LED Chip Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

LED Chip Market Size and Share:

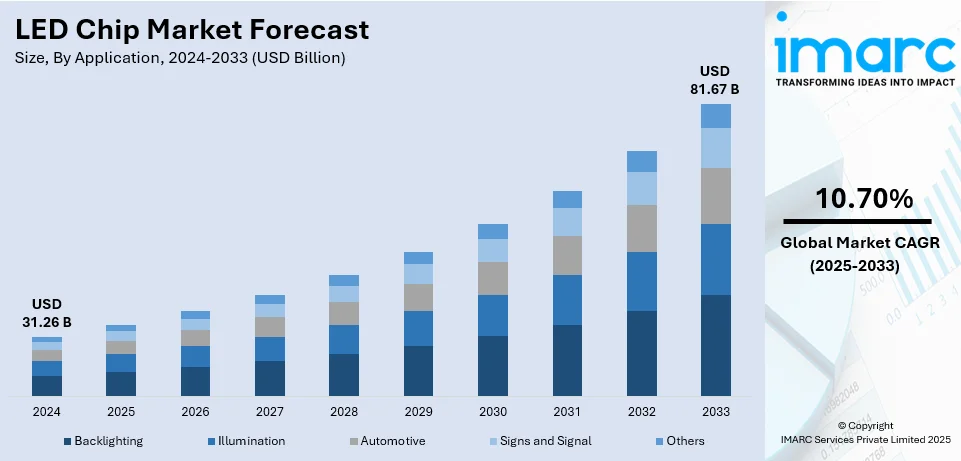

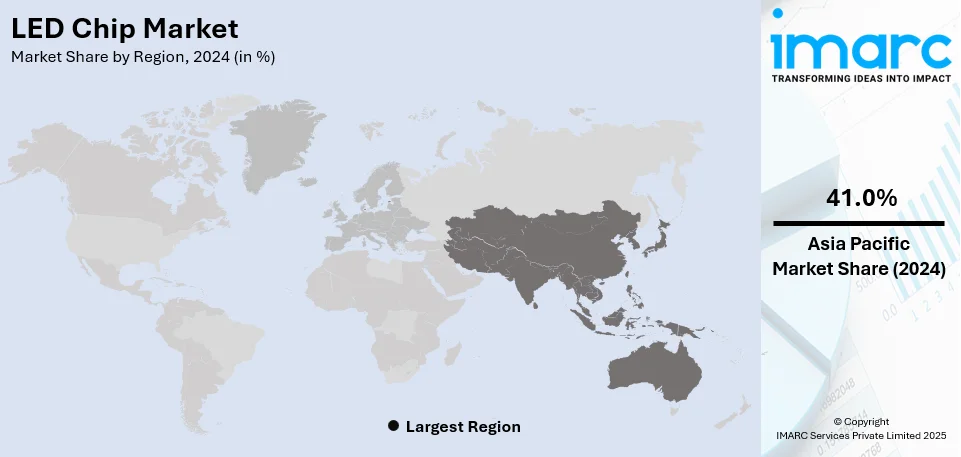

The global LED chip market size was valued at USD 31.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 81.67 Billion by 2033, exhibiting a CAGR of 10.70% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 41.0% in 2024. The augmenting demand for energy-efficient lighting solutions, expanding applications in automotive and consumer electronics, ongoing technological advancements, government regulations promoting energy conservation, rapid urbanization, and the increasing focus on sustainable infrastructure development are creating lucrative opportunities in the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 31.26 Billion |

|

Market Forecast in 2033

|

USD 81.67 Billion |

| Market Growth Rate 2025-2033 | 10.70% |

The global market is primarily driven by the growing adoption across key sectors, including residential, commercial, and industrial applications, driven by increasing demand for sustainable and cost-effective solutions. Moreover, continual technological advancements in LED technology, including improved brightness, enhanced color quality, and extended lifespan, are fostering market growth. Additionally, the rapid utilization of LEDs in automotive lighting, consumer electronics, and outdoor displays is further adding to the growth of the market. In line with this, favorable government regulations along with the introduction of energy-saving initiatives are also creating a positive outlook for the market. For instance, on January 6, 2025, the Indian Ministry of Power celebrated the 10th anniversary of the UJALA scheme, which has distributed 36.87 crores (368.7 million) LED bulbs across the country, saving INR 19,153 Crore annually. This scheme has significantly reduced energy consumption and carbon emissions, helping India achieve its environmental sustainability goals. The UJALA scheme is a prime example of the nation's commitment to energy efficiency and economic savings for consumers.

