LED Lighting Market Size, Share, Trends, and Forecast by Application and Region 2025-2033

Global LED Lighting Market:

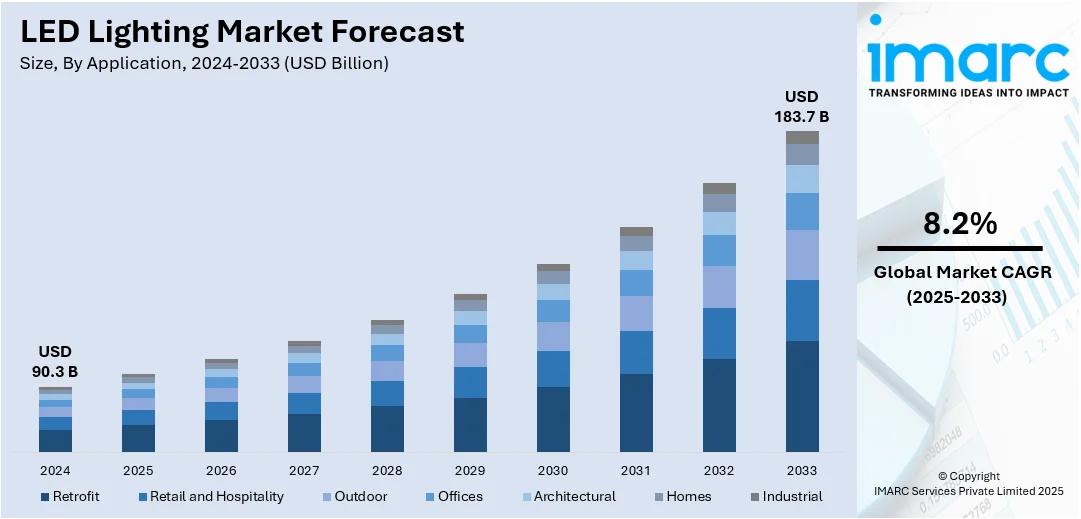

The global LED lighting market size was valued at USD 90.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 183.7 Billion by 2033, exhibiting a CAGR of 8.2% during 2025-2033. China currently dominates the market. This leadership can be attributed to its large-scale manufacturing, advanced technology, and strong government support. With competitive pricing and expansive production capacity, it exports significantly worldwide. This dominance positions China as a key player in influencing the global LED lighting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 90.3 Billion |

|

Market Forecast in 2033

|

USD 183.7 Billion |

|

Market Growth Rate 2025-2033

|

8.2% |

LED Lighting Market Analysis:

- Major Market Drivers: The increasing consumer environmental concerns are prompting a shift towards energy-efficient lighting solutions, such as LED lighting solutions. Moreover, as they have a longer lifespan and lower energy consumption, the global LED lighting market demand is elevating significantly. Besides this, the rising popularity of customizable and aesthetically pleasing lighting solutions in commercial, residential, and industrial sectors is expected to bolster the LED lighting market revenue.

- Key Market Trends: The LED bulb industry's top manufacturers are focusing on integrating advanced technologies to improve efficiency, minimize costs, and enhance their appeal to businesses and customers which is acting as one of the significant trends driving the market growth. Besides this, the development of smart lighting systems, where LEDs can be easily controlled via smartphones and other devices, is also fueling the LED lighting market across the globe.

- Competitive Landscape: Some of the leading LED lighting market companies include Acuity Inc., ams-OSRAM AG, Cree Lighting USA, LLC, Dialight, Everlight Electronics Co., Ltd., Halonix Technologies Private Limited, Hubbell Incorporated, Ledvance GmbH, LSI Industries Inc., Nichia Corporation, Panasonic Corporation, Signify Holding, and Zumtobel Group AG, among many others.

- Geographical Trends: According to the LED lighting market report, China held the biggest market share, as it is the manufacturing powerhouse for the LED lighting industry. In addition, rising technological advancements in LED lighting for improved efficiency are propelling the LED lighting market growth.

