Limestone Market Size, Share, Trends and Forecast by Type, Size, End-Use Industry, and Region, 2025-2033

Limestone Market Size and Share:

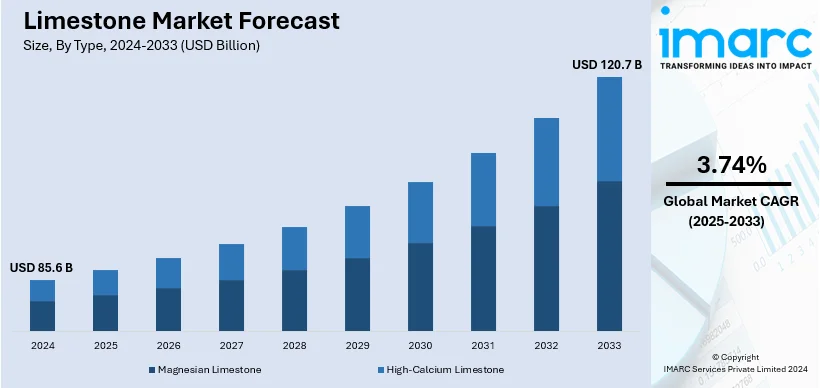

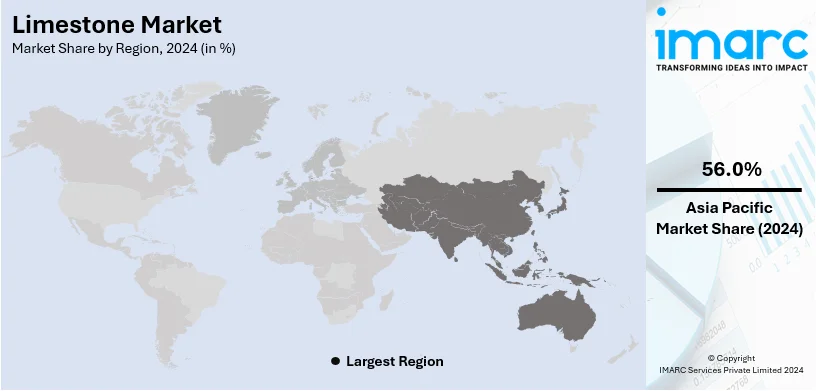

The global limestone market size was valued at USD 85.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 120.7 Billion by 2033, exhibiting a CAGR of 3.74% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 56.0% in 2024. The global market is driven by its critical role in construction and infrastructure, diverse applications in industrial and agricultural sectors, and increasing emphasis on environmental sustainability, positioning it for robust growth amid the rising global demand and eco-friendly practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 85.6 Billion |

|

Market Forecast in 2033

|

USD 120.7 Billion |

| Market Growth Rate 2025-2033 | 3.74% |

The market is influenced by growing demand across construction, agriculture, and industrial sectors. In construction, limestone is widely used for cement and concrete production, which fuels the demand due to rapid urbanization and infrastructure development globally. The agricultural sector relies on limestone for soil conditioning and pH regulation, enhancing crop productivity. Industrial applications, including steel manufacturing and water treatment, also boost market growth. Additionally, the widespread adoption of limestone in renewable energy projects, like flue gas desulfurization in power plants, promotes environmental compliance. Emerging economies further contribute to market expansion due to increased construction activities.

In the United States, the market is primarily driven by its extensive use in construction, infrastructure, and industrial applications. According to industry reports, construction spending has grown more than 41% in the U.S. from April 2020 to July 2024. The growing demand for cement and concrete in residential and commercial building projects supports market growth. Infrastructure modernization, including roads and bridges, further boosts limestone consumption. Industrial applications, such as steel manufacturing and water treatment, also contribute significantly to the market growth. The agricultural sector relies on limestone for soil conditioning, thereby enhancing its demand. In addition to this, environmental regulations drive its use in flue gas desulfurization to reduce emissions.

