Light Sensors Market Size, Share, Trends and Forecast by Function, Output, Integration, End Use Industry, and Region, 2025-2033

Light Sensors Market Size and Share:

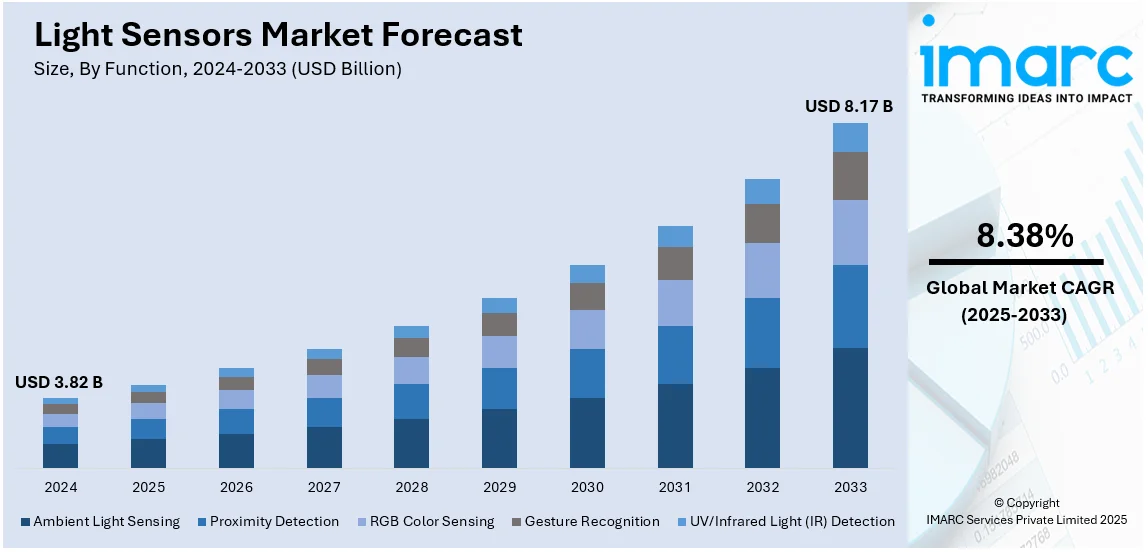

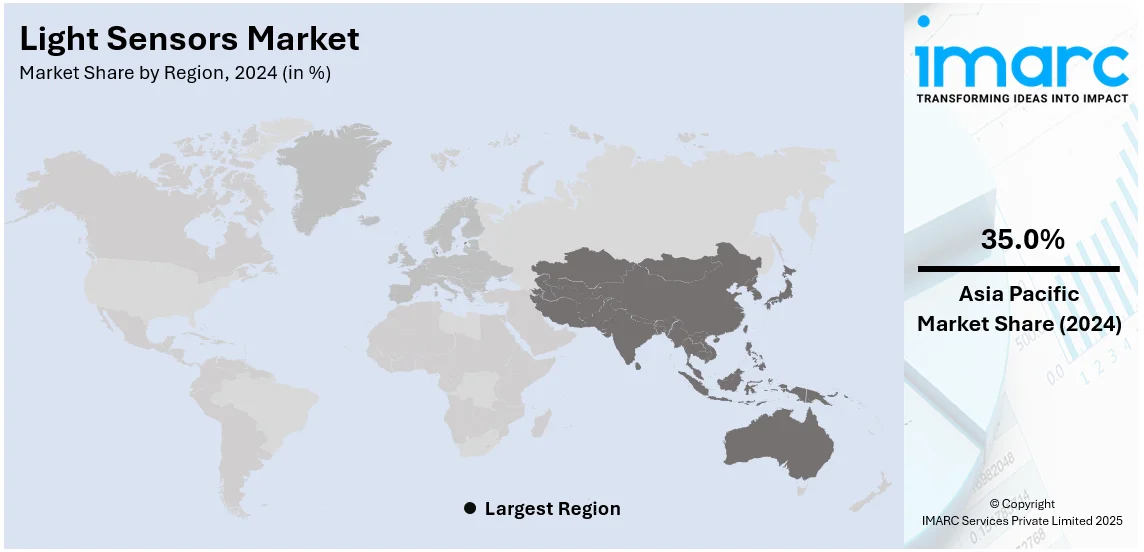

The global light sensors market size was valued at USD 3.82 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.17 Billion by 2033, exhibiting a CAGR of 8.38% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 35.0% in 2024. The rising need for smart home systems and smartphones, expanding automotive usages, growing industrial automation rates, increasing medical wearables acceptance, environmental observation systems, and sensor technology enhancements are some of the factors facilitating the light sensors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.82 Billion |

|

Market Forecast in 2033

|

USD 8.17 Billion |

| Market Growth Rate (2025-2033) | 8.38% |

The global light sensors market is driven by several key factors, including the increasing adoption of smart devices, IoT-enabled solutions, and energy-efficient lighting systems. The growing demand for automation in industries, smart homes, and automotive applications has significantly enhanced the need for light sensors. Additionally, advancements in sensor technology, such as improved accuracy and miniaturization, are enhancing their integration into various devices. Rising environmental concerns and government regulations promoting energy conservation further propel the light sensors market growth. The proliferation of consumer electronics, such as smartphones and wearables, also contributes to the expanding market, as light sensors play a critical role in optimizing display performance and battery life. A report indicates that 84% of smartphone users in India examine their devices within 15 minutes of rising, dedicating 31% of their waking hours to smartphone usage. The duration of time spent on smartphones has increased significantly, rising from 2 hours in 2010 to 4.9 hours in 2023, with an average of 80 checks per day.