- Challenges and Opportunities: The supply chain of LED lighting solutions is complex and often requires sourcing from various countries. Consequently, disruptions in the supply chain, owing to trade disputes and geopolitical tensions, can lead to product shortages and increased costs, thereby hindering the market growth. Furthermore, the rising number of large key players can also lead to challenges in standardizing LED lighting. However, numerous factors, such as favorable regulatory policies, strategic innovations, and the escalating need for energy-efficient lighting solutions, are some of the LED lighting market recent opportunities, which will continue to drive the growth of the market in the coming years.

To get more information on this market, Request Sample

The market is driven by increasing awareness of energy conservation and the rapid pace of smart city infrastructure development across emerging and developed economies. Government regulations enforcing the phase-out of inefficient lighting technologies have accelerated LED adoption. For instance, in 2025, Bengaluru is replacing over 5.3 lakh sodium streetlights with smart LEDs to reduce electricity bills by over 85%. The ₹700 crore project includes motion sensors, CCTV, and pollution monitors. Guwahati is installing 60 high-mast LED lights across all wards, enhancing urban safety and visibility. The initiative builds on the successful deployment of over 20,000 LEDs in earlier phases. Both cities aim to improve energy efficiency, public safety, and urban infrastructure through large-scale LED lighting upgrades. Additionally, declining average selling prices of LED products, coupled with continuous innovation in design and functionality, are making LEDs more attractive to consumers and commercial sectors alike. The integration of LEDs with IoT-enabled systems for intelligent lighting control is further expanding their application. Rising environmental concerns and international climate agreements are also prompting industries to switch to sustainable lighting solutions, thereby reinforcing LED lighting market growth worldwide.

In the United States, the LED lighting market is being propelled by robust federal and state-level incentives promoting energy-efficient technologies. Widespread retrofitting projects in commercial buildings, industrial facilities, and public infrastructure are significantly contributing to demand. The growing emphasis on reducing operational costs in the corporate sector has led to increased adoption of LED lighting systems. Technological advancements enabling human-centric lighting and enhanced customization are also gaining traction among residential users. Furthermore, heightened demand for smart lighting systems compatible with home automation platforms is boosting consumer interest. Strong environmental regulations and rising consumer preference for sustainable living continue to support the expansion of the U.S. LED lighting market.

LED Lighting Market Trends

Rising Demand for Energy-Efficient and Cost-Saving Lighting Solutions

The escalating demand for energy-efficient and cost-effective lighting solutions among the masses represents one of the prominent LED lighting market trends. LEDs convert a higher percentage of electrical energy into light, which saves a significant amount of energy. Individuals and government authorities across the globe are focusing on energy efficiency. Consequently, various leading companies are widely using LED lighting solutions, which is propelling the LED lighting market demand. Additionally, numerous concerned regulatory authorities of various developing nations are taking initiatives to build sustainable and energy-efficient cities, which is further catalyzing the market for LED lights. For instance, GSMA estimated that China may account for around 4.1 Billion IoT connections, which is almost one-third of the worldwide IoT connections, by 2025. In line with this, in February 2023, Signify helped the German municipality of Eichenzell become a future-proof smart city through a smart street lighting solution. Its BrightSites solution enabled Eichenzell to cater to next-generation IoT applications and future 5G densification. Signify installed LED lighting, which the Interact City System manages. Eichenzell can continuously monitor and manage all lights from a single dashboard. Furthermore, in January 2023, Savant company GE Lighting announced the expansion of its smart home ecosystem, called Cync. Cync launched its entire Dynamic Effects entertainment lineup, which included 16 Million presets, colors, custom light shows, on-device music syncing, and other features. Such initiatives are projected to propel the LED lighting market share in the coming years.