Limestone Market Trends:

Increasing Demand in Construction and Infrastructure Development

The global market is significantly driven by the booming construction and infrastructure sector globally. Limestone is a fundamental raw material in the production of cement, a critical component of the construction industry. With urbanization and the growth of megacities, especially in emerging economies, the augmenting demand for cement for buildings, roads, bridges has facilitated the limestone market value has increased. According to an industrial report, construction spending crossed USD 2 Trillion and maintained a balanced trajectory in the first half of 2024. Also, according to International Cement Review's "The Global Cement Report 15th Edition," global cement production has grown manifold in the last few decades. The total global production of cement was only 1.39 billion tons in 1995. In 2023, however, this figure stood at an estimated 4.1 billion tons, which means massive growth in construction activities around the world. This increase is not just limited to residential and commercial construction but also includes major infrastructure projects such as highways, airports, and water treatment facilities. The robust growth in the construction sector directly correlates with a heightened demand, positioning it as a key commodity in the global market. This trend is expected to continue as urbanization progresses, and governments invest in infrastructure to support economic growth.

Rising Use in Industrial and Agricultural Applications

The product versatility extends beyond construction, playing a pivotal role in various industrial and agricultural applications. Industrially, it is used for flue gas desulphurization in power plants, reducing harmful emissions and in the manufacturing of glass and steel, where it acts as a flux agent to remove impurities. In agriculture, it is a soil conditioner, used to neutralize acidic soils, thereby improving soil quality and crop yields. The U.S. alone applied about 20 million metric tons of agricultural lime in 2023 to address soil acidity issues. This wide range of applications underlines the indispensability across different sectors, driving its global market. As environmental regulations become stricter and the agricultural sector seeks to increase productivity sustainably, the demand for this product in these applications is expected to rise, further fueling market growth.

Environmental Sustainability Initiatives

Environmental sustainability initiatives are increasingly influencing the market dynamics. Limestone plays a critical role in water and air purification processes, contributing to environmental protection efforts. Its use in treating wastewater and reducing air pollutants highlights its importance in achieving sustainability goals. Moreover, the development of eco-friendly mining techniques and the recycling, in construction and industrial processes are making its production and use more sustainable. In order to achieve the Sustainable Development Goals by 2030 and net zero emissions by 2050, significant investment in sustainable and resilient infrastructure is required. The Organisation for Economic Co-operation and Development (OECD) estimates that USD 6.9 Trillion per year are needed up to 2050 for investment in infrastructure to meet development goals and create a low carbon, climate resilient future. As governments and corporations intensify their focus on reducing environmental impact, and augment the demand for this product, particularly from sources employing sustainable practices, is expected to grow. This shift towards sustainability not only drives the market but also aligns it with global efforts to combat climate change and protect natural resources.

Limestone Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global limestone market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, size, end-use industry, and region.

Analysis by Type:

- Magnesian Limestone

- High-Calcium Limestone

High-calcium limestone leads the market with around 69.5% of market share in 2024. High-calcium limestone, comprising over 95% calcium carbonate (CaCO3), is the dominant segment in the global market, primarily due to its extensive use in the construction industry for cement production and as a building material. Its purity makes it ideal for producing quicklime and hydrated lime, critical ingredients in various industrial processes, including the treatment of drinking water, wastewater, and flue gases. The benefit of this is an ongoing boom in global construction activities, especially in rapidly urbanizing regions in Asia Pacific and Africa, where the demand for infrastructure and residential buildings is at an all-time high. Furthermore, the high-calcium variant is indispensable in the agriculture sector as a soil conditioner to neutralize acidic soils and improve crop yields. Its broad application scope extends to the paper and pulp industry, where it is used as a filler and coating material to produce high-quality paper products.

Analysis by Size:

- Crushed Limestone

- Calcined Limestone (PCC)

- Ground Limestone (GCC)

Crushed limestone holds a substantial portion of the market as it is majorly used in construction and infrastructure applications. This raw material is associated with the manufacturing of cement and serves as a base material for the construction of roads and buildings, creating direct demand for further growth in the global construction industry. Urbanization and related infrastructure developments in emerging economies have propelled demand for the product. It is also widely used in landscaping, soil conditioning, and as a filler in many products, making it an integral part of construction as well as agriculture. The versatility and affordability of this is coupled with the ongoing construction projects worldwide, continue to drive its market.

