Liquid Packaging Cartons Market Size, Share, Trends and Forecast by Carton Type, Packaging Type, Shelf Life, End User, and Region, 2025-2033

Liquid Packaging Cartons Market Size and Share:

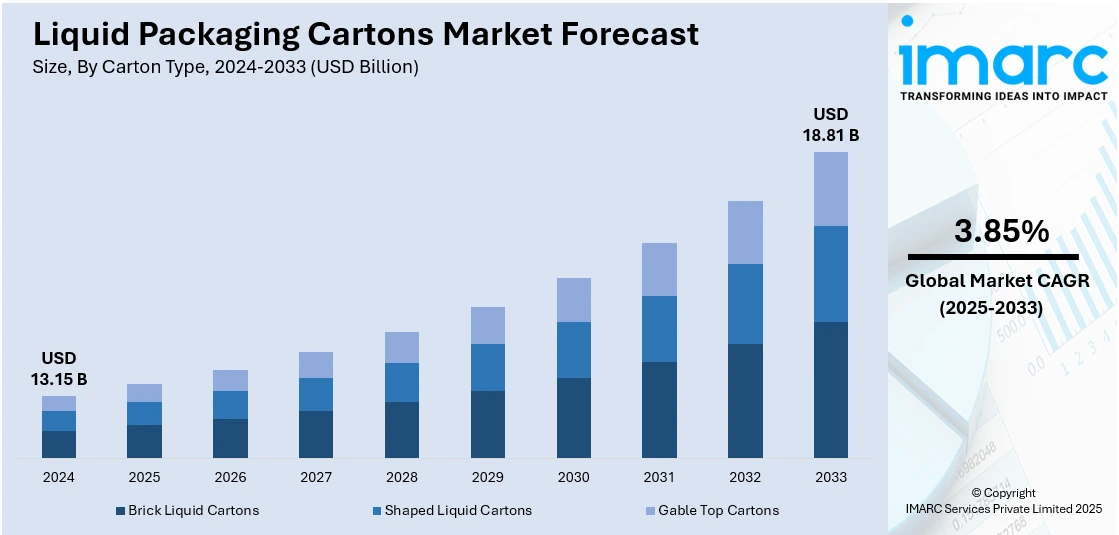

The global liquid packaging cartons market size was valued at USD 13.15 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.81 Billion by 2033, exhibiting a CAGR of 3.85% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 46.5% in 2024. Shifting consumer demand for sustainable and recyclable materials, adoption of stringent environmental regulations, accelerated technological developments in manufacturing and design, increasing product applications in the food and beverage (F&B) sector are some of the key drivers propelling the liquid packaging cartons market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.15 Billion |

| Market Forecast in 2033 | USD 18.81 Billion |

| Market Growth Rate 2025-2033 | 3.85% |

The liquid packaging cartons industry is driven mainly by increasing consumer demand for sustainable and environmentally friendly packaging solutions. With the increase in environmental concerns, consumers and companies alike are looking for alternatives to plastic, and liquid cartons emerge as a viable option because they are recyclable and made from renewable materials. Design innovations like light packaging and enhanced shelf-life protection also support the growth of the market, making it a more appealing proposition for manufacturers across the beverage, dairy, and food sectors. The growing trend towards ready-to-drink consumption, particularly among consumers with on-the-go lifestyles, has further driven demand for the market. Liquid cartons are perceived as the perfect package for providing portability, convenience, and product protection for applications such as juices, milk, and plant-based beverages.

The United States stands out as a key market disruptor, driven by its strong demand for sustainable packaging solutions and technological advancements. Rising consumer consciousness toward environmental concerns, especially plastic contamination, has created a move towards green alternatives, propelling the use of liquid packaging cartons. The vast beverage, dairy, and food industries in the country are seriously looking for novel, sustainable solutions to packaging, both to serve consumer needs and comply with tightened environmental regulations. Furthermore, the US market enjoys a very strong research and development network where companies invest in new technology packaging to improve the functionality and recyclability of liquid cartons. Furthermore, industry leaders such as Tetra Pak, SIG Combibloc, and Elopak have strong operations within the US, which help drive innovation and market penetration. The expansion of the plant-based beverage market, coupled with changing consumer tastes for convenient, sustainable offerings, further upends conventional packaging solutions in the region.

