Lithotripters Market Size, Share, Trends and Forecast by Device, Application, End User, and Region, 2025-2033

Lithotripters Market Size and Share:

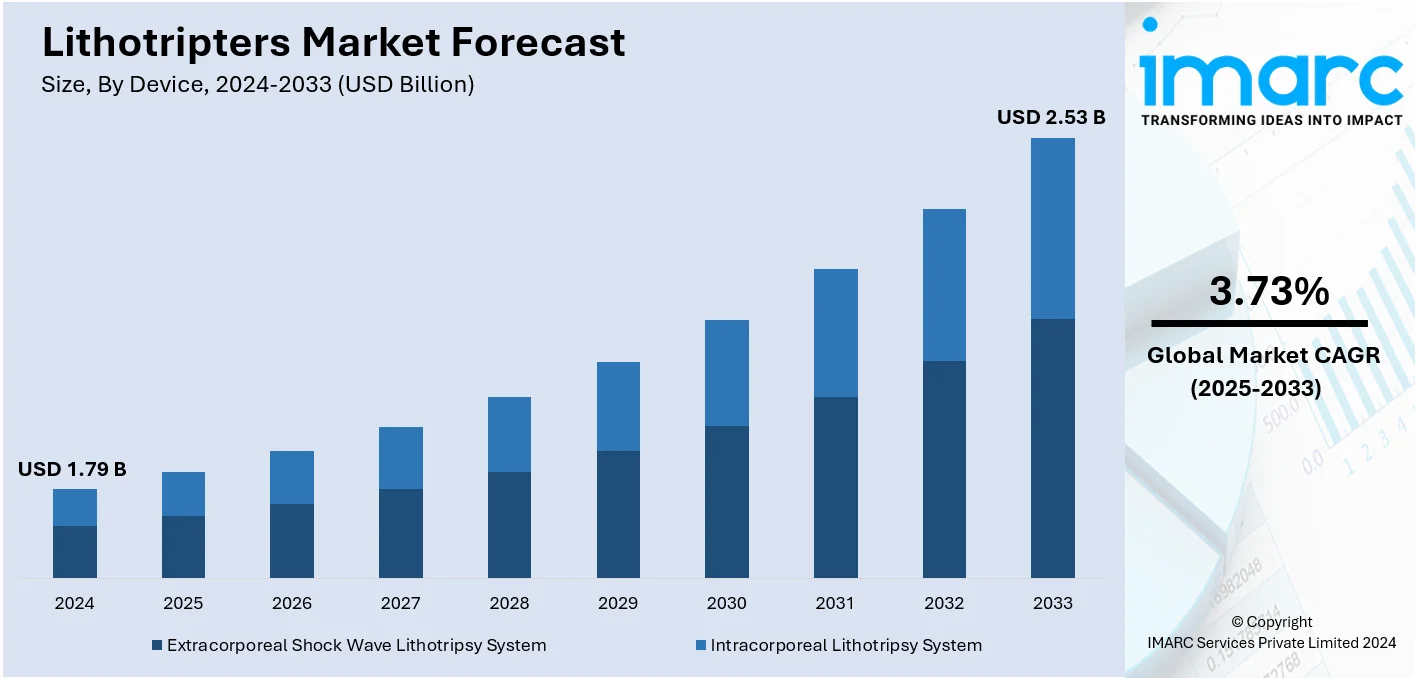

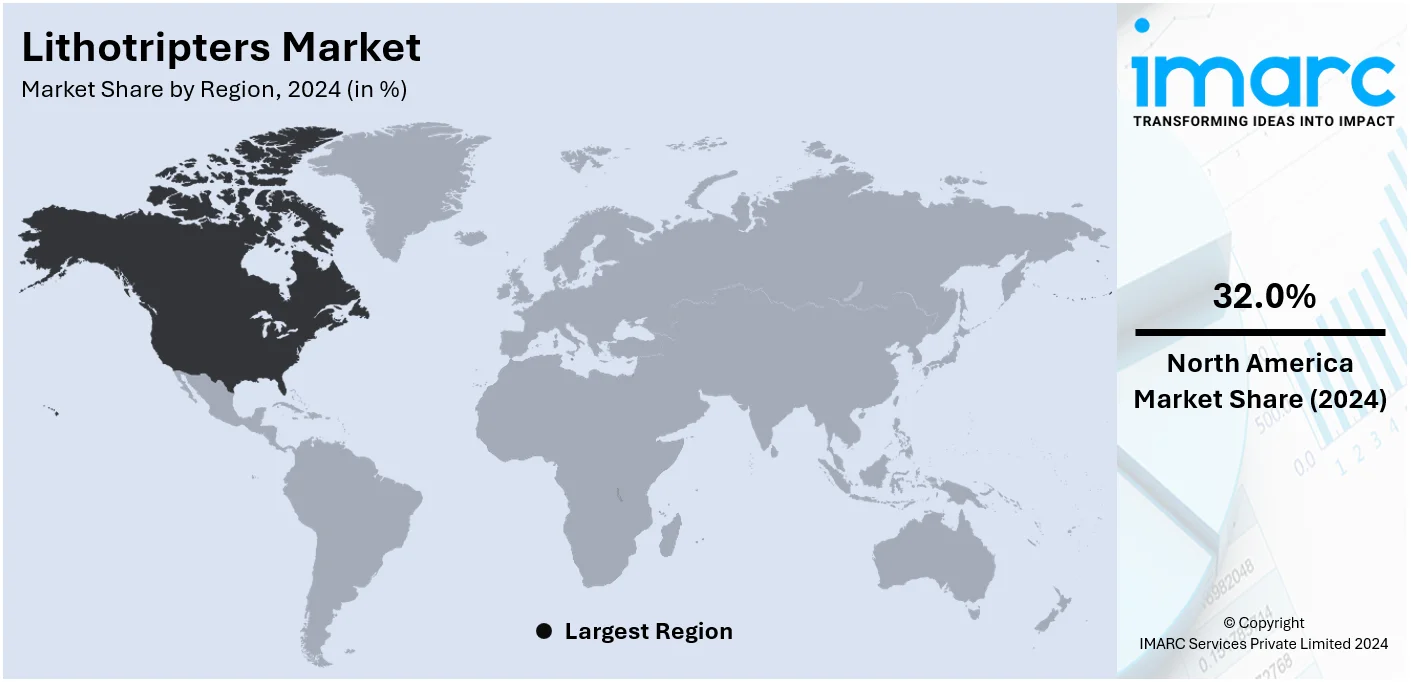

The global lithotripters market size was valued at USD 1.79 Billion in 2024. Looking forward, the market is projected to reach USD 2.53 Billion by 2033, exhibiting a CAGR of 3.73% from 2025-2033. North America currently dominates the market with rising prevalence of urolithiasis, geriatric population, and an upsurge in consumer preferences towards minimally invasive surgeries (MIS).

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.79 Billion |

| Market Forecast in 2033 | USD 2.53 Billion |

| Market Growth Rate (2025-2033) | 3.73% |

The lithotripters market growth is primarily driven by the rising incidence of kidney stones around the globe. Lethargic lifestyle, inappropriate dietary practices, and obesity cases lead to a significant rise in urolithiasis. Demand for lithotripsy, an effective and non-invasive procedure where shock waves with a high intensity destroy the kidney stone, is, therefore, also growing. Advancements in lithotripters - portable and compact versions improve accuracy and patient acceptability and support their increased deployment in both hospitals and clinics. Campaigns aimed at the importance of early intervention for kidney stone management, plus improved healthcare delivery, enhance growth in both mature and developing countries.

The U.S. lithotripters market is driven by a high prevalence of kidney stones, supported by sedentary lifestyles and dietary patterns among the population. In line with this, the occurrence of kidney stones in the United States rose from 3.8% in the late 1970s to 8.8% in the late 2000s, with men having an 11% risk and women a 9% risk. Market growth comes with a good healthcare infrastructure as well as an adoption rate for advanced medical technology. The dominant market position maintained by top-notch manufacturers and further research activities improve the availability of new lithotripters including compact and portable ones. Beneficial reimbursement policies and growing awareness of non-invasive treatments augment demand. Gaining outpatient surgical centers focused on urology procedures increase lithotripsy treatment adoption rates. In addition, the strong spending on health services and technology makes the United States a major market worldwide.

