Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2025-2033

Lithium-ion Battery Market Size and Share:

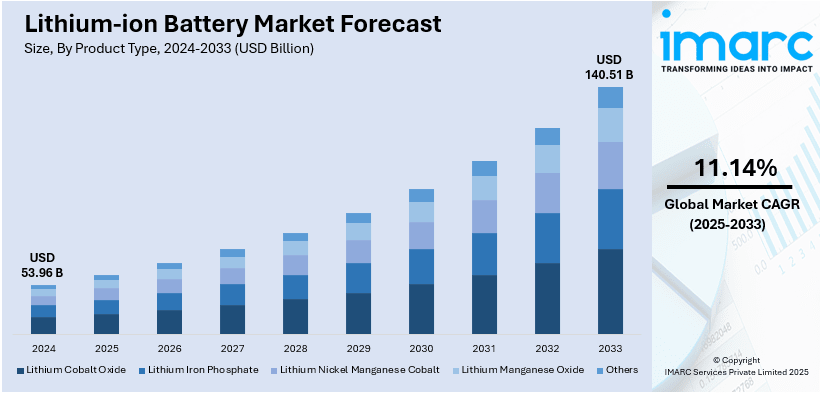

The global lithium-ion battery market size was valued at USD 53.96 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 140.51 Billion by 2033, exhibiting a CAGR of 11.14% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 40.5% in 2024. The rising demand for electric vehicles (EVs), rapid expansion of renewable energy storage solutions, continual technological advancements enhancing battery efficiency and capacity, along with the widespread product adoption in consumer electronics are some of the major factors expanding lithium-ion battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 53.96 Billion |

|

Market Forecast in 2033

|

USD 140.51 Billion |

| Market Growth Rate (2025-2033) | 11.14% |

The market is primarily driven by the increasing deployment of renewable energy storage systems that require high-efficiency, quick-response battery technologies. Moreover, continuous advances in cathode and anode materials are enhancing battery performance, and the integration of digital battery management systems is improving operational reliability, which is creating a positive market outlook. According to industry reports, in order to keep global warming to 1.5°C or below, by 2030, emissions must be cut by 45% and net zero by 2050. This target is resulting in intensified global efforts to decarbonize key sectors, particularly energy and transportation. As a result, regulatory frameworks are increasingly promoting the adoption of low-emission technologies, creating favorable conditions for investments in advanced energy storage systems. Lithium-ion batteries, known for their high energy density and efficiency, emerge as a critical enabler of this transition. Their deployment is expanding rapidly across renewable energy integration, electric mobility, and industrial backup applications.

The market in the United States is significantly expanding due to strategic federal initiatives supporting domestic battery supply chains, including incentives for local production and raw material sourcing. Furthermore, grid modernization efforts, combined with state-level mandates for energy storage capacity, are promoting utility-scale lithium-ion battery deployment, which is also an emerging lithium-ion battery market trend. According to an industry report, there are currently over 5,000 electric school buses in the United States, transporting about 254,000 pupils across 49 states. This rising adoption of electric school buses and commercial fleets is generating demand for compact, durable battery packs. In line with this, strategic collaborations between automakers and tech firms are accelerating innovation in battery chemistry tailored for U.S. climate and usage conditions. Apart from this, rising investments in the aerospace and defense sectors are encouraging the development of specialized lithium-ion solutions suited for high-reliability applications in mission-critical environments.

Lithium-ion Battery Market Trends:

Rapid Growth in EV Adoption

The global lithium-ion battery market dynamics are influenced by the rapid growth in electric vehicle (EV) adoption. According to the International Energy Agency (IEA), in 2023, sales of electric vehicles were 3.5 Million higher in comparison to 2022, recording an increase of 35%. As EVs gain popularity due to their environmental benefits, the demand for lithium-ion batteries is also rising steadily. These batteries are favored for their high energy density and efficiency, crucial for providing the longer driving ranges and reduced charging times that consumers desire. This trend is accelerating investments and technological advancements in the battery sector, ensuring that lithium-ion batteries continue to be integral to the EV revolution. For instance, in March 2024, Subaru and Panasonic Energy strengthened their partnership by signing an agreement for the supply of cylindrical automotive lithium-ion batteries. This supports Subaru's new electrification plan, with batteries from Panasonic Energy being installed in Subaru's BEVs to be produced in Japan.