Increasing Environmental Concerns Among Individuals

The growing adoption of LED lighting on account of the increasing environmental awareness among individuals and government authorities is further catalyzing the market for LED lighting solutions. People are increasingly preferring sustainable lighting solutions that assist in reducing pollution in the environment. Considering this, various key manufacturers are introducing sustainable and energy-efficient lighting solutions. For instance, in July 2023, Signify Malaysia introduced a whole range of sustainable and energy-efficient lighting products for the Malaysian market. These products included Philips Ultra Efficient LED and Philips Solar Lighting solutions. Philips Ultra Efficient LED has advanced LED design and optics technology, consisting of a range of LED bulbs and LED tubes that consume 60% less energy than standard LED products of the same category. Moreover, it could deliver up to 50,000 hours of light and more than 3.5x the lifetime usage. In line with this, the Philips Solar Lighting range has a selection of solar products, such as solar wall lights, solar flood lights, solar garden or landscape lighting products, and others. Similarly, government bodies across the world are also making significant investments in upgrading the lighting infrastructure and installing environment-friendly lighting solutions. For instance, in June 2023, government bodies in the United States collaborated with the U.S. Department of Energy (DOE) to facilitate energy enhancements in K-12 schools nationwide. They have funded USD 178 Million. This financial support helped these education facilities to undertake projects that were focused on minimizing energy expenditures, reducing emissions levels, and developing enhanced LED lighting solutions.

Favorable Government Initiatives

Governing agencies of various countries are encouraging the adoption of energy-efficient lighting solutions to curb pollution in the environment. They are introducing energy saving and tax benefits. For instance, the Indonesian government issued a 2015 Government Regulation No. 18, a series of preferential tax policies to attract domestic and foreign investment for LED, thereby providing low-cost consumer purchases. Similarly, Japan planned to implement Japan's Intended Nationally Determined Contributions (INDCs) draft to achieve at least a 50% reduction of global GHG emissions by 2050. This can be achieved by increasing the utilization of LED bulbs and other LED lighting solutions. Besides this, the government entities of North America are extensively investing in connected streetlights. Several communities across the region have seen improvements through street and roadway lighting initiatives. For example, in February 2021, the Grand Rapids City Council approved a $9.46 Million contract aimed at converting all municipal streetlights to energy-efficient LED technology.

LED Lighting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global LED lighting market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Retrofit

- Retail and Hospitality

- Outdoor

- Offices

- Architectural

- Homes

- Industrial

Retrofit leads the market with around 34.8% of market share in 2024. Retrofit application refers to the replacement of existing lighting fixtures with LED lighting solutions. In this, traditional lighting technologies, such as incandescent, fluorescent, and halogen bulbs, are replaced with energy-efficient LED alternatives. In addition, retrofitting offers a cost-effective way to upgrade lighting systems without changing the entire infrastructure.

Regional Analysis:

- India

- China

- Europe

- Japan

- Brazil

- Russia

- United States

In 2024, China accounted for the largest market share. China held the biggest market share, as it is the manufacturing powerhouse for the LED lighting industry. China exports most of its LED lighting to other APAC countries, making it the world's largest LED lighting exporter. For instance, as per industry reports, in 2024, China’s Raw Lead exports totaled $71.5 Million, with the primary export destinations being Vietnam ($23.2 Million), Malaysia ($17.5 Million), Thailand ($11.3 Million), Bangladesh ($10 Million), and Japan ($1.52 Million). Apart from this, governing agencies in the country are rapidly promoting the adoption of LED lighting by offering various incentives and subsidies, which are supporting the growth of the market. Additionally, the growing demand for the solution in residential areas is positively influencing the LED lighting market outlook.

Key Regional Takeaways:

United States LED Lighting Market Analysis

The U.S. LED lighting market continues to grow significantly, fuelled by increasing demand for energy-efficient lighting solutions in residential, commercial, and industrial applications. Government policies encouraging energy conservation, including phase-out of incandescent bulbs and tax credits for energy-saving technologies, have accelerated adoption. Growing smart home penetration and innovations in IoT-enabled lighting systems further boost market growth. For instance, 57% of all households in the United States are anticipated to have smart home devices by the end of 2025. Large city projects and infrastructure projects are incorporating LED lighting to minimize carbon footprints and reduce costs of operation. The consumers are also more and more opting for smart LED bulbs supported by platforms like Amazon Alexa and Google Home. Well-established players like Cree, GE Lighting, and Acuity Brands are present in the market, which means technological advancements and competitive pricing. Retrofitting of traditional light systems with LED options is also a major trend among industries seeking to reduce energy costs. Challenges, however, can come from market maturity and competition in pricing. On the whole, sustainability objectives and smart technology integration remain the leading forces defining the U.S. LED lighting market landscape.