The United States stands out as a key regional market, driven by the increasing demand for energy-efficient lighting solutions, especially in commercial and industrial sectors. Additionally, the rising usage of IoT-enabled smart lighting solutions across numerous end-use sectors is increasing the overall market penetration. Moreover, an enhanced focus on sustainable urban development and infrastructure modernization is propelling demand for advanced LED chips. Recent industry reports indicate 66% of the cities in United States are making substantial investments in smart city technologies. Notably, on December 10, 2024, Actelis Networks was selected by Seattle, recognized as the smartest city in the U.S., to deploy hybrid fiber-copper networking solutions for a major infrastructure modernization project enhancing connectivity and supporting advanced smart city applications. By upgrading legacy copper networks with hybrid fiber-copper solutions, the initiative aims to enhance smart city applications, benefiting traffic management and public safety systems, highlighting Seattle's commitment towards urban efficiency and sustainability. Besides, numerous innovations in miniaturized LED chip designs, making their usage more popular across a diverse set of industries, for applications in wearable devices and automobiles, are providing an impetus to the market.

LED Chip Market Trends:

Increasing Adoption of Smart Cities

The growth of smart cities has been a prominent driver for the growth of the LED chip market. Notably, the IMARC report states that the global smart cities market size stood at USD 1,233.7 Billion in 2023. Looking ahead, the market is expected to reach USD 4,633.9 Billion by 2032, expanding at a growth rate (CAGR) of 15.4% during 2024-2032. The smart cities are run on energy efficiency and sustainability. The LED lighting takes a very crucial role in the achievement of these goals. LED chips consume much less energy compared to conventional light systems. These factors are expected to drive the share of the LED chip in the market in the near future.

Expanding Automotive Applications

The applications of LEDs are rising in automotive fields, which include headlights, taillights, and interior lighting. This is due to their lower energy consumption, durability, and improved design flexibility are making their demand increase in the automotive industry. As per the industry report, in January 2024, Kenwood released LED headlights for the Indian market. The product will be available in 4300 Kelvin and 6000 Kelvin varieties for cars and SUVs, including H1, H4 / H19, H7, H8, H27, 9005, and 9006. These factors further positively influence the LED chip market forecast.

Ongoing Technological Innovations

Continuous innovations in LED chip technology, such as the development of micro-LEDs and quantum dots, are enhancing performance and expanding applications. These advancements lead to better color accuracy, brightness, and overall user experience. For instance, in May 2024, TCL introduced Next-Generation QD Mini LED Technology. The LED series has an unusual number of dimming zones (up to 5,000), remarkable peak brightness (up to 5,000 nits), and QLED ULTRA technology, which provides 97%+ of the DCI-P3 color gamut and 100% color volume. Its HEXA Mini LED Chip, UWA Optical Lens, and ODR LED Technology provide great brightness, precision light control, and increased optical stability, thereby boosting the LED chip market revenue.

LED Chip Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global LED chip market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on product and application.

