven dining and seafood-themed culinary trends gain popularity, food service remains the key driver of worldwide lobster sales.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 48%, due to its robust domestic consumption and significant export volumes. According to the National Oceanic and Atmospheric Administration (NOAA), the United States alone landed over 111 Million pounds of lobster with a value exceeding $625 Million in 2021. This statistic underscores the economic importance of lobster fisheries in North America, particularly in regions like Maine and Atlantic Canada, which are renowned for their high-quality lobsters. Domestically, North America's demand for lobsters is driven by consumer preferences for fresh seafood and the cultural significance of lobsters in regional cuisines. Lobsters are a staple in North American seafood markets, featured prominently in restaurants and grocery stores across the continent. Additionally, North American lobsters are exported globally, catering to international markets where there is a growing appetite for premium seafood products. Moreover, the lobster market forecast suggests continued growth in both domestic consumption and international exports, bolstered by strong demand and strategic market expansion efforts.

Key Regional Takeaways:

United States Lobster Market Analysis

In 2024, United States accounted for 91.60% of the market share in North America. The United States remains a dominant player in the market, with Maine and Massachusetts leading domestic production. The industry flourishes on strong domestic consumption and exports, particularly to China, Canada, and the European Union. Growth in fresh and frozen seafood consumption per capita climbed from about 63 percent in 1990 to almost 80 percent in 2021. Also, the rising demand for premium seafood continues to shape U.S.-China trade dynamics, reinforcing China’s role as a key market for American lobster exports. Furthermore, growing consumer preferences for live, frozen, and processed lobster due to higher disposable incomes and an increased focus on high-protein diets is impelling the market. However, the sector faces regulatory and environmental challenges, including restrictions to protect North Atlantic right whales and climate change impacts on lobster populations. In response, fisheries are implementing sustainable practices and exploring aquaculture solutions to maintain supply. The foodservice industry, spanning fine dining and casual seafood chains, is crucial for lobster sales, while ready-to-eat and frozen meal innovations are expanding market accessibility. Despite these challenges, technological advancements in logistics and supply chains continue to drive market stability and long-term growth.

Europe Lobster Market Analysis

The European lobster market is majorly driven by strong demand for premium seafood, particularly in France, Spain, Italy, and the United Kingdom. In line with this, rise in consumers favoring both locally caught and imported lobster, with Norway, Canada, and the U.S. as major suppliers is impelling the market. Furthermore, EU sustainability policies regulate sourcing and trade, ensuring responsible fishing practices, thereby propelling the market growth. Additionally, the increasing popularity of fine dining, seafood festivals, and gourmet retail chains is supporting consistent market demand, while online seafood delivery services have expanded accessibility. As of January 2025, destination dining is rising, with Google searches for "fine dining" increasing by 49% in the past year, according to The Luxury Travel Book. The Michelin Guide, known for prestigious star ratings, remains a trusted restaurant review source, with Paris leading at 121 Michelin-starred restaurants and Zurich excelling in sustainability with 8 Michelin Green Star restaurants in 2024. Besides this, climate change is impacting North Sea and Atlantic lobster fisheries, prompting investment in aquaculture and sustainable fishing. Post-Brexit trade regulations continue to influence supply chain dynamics, pricing, and availability in the market. Moreover, rapid innovations in packaging, cold chain logistics, and e-commerce are further reinforcing market stability.

Asia Pacific Lobster Market Analysis

The Asia Pacific market is expanding rapidly, propelled by rising seafood consumption in China, Japan, and South Korea, where growing disposable incomes and a strong preference for premium seafood fuel demand in hotels, restaurants, and luxury dining establishments. Live lobster imports dominate, with Australia, Canada, and the United States as key suppliers in the market. Furthermore, high-value species like rock lobster and spiny lobster remain particularly sought after in the industry. Similarly, continual advances in cold storage and live transport technologies are enhancing international trade efficiency, while e-commerce seafood platforms are broadening market accessibility. Meanwhile, Indonesia’s marine and fisheries sector is set to grow 8% in 2024, reaching IDR 12 Trillion in investment, according to the Ministry of Maritime Affairs and Fisheries (KKP). From January-September 2023, the sector secured IDR 9.56 Trillion, with IDR 5.32 Trillion from domestic investment and IDR 1.4 Trillion from foreign investors, led by China, Malaysia, and Switzerland, reinforcing Indonesia’s role in regional seafood trade.

Latin America Lobster Market Analysis

Latin America’s lobster market is witnessing growth attributed to significant exports, with Brazil, Mexico, and Nicaragua supplying high-value lobster species to North America, Europe, and Asia. The region’s rich marine biodiversity supports both wild-caught and farmed lobster production, though supply chain inefficiencies, illegal fishing, and regulatory challenges hinder growth. Similarly, efforts to certify sustainable fisheries and expand aquaculture are enhancing industry competitiveness, while improved processing facilities and expanded trade agreements strengthen exports. Furthermore, moderate domestic consumption, rising in coastal tourism hubs and high-end restaurants is impelling the market. At the G20 Agriculture Ministers’ Meeting in Brazil in 2024, leaders endorsed FAO’s Blue Transformation Roadmap (2022-2030) for sustainable fisheries and aquaculture, supporting 600 Million livelihoods and a USD 472 Billion industry (2022). FAO also emphasized family farming’s role, with 90% of farms globally contributing to food security and rural development.

