Life Science Analytics Market Report by Type (Reporting, Descriptive, Predictive, Prescriptive), Component (Software, Services), Deployment Mode (On-demand, On-premises), Application (Research and Development, Sales and Marketing Support, Supply Chain Analytics, Pharmacovigilance (PV), and Others), End Use (Medical Devices, Pharmaceutical, Biotechnology, and Others), and Region 2025-2033

Life Science Analytics Market Size:

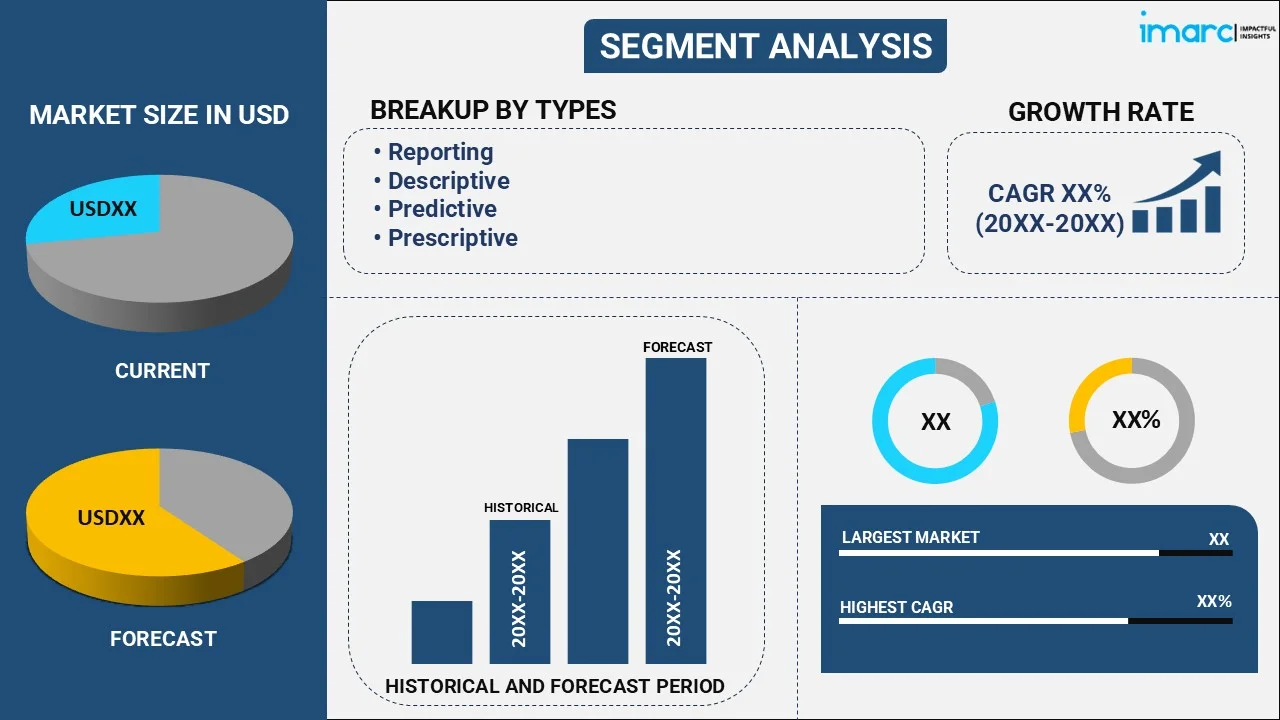

The global life science analytics market size is expected to exhibit a growth rate (CAGR) of 11.49% during 2025-2033. The market is driven by the growing demand for personalized medicine, stringent regulatory needs, technological advancements in AI and big data, the expansion of the pharmaceutical and biotech industries and the increasing adoption of electronic health records.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 11.49% |

Life Science Analytics Market Analysis:

- Major Market Drivers: The growth of the life science analytics ecosystem is facilitated by the demand for personalized medication, regulatory compliance requirement and technical breakthrough in alignment of big data and AI. Being able to have access to such type of information enables healthcare and pharmaceutical organizations to make informed decisions and deliver high quality products and services.