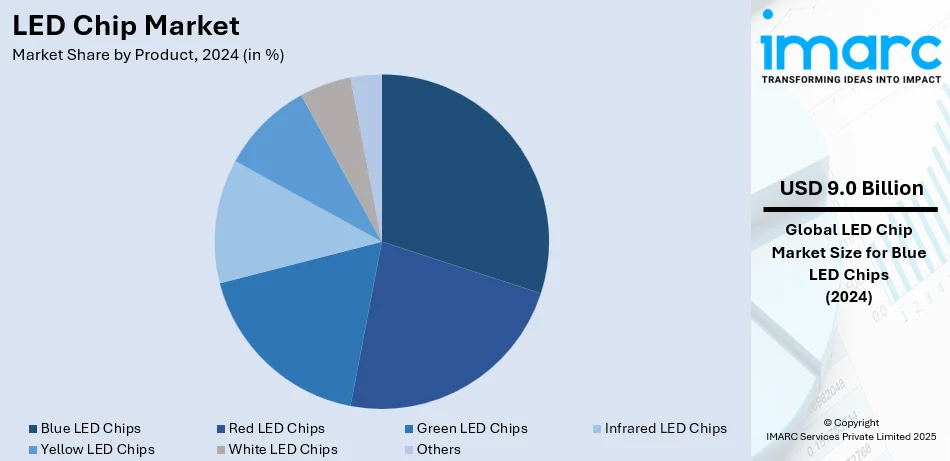

Analysis by Product:

- Blue LED Chips

- Red LED Chips

- Green LED Chips

- Infrared LED Chips

- Yellow LED Chips

- White LED Chips

- Others

Blue LED chips lead the market with around 28.9% of the market share in 2024. According to the LED chip market outlook, blue LED chips are important in many display technologies, such as LCD and OLED screens. Furthermore, their ability to produce bright and vibrant colors makes them indispensable for high-definition televisions, computer monitors, and smartphones, which is driving the market further. Moreover, these chips are increasingly being used in automotive applications, such as headlights and interior lighting, which in turn is fostering market growth. Their bright illumination improves visibility and safety while providing aesthetic appeal.

Analysis by Application:

- Backlighting

- Illumination

- Automotive

- Signs and Signal

- Others

Backlighting leads the market in 2024. LED backlighting, as indicated in the LED chip market overview, is far more energy-efficient compared to traditional lighting technologies such as CCFL, or cold cathode fluorescent lamp. The greater demand for reducing energy consumption and subsequently cutting down the cost of operations boosts the demand for LED backlighting. Furthermore, different types of display technologies such as LCD, OLED, and AMOLED, are becoming very popular, leading to an increase in the demand for LED chips. The rise of backlighting in consumer electronics means there is an ever-growing need for efficient solutions to backlight.

Analysis by Region:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 41.0%. According to the LED chip market statistics, the Asia Pacific region is experiencing rapid urbanization in such places that add to the construction of associated infrastructure. For instance, fast urbanization places a considerable burden on the commercial and residential sectors in terms of efficient lighting solutions such as LED chips. In addition, the escalating consumer electronics sector in countries such as China, Japan, and South Korea fuel demand for LED chips. Moreover, increased use of LED technology in smartphones, televisions, and other electronic devices is an indicator of the expansion of the market. Apart from this, accelerating demand for electric vehicles in Asia Pacific is also bolstering the growth of the LED chip market. Notably, the market size of electric vehicles in India has been USD 1,327.8 Million in 2023, with IMARC providing an estimate that the market will grow to USD 102,610.8 Million by 2032 at a CAGR of 60.2% in the 2024-2032 period. Electric vehicles usually are fitted with higher lighting systems. Also, LED lights are used for headlights, taillights, and interior illumination.

Key Regional Takeaways:

United States LED Chip Market Analysis

In 2024, the United States represented 86.40% of the North America LED Chip market driven by the ongoing technological advancements and increased focus on energy efficient solutions. Increasing demand for sustainable solutions for lighting, along with incentives and strict environment regulations given by government, has placed LED chips as one of the best choices for various sectors. The growth of industrial IoT is also fueling the transition towards energy-efficient lighting, with the US industrial IoT market valued at USD 135.6 Billion in 2024, further propelling the need for smart lighting systems integrated with LED technology. LEDs are widely used in consumer electronics, automotive applications, and signage, thereby contributing to the growth of the market. There has been increased adoption of LED lighting solutions as part of smart city development and smart infrastructure integration such as streetlights and public transportation through IoT. Other sectors such as retail and hospitality are increasingly becoming attracted to using LED lighting in their premises mainly due to it reduces costs, provides longer usage lifespan, and ensures improved lighting quality. As consumer awareness of energy conservation increases, LED technology is becoming an integral part of various sectors, including healthcare, agriculture, and residential spaces, which is further strengthening the US position in the global LED chip market.