Technological Advancements

Continual technological innovations and the development of batteries with silicon anodes are positively impacting the lithium-ion battery market outlook. These new batteries stand out due to their higher capacities and longer lifespans as compared to traditional lithium-ion batteries with graphite anodes. Silicon anodes can store up to ten times more lithium than graphite, thereby significantly enhancing the energy density of batteries. This breakthrough is setting a new standard for battery performance, potentially transforming power storage solutions across various applications, including electric vehicles (EVs) and portable electronics. For instance, in April 2024, Log9 Materials and Zeta Energy announced a partnership to advance battery technology. The collaboration aims to enhance overall cell performance by incorporating Zeta Energy's advanced Li-S materials into Log9's energy storage systems. This partnership is expected to yield insights into optimizing lithium-sulfur batteries for various market applications. The global lithium-ion battery market insights highlights that such technological advancements are crucial in maintaining the competitiveness of the market.

Expansion in Consumer Electronics Sector

The expansion in the consumer electronics sector, driven by the increased demand for products like smartphones and wearables, is propelling the lithium-ion battery market growth. According to the United Nations International Telecommunication Union (ITU), 78% of the global population aged 10 years and above owned a mobile phone in 2023. Innovations focusing on enhancing energy density and reducing the physical size of batteries are crucial. For instance, in March 2024, Ampace unveiled the Jumbo-Power series Cylindrical Lithium-ion Batteries at the 37th China International Hardware Fair. The first mass-produced product in this series, the JP40, showcases advancements in battery technology, including high power output, extended lifespan, and efficient fast charging. Ampace's collaboration with industry leaders in the power tool and vacuum cleaner sectors demonstrates a commitment to driving industry change with innovative technologies. These technological advancements allow for longer device lifetimes and smaller, more efficient batteries, meeting consumer expectations for high-performance, portable electronic devices. This trend highlights the crucial role of battery technology in the evolving landscape of consumer electronics.

Lithium-ion Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global lithium-ion battery market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, power capacity, and application.

Analysis by Product Type:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others (Lithium Nickel Cobalt Aluminium Oxide and Lithium Titanate Oxide)

Lithium cobalt oxide leads the market with around 37.8% of market share in 2024.The global market is significantly influenced by the widespread use of lithium cobalt oxide (LiCoO2) in various consumer electronics. Known for its high energy density and voltage capabilities, lithium cobalt oxide dominates the market, especially in smartphones and laptops. As the demand for these devices grows, so does the reliance on LiCoO2, although concerns about cobalt’s ethical sourcing and environmental footprint are prompting research into sustainable alternatives. This shift could potentially reshape the market dynamics as newer, eco-friendlier materials are developed and adopted. For instance, in October 2023, researchers at Hokkaido University and Kobe University developed a groundbreaking method to synthesize lithium cobalt oxide for lithium-ion batteries at a much lower temperature and in a fraction of the time previously required. This "hydroflux process" could revolutionize battery production and enable energy-saving measures in ceramic production processes.

Analysis by Power Capacity:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

3000mAh to 10000mAhleads the market with around 33.8% of market share in 2024. 3000mAh to 10000mAh power capacity range plays a significant part in consumer electronics, portable devices, and small power tools. Batteries in this range are widely applied in smartphones, tablets, wireless earphones, smartwatches, handheld gaming platforms, and small medical devices, providing flexibility in terms of portability and long usage times. The lower end of this range (3000mAh) is appropriate for light devices that need less power, whereas the upper end (nearly 10000mAh) is appropriate for devices that need longer battery life and less recharging. This range of capacity is most in demand due to growing demands for mobility and convenience among users for reliable energy sources for everyday use. Manufacturers are targeting enhanced energy density and cycles of charge within this range in order to comply with user performance and longevity demands.

