Leather Goods Market Report by Product (Footwear, Leather Products), Material (Genuine Leather, Synthetic Leather), Price (Premium Products, Mass Products), Distribution Channel (Clothing and Sportswear Retailers, Departmental Stores, Supermarkets and Hypermarkets, Online Stores, and Others), and Region 2026-2034

Leather Goods Market Size:

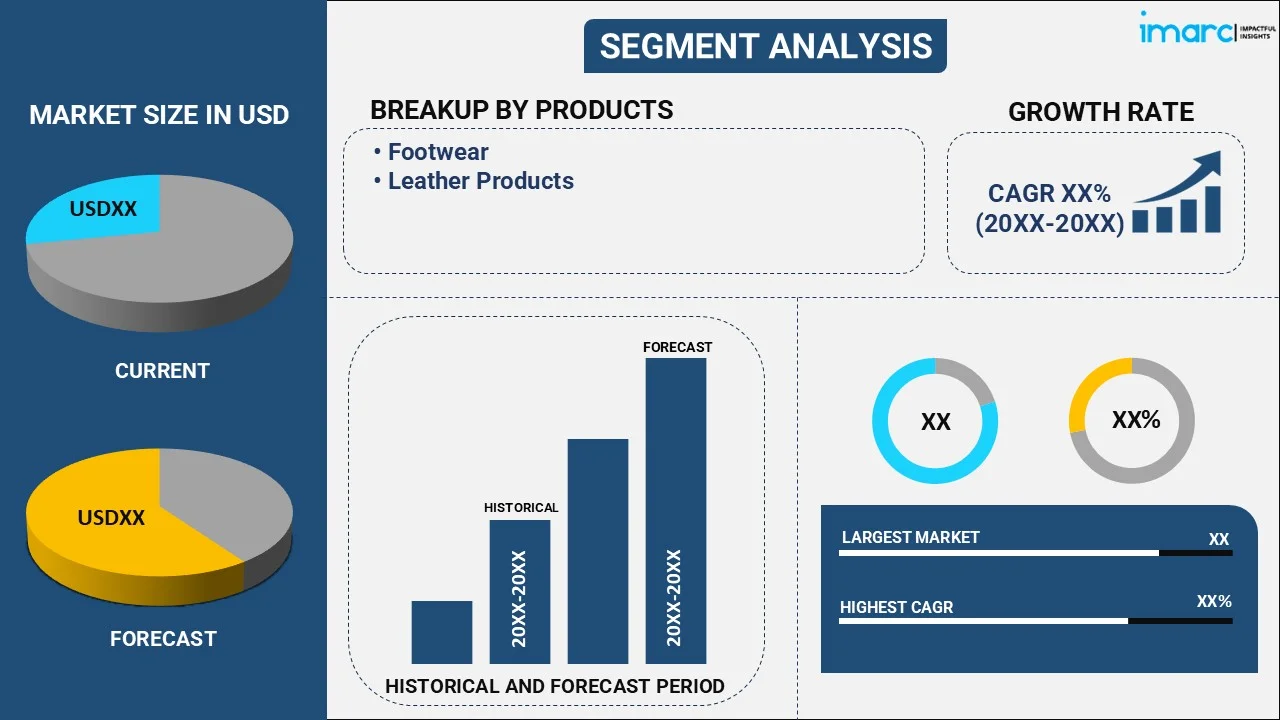

The global leather goods market size reached USD 428.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 648.1 Billion by 2034, exhibiting a growth rate (CAGR) of 4.47% during 2026-2034. Consumer preferences for luxury items and high-quality products, the increasing disposable incomes, technological advancements revolutionize manufacturing processes, shifting fashion trends and sustainable practices shape consumer choices, e-commerce expansion, and globalization are some of the factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 428.6 Billion |

|

Market Forecast in 2034

|

USD 648.1 Billion |

| Market Growth Rate 2026-2034 | 4.47% |

Leather Goods Market Analysis:

- Major Market Drivers: The primary factors driving the leather goods market share, include the higher disposable incomes, which will allow consumers to spend more on luxury leather goods. The growing power of social media celebrities to promote the product has contributed tremendously to attracting more and more consumers towards leather goods, which is boosting the market growth. The developments advanced technology has led to better quality of products that are also environmentally friendly, which is fueling the market growth. The rise in the consumption of eco-friendly and sustainable leather commodities and increasing trend towards responsible consumer behavior are supporting the leather goods market growth. The expansion of e-commerce platforms has enabled leather goods manufacturers to access in broader market, which is accelerating the market growth.

- Key Market Trends: Sustainability is another big trend in the leather goods sector, several brands are now aiming at environmentally friendly production process and material. Furthermore, the development of vegan leather made from plant-based materials is favoring the market growth. Moreover, 3D printing among other manufacturing techniques offers digital innovation that enable more efficient, flexible design solutions, which is another key leather goods market trends. Furthermore, the trend of athleisure has also driven the demand for fashionable and comfortable leather items, further augmenting the market growth. Additionally, brands are using blockchain technologies to create food supply chain transparency and traceability. With a rising gender-neutral fashion and its design considerations, both aspects have become an influencing effort on the leather goods production as well as marketing efforts.

- Geographical Trends: Asia-Pacific is presently dominating the global leather goods market on account of rapid economic expansion coupled with higher spending by consumers. China and India, both of which have large populations emerging into their respective middle classes, are also among the most significant contributors to the market growth. In line with this, Italy and France have a long history in craftsmanship of high-quality leather or famous luxury brands, which is further driving the leather goods demand. Moreover, North America holds a significant market share whereas U.S. is the prominent country in the region on accounts to high demand for premium and designer leather products. On the other hand, given high disposable incomes and a love for luxury goods, this region is becoming an increasingly lucrative opportunity. Latin America has potential for empowerment, specifically in countries like Brazil and Mexico where the production of leather is extremely local.