On the other hand, calcined limestone, primarily known as Precipitated Calcium Carbonate (PCC), represents a crucial segment in the global market, finding its application in numerous industries such as paper, plastics, paint, and coatings. The process of producing PCC involves heating it to a high temperature to release CO2 and then re-carbonating the resultant calcium oxide with CO2 to produce PCC. This segment has witnessed significant growth due to PCC's superior brightness, purity, and particle size control over ground calcium carbonate (GCC), making it the preferred choice in high-quality paper coatings and fillers. Additionally, PCC is becoming increasingly popular in the food and pharmaceutical industries as a dietary calcium supplement and antacid. The demand for PCC is expected to continue growing, driven by innovation in product applications and the expansion of industries that utilize PCC.

Ground limestone (GCC) has found application in many industries including paper, plastic, paint, rubber, and adhesives, where it serves as a filler bringing improvement in the properties of products and aiding cost reduction in the processing. Moreover, the requirements of GCC are strong in the paper industry, where it is used in manufacturing high-quality glossy paper. The role of GCC becomes extremely important with the struggle of many industries towards cost efficiency coupled with product quality improvement. Additionally, the construction industry uses GCC as an essential component in the manufacture of tiles, concrete, and cement, further bolstering its market demand. The environmental advantages of GCC, such as its low carbon footprint compared to other mineral fillers, also contribute to its popularity. Beyond several other application alternatives, GCC is favored over PCC due to its cost-effectiveness and availability.

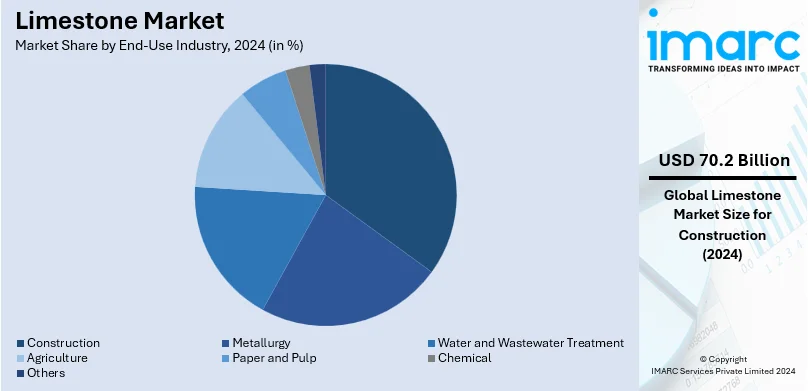

Analysis by End-Use Industry:

- Metallurgy

- Water and Wastewater Treatment

- Construction

- Agriculture

- Paper and Pulp

- Chemical

- Others

The construction segment leads the market with around 82.0% of market share in 2024. The construction segment is the largest and most significant in the global market, characterized by the global increase in infrastructure development, urbanization, and the need for housing. The use of this product in construction is further stimulated by its usage as a decorative stone in flooring and facades as well as in the interior as an aesthetic delight for durability. Massive activities in construction are taking place within the Asia Pacific region, particularly in China and India. Such events in a dominant segment have increased demand as urbanization continues and as emerging economies continue to build infrastructures, demand for this in construction continues to drive overall market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 56.0%. Asia Pacific represents the largest segment of the market, driven by rapid urbanization, infrastructure development, and industrial growth in countries like China, India, and Southeast Asian nations. The region's vast construction projects, from megacities to transportation networks, significantly fuel the demand for this in cement and concrete production. Moreover, Asia Pacific's growing agricultural sector contributes to the demand for the product as a soil amendment. The steel industry, particularly in China and India, also accounts for a substantial portion of this is in consumption in the region. With the highest population growth rates and urbanization levels, Asia Pacific's demand for this is projected to continue rising, making it the most significant regional market for this product.

Key Regional Takeaways:

North America Limestone Market Analysis

The market in North America is driven by factors such as growing demand in the construction industry for concrete production, road building, and infrastructure projects. The rise in residential and commercial building activities, along with rapid urbanization, fuels this demand. Additionally, limestone's use in environmental applications, including flue gas desulfurization and water treatment, supports market growth. For instance, in September 2024, a Nova Scotia (N.S.)-based firm announced that it has secured a grant of US$25 million to capture carbon by mixing limestone in rivers. The company further stated that it expects to receive US$25.4 million for projects aimed at reducing greenhouse gas (GHG) emissions by mixing crushed limestone in rivers in Canada and Scandinavia. The first project by has already started, as lime is being added to the West River in Pictou County at Watervale, N.S., about 45 kilometers east of Truro. The firm announced that adding lime boosts the river’s capacity to extract carbon dioxide in the water and the atmosphere around the river. The carbon dioxide combines with the limestone and is carried out to sea, where it will remain in that captured state for tens of thousands of years. This initiative highlights the growing environmental applications of limestone, particularly in carbon sequestration and water quality management, which are emerging as significant drivers for the limestone industry. Moreover, government investments in infrastructure and mining activities, coupled with favorable local availability of limestone, further boost the market in North America.

