Liquid Detergent Market Size, Share, Trends and Forecast by Product Type, End-Use, Distribution Channel, and Region, 2025-2033

Liquid Detergent Market Size and Share:

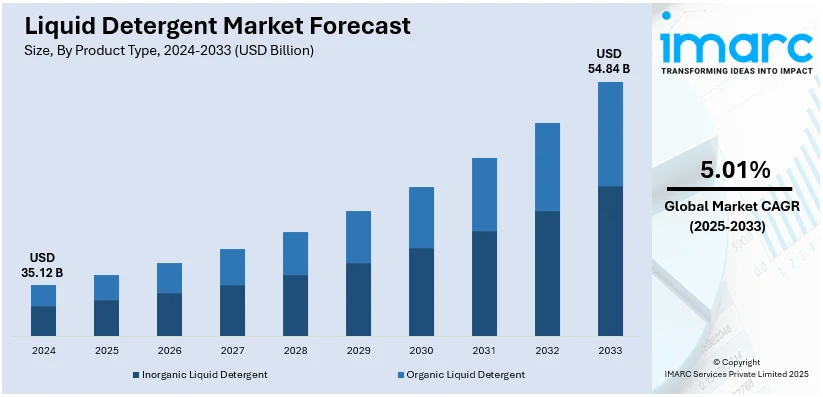

The global liquid detergent market size was valued at USD 35.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 54.84 Billion by 2033, exhibiting a CAGR of 5.01% from 2025-2033. North America currently dominates the market, holding a market share of over 30.2% in 2024. The growth of the North American region is driven by increasing demand for convenient cleaning solutions, rising awareness about hygiene, and a shift toward eco-friendly products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 35.12 Billion |

|

Market Forecast in 2033

|

USD 54.84 Billion |

| Market Growth Rate (2025-2033) | 5.01% |

The increasing demand for convenience and time-saving solutions is one of the critical factors impelling the market growth. Liquid detergents are easier to use compared to powder forms, as they dissolve quickly in water and require no extra effort to mix. This makes them an optimal choice for busy individuals looking for efficient laundry solutions. Furthermore, liquid detergents are adaptable, efficient in stain removal, and can be applied straight to trouble spots, providing a more targeted cleaning experience. In addition to this, producers are constantly innovating, developing new formulas with improved performance, such as superior stain removal, fabric protection, and even environment-friendly or hypoallergenic alternatives. These developments address changing user requirements, particularly for sensitive skin and eco-friendly product choices. Moreover, the rise of e-commerce and home delivery options is increasing the availability of liquid detergents, allowing shoppers to easily buy a variety of items from their residences.

To get more information on this market, Request Sample

The United States holds a significant position in the market, supported by the increasing concerns regarding cleanliness. Liquid detergents offer superior stain removal, fabric care, and antibacterial properties, which are sought after by users. Furthermore, the greater focus on sustainability is stimulating demand for liquid detergents that are consistent with environmentally responsible practices.. Individuals are increasingly aware of the environmental impact of their daily activities, including laundry. As a result, liquid detergent brands are innovating to promote more sustainable washing habits, such as using cold water for cleaning. Detergents designed for cold water laundry help users cut energy utilization, lower utility expenses, and shrink carbon footprints while maintaining cleaning effectiveness. In 2024, Tide and Walmart initiated a campaign encouraging cold water washing with Tide's enhanced liquid detergent formula. The initiative emphasizes the ecological and monetary advantages of washing with cold water, such as energy conservation and efficient cleaning. This partnership seeks to promote cold water washing as a common practice by 2030, lowering carbon emissions.

Liquid Detergent Market Trends:

Rising Demand for Convenience and Ease of Use

The main reason for the increasing demand for liquid detergent is the convenience and simplicity it provides to users. Liquid detergents are available in a ready-to-use format, which removes the need for measurement and lowers the likelihood of spills. This is especially advantageous for individuals seeking time-saving and efficient answers for their daily laundry requirements. In markets such as India, the need for ready-to-use detergents is swiftly growing, with per capita usage expected to increase from 2.7 kg to 7-9 kg annually. This increase signifies a wider global shift towards more effective cleaning products that provide ease and improved outcomes. The growing appeal of liquid detergents is supported by their adaptability, allowing for use in both standard and high-efficiency washers, and they function effectively across different water temperatures. The convenience of their packaging, including easy-pour bottles and accurate dispensing features, boosts their attractiveness, making the laundry experience hassle-free and more enjoyable for users.

