Lipstick Market Size, Share, Trends and Forecast by Product Type, Color, Applicator, Age Group, Gender, Distribution Channel, and Region, 2025-2033

Lipstick Market 2024, Size and Trends:

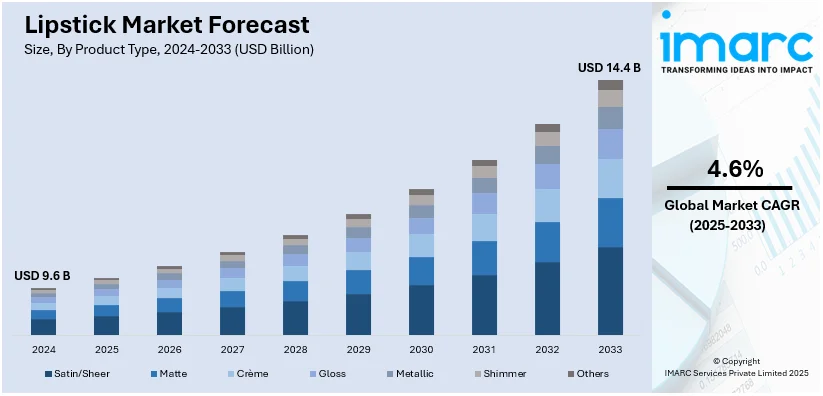

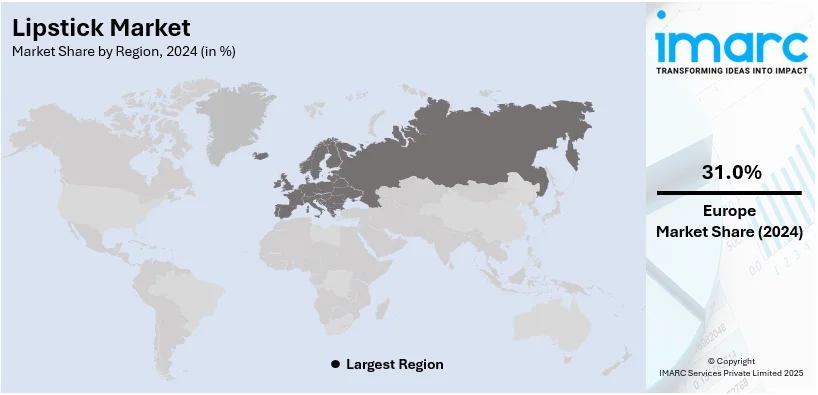

The global lipstick market size was valued at USD 9.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.4 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033. Europe currently dominates the market, holding a significant lipstick market share of over 31.0% in 2024. The European lipstick market share is driven by the region’s rich beauty culture and established presence of premium brands. Besides this, sustainability initiatives by European companies attract eco-conscious individuals prioritizing environmentally friendly beauty products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.6 Billion |

|

Market Forecast in 2033

|

USD 14.4 Billion |

| Market Growth Rate (2025-2033) | 4.6% |

E-commerce growth is revolutionizing shopping experiences globally, making it a prominent factor. Online platforms offer easy access to a wide variety of lipstick brands, shades, and formulations. People can shop anytime from home, making e-commerce particularly appealing to busy lifestyles today. Augmented reality (AR) tools, such as virtual try-ons, help customers confidently select suitable lipstick shades. In-depth product descriptions, along with reviews from customer support better purchasing decisions, enhancing buyer satisfaction and trust. E-commerce facilitates easy price comparisons, encouraging individuals to explore options and find affordable, quality products. Global online marketplaces allow smaller brands to reach wider audiences, increasing market competition and diversity. Frequent discounts, exclusive online launches, and limited-edition collections attract customers and drive lipstick sales. Mobile-friendly websites and apps enable smooth browsing, appealing to the tech-savvy demographic effectively.

Innovation in formulations significantly drives the United States lipstick market demand by addressing evolving preferences. Brands focus on long-lasting, smudge-proof formulas, meeting the demand for convenience and durability among busy individuals. For instance, in September 2024, Valentino Beauty launched a lipstick pop-up in New York City featuring Charli XCX. The pop-up showcases the brand's signature matte lipstick collection, emphasizing luxury and performance. Additionally, hydrating lipsticks with skincare benefits, such as vitamin-enriched options, attract health-conscious populations. Clean beauty trends have encouraged the development of vegan, cruelty-free, and paraben-free lipstick formulations nationwide. Innovative textures like powder-to-cream or glossy stains appeal to individuals seeking unique sensory experiences. Color-adaptive technology, adjusting shades based on skin chemistry, creates personalized options enhancing customer satisfaction. Advanced pigment technology delivers vibrant, fade-resistant shades that meet high expectations for quality and appearance. Hybrid products combining lipstick with lip balm or gloss expand choices for multifunctional beauty solutions. Sustainability-focused formulations, such as biodegradable ingredients, resonate with eco-conscious buyers prioritizing environmental responsibility. The introduction of refillable lipsticks aligns with zero-waste goals, are strengthening the lipstick market growth.