The United States stands out as a key regional market, primarily driven by the rapid adoption of smart home technologies, increasing demand for energy-efficient solutions, and the growing integration of sensors in automotive applications. The rise of IoT and connected devices has further fueled the need for light sensors in various industries, including consumer electronics, healthcare, and industrial automation. Government initiatives promoting sustainable practices and energy conservation also play a significant role in market growth. On 13th January 2025, Ameresco, a leading clean technology integrator, secured a USD 183 Million Energy Savings Performance Contract (ESPC) with the U.S. General Services Administration (GSA) to further support the goal of the Denver Federal Center to reach net-zero emissions by 2045. This includes 14.4 MW of solar photovoltaic systems, 62.4 MMBtu/h of geothermal systems, and 20.1 MMBtu/h of electric heat pumps that have reduced grid energy consumption by 51% and fossil fuel usage by 51.5%. This project aligns with the growing light sensor market, similar to how energy-efficient technologies can influence sustainability and innovation in the federal infrastructure. Additionally, advancements in sensor technology, such as enhanced sensitivity and durability, are expanding their use in diverse applications, contributing to the light sensors market demand across the country.

Light Sensors Market Trends:

Rising Demand for Smartphones and Tablets

Incorporation of high end features in smart phones and increasing usage of tablets with ambient light sensors are primary market growth factors. According to the latest report by IMARC, the India smartphone market is expected to expand at a CAGR of 4.86% by 2024-2032. These sensors help automatically adjust the screen brightness according to lighting conditions, which further helps improve user experience, reduce eye strain, and provide better battery life. In line with this, the growing use of both proximity and ambient light sensing (ALS) features in integrated high-end designs is driving market growth. These technologies help enhance performance, which has driven their use in consumer electronics applications, further supporting the market growth.