Shift Toward Eco-Friendly and Sustainable Products

With sustainability emerging as a worldwide focus, people are choosing liquid detergents composed of biodegradable components, devoid of harsh chemicals, and contained in recyclable or reusable packaging. Producers are addressing this demand by redesigning their offerings to be more environmentally friendly, producing plant-derived or non-toxic cleaners that attract eco-conscious buyers. Moreover, the focus on minimizing plastic waste is promoting the creation of refillable packaging alternatives. As individuals gain more knowledge regarding the environmental effects of their buys, they are intentionally looking for products that match their sustainability principles. The increasing demand for environmentally friendly liquid detergents is influencing the market, as companies concentrate on product innovation and packaging solutions that align with this eco-conscious trend. In 2024, ECOS introduced its Ultra-Concentrated Laundry Detergent at the Natural Products Expo West. Housed in a recyclable aluminum bottle, it provides almost 80 washes featuring stain-fighting enzymes, offered in Free & Clear and Lavender fragrances. The item, costing $17.99, will be accessible on Amazon beginning in mid-May.

Technological Integration for Faster and More Efficient Cleaning

Technological advancements are crucial in propelling the liquid detergent market, especially via innovations aimed at improving cleaning effectiveness and quickness. Producers are incorporating technologies like artificial intelligence (AI), robotics, and machine learning (ML) to create products that satisfy the increasing user need for faster and more efficient cleaning options. These advancements seek to enhance detergent compositions to perform efficiently in shorter wash cycles, guaranteeing optimal cleaning results with reduced time and effort. Moreover, technologies that remove residues and enhance detergent efficiency in particular situations, like low water temperatures or brief washing times, are increasingly common. In 2024, Unilever introduced Wonder Wash within its Dirt Is Good brand, aimed at functioning effectively in brief 15-minute laundry cycles. This advancement, created with AI and robotics, meets emerging user demands for prompt, efficient cleaning with no residues left behind.

Liquid Detergent Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global liquid detergent market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, end-use and distribution channel.

Analysis by Product Type:

- Inorganic Liquid Detergent

- Organic Liquid Detergent

Inorganic liquid detergent stand as the largest component in 2024, holding 55.0% of the market. Inorganic liquid detergent is the largest segment, driven by its widespread usage in both household and industrial cleaning. This kind of detergent usually includes surfactants, phosphates, and various chemical compounds that deliver effective stain removal and cleaning capabilities. Its ability to remove grease, oils, and dirt makes it a favored option for routine laundry, dishwashing, and general cleaning jobs. The demand for inorganic liquid detergent is also supported by its cost-effectiveness, accessibility, and long-standing presence in the market. Numerous people rely on inorganic formulas because of their established history of providing excellent cleaning effectiveness, especially for tough cleaning tasks. Moreover, inorganic liquid detergent works well with different types of washing machines, leading to its extensive usage. As individuals emphasize convenience and efficiency, inorganic liquid detergent remains the market leader.

Analysis by End-Use:

- Residential

- Commercial

Residential is the largest segment with 70.0% of market share in 2024. Residential holds the biggest market share due to the increasing need for efficient, convenient, and user-friendly cleaning solutions in homes. Resident users are opting for liquid detergents because of their enhanced stain removal effectiveness, convenience of use, and compatibility with different washing machines. The ease of use of liquid detergents, which dissolve readily in water and can be directly used on stains, makes them a favored option for everyday laundry tasks. Moreover, the shift towards environment-friendly and skin-sensitive formulas in liquid detergents is aiding their expansion in the market. People are becoming more aware about the components in their cleaning supplies, choosing formulas that are mild but still efficient. Due to hectic schedules, residential users focus on products that conserve time and energy, and liquid detergents meet these demands by offering a convenient and effective cleaning solution.