Lipstick Market Trends:

Rising Sustainability Focus

The growing need for eco-friendly beauty products is an example of lipsticks. This new wave is concentrated in the increasing awareness of plastic waste and harmful chemicals used in cosmetics. According to a PwC survey, more than 70% of customers are willing to pay more for sustainably produced goods. Brands in the lipstick market respond to customers by using biodegradable packing, natural ingredients, and adopting cruelty-free practices. Additionally, people are demanding products free from chemicals like sulfates, parabens, and phthalates. This has led companies to invest in creating vegan and environmentally friendly formulations that meet such demands. The fact that sustainability continues to remain a major influence in purchasing decisions places brands that make emphasis on sourcing, eco-friendly packaging, and cruelty-free certification in a vantage position for winning a devoted customer base. This also aligns with broader movements toward transparency in ingredient sourcing and production processes, as people are gradually becoming more knowledgeable and selective regarding the products they opt for.

Rise of Personalized Products

Customer behavior studies indicate a clear trend toward custom beauty products, including lipstick. Brands now allow people to choose their preferred shades, formulation types, and even packaging for their lipstick products. The trend is particularly attractive to individuals because the product will be different from others with specifications tailored to the individual's preferences, needs, and skin color. For instance, lipstick brands have started providing the tools for customers to create their own custom color blends, while some brands have expanded their shade ranges to a wider range of skin tones. Additionally, 46% of US customers are more likely to purchase a product that is customizable, according to a 2023 survey. Personalized packaging options, such as engraved names or limited-edition collections, are also becoming more popular. Social media is what fuels this trend, as people increasingly expect brands to offer unique experiences and exclusivity. Personalized products enhance the customer experience and help build brand loyalty, as people become more attached to the brand.

Influence of Social Media and Influencers

The influence of social media, particularly Instagram, TikTok, and YouTube, plays a pivotal role in determining lipstick trends and the customer's buying behavior. In a survey from 2022 wherein more than 2,000 global brands participated, around 80% reported about the usage of Instagram for influencer marketing. Lipstick brands are constantly promoted by beauty influencers, makeup artists, and celebrities, thus generating viral moments for younger customers to make decisions on. Reviews, tutorials, and user-generated content on social media platforms help to drive brand visibility and provide an immediate link between influencers and their followers. These, in turn, are exploited by brands as ways to access desired audiences through influencers or sponsored posts that incite customer interaction and loyalty. Beauty trends spread fast via social media, and such fast-moving phenomena generate urgency: a product is either available for only a short time, such as an edition, or has become a popular color for lipstick. Moreover, the growing trend of makeup challenges and beauty tutorials on TikTok has made it a place where people are experimenting with bold, unconventional lipstick shades, thus diversifying and changing the lipstick market.

Lipstick Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global lipstick market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on product type, color, applicator, age group, gender and distribution channel.

Analysis by Product Type:

- Satin/Sheer

- Matte

- Crème

- Gloss

- Metallic

- Shimmer

- Others

Shimmer leads the market with 37.5% of lipstick market share in 2024. Shimmer lipsticks provide a radiant finish, appealing to individuals seeking bold and eye-catching makeup. Younger demographics prefer shimmer lipsticks to experiment with unique looks inspired by social media trends. Festive seasons and celebrations significantly increase the demand for shimmer lipsticks, especially in emerging markets. The wide variety of shimmer options ensures availability across all price ranges and demographics. Leading brands frequently introduce limited-edition shimmer collections, driving customer excitement and repeat purchases. Shimmer formulations often include moisturizing ingredients, addressing demand for comfort alongside aesthetic appeal. These lipsticks are versatile, complementing both casual and formal outfits, ensuring consistent market demand. The influence of influencers and beauty tutorials highlights shimmer finishes, encouraging trial among new customers. Celebrity endorsements often feature shimmer shades, reinforcing their appeal and enhancing brand recognition across the globe. Emerging markets contribute heavily to this segment due to cultural preferences for glamorous, statement makeup.