Liquid Packaging Cartons Market Trends:

Changing consumer preferences for sustainable and recyclable materials

The increasing consumer awareness of the environmental impact of packaging materials is acting as a growth-inducing factor. In line with this, the growing preference for sustainable and recyclable options, such as liquid packaging cartons, which are primarily made from paperboard, is propelling the market growth. According to industry reports, 82% of consumers, including 90% of young adults, are willing to pay more for sustainable packaging, despite rising inflation. Furthermore, these cartons are designed to be eco-friendly and contribute to the reduction of emission levels. Moreover, consumers are seeking transparency in packaging and are inclined to support brands that align with their values of environmental stewardship. In addition, the increasing ecological campaigns and awareness, which further reinforce consumer choice, are supporting the market growth. Moreover, liquid packaging cartons are lightweight, recyclable, and often sourced from responsible forestry, which aligns well with consumer preferences, thus providing a positive liquid packaging cartons market outlook.

Implementation of stringent regulations

Governments and regulatory bodies across various regions are implementing stringent regulations regarding the use of packaging materials. Furthermore, these regulations are aimed at reducing the environmental impact, promoting recycling, and encouraging the use of materials that are biodegradable or derived from renewable resources. In addition, liquid packaging cartons, with their composition of paperboard and recyclable plastics, often meet these regulatory requirements, which further aids in boosting liquid packaging cartons demand. Moreover, adherence to such regulations also serves as a competitive advantage for businesses in showcasing their commitment to sustainability. Apart from this, several countries are actively discouraging or even banning certain types of non-biodegradable packaging, which is further propelling the shift towards environmentally responsible solutions, such as liquid packaging cartons.

Rapid technological advancements in manufacturing and design

Technological advancements have significantly influenced the liquid packaging cartons market by enabling enhanced functionality, design aesthetics, and manufacturing efficiency. In line with this, the innovation in materials science, which has led to the development of cartons that provide superior protection, extended shelf life, and better containment of the products, is boosting the market growth. Additionally, the recent advancements in printing technology, providing high-quality graphics and customization capabilities, which aid in enhancing brand visibility and appeal, are positively influencing the liquid packaging cartons market growth. Moreover, automation in the manufacturing process, which has streamlined production and enabled precision and consistency in quality, is contributing to the market growth. The global smart manufacturing market size was valued at USD 358.25 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 824.98 Billion by 2033, exhibiting a CAGR of 9.62% from 2025-2033. Along with this, these technological enhancements have allowed liquid packaging cartons to become adaptable to various closure types, sizes, and applications, making them suitable for a wide array of products.

Liquid Packaging Cartons Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global liquid packaging cartons market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on carton type, packaging type, shelf life, and end user.

Analysis by Carton Type:

- Brick Liquid Cartons

- Shaped Liquid Cartons

- Gable Top Cartons

Brick liquid cartons stand as the largest component in 2024, holding around 40.6% of the market. Brick liquid cartons are designed in a rectangular prism shape, which allows for optimal space utilization. This design enables efficient stacking and storage, both on store shelves and during transportation. Furthermore, this form factor also contributes to maximizing the use of space, reducing transportation costs, and enhancing overall logistics efficiency. Apart from this, these cartons are manufactured from renewable materials such as paperboard, with thin layers of plastic and aluminum for protection. This composition aligns with the growing emphasis on sustainability and environmental consciousness among consumers and regulators. Additionally, the manufacturing process of brick liquid cartons is relatively simple and efficient, leading to reduced production costs. These savings are further passed on to consumers, making products packaged in brick liquid cartons more competitively priced.

Analysis by Packaging Type:

- Flexible Liquid Packaging

- Rigid Liquid Packaging

Consumer electronics leads the market share in 2024. Flexible liquid packaging is lighter than traditional packaging solutions, which aids in reducing transportation costs and energy consumption, thus contributing to sustainability efforts. Furthermore, it conforms to the shape of the product, reducing wasted space in shipping and storage, which leads to further cost savings and logistical benefits. Moreover, flexible liquid packaging also aids in preserving the freshness and quality of the contents, thus extending the product’s shelf life.

Rigid liquid packaging provides robust protection against physical damage during transportation and handling. Its strength ensures the integrity of the product and prevents leakage or spoilage. Furthermore, it ensures stability on shelves and during transport, which prevents tipping and spilling, making handling and display more manageable. Moreover, rigid liquid packaging provides excellent barriers against moisture, oxygen, and contaminants, preserving the quality and extending the shelf life of the products.