United States Limestone Market Analysis

The United States accounts for 88% of the market share in North America. Robust construction activities, cement production, and infrastructure projects drive the U.S. limestone market. According to an industrial report, in 2023, the United States produced about 17 million metric tons of lime - a derivative of limestone. Limestone should gain from government initiatives like the Infrastructure Investment and Jobs Act, which assigns USD 1.2 Trillion to the modernization of infrastructure. Leading producers, such as Martin Marietta Materials and Vulcan Materials Company, are expanding operations to meet growing market needs. Rising employment of limestone in environmental applications-like flue gas desulfurization at power plants-highlights its critical role in reducing sulfur emissions. Residential and commercial building projects under construction also provide impetus to the market.

Europe Limestone Market Analysis

Extensive usage in construction, steel manufacturing, and environmental uses shape the Europe limestone market. According to an industrial report, in 2023, Europe made about 2.6 million metric tonnes of lime, of which the market leaders were Germany, the UK, and France. The European Green Deal's emphasis on sustainable construction and reducing carbon emissions has boosted limestone's role in producing low-carbon cement alternatives. Additionally, limestone's application in soil conditioning for agriculture contributes significantly to demand. The steel industry's recovery post-COVID-19 has also driven limestone consumption, as it is a critical input in steel manufacturing. It is imperative that the rise in investments on infrastructure, such as the EU's USD 833.44 Billion NextGenerationEU recovery plan, will mean more usage of limestones in construction activities. Market leaders such as Lhoist Group and Nordkalk concentrate on innovation to stay abreast with environmental regulations at acceptable production conditions, creating demand expansion in the region's limestone market.

Latin America Limestone Market Analysis

The limestone market in Latin America is constantly growing. It is primarily used by construction and mining industries. According to USGS publications, Brazil, was the largest producer in this region, accounted for about 8.1 million metric tons of lime in 2021. The region's vast limestone deposits ensure greater cement production, and in particular, rising urbanization in Mexico has added to its importance. Upgrades in mining technology help better efficiency in extracting the mineral. Limestone's use in agriculture, especially as a soil conditioner, is another strong growth enabler. The increasing emphasis on sustainable mining practices and government-supported initiatives like the Programa de Infraestructura in Colombia are other growth drivers.

Middle East and Africa Limestone Market Analysis

Increased construction activities and industrial developments drive the limestone market in the Middle East and Africa. The Giga Projects of Saudi Arabia's Vision 2030 and the UAE's Smart Dubai are contributing to increased demands for limestones in large cement and concrete projects such as NEOM city. Moreover, the UAE pumped nearly 18.5 billion Saudi riyals (USD 4.9 Billion) into projects in Saudi Arabia in 2023 to become the largest investor in the Gulf Kingdom, according to official data. As per USGS publications, major quantities of lime were produced in the region in 2021. Countries included Saudi Arabia and South Africa. Gaining importance in steel production and environmental applications such as water treatment, limestone is also acquiring new significances. The increasing adoption of lime in flue gas desulfurization to minimize emissions of the industry further supports the expansion of this market. Companies such as National Lime & Stone and Oman Cement are investing in capacity expansions for catering to increased demand.

Competitive Landscape:

Key players in this market are actively expanding their production capacities and engaging in strategic partnerships to enhance their market presence and meet the increasing global demand. They are investing in advanced mining technologies to improve efficiency and reduce environmental impact, focusing on sustainable practices to align with global environmental standards. According to the limestone market forecast, companies are also diversifying their product offerings to cater to a wide range of industries, including construction, agriculture, and manufacturing, thereby strengthening their market position. By focusing on innovation, sustainability, and global expansion, these key players are not only addressing the current demand but are also preparing for future market dynamics. For instance, in August 2024, Graymont launched a global initiative to build its brand to reflect the organization’s industry-leading lime business as well as its emergence as a fast-expanding global provider of low-carbon, calcium-based solutions. Calcium is the essential mineral, and the common denominator of Graymont’s entire product offering, from limestone and lime to more-complex solutions utilizing high-purity lime and precise blends of calcium compounds.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AMR India Limited

- Carmeuse

- Graymont Limited

- Imerys (Belgian Securities B.V.)