Lithotripters Market Trends:

Rising Prevalence of Urolithiasis (Kidney Stones)

The rise in the incidence of kidney stones, brought on by a changed lifestyle, inappropriate dieting habits, and lower water consumption, is an important growth factor for the lithotripsy market. A greater incidence of urolithiasis in warmer climates has spurred the demand for non-invasive treatments like lithotripsy. The International Federation of Diabetics Report 2022 projects that the number of people with diabetes will reach 643 million by 2030, and is expected to rise to 783 million by 2045. Type 2 diabetes is rapidly increasing in low and middle-income countries. Diabetes promotes the formation of kidney stones because in the urine, the high sugar content acts as a nutrient medium to promote bacterial growth. The continuously increasing incidence rates of both diabetes and kidney stones are also increasing the demand for non-invasive and effective kidney stone treatments, such as lithotripsy.

Advancements in Lithotripsy Technology

Developments in lithotripsy, specifically extracorporeal shock wave lithotripsy, have greatly promoted the market by offering non-invasive and efficient disintegration of stones. Better targeting due to the advancement of imaging techniques further increased the chances of success in this field. Advances in making these devices smaller, portable, and more powerful have made energy sources safer, leading to improved patient convenience while being treated in hospitals. For example, in January 2022, Applaud Medical's Acoustic Enhancer received Breakthrough Device Designation from the FDA. The device is placed in addition to laser lithotripsy and ureteroscopy to break the calcium-based kidney stones. This type of technological enhancement is what drives growth in the lithotripsy market; it increases the effectiveness of treatment, reduces discomfort in patients, and also makes the entire procedure safer.

Growing Geriatric Population and Awareness

The demand for lithotripters has largely been driven by the aging population that is more likely to develop kidney stones. The risk of forming kidney stones tends to increase with age, and hence, effective yet minimally invasive treatments like lithotripsy are gaining traction. Moreover, awareness of such treatment options, which is largely driven by campaigns and the existence of advanced technologies, has fueled adoption, especially in emerging economies. The aging population coupled with an increased count of people above the age of 65 years, close to doubling from 5.5% in 1974 to 10.3% in 2024, as per reports, is upping the demand for lithotripsy solutions as health care providers look for non-invasive solutions for kidney stones conditions for the aging population. Main driver for the lithotripter market is the aging population and enhanced awareness of minimally invasive treatments.

Lithotripters Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global lithotripters market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on device, application and end user.

Analysis by Device:

- Extracorporeal Shock Wave Lithotripsy System

- Intracorporeal Lithotripsy System

- Laser Lithotripsy

- Electrohydraulic Lithotripsy

- Mechanical Lithotripsy

- Ultrasonic Lithotripsy

The extracorporeal shock wave lithotripsy system stands as the largest component in 2024 due to its non-invasive nature and widespread adoption in urological procedures. ESWL systems apply focused shock waves to break up kidney stones, thus avoiding the need for surgical interventions. They have become the preferred treatment for stones because they are efficient with minimal patient discomfort and reduced recovery time. The technological advancements include improved imaging for stone localization and energy delivery precision, which enhance the efficacy of ESWL systems. In addition, the various sizes of stones that they can manage and the increasing incidence of kidney stones worldwide make their superiors in the market for lithotripters.