- Key Market Trends: Analytics is increasingly becoming demand-driven and cloud-based, solution providing flexibility and scalability. Furthermore, the EHRs concept in conjunction with analytics is spreading, so clinicians and researchers get more information about the patients' process and about their treatment success, which lets them to take more data-based decisions about healthcare.

- Geographical Trends: As per the life science analytics market outlook, North America takes the lead in the world market, backed by the information technology and health investment were very much advanced. In addition, the area leadership is reinforced by the continuation-oriented new R&D programs which are financed by both state and private financing channels and the well-established pharmaceutical and biotech sector.

- Competitive Landscape: The competitive environment is defined by the involvement of the key players including Accenture Plc, Cognizant, Infosys Limited, International Business Machines Corporation, and IQVIA Inc. Such companies are seeking market penetration avenues in the process through alliances approaches, technical upgrades, and mergers & acquisitions, focusing to build on their depth of knowledge and data analytic capabilities, which is further impacting the market.

- Challenges and Opportunities: According to the life science analytics market forecast, the market arises to overcome issues, including data privacy concerns as well as the necessity of a workforce. These are the challenges that also visualize the market potential. Now and in the future, the progress in analytical technology and the increase in volume of healthcare data are the strong drivers for the growth of the market and create lots of opportunities for the production of new analytical instruments and methods.

Life Science Analytics Market Trends:

Increasing Demand for Personalized Medicine:

A primary driver of life science analytics market growth is the escalating demand for personalized medicine. The concept of personalized medicine is an inevitable consequence of advanced technologies in medicine that enable data analysis and interpretation to detect specific patterns that can lead to different types of treatment. This change towards personalized healthcare management not only benefits the patient, but it also enables healthcare providers to achieve higher operational efficiencies. Analytics provide real-time precision forecasting and better decision-making thus promotes the growth of life science analytics demand and market expansion.

In 2015, President Obama unveiled the precision medicine initiative, supported by a $215 million investment from the 2016 Budget. This initiative aims to accelerate biomedical discoveries and equip clinicians with cutting-edge tools, insights, and treatments, enhancing personalized and effective healthcare for patients.

Regulatory Compliance and Risk Management:

Life science analytics market covers compliance and risk management strategies that are important factors in highly regulated pharmaceutical and biotechnology industries. A life science analytics strategy assists companies in establishing compliance with their regulatory requirements, in minimizing risks, and maintaining product quality and safety levels. This as well not only cuts the risk of the cost related enforcement, but also contributes to more aligned lifecycle processes. Analytics capability to make deep insights by real time monitoring can enhance the performance of life science analytics companies which will further push the market revenue upwards.

Technological Advancements in Big Data and AI:

The adoption of sophisticated technologies, such as big data analytics and artificial intelligence (AI) into the life sciences field signifies the key factor for the increase in demand across this area. Via these technologies, life science analytics companies acquire advanced decision support systems that are advantageous in terms of complex data processing and advanced market analysis capabilities. Such technological developments enable the achievement of novel therapies, as well as correct and sophisticated clinical trials, as is the case with the structural changes in the life science analytics market trends. The wide adoption of such advanced technologies inevitably intensifies the scale and efficacy of data solutions by increasing the rate of growth and innovation in the market share.

Life Science Analytics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, component, deployment mode, application, and end use.

Breakup by Type:

- Reporting

- Descriptive

- Predictive

- Prescriptive

Descriptive accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes reporting, descriptive, predictive, and prescriptive. According to the report, descriptive represented the largest segment.