Analysis by Color:

- Red

- Pink

- Nude

- Maroon

- Others

Red lipsticks are iconic, symbolizing confidence and elegance, making them a timeless customer favorite. They hold cultural significance in many regions, enhancing their traction across demographics. Red is versatile, complementing a variety of outfits and occasions, catalyzing its consistent market demand. Social media influencers often showcase red lipsticks, solidifying their status as a go-to statement shade. Red shades are offered across all price points, ensuring accessibility for diverse customer segments globally. People associate red lipstick with empowerment, improving its acceptance in professional and social settings. This color remains a best-seller during festive seasons and special occasions, driving consistent market demand. Premium and luxury brands frequently launch red lipsticks in exclusive collections, reinforcing their high-end appeal. Hollywood and fashion runways prominently feature red lipstick, perpetuating its cultural relevance and desirability.

Analysis by Applicator:

- Lipstick Cream

- Lipstick Palette

- Lipstick Pencil

- Lipstick Tube/Stick

- Liquid Lipstick

Lipstick tubes/sticks format remains universally recognized, fostering familiarity and trust among diverse customer demographics. Their compact size is why it is being preferred by individuals seeking on-the-go (OTG) beauty solutions. Tubes offer precise application, reducing the need for additional tools or expertise during use. Leading brands innovate with twist-up designs, enhancing usability while maintaining product integrity over time. Refillable tube options appeal to environmentally conscious customers, strengthening their lipstick market demand.

Lipstick sticks cater to all finishes, from matte to satin, expanding their appeal to varied preferences. Their durability and spill-proof nature enhance practicality, particularly for individuals with active, fast-paced lifestyles. Prominent endorsements and advertisements consistently showcase tube lipsticks, maintaining their cultural and commercial significance. The enduring popularity of classic tube designs ensures sustained production and innovation from leading brands worldwide.

Analysis by Age Group:

- Under 18

- 18-30

- 30-40

- 40-50

- Above 50

Customers aged 18-30 frequently seeks innovative products, driving demand for new finishes and vibrant shades. Social media heavily influences purchasing decisions, with platforms driving interest in trendy lip products. They exhibit high brand loyalty, especially toward companies promoting inclusivity and sustainability in their offerings. Frequent purchases within this group stem from an active lifestyle and preference for expressive makeup. Influencers targeting young audiences shape preferences, fueling demand for specific brands and product lines in the lipstick market outlook. This demographic spends significantly on beauty, benefiting from increasing disposable incomes in emerging economies. Youth-centric campaigns and collaborations ensure consistent engagement with this segment, bolstering market growth. Brands leverage cultural moments and seasonal trends to target young customers effectively with limited editions. Their focus on individuality and self-expression makes them a key audience for bold and innovative lipsticks. This age group prioritizes convenience, leading to increased demand for multifunctional and travel-friendly lip products.

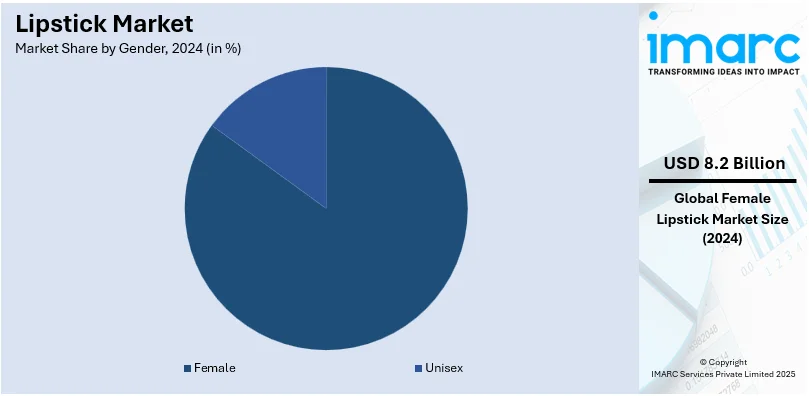

Analysis by Gender:

- Female

- Unisex

Based on the lipstick market forecast, the female leads the market with 85.0% of market share in 2024. Female constitutes the largest customer base, reflecting their significant investment in beauty and personal care. Lipsticks have long been associated with femininity, making them a staple in women's beauty routines. Women prioritize diverse options including shades, finishes, and formulations, encouraging continuous product development. The strong cultural association between lipsticks and women ensures consistent demand across regions and generations. Campaigns targeted specifically toward women leverage emotional and aesthetic appeal to drive market engagement. Working women often choose lipsticks as a quick, effective way to enhance their appearance effortlessly. Women’s growing economic participation fuels their spending on premium and luxury lipstick brands around the world. Seasonal trends, wedding seasons, and special occasions significantly influences the lipstick sales among female buyers. Women are increasingly drawn to inclusive brands offering diverse color ranges for all skin tones. Brands targeting female empowerment and self-expression find significant traction within this dominant group. Refillable and eco-friendly packaging options resonate particularly well with women seeking sustainable beauty solutions.