Europe LED Lighting Market Analysis

The European LED lighting industry is driven by strict energy-efficiency regulations and high demand for sustainability. The directives by the EU to eliminate inefficient lighting technology, and the incentives offered for energy-saving retrofits, have given a boost to the adoption of LEDs. Nations such as Germany, France, and the UK are leading the transition towards intelligent lighting in intelligent city schemes and green buildings. Moreover, retrofit projects in heritage buildings and public infrastructure are driving market demand. Advances in technology, such as color-changing and tunable white LEDs for illumination and light designs, are becoming increasingly popular in residential and commercial settings. Nevertheless, the region is hindered by high capital expenses and intricate regulatory fulfillment. Nevertheless, Europe's carbon neutrality pledge by 2050 guarantees a favorable future for LED lighting through ongoing innovation and government assistance. For instance, In the EU, which as a bloc would be the third largest source of emissions in February 2025, emissions declined by 2.63 Million tonnes CO2e compared to February 2024, or 0.79%.

Asia Pacific LED Lighting Market Analysis

Asia Pacific is the largest of the global LED lighting markets, driven by urbanization, industrialization, and government policies encouraging energy-efficient lighting. For instance, India Industrial production rose 5.0 % YoY in Jan 2025, following an increase of 3.5 % YoY in the previous month. China, Japan, South Korea, and India are the key contributors, with a focus on developing smart cities and modernizing infrastructure. Region-specific manufacturers' competitive pricing has made LED products available to a broad base across residential and commercial segments. Increasing consumer knowledge about energy savings as well as environmental benefits also drives demand higher. In addition, subsidies and lenient regulations from local authorities promote broad use of LEDs, cementing Asia Pacific's dominance in the industry.

Latin America LED Lighting Market Analysis

The Latin American LED lighting industry is reflecting promising growth with enhanced infrastructure projects and energy conservation programs. The top markets are Brazil, Mexico, and Argentina driven by growing urbanization and the drive to lower electricity bills. For instance, Latin America and the Caribbean underwent a rapid urbanization process, making it one of the most urbanized regions in the world. In 2025, 82% of the population lives in urban areas, compared to the global average of 58%. The government-run programs with incentives for energy-efficient products are accelerating LED usage in residential as well as public spaces. Economic uncertainty and excessive import dependence for LED components can, however, hinder market growth. In spite of adversity, demand for sustainable lighting solutions is high throughout the region.

Middle East and Africa LED Lighting Market Analysis

Within the Middle East and Africa, the LED lighting industry is growing steadily with urban development and efforts at diversifying energy. The UAE and Saudi Arabia are both incorporating LED solutions into their major infrastructure and smart city projects in order to maximize energy efficiency. For instance, the Middle East expects to invest nearly USD 50 Billion in smart city projects through to 2025. Increasing green awareness and the requirement to decrease operating costs in commercial premises are fueling the demand. Yet, sparse regional manufacturing and high initial costs are issues, although government efforts at the regional level still promote LED use.

Competitive Landscape:

The competitive landscape of the LED lighting market is characterized by intense rivalry, rapid technological advancements, and continuous product innovation. Companies are heavily investing in research and development to enhance energy efficiency, smart lighting capabilities, and design aesthetics to differentiate their offerings. Market players are also focusing on strategic collaborations, mergers, and expansion into emerging markets to strengthen their global footprint. For instance, in July 2025, Panasonic announced plans to acquire a controlling stake in Focus Lighting and Fixtures, a company specializing in commercial LED lighting solutions, for around ₹526 crore. The deal includes acquiring the Sheth family’s 55% stake and a mandatory open offer to public shareholders. The move aligns with Panasonic’s strategy to expand its footprint in India’s B2B LED lighting market. Focus Lighting’s clients include major players like Reliance Retail and DLF. The growing demand for connected and sustainable lighting solutions is driving competition, particularly in commercial and industrial segments. Additionally, price competitiveness remains a critical factor influencing market dynamics. The LED lighting market forecast projects sustained growth, driven by ongoing urbanization, smart city initiatives, and regulatory support promoting energy-efficient technologies across residential, commercial, and public infrastructure applications.