- J.M. Huber Corporation

- LafargeHolcim

- Minerals Technologies Inc.

- Mitsubishi Materials Corporation

- Schaefer Kalk

- Sumitomo Osaka Cement Co. Ltd.

- Eliotte Stone Co. Inc.

Recent Developments:

- October 2024: Ambuja Cements announced that it has significantly increased its limestone reserve to eight billion tonnes through strategic acquisitions, including those of Sanghi Industries and Penna Cement. It also gained 24 new limestone mines through auctions, strengthening its competitiveness against UltraTech Cement in the Indian cement industry.

- June 2024: J.M. Huber Corporation announced that through its subsidiary Huber Engineered Materials, LLC it has completed the acquisition of Jurassic Holdings Corp. and its subsidiaries, including Active Minerals International, LLC, from Golden Gate Capital. AMI is now part of the Huber Specialty Minerals business unit within HEM, a niche materials manufacturing company within the Huber portfolio.

- December 2023: Imerys and Seitiss have formed a joint venture, Seitiss Imerys Minéraux Circulaires (SIMC), to promote a circular economy by transforming waste minerals from industrial activities into circular products. Leveraging Seitiss's innovative value chain creation and digital tools alongside Imerys's industrial expertise and global reach, SIMC aims to enhance sustainability in mineral utilization.

- October 2023: Carmeuse partners with Tallman Technologies and Schenck Process to offer advanced lime injection systems for EAF steel plants, providing customized solutions from truck offloading to supersonic injection, suitable for new and existing facilities.

- May 2023: Graymont is pleased to announce that it completed the acquisition of the Gridland limestone quarry located in Ipoh, Perak, from GCCP Resources Ltd. The quarry is located in an area renowned for high quality limestone.

Limestone Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Magnesian Limestone, High-Calcium Limestone |

| Sizes Covered | Crushed Limestone, Calcined Limestone (PCC), Ground Limestone (GCC) |

| End-Use Industries Covered | Metallurgy, Water and Wastewater Treatment, Construction, Agriculture, Paper and Pulp, Chemical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AMR India Limited, Carmeuse, Graymont Limited, Imerys (Belgian Securities B.V.), J.M. Huber Corporation, LafargeHolcim, Minerals Technologies Inc., Mitsubishi Materials Corporation, Schaefer Kalk, Sumitomo Osaka Cement Co. Ltd., Eliotte Stone Co. Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, limestone market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global limestone market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the limestone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Limestone is a sedimentary rock primarily composed of calcium carbonate (CaCO3), often formed from marine organisms' skeletal remains. It is widely used in construction for cement and aggregate production, as well as in agriculture, steel manufacturing, and water treatment. Limestone is valued for its durability, versatility, and chemical properties.

The global limestone market was valued at USD 85.6 Billion in 2024.

IMARC estimates the global limestone market to exhibit a CAGR of 3.74% during 2025-2033.

The key factors driving the global limestone market are its extensive use in construction, agriculture, and industrial applications. The rising infrastructure projects and urbanization fuel the demand for cement and aggregates. In agriculture, limestone improves soil quality and crop yields. Its role in steel manufacturing, water treatment, and flue gas desulfurization, along with growth in emerging economies, further propels market expansion.

According to the report, high-calcium limestone represented the largest segment by type, driven by its purity, making it ideal for steelmaking, flue gas treatment, and agriculture.

Construction is the leading segment by the end-use industry, due to its essential use in cement, concrete, and infrastructure development worldwide.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global limestone market include AMR India Limited, Carmeuse, Graymont Limited, Imerys (Belgian Securities B.V.), J.M. Huber Corporation, LafargeHolcim, Minerals Technologies Inc., Mitsubishi Materials Corporation, Schaefer Kalk, Sumitomo Osaka Cement Co. Ltd., Eliotte Stone Co. Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)