Analysis by Shelf Life:

- Long Shelf Life Cartons

- Short Shelf Life Cartons

Long shelf life cartons lead the market with around 57.6% of market share in 2024. Long shelf life cartons are specifically engineered to preserve the quality of the liquid content. They are constructed with layers of materials, such as paperboard, plastic, and aluminum, which work together to prevent the ingress of air and light, factors that can undermine the quality of the product. Furthermore, they ensure that the liquid remains fresh and retains its original taste, texture, and nutritional value. Additionally, long shelf life cartons allow manufacturers to distribute their goods over long distances without the need for refrigeration. Moreover, they aid in reducing wastage at the retail level, which is an attractive feature for both retailers and consumers. Besides this, long shelf life cartons offer flexibility in consumption, as they allow consumers to purchase in bulk and store for future use without concern for rapid spoilage.

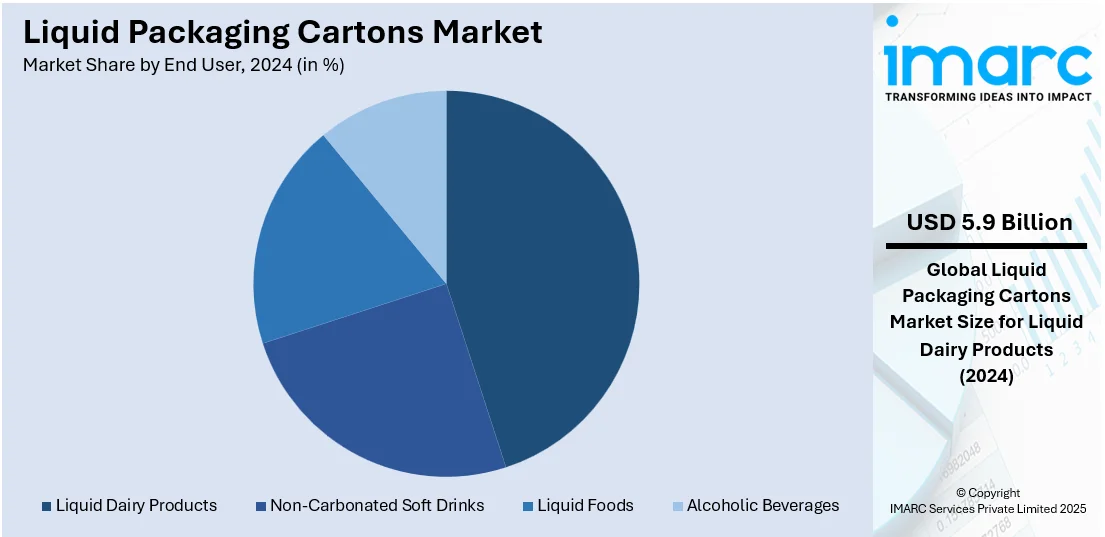

Analysis by End User:

- Liquid Dairy Products

- Non-Carbonated Soft Drinks

- Liquid Foods

- Alcoholic Beverages

Liquid dairy products lead the market with around 45.0% of market share in 2024. Liquid dairy products such as milk, yogurt, and cream are staples in many diets around the world, which ensures a consistent demand for effective packaging solutions, such as liquid packaging cartons. Furthermore, they are perishable and require proper packaging to maintain freshness and prevent contamination. In line with this, liquid packaging cartons are designed to offer extended shelf life and preserve the quality of the content, making them a preferred choice for dairy packaging. Additionally, the increasing focus of the dairy industry on sustainability is facilitating the demand for liquid packaging cartons that are recyclable and often made from renewable resources. Moreover, liquid packaging cartons align with modern consumer lifestyles as they are lightweight and easy to handle, making them suitable for on-the-go consumption of dairy products.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 46.5%. Europe is witnessing considerable growth in the market due to the imposition of stringent regulations and standards by regional governments concerning packaging materials, particularly with a focus on environmental sustainability. Furthermore, the escalating environmental consciousness among regional consumers is facilitating the demand for products packaged in sustainable and recyclable materials. Additionally, the presence of leading packaging companies in Europe that are heavily investing the developing advanced liquid packaging solutions is boosting the market growth. Moreover, the significant growth in the food and beverage (F&B) in the region, which requires liquid packaging cartons for various products, such as juices, sauces, and dairy, is propelling the market growth. In addition, the introduction of supportive policies by governments promoting a circular economy, focusing on the life cycle of materials through reduction, recycling, and reuse, is positively influencing the market growth.