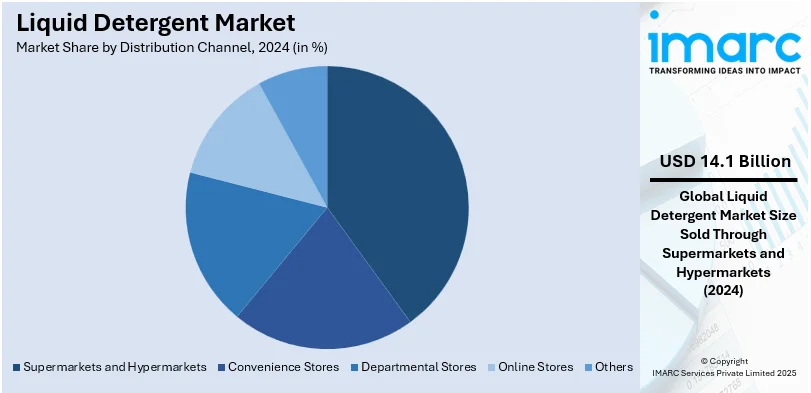

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market, accounting 40.2% share in 2024. Supermarkets and hypermarkets represent the largest segment, owing primarily to their broad market reach and the ability to provide a diverse selection of liquid detergent brands. These shops provide a complete shopping experience, enabling users to easily find different product types, sizes, and formulas of liquid detergents, catering to a variety of preferences and needs. Supermarkets and hypermarkets provide the benefit of buying in bulk, frequently offering discounts or deals that appeal to budget-minded buyers. The ease of exploring and buying home goods in one place, coupled with the presence of reliable brands, is establishing supermarkets and hypermarkets as the leading channel in the market. Additionally, these stores are strategically located in both urban and suburban areas, making them accessible to a broad user base. Their large-scale operations, combined with effective merchandising and client loyalty programs, contribute to their leading position in the distribution landscape.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share, reaching 30.2%. North America dominates the market, owing to the region’s preference for high-quality, convenient cleaning products and a well-established retail infrastructure. The increasing popularity of innovative formulations that cater to diverse user needs, such as eco-friendly, hypoallergenic, and high-efficiency detergents are bolstering the market growth. Individuals are highly focused on efficiency and performance, leading to a preference for liquid detergents due to their superior stain-fighting abilities and ease of use. In 2024, P&G Professional North America revealed the introduction of Tide Professional Commercial Laundry Detergent and Downy Professional Fabric Softener. These items are intended to assist businesses, such as hospitality and healthcare, in saving time and enhancing efficiency by offering a reliable clean in a single wash. The selection features liquid, powder, and PODS choices, offered in different sizes for commercial purposes.

Key Regional Takeaways:

United States Liquid Detergent Market Analysis

In North America, the United States accounted for 84.40% of the total market share. In the United States, the growing involvement in sports is significantly contributing to the rise in the use of liquid detergents. For example, in 2023, the US recorded an unprecedented 242 million active participants in sports and fitness, reflecting a 12.1% rise since 2016. The increase in sports participation boosts the need for liquid detergents, as people look for effective cleaning options for their athletic clothing. The expanding fitness trend is consequently increasing the use of liquid detergents in homes. As people partake in athletic pursuits, there is a heightened demand for efficient cleaning products that can address the specific stains and smells linked to sports clothing. Liquid detergents are greatly preferred for their capacity to eliminate oils and smells, guaranteeing a fresh and clean result for sports clothing. The rising need for specialized laundry options is enhancing the appeal of liquid detergents, providing focused effectiveness for athletic wear. This shift is also influenced by the growing awareness about laundry care products that provide enhanced fabric protection while maintaining the cleanliness of sports clothing. As sports participation continues to rise across various age groups and levels, the preference for liquid detergents in households is expected to grow.

Europe Liquid Detergent Market Analysis

In Europe, the growing trend of sustainable living is promoting the use of liquid detergents composed of organic and environment-friendly components. Reports indicate that in 2023, the demand for eco-friendly home care products in Germany soared to 70%, showcasing an increasing user inclination towards sustainable choices. This change is especially advantageous for the uptake of liquid detergents, as environmentally aware individuals look for sustainable options. The increase in sustainable product buying reveals a notable market chance for eco-friendly liquid detergent brands. Liquid detergents made with biodegradable and non-toxic ingredients match the increasing demand for eco-friendly options. The interest in natural and organic products is prompting manufacturers to concentrate on developing detergent solutions that appeal to this environmentally aware user group. With rising worries about pollution and waste, eco-friendly liquid detergents like those featuring recyclable packaging and lower chemical levels are becoming more popular, showcasing the larger transition toward sustainable living in the area.

Asia Pacific Liquid Detergent Market Analysis

In the Asia-Pacific region, the surge in online shopping is contributing to the growing demand for liquid detergents. According to India Brand Equity Foundation, India's online shopper base has surged by 125 Million in the past three years, with an additional 80 Million expected by 2025. This growth is driving the adoption of liquid detergents, as people prefer the convenience of online shopping. The shift to e-commerce is enhancing product accessibility, leading to greater demand for liquid detergent brands. With the convenience of digital platforms, buyers have easier access to a wide range of products, including various liquid detergent brands. This shift in shopping habits is making it simpler for individuals to explore different detergent types and choose products based on preferences such as effectiveness, price, and sustainability. E-commerce sites offer comprehensive details and user feedback, assisting buyers in making knowledgeable choices regarding the most suitable liquid detergents for their requirements. Additionally, the growth of online shopping is making liquid detergents more available in both city and rural settings, increasing their usage.