Asia Pacific LED Chip Market Analysis

The LED chip market in the Asia-Pacific (APAC) region is driven by rapid urbanization, increasing disposable incomes, and government initiatives promoting energy-efficient lighting. According to the World Bank, East Asia and the Pacific has average annual urbanization rate of 3%, marking one of the most rapid urbanization rates. Urban growth is fostering the demand for smart lighting solutions, in particular, LED chips have become the focal point in infrastructure projects in the city. Currently, China, India, and Japan are leading the pack in adopting LED technology in various applications such as electronics, automotive, and public lighting. And incentives and programs backed by governments also accelerate this pace further. Apart from this, the growing affordability of LED chips amid rising awareness of energy conservation, is fueling the continuing shift from conventional lighting to more sustainable solutions. The region's strong manufacturing capabilities and presence of leading LED chip manufacturers further supports market growth, establishing APAC as a major player in the global LED chip industry.

Europe LED Chip Market Analysis

Europe's LED chip market is primarily driven by stringent environmental regulations and a growing emphasis on sustainability. The commitment to reducing carbon emissions by the European Union has seen energy-efficient LED lighting become the most important focus area in residential, commercial, and industrial sectors. According to industry reports, 90% of European consumers were more attentive to the sustainability of products in 2022, further fueling demand for LED solutions. Government incentives, including tax rebates and subsidies for adopting energy-efficient lighting, are major growth accelerators. Moreover, the growth of smart cities, where LED chips are an integral part of smart lighting systems, supports demand. The commercial sector, especially retail and hospitality, is increasingly opting for LED lighting due to its cost-effectiveness, longer lifespan, and environmental benefits. In addition, the European automotive sector is adopting LED technology for the development of novel vehicle lighting. As consumers demand more sustainable and energy-efficient products, LED chips will play an increasingly crucial role in the lighting industry of Europe, establishing the region as a global market leader.

Latin America LED Chip Market Analysis

The LED chip market is growing steadily in Latin America with increasing urbanization and government efforts to promote energy-efficient lighting. Researchers stated that urbanization in Latin American countries has reached nearly 80% and is considerably higher than in most other regions, which is quite significantly fostering demand for modern lighting solutions. The increased interest in energy saving, combined with the availability of LED chips at affordable prices, has led to increased adoption across infrastructure, retail, and residential sectors. Government favorable initiatives for energy-efficient technologies have also contributed to the transition from traditional lighting to LED lighting in the region.

Middle East and Africa LED Chip Market Analysis

The Middle East and Africa region is experiencing significant penetration of LED chips, driven by ongoing infrastructure development activities and a strong commitment towards the adoption of energy-efficient technologies. The region's growing smart cities market is a significant contributor, with a projected CAGR of 22.82% from 2024 to 2032. Countries such as the UAE and Saudi Arabia are leading investments in smart city projects, where LED chips play a crucial role in energy-efficient street lighting and smart infrastructure. Government policies promoting sustainability and energy conservation continue to accelerate the transition to LED lighting across residential, commercial, and automotive sectors.

Competitive Landscape:

The global market is highly competitive, driven by ongoing technological advancements and the increasing demand for energy-efficient lighting solutions. Market participants are focusing on developing innovative products such as miniaturized and high-performance chips to cater to diverse applications, including automotive, consumer electronics, and smart lighting. Additionally, strategic partnerships and investments in research and development are also helping companies strengthen their market presence. Adoption of sustainable manufacturing processes and entry into new emerging markets are the other key competitive strategies shaping the market landscape. Notably, On December 10, 2024, Mouser Electronics announced its collaboration with American Bright Optoelectronics as a new authorized distributor for their LED and optoelectronic components. The partnership aims to provide advanced LED solutions, including lighting, automotive, and industrial applications, to meet the growing global demand. Mouser's portfolio is strengthened by this addition, which furthers the company's dedication to providing cutting-edge goods to a wide range of client base.