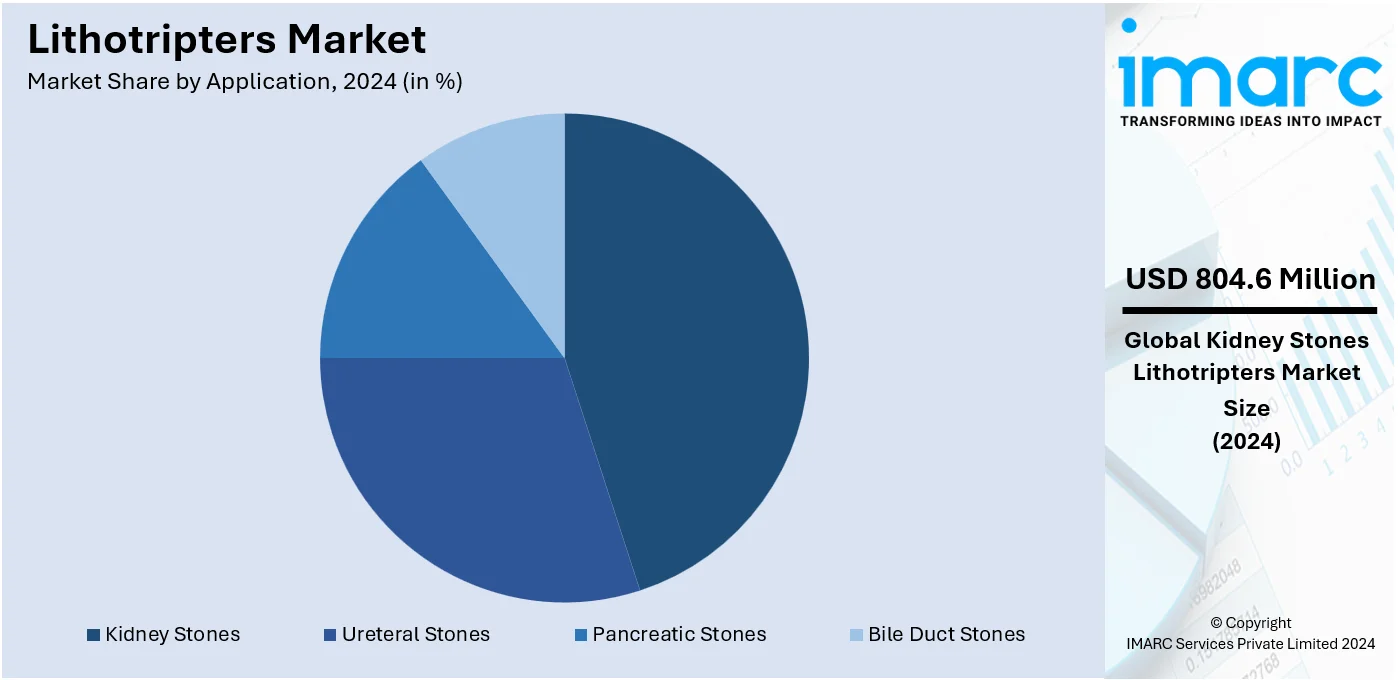

Analysis by Application:

- Kidney Stones

- Ureteral Stones

- Pancreatic Stones

- Bile Duct Stones

Kidney Stones leads the market as they are among the most prevalent urological conditions globally, fueled by factors such as sedentary lifestyles, dietary habits high in sodium, and inadequate hydration. This also had an increasing propensity for stone formation coupled with growing levels of obesity and metabolic diseases. Being highly effective and minimally invasive, the first line in the treatment for kidney stones is indeed lithotripsy. Further advancements in technologies for imaging coupled with new types of shockwave delivery systems allow for enhanced procedural accuracy and have increased the deployment of the above procedure. In addition to the increasing recognition of non-invasive treatments and access to health care in developing regions, it is the kidney stones application that remains at the top, amplified by demand for lithotripters.

Analysis by End User:

- Hospitals

- Ambulatory Surgical Centers

- Others

In 2024, hospitals represent the largest segment of the market, owing to their extensive infrastructure, advanced medical equipment, and capacity to manage a high volume of patients. Being major diagnostic and treatment centers, hospitals are equipped with the latest technologies in lithotripsy, such as extracorporeal, intracorporeal, and laser-based technology, making the management of kidney stones easier. They also provide access to medical professionals with great experience and to departments specializing in urology, which can offer high-quality care. Advanced imaging systems available in hospitals also improve the accuracy of lithotripsy, thereby promoting the use of these technologies. Additionally, hospitals are often the first point of care for patients with severe or recurrent kidney stone issues, reinforcing their dominant share in the lithotripters market across both developed and emerging regions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the largest market share, driven by the high prevalence of kidney stones, influenced by sedentary lifestyles and dietary habits. The region offers developed health infrastructure along with emphasis on embracing innovative medical technologies. Effective reimbursement policies along with access to the widespread network of health facilities ensure adequate accessibility for the patient population seeking lithotripsy treatments. Dominant manufacturing bases and intensive R&D works lead to innovation in the field of lithotripsy systems. Rising awareness campaigns about kidney stone prevention and non-invasive treatments further drive market demand. Additionally, the increasing number of outpatient surgical centers specializing in urology and significant investment in healthcare services position North America as a dominant player in the global lithotripters market.

