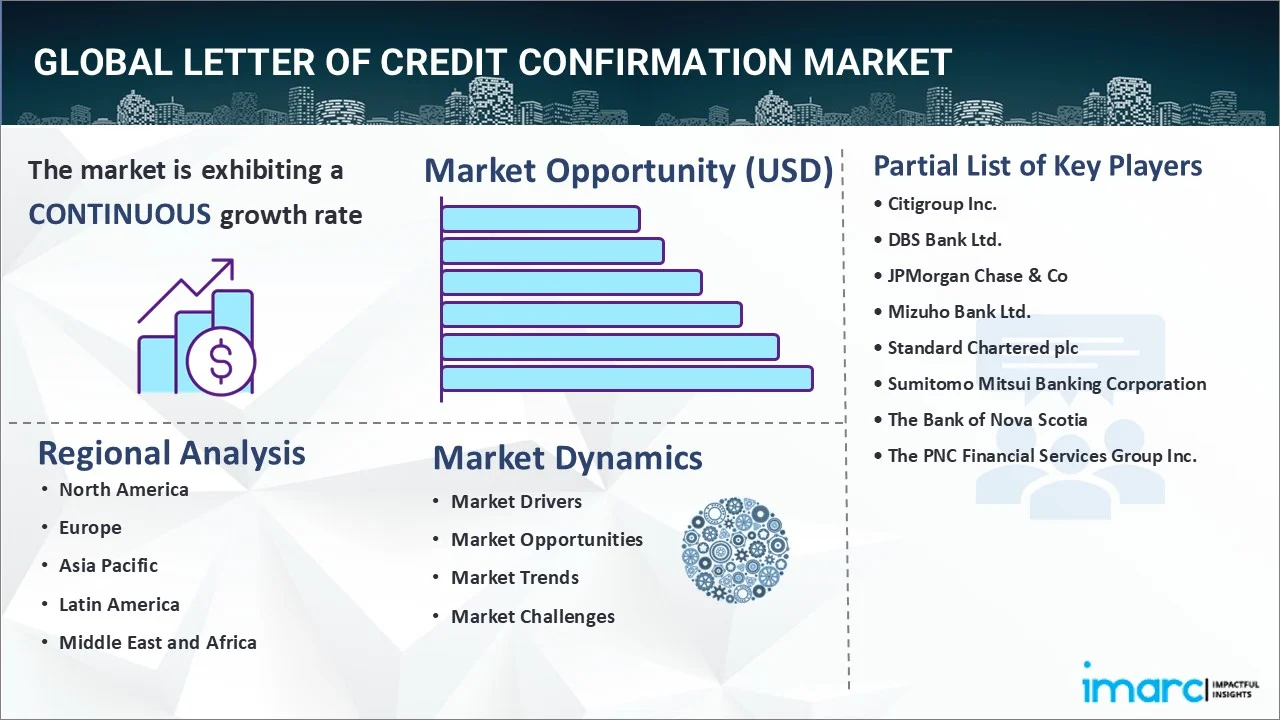

Letter of Credit Confirmation Market Report by L/C Type (Sight L/C, Usance L/C), End User (Small-sized Businesses, Medium-sized Businesses, Large Enterprises), and Region 2026-2034

Market Overview:

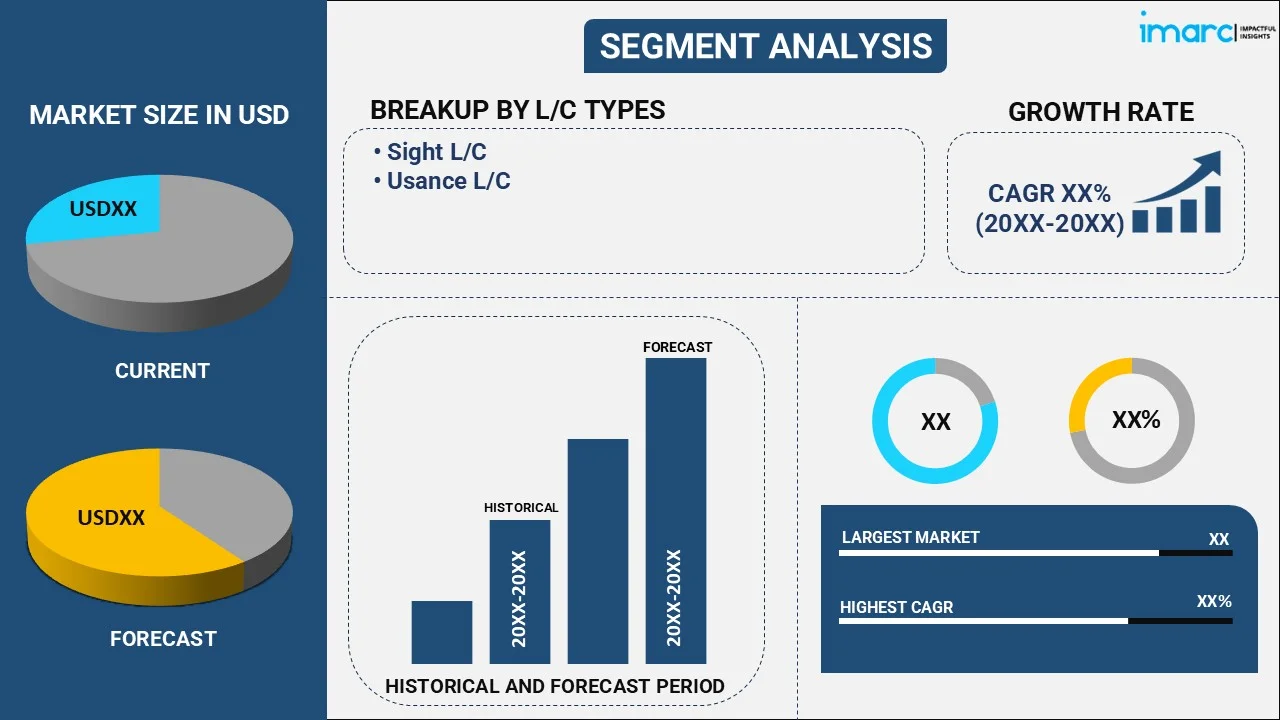

The global letter of credit confirmation market size reached USD 4.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.3 Billion by 2034, exhibiting a growth rate (CAGR) of 3.14% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2034 | USD 6.3 Billion |

| Market Growth Rate (2026-2034) | 3.14% |

Letter of credit confirmation is a service offered by the confirming banks based in the country where the exporters reside, assuming that the terms and conditions (T&C) for existing trade are fulfilled by the issuing banks. It acts as evidence for executing payments and transactions of traded goods and services and consequently provides security to buyers and sellers during international trade. At present, the rising sales of luxury vehicles on account of the improving living standards and inflating income levels are driving the demand for a letter of credit confirmation across the globe.

To get more information on this market Request Sample

Letter of Credit Confirmation Market Trends:

The increasing number of international trade activities among small, medium, and large enterprises represents one of the major factors positively influencing the demand for a letter of credit confirmation services around the world. In addition, the rising demand for customized trade finance solutions and regulatory support in the growth of strict regulations for a secured letter of credit confirmation services are creating a positive outlook for the market. Besides this, there is an increase in the integration of distributed ledger (DLT) and blockchain technologies, the Internet of Things (IoT), cloud computing, and artificial intelligence (AI) solutions in the letter of credit confirmation services. It assists in creating the real-time digitalized letter of credit contract and offers auto notification alerts over trades and enhanced business efficiency. It also helps in minimizing fraudulent activities, data theft, and financial losses, improving data security, preventing identity thefts and data tempering, and minimizing unauthorized access to sensitive data of the users. This, in turn, is offering lucrative growth opportunities to market players operating in the industry. Furthermore, significant improvements in the information technology (IT) infrastructure is anticipated to provide a favorable market outlook.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global letter of credit confirmation market report, along with forecasts at the global, regional and country level from 2026-2034. Our report has categorized the market based on L/C type and end user.