Descriptive analytics has a unique niche in the market. It specifically deals with the analysis and interpretation of historical data for the purpose of identifying trends and patterns which gives a basis for both strategic and operational decisions. The role of analytics is well illustrated from the study which shows that descriptive analytics is widely used in reporting and monitoring functions supporting the compliance with regulations, product quality, and marketing strategies. This is overall supported in the market report showing that demand in this segment is higher and by the analytics market forecast projection that shows that the demand will persist over time.

Breakup by Component:

- Software

- Services

Services holds the largest share of the industry

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes software and services. According to the report, services accounted for the largest market share.

The services offered in the field of analytics are not limited to the range of services and their combination includes consulting, implementation, and support, which are represented by a large share of the market. The success of data mining in the life science area largely depends on the integration of analytics with existing workflows, which in turn suggests a healthy market perspective to life science analytics. With data environments growing in their complexity, the need for quality expert services that enable efficient data management and analysis is increasing day by day. The described trend is embedded in specialized advanced analytics in life science market overview, which reveals that services are more and more improved by the means of operational efficiencies improvement, adaptation to new laws, and identification of the most top-notch opportunities.

Breakup by Deployment Mode:

- On-demand

- On-premises

On-demand represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-demand and on-premises. According to the report, on-demand represented the largest segment.

On-demand deployments lead the segment within health sciences analytics market providing scalability and versatility that are unmatched by the on-premises approach. This option provides a flexible option for life sciences firms as it offers the ability to keep costs low while tapping into advanced analytics and storage platforms without these being ongoing expenses. Market statistics depict a rising trend towards cloud computing applications as they afford real-time access to analytics resources over geographically diverse situations. The life science analytics market recent developments are now increasingly being driven by demand-based services that further confirms the trend towards digital transformation, which also encompasses in the health industry services.

Breakup by Application:

- Research and Development

- Sales and Marketing Support

- Supply Chain Analytics

- Pharmacovigilance (PV)

- Others

Research and development exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes research and development, sales and marketing support, supply chain analytics, pharmacovigilance (PV), and others. According to the report, research and development accounted for the largest market share.

Research and development (R&D) represents the largest market due to the demand for accelerating drug developing and improving clinical research. As per the life science analytics market overview, modern analytics tools significantly improve data management and trials outcomes, which is currently a major focus in the industry. This shifting focus on R&D is thought to sustain, as described in life science analytics markets forecasts, since notable investments would not only be made in innovation but also efficiency. Through this way, frequent improvements in analytics functions are sustained in the market of the pharmaceuticals and biotech sectors, in line with the ever-changing industry needs, and the new avenues that are being created by the emerging life science analytics market are considered.

Breakup by End Use:

- Medical Devices

- Pharmaceutical

- Biotechnology

- Others

Pharmaceutical dominates the market

The report has provided a detailed breakup and analysis of the market based on the end use. This includes medical devices, pharmaceutical, biotechnology, and others. According to the report, pharmaceutical represented the largest segment.

Drug discovery to commercialization life science analytics is the predominant platform and operations in the end-use segment market are being assisted by the analytics to remove operation complexities. The pharmaceutical companies’ life science analytics overview outlines how they implement analytics to provide analytics for patients’ outcomes, supply chain and compliance management. The dominance will be supported by life science analytics market statistics that show continuous growth of investments by pharmaceutical companies that aim to capitalize on recent opportunities for growth and innovation in an extremely competitive and regulated environment with rising software cost.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest life science analytics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for life science analytics.

North America represents the largest share of the market due to the well-developed healthcare system, massive scientific research and development support and a strong role of regulations and optimization in healthcare in the region. The region's leading position on healthcare IT is determined by the application of advanced technologies and significant health care IT solution spending, which are found in the life science analytics market report. Life science analytics leaders in North America are strengthening the region's dominance, as they continue to deliver innovative solutions for different analytics applications throughout the industry. Forecast for the region remains robust, stimulated by the increasing use of EHRs and personalized medicine, which are gradually presenting better market opportunities.