Smart Home Systems and Energy Efficiency

The growing use of smart home systems is acting as one of the significant light sensors market trends. The global smart homes market size reached USD 123.8 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 345.6 Billion by 2032, exhibiting a growth rate (CAGR) of 10.87% during 2024-2032. Sensors play a crucial role in optimizing energy consumption by enabling smart homes to regulate lighting, reduce electricity usage, and enhance energy conservation. As homeowners increasingly seek eco-friendly alternatives, key market players are introducing cost effective and sustainable light sensors, which is further providing a considerable thrust to the market growth. Moreover, governments and energy organizations are encouraging the adoption of energy-efficient technologies, which is further driving the demand for smart lighting solutions, creating a positive light sensors market outlook for the market.

Automotive Light Sensors for Enhanced Safety

Automotive applications are driving the global light sensor market, particularly with the rise of automatic headlight systems and interior lighting controls. According to the latest Residential Energy Consumption Survey (RECS), 47% of U.S. households reported using LED bulbs for most or all indoor lighting in 2020. Light sensors are integral to advanced driver assistance systems (ADAS), enabling vehicles to automatically adjust headlights based on external lighting conditions, improving visibility and safety for drivers. In addition to headlight control, these sensors are used for dimming dashboard displays at night and controlling interior ambient lighting. As the automotive industry shifts toward smarter, more autonomous vehicles, the need for advanced sensor technologies is growing.

Light Sensors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global light sensors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on function, output, integration, and end use industry.

Analysis by Function:

- Ambient Light Sensing

- Proximity Detection

- RGB Color Sensing

- Gesture Recognition

- UV/Infrared Light (IR) Detection

Proximity detection stand as the largest component in 2024, holding around 22.7% of the market. Proximity detection has emerged as the largest function type segment in the market, driven by its widespread application across various industries. In consumer electronics, such as smartphones and tablets, proximity sensors are essential for touchscreen deactivation during calls, enhancing user experience and conserving battery life. The automotive sector also relies heavily on proximity detection for features including parking assistance and collision avoidance systems, improving safety and convenience. Additionally, industrial automation utilizes these sensors for object detection and machinery control, ensuring operational efficiency. The growing demand for IoT-enabled devices and smart technologies further amplifies the need for proximity detection, solidifying its position as a dominant segment in the market.

Analysis by Output:

- Analog

- Digital

Digital leads the market with around 58.2% of market share in 2024. The digital segment is driven by the need for higher precision, advanced features, and the ability to process complex light data. Digital light sensors offer enhanced accuracy and integration capabilities, making them ideal for applications in healthcare devices, smart home systems, and automotive advanced driver assistance systems (ADAS). These sensors can transmit detailed data directly to microcontrollers, enabling more sophisticated control over lighting, display adjustments, and safety systems. As IoT and artificial intelligence (AI) technologies continue to change, the demand for digital light sensors, particularly in connected devices and automation, is rapidly increasing.

Analysis by Integration:

- Discrete

- Combination

Combination leads the market in 2024. The combination segment is driven by the increasing preference for integrated sensors that offer multifunctionality in a single package. This segment is gaining traction in applications that demand compact, cost-effective solutions with high efficiency, such as smartphones, smart home systems, and advanced driver assistance systems (ADAS) in automobiles. The rise of smart devices that require multiple sensing capabilities—such as ambient light sensing, proximity detection, and RGB color sensing—has accelerated the demand for combination light sensors. These integrated solutions reduce the need for multiple discrete components, simplifying the design and reducing manufacturing costs.