Analysis by Distribution Channel:

- Departmental/Grocery Stores

- Multi Branded Retail Stores

- Supermarkets and Hypermarkets

- Exclusive Retail Stores

- Online Channels

- Others

Supermarkets and hypermarkets dominate the market with 33.8% of market share in 2024. Supermarkets and hypermarkets lead lipstick sales due to convenience and widespread availability for customers. These stores offer an extensive range of brands and shades, catering to diverse customer preferences. Customers trust supermarkets for product authenticity, ensuring consistent purchases of lipsticks from well-known brands. Frequent promotions, discounts, and loyalty programs in stores encourage impulse buying and repeat visits. Their strategic locations in suburban and urban areas make them accessible to a broad customer base. Shoppers value the ability to physically test lipsticks, which is facilitated by in-store beauty sections. Supermarkets serve as one-stop destinations, allowing customers to buy lipsticks alongside other essential items. Retailers often host exclusive lipstick launches, increasing foot traffic and enhancing customer engagement in stores. The affordability of products in these channels attracts budget-conscious buyers seeking quality at reasonable prices. Seasonal sales and festive displays drive peak lipstick sales during high-demand periods across regions. Many supermarkets include premium sections, expanding their appeal to luxury lipstick shoppers. In emerging markets, supermarkets act as primary retail points, driving lipstick sales through localized marketing strategies.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2024, Europe accounted for the largest market share of 31.0%. Europe leads the lipstick market due to a its strong beauty culture and well-established premium brand presence. Customer in Europe prioritize quality, driving demand for high-end and innovative lipstick formulations. Sustainability initiatives by European brands resonate with eco-conscious buyers, reinforcing their dominance in the market. Luxury fashion and cosmetics brands originating from Europe bolster the region’s reputation as a beauty hub. For example, in October 2024, French fashion house CELINE launched Rouge Triomphe, its first luxury lipstick, featuring a crimson shade in a gold tube. To complement the lipstick, CELINE offers a gold lip brush and a Triomphe-printed makeup pouch. Besides this, stringent regulatory standards ensure product safety, enhancing customer trust and preference for European lipsticks. European countries host global beauty expos, fostering innovation and market competitiveness within the region. High disposable incomes in Western Europe contribute to the consistent growth of the premium lipstick segment. The region benefits from a mature retail network, ensuring wide accessibility of products to urban and rural customers. Seasonal trends, influenced by fashion weeks, drive new product launches and sales cycles annually. Individual emphasis on self-expression aligns with brands offering diverse shades and finishes catering to individual needs. Europe’s historical and cultural association with beauty further cements its leading position in the global market.

Key Regional Takeaways:

United States Lipstick Market Analysis

The United States hold 75.90% of the market share in North America. The United States market is fueled by growing fashion trend and the rising demand for quality lipstick. According to the US Census Bureau, women comprised 50.49% of the population in the US up to 2022. In 2023, YouGov conducted a study that indicated that 43% of women in the US wear lipstick or lip gloss weekly, demonstrating ongoing and high demand for these cosmetics. Demand in lipstick is seen to be stronger among millennials and Gen Z. Long-lasting formulas and moisturizing formulas are dominating the trends in lipstick. It is dominated mainly by Estée Lauder and L'Oréal, which take on diverse product offers, and celebrity endorses. E-commerce growth is another reason influencing the online lipstick sales steadily. Sustainable and clean beauty trends are growing as more and more customers look towards lip products that are cruelty-free and environmentally friendly. Luxury and premium brands dominate the market, supported by rising disposable incomes and gifting trends. Additionally, subscription models and custom lipstick services add personalization, appealing to younger, tech-savvy customers.