Key Regional Takeaways:

United States Liquid Packaging Cartons Market Analysis

In 2024, the United States accounted for over 88.20% of the liquid packaging cartons market in North America. The liquid packaging cartons market in the United States is driven by increasing demand for sustainable packaging solutions. As environmental concerns rise, consumers and companies are prioritizing eco-friendly options like liquid cartons, which are recyclable and made from renewable materials. The growing popularity of plant-based beverages, such as dairy alternatives, alongside traditional dairy products, further propels the market. According to reports, 84% of U.S. consumers consume dairy or dairy alternatives, highlighting a strong and expanding market for these products. Additionally, advances in packaging technology, such as improved barrier properties and longer shelf-life capabilities, enhance the appeal of liquid cartons. The rise in on-the-go consumption and e-commerce supports market growth, as manufacturers adapt to meet the needs of direct-to-consumer channels. Moreover, government initiatives promoting sustainability and regulations on plastic packaging contribute to the adoption of liquid cartons as a viable alternative. This trend of environment-conscious packaging choices, combined with the strong demand for dairy and dairy alternative beverages, is set to continue driving the U.S. liquid packaging cartons market forward.

Asia Pacific Liquid Packaging Cartons Market Analysis

In the Asia-Pacific region, the liquid packaging cartons market is fueled by rapid urbanization and shifting consumer preferences towards convenient and sustainable packaging. As disposable incomes rise, particularly in emerging markets like India, the demand for packaged beverages such as dairy, juices, and non-carbonated drinks has surged. According to industry reports, India’s per capita disposable income increased from USD 2.11 Thousand in 2019 to USD 2.54 Thousand in 2023, and is projected to reach USD 4.34 Thousand by 2029. This economic growth drives consumer spending on packaged drinks. Additionally, the growing regulatory push for eco-friendly packaging alternatives in countries like India, China, and Japan has accelerated the shift towards liquid cartons. Rising concerns over plastic waste and the environmental impact of traditional packaging also drive demand for more sustainable options.

Europe Liquid Packaging Cartons Market Analysis

In Europe, the liquid packaging cartons market is primarily driven by stringent environmental regulations and the growing emphasis on sustainable packaging solutions. The European Union's focus on reducing plastic waste, coupled with packaging recyclability targets, has encouraged the adoption of eco-friendly alternatives like liquid cartons. According to the European Union, more than three-quarters of Europeans (78%) agree that environmental issues directly impact their daily lives and health, which further fuels the demand for sustainable packaging options. Consumer preferences for healthy and organic beverages, such as fruit juices, smoothies, and dairy alternatives, continue to expand market opportunities. Additionally, the region's strong recycling infrastructure and increasing consumer awareness of environmental concerns promote the use of recyclable packaging. The demand for convenience, coupled with technological advancements in liquid carton packaging such as lightweight designs and improved shelf-life capabilities, also contributes to market growth. The rise in e-commerce and online grocery shopping has further driven the need for liquid packaging solutions, as manufacturers look to meet the demands of direct-to-consumer deliveries. These factors are expected to support continued growth in the European liquid packaging cartons market.

Latin America Liquid Packaging Cartons Market Analysis

In Latin America, the liquid packaging cartons market is driven by the growing demand for packaged beverages, particularly juices and dairy products. According to reports, the Latin American dairy market, valued at USD 60 Billion, accounts for less than 15% of global dairy sales, indicating significant regional consumption. Rising awareness of environmental concerns has led to increased preference for recyclable packaging. Additionally, the region's growing focus on health and wellness, along with rising disposable incomes, is driving demand for nutritious, ready-to-consume beverages. These factors, coupled with regulatory pushes for eco-friendly packaging, are expected to fuel continued market growth.

Middle East and Africa Liquid Packaging Cartons Market Analysis

In the Middle East and Africa, the liquid packaging cartons market is propelled by a shift towards sustainable packaging solutions and increasing demand for convenience in the food and beverage sector. The Middle East beverage packaging market is projected to exhibit a growth rate (CAGR) of 4.27% from 2024 to 2032. Growing awareness of environmental concerns, alongside efforts to reduce plastic usage, has driven the demand for eco-friendly packaging options like liquid cartons. Additionally, expanding beverage consumption due to health trends and a rising population further supports the market's growth in the region.

Competitive Landscape:

A number of top players in the market for liquid packaging cartons have been working to drive growth in the market through innovation, sustainability initiatives, and strategic alliances. Tetra Pak, SIG Combibloc, and Elopak are among the top players that are spearheading the push through concentration on product innovation to address evolving consumer needs for convenience, portability, and sustainability. Such players are making sizeable investments in R&D for designing new age, innovative, packaging solutions which are light-weighted, simple in usage, and tailor-made to suit many a beverage, milk-based item, and food solutions. Focus has been considerably increased in strengthening recyclability as well as lowering environmental impact through cartons meant for liquid packs. Several of such companies are introducing eco-friendly raw materials, curbing the consumption of plastics, and adhering to environment-friendly manufacturing protocols. Also, certain players are making notable efforts in developing complete renewable packaging, for instance, Tetra Pak's concentration on renewable plant-based materials. Strategic partnerships with food and beverage companies and suppliers have also played an important role in broadening the use of liquid cartons to various markets.