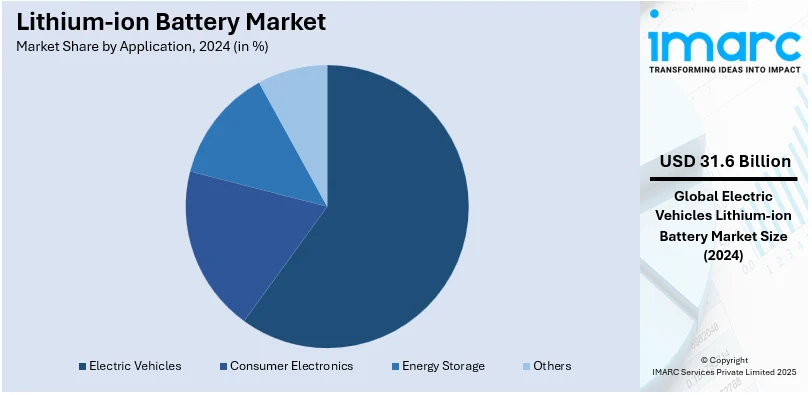

Analysis by Application:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

Electric vehicles lead the market with around 58.5% of market share in 2024. The transition to cleaner transportation and tighter emission controls is greatly increasing demand for high-performance, rechargeable batteries with the capability for long driving ranges, rapid charging, and stable power delivery. Lithium-ion batteries are the battery of choice for EVs due to their high energy density, low weight, and long cycle life. As more auto makers add EVs to their lineups, the need for advanced lithium-ion chemistries like lithium iron phosphate (LFP) and nickel-manganese-cobalt (NMC) keeps on rising. This application segment also promotes advancements in battery management systems, thermal management, and second-life applications. The EV market not only accounts for most lithium-ion battery demand but also defines the trajectory of research, investment, and manufacturing capacity within the battery sector, thereby solidifying its status as key to the world's transition to sustainable mobility.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia Pacific accounted for the largest market share of over 40.5%. The market in the region is primarily driven by robust manufacturing capabilities, significant investments in battery technology, and the growing demand for electric vehicles (EV) and mobile technologies. In addition, government policies promoting electric mobility and localized battery production create favorable conditions for continuous expansion. Asia Pacific's dominance is further supported by the presence of major battery manufacturers and a vast consumer base, which makes it a critical area for market growth and innovation in the lithium-ion battery industry. For instance, in November 2023, BASF and SK On partnered to explore opportunities in the global lithium-ion battery market, focusing on North America and Asia-Pacific. They aim to prioritize the production of cathode active materials and develop sustainable solutions for battery and electric vehicle producers worldwide.

Key Regional Takeaways:

United States Lithium-ion Battery Market Analysis

The United States holds a substantial share of the North America lithium-ion battery market with 88.60% in 2024. The market in the United States is primarily driven by rapid technological advancements, rising demand for sustainable energy solutions, and government initiatives to support clean energy transitions. The growing interest in grid energy storage solutions is a notable growth-inducing factor, as lithium-ion batteries provide a reliable and efficient way to store excess energy generated from renewable sources such as solar and wind. This aligns with the country's increasing investment in renewable energy infrastructure and efforts to transition away from traditional power sources. The adoption of lithium-ion batteries in the defense and aerospace sectors is also contributing to expansion of market size, as these industries require high-performance, lightweight batteries for various applications. Furthermore, the rise in consumer electronics, including smartphones, laptops, and wearables, also continues to support market growth. According to reports, in 2024, 91% of adults in the United States owned a smartphone. Additionally, the supply chain for lithium-ion batteries is being optimized through domestic mining of key raw materials and the establishment of local manufacturing facilities, which help reduce reliance on foreign imports and improve market stability. Collaboration between tech companies, automakers, and energy providers is also propelling the adoption of next-generation battery technologies, making lithium-ion batteries a cornerstone of the United States' energy future.

Asia Pacific Lithium-ion Battery Market Analysis

The Asia Pacific lithium-ion battery market is expanding due to the growing demand for electric vehicles (EVs) and the increasing need for renewable energy storage solutions. As per lithium-ion battery market forecast, countries such as China, Japan, and South Korea are major contributors to the market, with significant investments in battery manufacturing and research and development (R&D) activities. The rise of the EV industry in Asia Pacific, propelled by government incentives and stricter emission regulations, has created a substantial demand for lithium-ion batteries. For instance, in 2023, China accounted for around 60% of all new EV registrations globally, as per the International Energy Agency (IEA). Additionally, the region's robust industrial infrastructure and low-cost manufacturing advantages make it an ideal hub for lithium-ion battery production. The rise in consumer demand for portable electronics and electric two-wheelers in emerging economies, particularly in India and Southeast Asia, is also contributing substantially to market expansion.