Key Regional Takeaways:

United States Life Science Analytics Market Analysis

The United States has the largest share in the global life science analytics market because of the location of leading pharma companies, strong healthcare infrastructure, and high emphasis on R&D innovation. Growing use of cutting-edge analytics solutions such as AI and big data by biotech and pharma organizations is fueling market growth. Furthermore, growing clinical trials and personalized medicine practices need data-driven tools to maximize drug discovery and patient care. The prevalence of electronic health records (EHRs) and predictive analytics to improve clinical decision-making further enhance the market. Government efforts to encourage data interoperability, along with increasing healthcare spending and an aging population, reinforce this growth. In addition, tactical partnerships among technology firms and life science companies are driving innovative analytics platforms, enhancing the market penetration. But data protection laws and tight regulations could slow down growth to some extent. Nevertheless, the U.S. market continues to be the second-largest market globally for life science analytics, influencing other regions with respect to trends in revenues.

Europe Life Science Analytics Market Analysis

Europe leads the market share for the life science analytics market, which is being fueled by the growing pharmaceutical industry and investments in digitization of healthcare. The UK, Germany, and France are top adopters of advanced analytics solutions to optimize drug development and patient care. Precision medicine and value-based healthcare in the region are forcing the inclusion of real-time data analytics in clinical and operational workflows. Compliance requirements of regulatory laws like GDPR guarantee safe handling of data, promoting the use of compliant analytics solutions. Government funding and public-private partnerships for digital health solutions also expedite market expansion. Market growth may, however, be hindered by the intricacies of multi-country regulation and differences in healthcare systems. Nevertheless, Europe remains to rise as a crucial driver in utilizing life science analytics for improved research and healthcare outcomes.

Asia Pacific Life Science Analytics Market Analysis

The life science analytics market in the Asia Pacific is growing very fast, driven by increasing healthcare infrastructure, growing R&D investment, and increasing clinical trial activity, especially in China, India, and Japan. Government policies driving digital health transformation and the increasing presence of multinational pharma companies are driving market growth. Demand for data analytics for drug development, disease management, and personalized medicine is on the increase. But data privacy and compliance issues may hinder adoption in certain markets. Overall, Asia Pacific is a high-growth market with growing demand for innovative analytics offerings for life sciences.

Latin America Life Science Analytics Market Analysis

Latin America life science analytics market is slowly growing, backed by enhanced healthcare infrastructure and increasing pharmaceutical activities in nations like Brazil and Mexico. Implementation of digital health solutions and data analytics software for clinical research and healthcare administration is increasingly gaining traction. Market growth is slightly hampered by poor technological infrastructure and regulatory complexity. In spite of the challenges, the region is promising as pharmaceutical investment and public health activities spur demand for life science analytics solutions.

Middle East and Africa Life Science Analytics Market Analysis

Middle East and Africa life science analytics market is experiencing consistent growth as a result of growing investments in healthcare digitalization and modernization. The UAE and South Africa are embracing analytics platforms to improve clinical performance and operating effectiveness. Although infrastructural and regulatory challenges still exist, government-backed health reforms and collaborations with foreign technology companies are driving the adoption of data-driven solutions in life sciences. The area has growth potential, especially with the need for more advanced healthcare services increasing.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the life science analytics industry include.

- Accenture Plc

- Cognizant

- Infosys Limited

- International Business Machines Corporation

- IQVIA Inc.

- Oracle Corporation

- Rockwell Automation Inc.

- SAS Institute Inc.

- TAKE Solutions Limited

- Wipro Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

The key participants of the market focus on improving their offerings with the help of complex technologies such as artificial intelligence (AI) and machine learning (ML). They are emphasizing partnerships and acquisitions to widen their technological expertise and deepen the penetration of their footprints geographically. Moreover, they are investing on cloud based solutions to meet the growing need of larger end users for scalable and flexible analytics platforms, thus creating life science analytics market recent opportunities. They pursue this strategy with the goal to develop such a comprehensive, end-to-end analytics services that they can meet the many complex data requirements of the life science industry, ultimately helping for market growth and for retaining their customers.