Middle East and Africa Lobster Market Analysis

The Middle East and Africa market is steadily expanding, propelled by high-end seafood consumption and production in the UAE, Saudi Arabia, and South Africa. Saudi Arabia’s fisheries department aims to increase fish production to 230,000 MT in 2024, reducing reliance on imports after an 80% rise in 2023, reaching 214,600 MT. The hospitality and luxury dining sector, including five-star hotels, cruise lines, and fine dining establishments, fuels market demand. Furthermore, the Gulf region’s seafood imports from Australia, the U.S., and Canada have increased investments in logistics and supply chain infrastructure, thereby propelling the market. Apart from this, Africa’s lobster industry, particularly in Mozambique and South Africa, remains export driven. Regulatory challenges, overfishing, and limited aquaculture production impact supply stability and market growth. However, government-backed sustainability initiatives and growing high-end seafood markets are strengthening industry prospects, positioning the MEA region for long-term growth in seafood processing and sustainable fishing practices.

Competitive Landscape:

The lobster market is competitive, with major players emphasizing sustainable supply, efficient supply chain, and high-end product offerings. Leading firms compete on quality, price, and export capacity, with improvements in cold chain logistics and aquaculture broadening market coverage. Moreover, the rising demand from upscale dining and online seafood platforms is heightening competition. In addition, players are focusing on regulatory compliance, sustainability certification, and alliances with large food retailers and restaurants to consolidate their place. Investment in direct-to-consumer sales and traceability technologies for seafood is also influencing the market, maintaining product freshness and consumer confidence in sourcing and supply chain integrity. For instance, in September 2024, Red Lobster announced that RL Investor Holdings LLC is set to acquire the restaurant chain after receiving court approval for its Chapter 11 restructuring plan. The acquisition, backed by Fortress Investment Group, TCW Private Credit, and Blue Torch, includes USD 60 Million in new funding to support the brand’s revitalization.

The report provides a comprehensive analysis of the competitive landscape in the lobster market with detailed profiles of all major companies, including:

- Boston Lobster

- Clearwater Seafoods

- East Coast Seafood Group

- Geraldton Fishermen’s Co-operative

- High Liner Foods Incorporated

- PESCANOVA ESPAÑA SL

- Supreme Lobster

- Tangier Lobster

- Thai Union Manufacturing Company Ltd.

Latest News and Developments:

- January 2025, Australia’s first onshore lobster farming facility launched at Toomulla Beach, Townsville. Developed with ARC research hubs and Ornatas, the high-tech hatchery nurtures 90,000 Tropical Rock Lobsters from hatchery to harvest, employing 30 staff and positioning Australia as a leader in sustainable onshore aquaculture.

- November 2024, Sea Grant’s American Lobster Initiative awarded USD 5.4 Million to support 15 research projects and outreach efforts addressing lobster growth, distribution, ecosystem changes, and socio-economic impacts. Funded by NOAA Sea Grant, the projects aim to sustain the American lobster fishery amid environmental and economic challenges.

- March 2024, Aquamar launched new shellfish products at Seafood Expo North America in Boston, including Aquamar Wild Red Shrimp in Lobster Sauce, featuring all-natural wild-caught red shrimp from Argentina. The brand also introduced baby clams, seafood medleys, shrimp skewers, and mussels, emphasizing sustainability, convenience, and premium seafood quality.

Lobster Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, ‘000 Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Species Covered | American Lobster, Spiny Lobster, Rock Lobster, European Lobster |

| Weights Covered | 0.5 - 0.75 lbs, 0.76 - 3.0 lbs, Over 3 lbs |

| Product Types Covered | Whole Lobster, Lobster Tail, Lobster Meat, Lobster Claw |

| Distribution Channels Covered | Food Service, Retail |

| Regions Covered | North America, Europe, Asia, Oceania, Others |

| Companies Covered | Boston Lobster, Clearwater Seafoods, East Coast Seafood Group, Geraldton Fishermen’s Co-operative, High Liner Foods Incorporated, PESCANOVA ESPAÑA SL, Supreme Lobster, Tangier Lobster, Thai Union Manufacturing Company Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lobster market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global lobster market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lobster industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lobster market was valued at USD 8.3 Billion in 2024.

IMARC estimates the global lobster market to reach USD 16.5 Billion in 2033, exhibiting a CAGR of 8% during 2025-2033.

The lobster market is being driven by increasing consumer demand for high-quality seafood, boosted by higher disposable incomes and a growing interest in fine dining. Additionally, sustainability initiatives, technological innovations in traceability, and the rise of e-commerce platforms offering direct-to-consumer sales are playing crucial roles in the market's expansion.

North America currently dominates the market, holding a market share of over 48% in 2024. This leadership is driven by strong demand in the U.S. and Canada. The region also benefits from established lobster fisheries, advanced processing capabilities, and increasing consumer preference for premium seafood products, thereby contributing to the market growth.

Some of the major players in the lobster market include Boston Lobster, Clearwater Seafoods, East Coast Seafood Group, Geraldton Fishermen’s Co-operative, High Liner Foods Incorporated, PESCANOVA ESPAÑA SL, Supreme Lobster, Tangier Lobster, Thai Union Manufacturing Company Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)