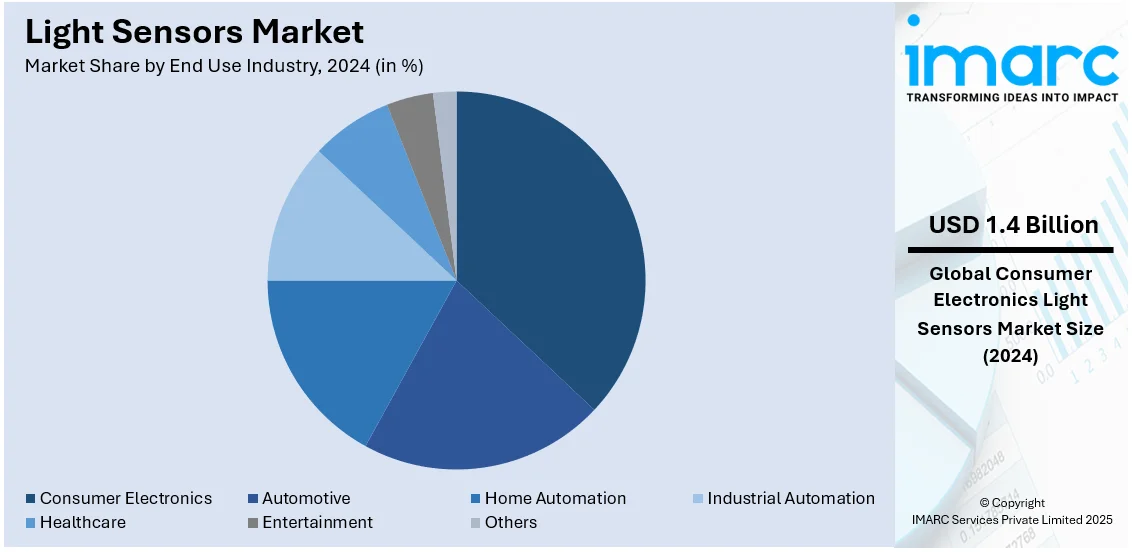

Analysis by End Use Industry:

- Consumer Electronics

- Automotive

- Home Automation

- Industrial Automation

- Healthcare

- Entertainment

- Others

Consumer electronics leads the market with around 36.5% of market share in 2024. The consumer electronics segment is driven by the increasing integration of light sensors in smartphones, tablets, and wearable devices to enhance user experience and optimize battery life through automatic brightness adjustments. With the rise of smart devices, ambient light sensors are becoming a standard feature, contributing to demand. Additionally, the popularity of augmented and virtual reality applications, which rely on advanced sensor technology, is further accelerating growth in this segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 35.0%. The Asia Pacific regional market is driven by the expanding consumer electronics sector, particularly in countries such as China, Japan, and South Korea. The rise in smartphone manufacturing, coupled with the rising adoption of IoT and smart home technologies, is increasing the demand for light sensors. Furthermore, the rapid industrialization and automation trends across various sectors, combined with government initiatives promoting energy efficiency, are fueling the light sensor market's expansion in Asia Pacific.

Key Regional Takeaways:

United States Light Sensors Market Analysis

The US accounted for around 80.60% of the total North America light sensors market in 2024. The light sensors market in the United States is experiencing significant growth, driven by the increasing demand for energy-efficient solutions across multiple industries. The growing adoption of IoT technologies, especially in industrial applications, is enhancing market potential. The U.S. industrial IoT market size was valued at USD 135.6 Billion in 2024 and is projected to reach USD 568.9 Billion by 2033, growing at a CAGR of 17.1% from 2025-2033. This trend is contributing to the integration of light sensors in smart lighting systems within industrial, automotive, and consumer electronics sectors. Moreover, the rise of electric vehicles (EVs) is driving the demand for advanced automotive lighting solutions that rely on light sensors to optimize energy use. Government initiatives aimed at promoting sustainability and reducing carbon emissions are further propelling the adoption of energy-efficient technologies, including light sensors. Additionally, the growing trend of smart homes, which incorporate integrated light sensors for energy management, further supports market expansion. With strong investments in green infrastructure and ongoing technological advancements, the U.S. light sensors market is set for robust growth over the forecast period, providing opportunities for innovation in sensor technologies.