Key Regional Takeaways:

United States Lithotripters Market Analysis

Increasing kidney diseases, including nephrolithiasis, are a huge growth driver in the lithotripters market in the United States. According to a recent study in the journal Urolithiasis in February 2021, the incidence rate of nephrolithiasis is rising in the United States, with an estimated value of 10.1%. Additionally, the Centers for Disease Control and Prevention estimate that nearly 37 million Americans, or 15% of the adult population, had chronic kidney disease as of July 2022. The rising prevalence of renal disease is contributing to the growing demand for effective treatments, including lithotripsy. With more than 50,000 lithotripsy procedures performed each year in the United States, the demand for improved lithotripter devices is likely to increase further. The increasing cases of kidney stones and chronic kidney diseases emphasize the need for lithotripsy technology to treat these conditions, increasing the demand for lithotripers in the U.S.

Europe Lithotripters Market Analysis

The rise in the incidence of urinary stones, among other factors, with the increasing aging population is driving the demand in Europe. The prevalence rates of urinary stones vary from 1 to 20%. Countries where the prevalence rate is over 10% are Sweden and others as categorized by the European Association of Urology (EAU) with very high standards of living. This is also evident in Europe, where kidney stones are increasingly being experienced due to lifestyle and aging demographics. Additionally, Europe's aging population is driving the demand for effective treatment options like lithotripsy. According to the European Commission, as of 2020, 20.6% of the EU population was aged 65 or older, a 3.0 percentage point increase from the previous decade. This aging population, coupled with the rising incidence of kidney stones, is most likely to boost demand for lithotripter devices in Europe in the near future and continue the growth trajectory of the market.

Asia Pacific Lithotripters Market Analysis

The growing incidence of urolithiasis and the aging population are major growth drivers for the Asia Pacific lithotripters market. According to a 2018 article by the National Institutes of Health (NIH), approximately 1% to 19.1% of the population in Asia suffer from urolithiasis, which is becoming more prevalent due to changes in lifestyle and dietary habits. Further, the region's aging population increasingly leads to an increased predisposition to kidney stones. In China, for instance, according to the World Health Organization, with an increased life expectancy and reduced fertility rate, the people above 60 years are expected to be at 28% by 2040. The elderly population is more exposed to developing kidney stones. Thus, the demand for effective treatment alternatives is increasingly fueled. These factors are expected to propel the adoption of lithotripter devices across Asia Pacific, henceforth contributing to the growth of the market.

Latin America Lithotripters Market Analysis

Incidences of urolithiasis are on an increase in Latin America and has been a growth driver for the lithotripters market. The Caribbean region had the greatest increase trend in urolithiasis rates during 2019, with a value of 48.3 per 100,000 people. This alarming rise in kidney stone prevalence is mirrored in a few other Latin American countries, where changes in lifestyle, dietary habits, and growing urbanization are contributing to the ever-increasing burden of urolithiasis. With the speedy growth of an aged population within the region, the demand for effective treatment solution for kidney stones is also raising higher. Since there are improvements in health care and enhanced awareness towards the non-invasive treatments, lithotripsy, advanced requirements for the sophisticated lithotriters are bound to increase in demand. Latin America has experienced steady prevalence of kidney stone and it has been witnessed that the region would see rapid expansion in lithotriters during the coming years.

Middle East and Africa Lithotripters Market Analysis

A significant growth driver for the lithotripters market is the growing prevalence of obesity and NCDs, such as diabetes, among the expatriate population in the Middle East and Africa, especially in the UAE. As of recent studies, it is determined that 32.3% of expatriates in the UAE suffer from obesity, while 15.5% are affected by diabetes. These conditions, when left untreated, contribute to the increasing incidence of kidney stones as highlighted by NCBI. A rising prevalence of kidney stones together with the population aging in this region is contributing to an ever-increasing pressure for effective non-invasive forms of treatment, such as lithotripsy. Given this, the use of advanced lithotripters in the region is expected to increase with awareness about the disease and its preventions and treatment. This might further boost expansion in the markets of lithotripters in the said region.