Latin America Liquid Detergent Market Analysis

In Latin America, the rise in disposable incomes is a major factor contributing to the growing popularity of liquid detergents. For example, it is anticipated that total disposable income in Latin America will rise by almost 60% from 2021 to 2040, fueled by reduced regional inequalities and advancements in technology. When individuals attain greater income levels, they tend to be more willing to invest in products that provide convenience and efficiency, like liquid detergents. These items are viewed as contemporary and adaptable, addressing various laundry requirements, from routine washing to specialized treatment for delicate materials. With rising disposable incomes, especially in developing markets, a clear change in user behavior is occurring, favoring premium laundry products, as liquid detergents are increasingly preferred for their excellent cleaning ability and convenience.

Middle East and Africa Liquid Detergent Market Analysis

The adoption of liquid detergents in the Middle East and Africa is propelled by an expanding distribution network, including supermarkets, hypermarkets, and specialized retail stores, offering buyers convenient access to a variety of options. According to McKinsey, the growing distribution channels in Egypt, the UAE, and Morocco, with a record number of new store openings, are driving the adoption of liquid detergents. In 2023, 211 stores opened in Egypt, 147 in the UAE, and 131 in Morocco, enhancing product accessibility and market penetration. Increased user awareness about the efficacy and versatility of liquid detergents contributes to their growing popularity. The preference for compact and easy-to-use packaging further supports adoption, as individuals seek practical solutions for everyday cleaning needs. Additionally, innovations in product formulations, providing specialized cleaning properties, cater to a broader range of user demands, including stain removal and fabric care. The availability of competitive pricing strategies also makes liquid detergents more appealing to a wide demographic.

Competitive Landscape:

Key players are presently focusing on sustainability, product innovation, and expanding their overall market reach. Numerous companies are creating sustainable and biodegradable formulas to address the increasing demand for eco-conscious products. Moreover, they are channeling funds into cutting-edge technology to boost product effectiveness, like enhanced stain removal and fabric maintenance. Businesses are concentrating on tailored user experiences by launching specialized detergents for sensitive skin or specific laundry requirements. Efforts are underway to establish strategic partnerships and collaborations with retail chains and online platforms for enhancing distribution and visibility. Additionally, players are embracing sustainable packaging options, like recyclable or refillable containers, to connect with environmentally aware user trends. In December 2024, Ocado has broadened its Reuse selection to feature laundry necessities, providing customers with Reuse Non-Bio Liquid Detergent (2.7L) and Reuse Clear Skies Fabric Conditioner (2.7L). This program is a component of the Refill Coalition's campaign to minimize single-use packaging.

The report provides a comprehensive analysis of the competitive landscape in the liquid detergent market with detailed profiles of all major companies, including:

- Amway Corporation

- Church & Dwight Co., Inc.

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Kao Corporation

- Lion Corporation

- Reckitt Benckiser Group PLC

- S. C. Johnson & Son, Inc.

- The Procter & Gamble Company

- Unilever Plc

Latest News and Developments:

- February 2024: Swash® Laundry Detergent has unveiled a fresh new look with bold packaging and a re-engineered Auto-Stop Top, enhancing its ultra-concentrated formula. As part of its expansion, the brand has invested in a new advertising campaign featuring Hollywood's Ronald Gladden.

- December 2023: Godrej Consumers has unveiled a liquid detergent brand called 'Godrej Fab' that is marketed to the mass market of South India, including Tamil Nadu, Andhra Pradesh, Karnataka, and Kerala. In order to support the demand that is growing for the FMCG sector, the company invests in expanding its product portfolio.

Liquid Detergent Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Inorganic Liquid Detergent, Organic liquid Detergent |

| End Uses Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Amway Corporation, Church & Dwight Co., Inc., Godrej Consumer Products Limited, Henkel AG & Co. KGaA, Kao Corporation, Lion Corporation, Reckitt Benckiser Group PLC, S. C. Johnson & Son, Inc., The Procter & Gamble Company, Unilever Plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special reque |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the liquid detergent market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global liquid detergent market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the liquid detergent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The liquid detergent market was valued at USD 35.12 Billion in 2024.

IMARC estimates the liquid detergent market to exhibit a CAGR of 5.01% during 2025-2033, reaching a value of USD 54.84 Billion by 2033.

The market is driven by increasing demand for convenience, superior stain removal capabilities, eco-friendly and sustainable products, and innovations in detergent formulations that cater to changing consumer preferences, such as hypoallergenic and biodegradable options.

North America currently dominates the liquid detergent market, accounting for a share exceeding 30.2%. This dominance is fueled by a preference for high-quality, convenient cleaning products, and innovations in sustainable and efficient solutions.

Some of the major players in the liquid detergent market include Amway Corporation, Church & Dwight Co., Inc., Godrej Consumer Products Limited, Henkel AG & Co. KGaA, Kao Corporation, Lion Corporation, Reckitt Benckiser Group PLC, S. C. Johnson & Son, Inc., The Procter & Gamble Company, and Unilever Plc, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)