Asia Pacific Light Sensors Market Analysis

The light sensors market in APAC is experiencing rapid growth, driven by urbanization, technological advancements, and the increasing demand for energy-efficient solutions. With over 1 Billion smartphone users in the region, the adoption of light sensors in consumer electronics, including smartphones and wearables, is accelerating. As countries including China, India, and Japan invest in smart cities and renewable energy, the demand for advanced lighting systems integrated with light sensors is rising. These systems are key to optimizing energy consumption and supporting sustainability efforts. The automotive sector, particularly in electric vehicles, is another significant driver, as manufacturers seek energy-efficient lighting technologies. Furthermore, government policies in the region that promote smart technologies and environmental sustainability are supporting market expansion. With the growing focus on energy-saving solutions and the ongoing development of smart infrastructure, the APAC light sensors market is poised for substantial growth in the coming years.

Europe Light Sensors Market Analysis

The light sensors market in Europe is experiencing growth driven by increasing environmental awareness, stringent energy efficiency regulations, and the rising demand for sustainable infrastructure. According to the European Union, 78% of Europeans acknowledge that environmental issues directly affect their daily lives and health, which has contributed to a growing focus on energy-efficient technologies, such as smart lighting systems. These systems, which rely heavily on light sensors, help optimize energy consumption in residential, commercial, and industrial buildings. With a strong commitment to reducing carbon emissions, European countries are investing heavily in green infrastructure, smart cities, and renewable energy projects, all of which drive demand for light sensors. The automotive industry in Europe is also a key contributor, particularly with the rise of electric vehicles (EVs). As EV manufacturers focus on energy efficiency and advanced lighting technologies, light sensors are increasingly integrated into automotive lighting solutions to enhance performance and reduce energy consumption. Additionally, Europe’s emphasis on regulatory frameworks that incentivize sustainability and energy savings further accelerates market growth. As technological advancements continue, the adoption of light sensors in wearables, consumer electronics, and other innovative applications will further expand the market, positioning Europe as a leader in energy-efficient lighting solutions.

Latin America Light Sensors Market Analysis

The light sensors market in Latin America is being driven by rapid urbanization and an increasing focus on energy-efficient solutions. According to reports, urbanization in Latin American countries is now around 80%, a level higher than in most other regions, which contributes to the growing demand for smart city initiatives. These initiatives often incorporate energy-saving technologies, such as light sensors, to optimize lighting and reduce energy consumption. Additionally, the shift towards sustainable infrastructure and green building projects, as well as the growing automotive sector's interest in energy-efficient lighting solutions, is further fueling market growth in the region.

Middle East and Africa Light Sensors Market Analysis

In the Middle East and Africa, the light sensors market is experiencing growth due to rapid urbanization and technological advancements. According to the World Bank, the MENA region is already 64% urbanized, contributing to the demand for smart lighting systems. Additionally, the region saw the deployment of 0.28 Billion IoT devices in 2023, which has increased the adoption of advanced technologies such as light sensors in various applications. These sensors are essential for optimizing energy usage in urban environments and supporting sustainable infrastructure initiatives. As the region continues to invest in smart city projects and energy-efficient solutions, the demand for light sensors will grow further.

Competitive Landscape:

The key industry players focus on innovation and expanding their product offerings to cater to the increasing demand from various end-use industries. Growing investments are in place to research and develop (R&D) the ability of sensors, mainly aiming for greater sensitivity, accuracy, and energy efficiency. Tech collaborations have become more common to embed light sensors in state-of-the-art consumer electronics, vehicle motion safety systems, and smart home technologies. In addition, these firms are bolstering their global presence by entering new markets, such as those in Asia-Pacific and Latin America, that have shown a rapidly increasing demand for consumer electronics and intelligent solutions. With the rising demand for miniaturized components for compact devices such as wearables and smartphones, companies working in the area of light sensors are also inclined towards the miniaturization of their products.

The report provides a comprehensive analysis of the competitive landscape in the light sensors market with detailed profiles of all major companies, including:

- ams AG

- Apple Inc.

- Broadcom Inc.

- Everlight Electronics Co. Ltd.

- Maxim Integrated Products Inc.

- ROHM Co. Ltd.