The report provides a comprehensive analysis of the competitive landscape in the LED lighting market with detailed profiles of all major companies, including:

- Acuity Inc.

- ams-OSRAM AG

- Cree Lighting USA, LLC

- Dialight

- Everlight Electronics Co., Ltd.

- Halonix Technologies Private Limited

- Hubbell Incorporated

- Ledvance GmbH

- LSI Industries Inc.

- Nichia Corporation

- Panasonic Corporation

- Signify Holding

- Zumtobel Group AG

Latest News and Developments:

- June 2025: Optronics International launched its STL104 Series custom 4-inch round LED logo lights in June 2025, introducing a cost-effective LED lighting solution that integrated branding into commercial vehicle lights. The innovation marked a shift by making custom LED lighting, once exclusive to large OEMs, accessible to a wider market while retaining full safety functionality.

- May 2025: Signify launched Europe’s first LED Lighting tube made with recycled plastic, introducing the Philips MASTER LEDtube T8 EM/mains containing 40% post-consumer-recycled materials sourced from fishing nets, water jugs, and car headlights. The LED Lighting product also featured sustainable packaging made from 80% recycled paper and marked Signify’s expansion into ASEAN, Indonesia, and Greater China markets.

- May 2025: Kyocera launched the G7A Series air-cooled UV LED lighting, offering compact size and top-class irradiance for curing ink, resin, and adhesives. The LED lighting featured customisable irradiation width, space-saving design, and stable operation through advanced monitoring functions.

- April 2025: Excelite launched a certified range of miniature LED lighting signal lights tailored for car tuning enthusiasts, featuring models like LED P21/5W DRL and LED T15, designed to ensure 1:1 compatibility and legal compliance while enhancing vehicle performance and safety.

- April 2025: Fusion Optix acquired LEDdynamics, along with its brands Prolume and LEDSupply, expanding its portfolio to five brands across LED components, fixtures, and e-commerce. Both companies operate manufacturing facilities in New England, emphasizing domestic production amid global supply chain uncertainties and rising tariffs on Chinese imports. This strategic move strengthens Fusion Optix’s U.S.-based capabilities and market reach in the LED lighting industry.

LED Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Retrofit, Retail and Hospitality, Outdoor, Offices, Architectural, Homes, Industrial |

| Regions Covered | Europe, India, China, United States, Japan, Brazil, Russia |

| Companies Covered | Acuity Inc., ams-OSRAM AG, Cree Lighting USA, LLC, Dialight, Everlight Electronics Co., Ltd., Halonix Technologies Private Limited, Hubbell Incorporated, Ledvance GmbH, LSI Industries Inc., Nichia Corporation, Panasonic Corporation, Signify Holding, Zumtobel Group AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the LED lighting market from 2019-2033.

- The LED lighting market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the LED lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The LED lighting market was valued at USD 90.3 Billion in 2024.

The LED lighting market is projected to exhibit a CAGR of 8.2% during 2025-2033,reaching a value of USD 183.7 Billion by 2033.

Key factors driving the LED lighting market include rising demand for energy-efficient lighting systems, increasing adoption of smart and connected lighting solutions, government initiatives promoting sustainable infrastructure, declining LED product costs, and growing awareness of environmental impact. Additionally, advancements in IoT integration, smart city developments, and heightened commercial and industrial retrofitting activities further contribute to market expansion.

As of 2024, China dominates the global LED lighting market, driven by its large-scale manufacturing capabilities, favorable government policies, extensive infrastructure development, and strong export capacity. The region’s leadership is also supported by rapid urbanization, significant investment in smart city projects, and wide adoption of energy-efficient technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)