Europe Lithium-ion Battery Market Analysis

The Europe lithium-ion battery market is experiencing rapid growth, fueled by the shift toward electrification in the automotive sector, increasing demand for renewable energy storage, and supportive government policies. One of the primary drivers of market growth is the European Union's strong focus on sustainability, which includes regulations to reduce carbon emissions and incentives for electric vehicle (EV) adoption. According to reports, in Q2 2024, GHG emissions in the European Union reached approximately 790 Million Tons of CO2-equivalents, recording a decline of 2.6% in comparison to the same period in the previous year. Additionally, the growing need for energy storage solutions to support the integration of renewable energy sources such as wind and solar power is propelling the use of lithium-ion batteries in grid storage systems. Europe is also focusing on establishing a local battery manufacturing ecosystem, with significant investments in gigafactories to reduce reliance on foreign imports and boost economic growth. Moreover, the development of recycling technologies for lithium-ion batteries is a significant factor augmenting market share, as it ensures a more sustainable supply chain by recovering valuable materials such as lithium, cobalt, and nickel. Besides this, advancements in battery efficiency, charging speed, and cost reduction are making lithium-ion batteries more accessible across various sectors, further driving market expansion in Europe.

Latin America Lithium-ion Battery Market Analysis

The lithium-ion battery market in Latin America is greatly benefiting from the increasing demand for electric vehicles (EVs), renewable energy storage, and consumer electronics. As governments across the region focus on cleaner energy and lower carbon emissions, incentives for EV adoption and the transition to renewable energy are driving the need for efficient energy storage solutions. Countries such as Brazil are expanding their electric vehicle market, which significantly boosts the lithium-ion battery market demand. As per industry reports, in 2023, 52,000 new electric vehicles (EVs) were registered in Brazil, recording a growth of 181.1% in comparison to the previous year. Other than this, increased investments in infrastructure, such as EV charging stations and energy storage systems, are further propelling the market.

Middle East and Africa Lithium-ion Battery Market Analysis

The Middle East and Africa lithium-ion battery market is being increasingly propelled by rising investments in renewable energy projects, particularly solar and wind, which require efficient storage solutions. According to a report by the IMARC Group, the Middle East renewable energy market is projected to grow at a CAGR of 13.53% during 2024-2032. As these regions aim to diversify their energy mix and reduce dependence on fossil fuels, the demand for energy storage systems powered by lithium-ion batteries is growing. Additionally, the rise of smart cities and infrastructure development, particularly in the Gulf Cooperation Council (GCC) countries, is also contributing to the demand for advanced energy storage solutions. As the region focuses on economic diversification and sustainability, investments in electric mobility and renewable energy storage are creating new opportunities for lithium-ion battery adoption.

Competitive Landscape:

The lithium-ion batteries market is characterized by stiff competition fueled by technological innovations, growing demand for electric vehicles, and the increasing adoption of renewable energy storage. Companies are competing to enhance energy density, charging rates, and battery durability, as well as cost-effective and sustainable materials. Industry participants are building capacities and investing in future-generation chemistries, such as solid-state batteries and silicon anodes, to get ahead. Geopolitical considerations and dependencies of supply chains, particularly in raw materials such as lithium and cobalt, also influence competitive strategies. Furthermore, strategic collaborations with automakers and electronics producers are a crucial lever for the attainment of long-term deals. Regional Players are arising in consideration of local demand as well as policy incentives, further contributing to rivalry. The growth path of the market continues to draw new players, including the emergence of startups dealing with recycling and second-life battery usage.

The report provides a comprehensive analysis of the competitive landscape in the lithium-ion battery market with detailed profiles of all major companies, including:

- A123 Systems LLC

- AESC SDI CO., LTD.

- LG Chem Ltd.

- Panasonic Corporation

- SAMSUNG SDI CO., LTD.

- Toshiba Corporation

- Amperex Technology Limited

- BAK Group

- Blue Energy Limited

- BYD Company Ltd.

- CBAK Energy Technology, Inc.

- Tianjin Lishen Battery Joint-Stock CO., LTD.