Top Lithotripter Manufacturers:

The lithotripters market is highly competitive, driven by continuous innovation and technological advancements as companies aim to enhance device efficiency, precision, and patient comfort. Market players are focusing heavily on research and development to introduce next-generation lithotripters with improved imaging features and greater portability. To strengthen their market presence and capitalize on technological synergies, companies frequently engage in strategic partnerships, mergers, and acquisitions. The introduction of minimally invasive and outpatient-friendly devices has increased competition between the companies since they have to fulfill the demands of various customers in hospitals, clinics, and ambulatory surgery centers. In addition, the companies are emphasizing fulfilling the regulatory and cost structure requirements in developed and emerging markets, thereby increasing market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the lithotripters market with detailed profiles of all major companies, including:

- Boston Scientific Corporation

- Convergent Laser Technologies

- Cook Group Incorporated

- DirexGroup

- Dornier MedTech GmbH (Accuron Technologies Limited)

- EDAP TMS

- Medispec

- Olympus Corporation

- Storz Medical AG

Latest News and Developments:

- In May 2024, Dornier Medtech collaborated with urologists to launch Urogpt, a cutting-edge AI tool for patients suffering from kidney stones. This product launch highlighted Dornier's dedication to digital solutions that address patient needs. The introduction of Urogpt marked a significant milestone in the company's mission to assist individuals with kidney stones. It offers urology patients instant advice and actionable insights, thus bringing clarity and reassurance.

- In February 2024, INHS Asvini's Urology Department has been inaugurated with an ESWL machine. The new advanced ESWL machine allows for the non-invasive fragmentation of kidney stones, thus making it a highly advanced treatment in kidney stone diseases and patient care at INHS Asvini.

- In January 2024, Siemens Healthineers Launches Artis Q.GO X-Ray System for Enhanced Lithotripsy Solutions The company is offering the smallest and most mobile system for urology clinics and smaller hospitals, providing the potential to reach more patients underserved by conventional lithotripsy treatment.

Lithotripters Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered |

|

| Applications Covered | Kidney Stones, Ureteral Stones, Pancreatic Stones, Bile Duct Stones |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boston Scientific Corporation, Convergent Laser Technologies, Cook Group Incorporated, DirexGroup, Dornier MedTech GmbH (Accuron Technologies Limited), EDAP TMS, Medispec, Olympus Corporation, Storz Medical AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lithotripters market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global lithotripters market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lithotripters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Lithotripters are medical devices used to treat kidney stones and other urinary tract stones non-invasively. They generate high-energy shock waves to break stones into smaller fragments, which can then pass naturally through the urinary system. Lithotripters are commonly used in hospitals, clinics, and outpatient surgical centers for urological treatments.

The lithotripters market was valued at USD 1.79 Billion in 2024.

IMARC estimates the global lithotripters market to exhibit a CAGR of 3.73% during 2025-2033.

Key factors driving the lithotripters market include rising kidney stone prevalence, advancements in non-invasive technology, increasing demand for outpatient procedures, and expanding healthcare infrastructure. Awareness of early stone management, supportive reimbursement policies, and innovations in portable and compact devices further fuel adoption across hospitals, clinics, and ambulatory surgical centers globally.

In 2024, extracorporeal shock wave lithotripsy systems represented the largest segment by devices, driven by their non-invasive nature and widespread adoption.

Kidney stones lead the market by application owing to their high prevalence, linked to lifestyle factors and dietary habits globally.

The hospitals are the leading segment by end user, driven by advanced infrastructure, specialized urology departments, and high patient volume.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global lithotripters market include Boston Scientific Corporation, Convergent Laser Technologies, Cook Group Incorporated, DirexGroup, Dornier MedTech GmbH (Accuron Technologies Limited), EDAP TMS, Medispec, Olympus Corporation, Storz Medical AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)