Breakup by L/C Type:

To get detailed segment analysis of this market Request Sample

- Sight L/C

- Usance L/C

Breakup by End User:

- Small-sized Businesses

- Medium-sized Businesses

- Large Enterprises

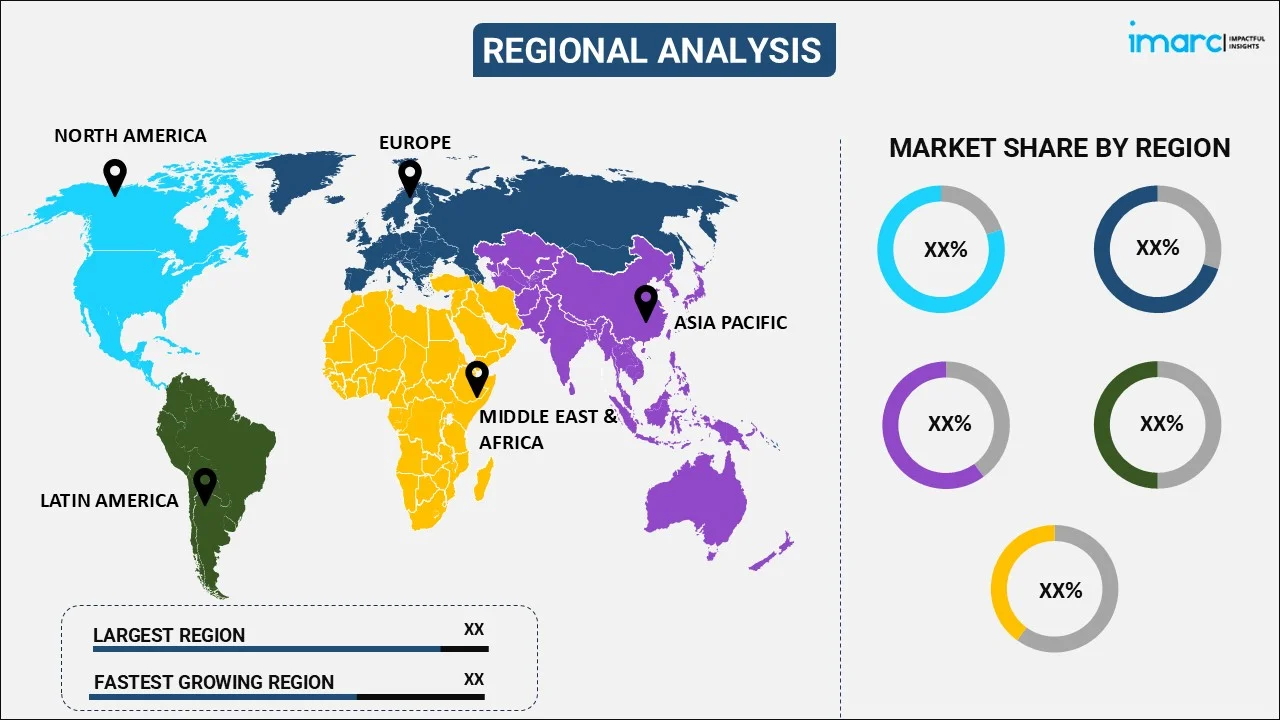

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being Citigroup Inc., DBS Bank Ltd., JPMorgan Chase & Co, Mizuho Bank Ltd., Standard Chartered plc, Sumitomo Mitsui Banking Corporation, The Bank of Nova Scotia and The PNC Financial Services Group Inc.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Segment Coverage | L/C Type, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Citigroup Inc., DBS Bank Ltd., JPMorgan Chase & Co, Mizuho Bank Ltd., Standard Chartered plc, Sumitomo Mitsui Banking Corporation, The Bank of Nova Scotia and The PNC Financial Services Group Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The global letter of credit confirmation market size reached USD 4.8 Billion in 2025.

We expect the global letter of credit confirmation market to exhibit a CAGR of 3.14% during 2026-2034.

The rising integration of the Internet of Things (IoT), cloud computing, and Artificial Intelligence (AI) solutions with the letter of credit confirmation services, as they help in improving data security, preventing identity thefts and data tempering, minimizing unauthorized access to sensitive data of the users, etc., is primarily driving the global letter of credit confirmation market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in temporary halt in numerous trade activities, thereby negatively impacting the global market for letter of credit confirmation services.

Based on the L/C type, the global letter of credit confirmation market has been segregated into sight L/C and usance L/C, where sight L/C currently holds the largest market share.

Based on the end user, the global letter of credit confirmation market can be bifurcated into small-sized businesses, medium-sized businesses, and large enterprises. Currently, large enterprises exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global letter of credit confirmation market include Citigroup Inc., DBS Bank Ltd., JPMorgan Chase & Co, Mizuho Bank Ltd., Standard Chartered plc, Sumitomo Mitsui Banking Corporation, The Bank of Nova Scotia, and The PNC Financial Services Group Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)