- Samsung Electronics Co. Ltd.

- Sharp Corporation (Foxconn Group)

- Sitronix Technology Corp.

- STMicroelectronics SA

- Texas Instruments Incorporated

- Vishay Intertechnology Inc.

Latest News and Developments:

- January 2025: Exeger, the Swedish company behind Powerfoyle™ solar cell technology, has partnered with Leedarson, a leader in smart lighting and IoT solutions, to co-develop a light-powered door window sensor. This sensor, designed for home automation and security systems, operates without the need for battery replacements by harnessing both indoor and outdoor light.

- January 2025: Signify has launched new features and accessories for Philips Hue, enhancing smart lighting for homes. The introduction of an AI-powered assistant in the Hue app, available in 2025, allows users to create personalized lighting scenes based on mood or occasion.

- October 2024: ams OSRAM showcased its intelligent optical lighting and sensor solutions at electronica 2024 in Munich, highlighting advancements in safety, comfort, health, and sustainability. At Booth 279, Hall B4, from November 12-15, visitors explored the company’s portfolio, which included dynamic lighting systems for vehicles, such as the EVIYOS™ product family with 25,600 controllable pixels, innovative automotive sensors, and interior lighting solutions.

- April 2024: Sentinum, an IFM company, has launched a temperature and humidity sensor powered by Epishine's organic indoor solar cells, compatible with both Mioty and LoRa technologies. This collaboration introduces a sustainable, maintenance-free alternative to traditional battery-powered devices, addressing the challenges of maintaining smart building sensors.

- April 2024: onsemi has launched the CEM102, a miniaturized analog front-end (AFE) for electrochemical sensing, offering high accuracy at low currents and minimal power consumption. The device is designed for industrial, environmental, and healthcare applications such as air and gas detection, food processing, and medical wearables including continuous glucose monitors. The CEM102, paired with the RSL15 Bluetooth® 5.2 microcontroller, enables energy-efficient, compact solutions, ideal for battery-operated sensors.

Light Sensors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Ambient Light Sensing, Proximity Detection, RGB Color Sensing, Gesture Recognition, UV/Infrared Light (IR) Detection Technologies |

| Outputs Covered | Analog, Digital |

| Integrations Covered | Discrete, Combination |

| End Use Industries Covered | Consumer Electronics, Automotive, Home Automation, Industrial Automation, Healthcare, Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ams AG, Apple Inc., Broadcom Inc., Everlight Electronics Co. Ltd., Maxim Integrated Products Inc., ROHM Co. Ltd., Samsung Electronics Co. Ltd., Sharp Corporation (Foxconn Group), Sitronix Technology Corp., STMicroelectronics SA, Texas Instruments Incorporated, Vishay Intertechnology Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the light sensors market from 2019-2033.

- The light sensors market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the light sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The light sensors market was valued at USD 3.82 Billion in 2024.

IMARC estimates the light sensors market to exhibit a CAGR of 8.38% during 2025-2033, reaching a value of USD 8.17 Billion by 2033.

The light sensors market is driven by the increasing adoption of smart devices, IoT-enabled solutions, energy-efficient lighting systems, and automation in industries, smart homes, and automotive applications. Advancements in sensor technology, rising environmental concerns, and the proliferation of consumer electronics including smartphones and wearables also contribute to market growth.

Asia-Pacific currently dominates the light sensors market, accounting for a share exceeding 35.0%. This dominance is fueled by the expanding consumer electronics sector, rapid industrialization, and government initiatives promoting energy efficiency.

Some of the major players in the light sensors market include ams AG, Apple Inc., Broadcom Inc., Everlight Electronics Co. Ltd., Maxim Integrated Products Inc., ROHM Co. Ltd., Samsung Electronics Co. Ltd., Sharp Corporation (Foxconn Group), Sitronix Technology Corp., STMicroelectronics SA, Texas Instruments Incorporated, and Vishay Intertechnology Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)