Europe Lipstick Market Analysis

The European market is growing consistently with the rise in demand among customers for premium and luxury beauty products. According to an industry report, in Germany, about 16 million women used lipstick in 2023, indicating the huge demand for the product. Lipsticks remain one of the most common beauty products, which can be used by the younger and older females; hence, countries like France and the UK are noticing a huge demand for lipstick with many choosing sustainable packaging. This increased demand for organic and vegan lip products is driving L'Oréal and Dior to launch, which offer environment-friendly options. Social media influencers and beauty bloggers are also contributing to awareness and the expansion of customer base. Governments are also encouraging cosmetic brands to follow safety standards, which adds to the innovation in the industry. Europe’s focus on sustainability and eco-friendly practices continues to define the region’s lipstick market dynamics.

Asia Pacific Lipstick Market Analysis

The Asia Pacific market is growing at a rapid pace due to shifting beauty standards and the evolving middle class. A large percentage of women in the Asia Pacific use lipstick. In fact, a YouGov poll found that 52% of women in the region considered lipstick to be one of their two most essential cosmetic products. Both luxury as well as lower-priced lipsticks are being rapidly demanded from major countries in regions like China and India. With special emphasis on two-in-one lipstick tints, also known as lipstick balms. E-commerce growth is seen on fast track, replacing the in-person shopping pattern in the beauty market. Strong demand for k-beauty products from South Korean influence the regional requirements of lipsticks. There is also an increased demand for natural and organic lipstick variants due to awareness of skincare ingredients and sustainable beauty practices. Major players like Shiseido and Amorepacific are leading in this regard. Local brands are capitalizing the emerging trend, which is strengthening the market growth.

In 2024, China emerged as the leading revenue contributor to the Asia Pacific lipstick market and is projected to maintain its dominance through 2030. This growth has been fueled by robust government initiatives aimed at promoting women's participation in the workforce, the rapid expansion of e-commerce platforms, and the increasing influence of social media on Chinese consumers. Local players have significantly strengthened their foothold in the market by introducing innovative products and advanced technologies. For example, in October 2023, the Chinese brand Perfect Diary unveiled its revolutionary ‘BioLip Essence Lipstick,’ incorporating proprietary ‘biolip’ technology, which reportedly offers the combined benefits of a lip essence and a lip mask.

Middle East and Africa Lipstick Market Analysis

The Middle East and Africa region is experiencing consistent lipstick demand, supported by evolving beauty standards and demand. The regions high portion of the female population that constitutes 49.7% in the Middle East and North Africa (MENA) demands cosmetics, specifically lip products, as stated in reports. There is a strong demand for high-end lipsticks in the gulf countries, such as UAE and Saudi Arabia. People are ready to spend on premium beauty products, which is further enhanced by the entry of international cosmetic brands into the region, meeting the need for quality and innovative products. Local brands are also following the trends for halal beauty products, lipstick formulations tailored to the regional preferences. Social media influencers as well as local celebrities are influencing buying preferences in Middle East region. Besides this, government control over quality as well as other safety standards added to the region’s market growth.

Latin America Lipstick Market Analysis

The Latin American market is experiencing growth as a result of increased spending by customers and increasing appeal for beautification. An industrial report reveals that, in 2018, Brazilian women spent the most average amount on cosmetics compared to other countries. The average was USD 936 per capita. According to an industry report, the lip cosmetics market in Latin America is likely to grow at a yearly rate of 7.76% from 2025 to 2029. This increased demand for beauty products, especially lipstick is due to the growth of local brands like Natura and Boticário, selling lipsticks at varying price points that are both budget-friendly and of high quality. In Mexico and Argentina, growth in the beauty market is further fueled by online digital platforms in e-commerce sales, where a growing number of individuals are now buying beauty products online. Growth in middle-class populations and increased beauty influencers further contribute to market growth in the region, positioning Latin America as an emerging cosmetic innovation hub.

Competitive Landscape:

Key players are shaping the market through the introduction of innovative formulations, such as long-lasting, hydrating, and vegan-friendly options, to meet customer preferences. Aggressive marketing strategies and collaborations with influencers enhance brand visibility and drive product demand worldwide. These companies invest heavily in research and development (R&D) to create unique and trend-setting lipstick products. Many leading brands prioritize sustainability, incorporating eco-friendly materials and refillable packaging to attract environmentally conscious buyers. Expansion into emerging markets, particularly in Asia and Latin America, significantly strengthens their market growth across the globe. Key players utilize digital platforms effectively, leveraging e-commerce to reach a broader and diverse customer base. Celebrity endorsements and social media campaigns create strong emotional connections, enhancing customer loyalty and brand value. Partnerships with retailers and online platforms enable better product availability and convenience for customers worldwide. For instance, in February 2024, Estée Lauder and Sabyasachi unveiled a limited-edition lipstick collection featuring ten matte shades in gilded cases. The shades, including Muslin Tea, Udaipur Coral, and Coffee Masala, reflect India’s color story. Each lipstick is housed in a 24K gold-plated case with a Bengal tiger embossing.