The report provides a comprehensive analysis of the competitive landscape in the LED chip market with detailed profiles of all major companies, including:

- AVA Technologies, Inc.

- Bright LED Electronics Corporation

- Cree, Inc.

- Bridgelux, Inc.

- Hitachi Cable, Ltd.

- Huga Optech, Inc.

- Dowa Electronics Materials Co., Ltd.

- Epistar Corporation

- Nichia Corporation

- Formosa Epitaxy, Inc.

- Goldeneye, Inc.

- Kingbright Electronic Co. Ltd.

- Optek Technology (TT Electronic PLC)

- OSA Opto Light GmbH

- Osram Opto Semiconductors GmbH

Latest News and Developments:

- June 2024: INFiLED, a global LED producer, unveiled its innovative ColdLED technology at InfoComm 2024. ColdLED technology uses numerous essential approaches, including the flip-chip method, common cathode technology, high-quality ICs, and a PCB layout design. It entails installing LED chips and integrated circuits directly into the substrate.

- February 2024: City Theatrical launched its QolorFLEX® Quad Chip RGB Amber Plus Deep Red LED Tape in 2024. This new addition to the QolorFLEX line offers lighting designers a solution for achieving true deep red color in various applications, including live entertainment, film, video, and architectural lighting.

- January 2024: Nichia, an LED manufacturer and the developer of the high-brightness blue and white LED, launched a chip-scale LED (Part No. NFSWL11A-D6) with horizontal light distribution.

- January 2024: Samsung has introduced its 2024 Neo QLED TVs featuring the new NQ8 AI Gen3 chipset, available in 8K and 4K. The chipset, with a significantly faster neural processing unit, enables AI-driven features such as 8K AI Upscaling Pro and AI Motion Enhancer Pro for improved image and motion clarity. Additionally, the TVs offer Active Voice Amplifier Pro for clearer dialogue and improved accessibility options such as Optical Character Recognition (OCR) for real-time subtitles.

- July 2023: Nichia has added the E11A (1.1mm x 1.1mm) Red, Brilliant Red, and Green LEDs to its Direct Mountable Chip portfolio. These compact chips maintain the high luminous flux density and uniform forward voltage of the larger E17A series, offering improved fixture flexibility. The E11A series is ideal for landscape, architectural, and indirect lighting applications, expanding design possibilities.

LED Chip Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Blue LED Chips, Red LED Chips, Green LED Chips, Infrared LED Chips, Yellow LED Chips, White LED Chips, Others |

| Applications Covered | Backlighting, Illumination, Automotive, Signs and Signal, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AVA Technologies, Inc., Bright LED Electronics Corporation, Cree, Inc., Bridgelux, Inc., Hitachi Cable, Ltd., Huga Optech, Inc., Dowa Electronics Materials Co., Ltd., Epistar Corporation, Nichia Corporation, Formosa Epitaxy, Inc., Goldeneye, Inc., Kingbright Electronic Co. Ltd., Optek Technology (TT Electronic PLC), OSA Opto Light GmbH, Osram Opto Semiconductors GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the LED chip market from 2019-2033.

- The LED chip market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the LED chip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global LED Chip market was valued at USD 31.26 Billion in 2024.

The LED chip market is projected to exhibit a CAGR of 10.70% during 2025-2033, reaching a value of USD 81.67 Billion by 2033.

Key factors include increasing demand for energy-efficient lighting solutions, sustainability efforts, government regulations, expanding automotive applications, growing adoption in consumer electronics, rising use in smart cities, ongoing technological innovations, and increased awareness about reducing carbon footprints.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global LED chip market include AVA Technologies, Inc., Bright LED Electronics Corporation, Cree, Inc., Bridgelux, Inc., Hitachi Cable, Ltd., Huga Optech, Inc., Dowa Electronics Materials Co., Ltd., Epistar Corporation, Nichia Corporation, Formosa Epitaxy, Inc., Goldeneye, Inc., Kingbright Electronic Co. Ltd., Optek Technology (TT Electronic PLC), OSA Opto Light GmbH, and Osram Opto Semiconductors GmbH, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)