The report provides a comprehensive analysis of the competitive landscape in the liquid packaging cartons market with detailed profiles of all major companies, including:

- Adam Pack S.A.

- Billerud AB

- Elopak

- Greatview Aseptic Packaging Co. Ltd.

- IPI s.r.l. (Coesia S.p.A.)

- Mondi plc

- Nippon Paper Industries Co. Ltd.

- Pactiv Evergreen Inc.

- SIG Combibloc Group Ltd. (Reynolds Group Holdings)

- Smurfit Kappa Group plc

- Tetra Laval Group

- Uflex Limited

Latest News and Developments:

- October 2024: Tetra Pak partnered with Lactalis to introduce ISCC PLUS-certified recycled polymers in carton packaging. Sourced from recycled beverage cartons in Spain, the material maintains quality through chemical recycling. The initiative supports circular packaging, with Tetra Pak committing €100 million annually over the next decade.

- September 2024: Carton Service CSI is expanding its liquid packaging facility in Shelby, Ohio, with a USD 10 Million investment in printing, sealing, and testing equipment. The company aims to address the limited supply of North American liquid carton producers, particularly amid increasing demand for sustainable packaging. The expansion includes workforce growth and innovations in gable-top cartons for dairy, non-dairy, beverages, and non-traditional liquids.

- June 2024: Zotefoams, in partnership with Refresco, advanced ReZorce® beverage carton trials, signing its first contract manufacturing partner with a 100 Million carton capacity. At a May 15 event, experts emphasized ReZorce’s recyclability and role in sustainable packaging solutions.

- May 2024: UFlex expanded its packaging portfolio in Q1 2024, introducing advanced liquid packaging solutions. Notable innovations include a 5L spout pouch for More Light liquid detergent and a 5kg stand-up spout pouch for Asal idly-dosa batter. These designs enhance convenience, durability, and sustainability. The company also launched high-barrier films and coatings, reinforcing its commitment to innovative, eco-friendly packaging.

- February 2024: Dr. Bronner’s launched a 32 oz. soap refill carton nationwide, reducing plastic use in personal care and home cleaning. A life cycle analysis confirmed paper cartons as the most sustainable option compared to plastic, aluminum, and glass.

Liquid Packaging Cartons Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Carton Types Covered | Brick Liquid Cartons, Shaped Liquid Cartons, Gable Top Cartons |

| Packaging Types Covered | Flexible Liquid Packaging, Rigid Liquid Packaging |

| Shelf Life Covered | Long Shelf Life Cartons, Short Shelf Life Cartons |

| End Users Covered | Liquid Dairy Products, Non-Carbonated Soft Drinks, Liquid Foods, Alcoholic Beverages |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adam Pack S.A., Billerud AB, Elopak, Greatview Aseptic Packaging Co. Ltd., IPI s.r.l. (Coesia S.p.A.), Mondi plc, Nippon Paper Industries Co. Ltd., Pactiv Evergreen Inc., SIG Combibloc Group Ltd. (Reynolds Group Holdings), Smurfit Kappa Group plc, Tetra Laval Group, Uflex Limited. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the liquid packaging cartons market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global liquid packaging cartons market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the liquid packaging cartons industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The liquid packaging cartons market was valued at USD 13.15 Billion in 2024.

The liquid packaging cartons market is projected to exhibit a CAGR of 3.85% during 2025-2033.

The liquid packaging cartons market is driven by increasing demand for sustainable and eco-friendly packaging solutions, consumer preference for convenience, and rising awareness about environmental impact. Innovations in design and materials, along with the growth of the beverage, dairy, and food industries, further contribute to the market's expansion.

Europe currently dominates the market driven by increasing demand for sustainable packaging, consumer preference for eco-friendly solutions, and rising awareness about reducing plastic waste.

Some of the major players in the liquid packaging cartons market include Adam Pack S.A., Billerud AB, Elopak, Greatview Aseptic Packaging Co. Ltd., IPI s.r.l. (Coesia S.p.A.), Mondi plc, Nippon Paper Industries Co. Ltd., Pactiv Evergreen Inc., SIG Combibloc Group Ltd. (Reynolds Group Holdings), Smurfit Kappa Group plc, Tetra Laval Group, Uflex Limited. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)