The report provides a comprehensive analysis of the competitive landscape in the lipstick market with detailed profiles of all major companies, including:

- L'Oréal SA

- Procter & Gamble (P&G) Company

- Avon Products, Inc.

- Shiseido Company, Limited

- LVMH Moët Hennessy – Louis Vuitton SE

- Estee Lauder Companies Inc.

- Oriflame Holding AG

- Revlon, Inc.

- Markwins Beauty Brands, Inc.

- Stargazer Products

- Coty Inc.

- The Clorox Company

- DHC Corporation

- Johnson& Johnson

- Chanel S.A.

- Inglot Cosmetics

- Unilever Group

- Rohto Pharmaceutical Co., Ltd.

Latest News and Developments:

- October 2024: Revlon announced that it has expanded its ColorStay range with the launch of Limitless Matte Liquid Lipstick in 14 shades.

- September 2024: According to MAC, the brand launched MACximal, a reformulated version of its satin lipstick, which includes a pigment-rich hydrating formula for a sleek satin finish. It has 34 shades, from "blankety" to "creme d'nude." The lipstick has high-shine packaging and the signature vanilla scent.

- February 2024: RAIKU has partnered with LVMH, the world's largest luxury company, to bring its 100% natural packaging to the luxury market. The partnership aims to replace single-use plastics and reduce environmental footprints. RAIKU was selected from over 1,500 applicants for LVMH's prestigious Accelerator program.

- January 2024: According to MAC, the brand launched MACximal, a reformulated version of its satin lipstick, which includes a pigment-rich hydrating formula for a sleek satin finish. It has 34 shades, from "blankety" to "creme d'nude." The lipstick has high-shine packaging and the signature vanilla scent.

Lipstick Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Satin/Sheer, Matte, Crème, Gloss, Metallic, Shimmer, Others |

| Colors Covered | Red, Pink, Nude, Maroon, Others |

| Applicators Covered | Lipstick Cream, Lipstick Palette, Lipstick Pencil, Lipstick Tube/Stick, Liquid Lipstick |

| Age Groups Covered | Under 18, 18-30, 30-40, 40-50, Above 50 |

| Genders Covered | Female, Unisex |

| Distribution Channels Covered | Departmental/Grocery Stores, Multi Branded Retail Stores, Supermarkets and Hypermarkets, Exclusive Retail Stores, Online Channels, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | L'Oréal SA, Procter & Gamble (P&G) Company, Avon Products, Inc., Shiseido Company, Limited, LVMH Moët Hennessy – Louis Vuitton SE, Estee Lauder Companies Inc., Oriflame Holding AG, Revlon, Inc., Markwins Beauty Brands, Inc., Stargazer Products, Coty Inc., The Clorox Company, DHC Corporation, Johnson& Johnson, Chanel S.A., Inglot Cosmetics, Unilever Group and Rohto Pharmaceutical Co., Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, lipstick market outlook, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global lipstick market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lipstick industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lipstick market was valued at USD 9.6 Billion in 2024.

IMARC estimates the lipstick market to reach USD 14.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.6% during 2025-2033.

The lipstick market growth is driven by rising interest in personal grooming and innovative formulations, such as long-lasting and hydrating options. Social media and influencer endorsements significantly shape trends are driving the demand for vibrant and unique shades. Sustainability concerns have led to demand for eco-friendly packaging and cruelty-free products. Advances in e-commerce platforms provide convenient access to diverse options, expanding customer reach around the world.

Based on the lipstick market, the market is segmented into product type, Color, applicator, age group, gender and distribution channel.

Europe currently dominates the lipstick market, accounting for a share exceeding 31.0%. This dominance is driven by its established beauty industry and premium brands. High disposable incomes, a strong retail network, and cultural emphasis on beauty drives consistent demand.

Some of the major players in the lipstick market include L'Oréal SA, Procter & Gamble (P&G) Company, Avon Products, Inc., Shiseido Company, Limited, LVMH Moët Hennessy – Louis Vuitton SE, Estee Lauder Companies Inc., Oriflame Holding AG, Revlon, Inc., Markwins Beauty Brands, Inc., Stargazer Products, Coty Inc., The Clorox Company, DHC Corporation, Johnson& Johnson, Chanel S.A., Inglot Cosmetics, Unilever Group and Rohto Pharmaceutical Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)