- Valence Technology, Inc.

- SK Innovation Co., Ltd

- Hitachi, Ltd.

Latest News and Developments:

- January 2025: BatX Energies Pvt. Ltd., a renowned recycler of lithium-ion batteries, opened its Critical Minerals Extraction unit (HUB-1) in Uttar Pradesh. The plant has been established to successfully extract various vital elements, including lithium, nickel, manganese, and cobalt, from spent lithium-ion batteries.

- December 2024: Re-New-Able Technologies and Redivivus entered into a partnership to set up the first lithium-ion battery recycling plant in Illinois. This marks a significant milestone for the state, strengthening the position of Illinois in the clean energy sector.

- October 2024: Getsun Power, a new startup in the field of creative energy storage technologies, unveiled its innovative lithium-ion battery solutions at the India Expo Mart. Moreover, the company also introduced its most recent innovation, a ground-breaking lithium-ion battery storage system for homes and workplaces.

- August 2024: Tata Motors Ltd. formed a strategic alliance with Octillion Power Systems India Private Limited in order to source batteries for its electric vehicles (EVs). With this partnership, the newest Curvv coupe SUV by Tata will be equipped with Octillion’s lithium-ion battery packs, marking a significant shift in the company’s operations as Tata acquires an external supplier of batteries for the very first time.

- May 2024: the JSW Group announced its plans to establish a 60,000-ton lithium-ion refinery and cell production facility in Paradip, Odisha. This will be done through a technological partnership with a leading Chinese manufacturer. This move reflects the growing trend of Indian and global companies seeking to benefit from Chinese expertise in battery technologies for electric vehicles. With an investment of ₹40,000 crore, JSW aims to secure a significant share of India's electric car market, indicating a strategic shift towards sustainable and self-reliant automotive production.

- April 2024: Exide Energy Solutions and Hyundai and Kia formed a strategic alliance to produce electric vehicle (EV) batteries in India. Lithium iron phosphate cells would be the focus in order to include locally made batteries into their next EV models for the Indian market. This project shows the growing momentum in the nation's lithium-ion battery industry and aligns with the Indian government's carbon neutrality ambitions.

Lithium-ion Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others (Lithium Nickel Cobalt Aluminium Oxide and Lithium Titanate Oxide) |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More Than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Asia Pacific, North America, Europe, Middle East and Africa, Latin America |

| Companies Covered | A123 Systems LLC, AESC SDI CO.,LTD., LG Chem Ltd., Panasonic Corporation, SAMSUNG SDI CO.,LTD., Toshiba Corporation, Amperex Technology Limited, BAK Group, Blue Energy Limited, BYD Company Ltd., CBAK Energy Technology, Inc., Tianjin Lishen Battery Joint-Stock CO.,LTD., Valence Technology, Inc., SK innovation Co., Ltd, Hitachi, Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lithium-ion battery market from 2019-2033.

- The lithium-ion battery market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lithium-ion battery market was valued at USD 53.96 Billion in 2024.

The lithium-ion battery market is projected to exhibit a CAGR of 11.14% during 2025-2033, reaching a value of USD 140.51 Billion by 2033.

The market is driven by the rising adoption of electric vehicles (EVs), growing demand for portable consumer electronics, and increasing reliance on renewable energy storage systems. Supportive government policies, declining battery costs, and advances in battery chemistry are also accelerating uptake. Moreover, industrial automation and the expanding grid storage sector are further contributing to market expansion across automotive, energy, and electronics segments.

Asia Pacific currently dominates the lithium-ion battery market, accounting for a share of 40.5% in 2024. The dominance is fueled by robust EV production in China, strong electronics manufacturing bases in South Korea and Japan, and heavy government investment in clean energy infrastructure and local battery production capabilities across the region.

Some of the major players in the lithium-ion battery market include A123 Systems LLC, AESC SDI CO.,LTD., LG Chem Ltd., Panasonic Corporation, SAMSUNG SDI CO.,LTD., Toshiba Corporation, Amperex Technology Limited, BAK Group, Blue Energy Limited, BYD Company Ltd., CBAK Energy Technology, Inc., Tianjin Lishen Battery Joint-Stock CO.,LTD., Valence Technology, Inc., SK innovation Co., Ltd, Hitachi, Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)