Life Science Analytics Market News:

- In May 2025, Salesforce launched its Life Sciences Partner Network to speed up adoption of its HIPAA-ready, GxP-compliant Life Sciences Cloud platform. The network connects pharma and medtech firms with certified partners to streamline migration, AI agent deployment, and data integration. With access to real-time clinical and claims data from partners like athenahealth and Viz.ai, organizations can enhance digital labor via Agentforce, improving insights and coordination across research, manufacturing, and sales operations.

- In January 2025, Clarivate Plc launched DRG Fusion, a new life sciences analytics platform powered by integrated real-world data. Designed for biopharma and medtech organizations, Fusion simplifies complex data analysis, helping commercial teams optimize strategies and improve patient outcomes. The modular solution offers pre-built, configurable dashboards for patient journey analysis, market access optimization, and sales targeting. With continuous data updates and AI-driven features planned, Fusion empowers life sciences firms to make faster, insight-driven decisions in dynamic market landscapes.

- In October 2024, Oracle launched Oracle Analytics Intelligence for Life Sciences, an AI-powered, cloud-based platform that unifies diverse data sources to accelerate insights in clinical research and care. The solution offers pre-built datasets, adaptable models, and real-world data from sources like CancerMPact and multiomics, enabling better therapeutic launch strategies and patient outcome analysis. Integrated with Oracle Health Data Intelligence, it supports secure, EHR-agnostic data analysis for improved clinical decision-making and value-based care delivery.

- 12 March 2024, Oracle announced significant enhancements to oracle health data intelligence, including a new generative AI service to help increase care management efficiency. The suite enables a broad range of healthcare and government stakeholders to use data from across the healthcare ecosystem to help advance patient health, improve care delivery, and drive operational efficiency.

- 30 November 2023, Wipro Limited, announced its partnership with Amazon Web Services (AWS) to redefine laboratory processes in the life sciences industry. This collaboration aims to address the longstanding inefficiencies and high costs associated with outdated laboratory practices in the sector.

- 13 July 2022, Infosys announced a definitive agreement to acquire BASE life science, a leading technology and consulting firm in the life sciences industry, in Europe. The acquisition reaffirms the commitment to help global life sciences companies realize business value from cloud-first digital platforms and data to speed-up clinical trials and scale drug development, positively impacting lives and achieving better health outcomes.

Life Science Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Reporting, Descriptive, Predictive, Prescriptive |

| Components Covered | Software, Services |

| Deployment Modes Covered | On-Demand, On-Premises |

| Applications Covered | Research and Development, Sales and Marketing Support, Supply Chain Analytics, Pharmacovigilance (PV), Others |

| End Uses Covered | Medical Devices, Pharmaceutical, Biotechnology, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture Plc, Cognizant, Infosys Limited, International Business Machines Corporation, IQVIA Inc., Oracle Corporation, Rockwell Automation Inc., SAS Institute Inc., TAKE Solutions Limited, Wipro Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the life science analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global Life Science Analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the life science analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The life science analytics market is projected to exhibit a CAGR of 11.49% during 2025-2033.

The life science analytics market is driven by AI adoption in drug development, rising demand for personalized medicine, increased use of real-world data, regulatory compliance needs, wearable health devices, and collaborations between life sciences and tech firms for advanced analytics.

North America leads the life science analytics market due to advanced healthcare IT infrastructure, strong presence of major pharma companies, high R&D spending, regulatory support for real-world evidence, widespread AI adoption, and increasing demand for data-driven healthcare solutions.

Some of the major players in the life science analytics market include Accenture Plc, Cognizant, Infosys Limited, International Business Machines Corporation, IQVIA Inc., Oracle Corporation, Rockwell Automation Inc., SAS Institute Inc., TAKE Solutions Limited, and Wipro Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)