- Competitive Landscape: The competitive landscape of the market is characterized by the presence of key leather goods companies, such as Adidas AG, American Leather Holdings LLC, Capri Holdings Limited, Hermès International S.A., Kering S.A., LVMH, Prada S.p.A. (Prada Holding S.P.A), Puma SE, Tapestry Inc., VIP Industries (Piramal Group), Woodland (Aero Group), etc.

- Challenges and Opportunities: The leather goods market faces several challenges, including fluctuating raw material prices and the impact of environmental regulations on leather production. The growing concern over animal welfare and the rise of veganism pose threats to traditional leather products. Counterfeiting and the proliferation of fake goods undermine brand reputation and profitability. The market is also impacted by economic downturns, which can reduce consumer spending on luxury items. However, there are significant opportunities for growth. The increasing demand for sustainable and eco-friendly leather alternatives opens new market segments. Technological advancements in leather processing and product innovation present opportunities for differentiation, which is providing a positive leather goods market outlook.

To get more information on this market Request Sample

Leather Goods Market Trends:

Consumer Preferences for Luxury and High-Quality Products

Global demand in the leather goods market is closely tied to consumer preference for luxury and premium quality offerings. Due to these reasons leather goods like bags and wallets, among others generally resembles prestige and style while also exhibits long life which is quite attractive for anyone that wants status-endorsing properties. More than their utility, these goods also are a matter of craftsmanship, design and brand name. Since consumers are shelling out thousands of dollars to use leather goods as a symbol of their swanky lifestyle, manufacturers and retailers will strive to innovate with new models, while abiding by extremely stringent quality criteria in order to keep up the pace alongside changing demands.

Increasing Disposable Incomes, Particularly in Emerging Economies

Increasing disposable incomes and per capita earnings especially in developing economies is anticipated to drive growth over the forecast period for global leather goods market. When economies grow, and people start making more money or/and there’s overall higher level of financial security among population, it naturally leads to the higher purchasing power and desire to spend more. While this also means that they are more inclined to spend on luxury/premium goods such as leather handbags, wallets, shoes, and accessories. Countries such as China, India and Brazil in particular have seen the emergence of sizable middle-class segments seeking more aspirational lifestyles. This has served to drive substantial demand growth and create profitable opportunities to stretch presence further across consumer preferences for market players. As per some industry reports, in India, the middle-class segment accounts for 31% of the population as of now, and is expected to reach 38 % in 2031 & 60% by 2047.

Advancements in Technology and Manufacturing Processes

Technological advancements have been changing the hands-on skills that go behind manufacturing leather goods and the following points explain how these technologies are helping in improving product quality, efficiency, and innovation. Technological advancements within the production process - automated cutting and stitching, digital design or 3D printing – not only facilitate smoother operations but also shortened lead times and allow for more customized products that will keep up with consumers’ expectations of a perfect fit & high personalization. Additionally, improved methods of leather treatment and finishing play an integral role in boosting the durability, texture quality, and overall look of leather goods while ensuring that they comply with high criteria for quality and adequately fulfill consumer requirements, which is further accelerating the leather goods industry.

Leather Goods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on the product, material, price, and distribution channel.

Breakup by Product:

To get detailed segment analysis of this market Request Sample

- Footwear

- Military Shoes

- Casual Shoes

- Formal Shoes

- Sports Shoes

- Others

- Leather Products

- Upholstery

- Luggage

- Accessories

- Clothing and Apparel

- Bags, Wallets and Purses

- Others

Footwear accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes footwear (military shoes, casual shoes, formal shoes, sports shoes, and others) and leather products (upholstery, luggage, accessories, clothing and apparel, bags, wallets and purses, and others). According to the report, footwear represented the largest segment.

The footwear segment is driven by the increasing consumer preference for high-quality, stylish, and exclusive products that signify status and personal taste. One key factor is the rising disposable income among affluent consumers, enabling them to invest in premium brands known for their craftsmanship and design excellence. Additionally, the influence of social media and celebrity endorsements plays a significant role in shaping consumer perceptions and driving demand for leather footwear. The segment also benefits from advancements in e-commerce, allowing brands to reach a global audience and offer personalized shopping experiences. Furthermore, collaborations between luxury footwear brands and renowned designers or artists create limited-edition collections that attract fashion enthusiasts. Sustainability and ethical manufacturing practices are becoming increasingly important, with consumers seeking luxury footwear made from eco-friendly materials and produced under fair labor conditions.

Breakup by Material:

- Genuine Leather

- Top-grain Leather

- Split-grain Leather

- Synthetic Leather

- PU-Based Leather

- PVC-Based Leather

- Bio-Based Leather

Genuine leather accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the material. This includes genuine leather (top-grain leather and split-grain leather) and synthetic leather (PU-based leather, PVC-based leather, and bio-based leather). According to the report, genuine leather represented the largest segment.

The genuine leather segment is driven by the increasing demand for high-quality, durable, and aesthetically appealing products among consumers who associate leather with luxury and prestige. The rising disposable income and changing lifestyle preferences, particularly in emerging economies, are fueling the growth of this segment. Additionally, the focus on sustainable and ethically sourced leather is becoming a significant trend, appealing to environmentally conscious buyers. The craftsmanship and heritage associated with genuine leather goods also contribute to their desirability. Innovations in leather processing and design are further enhancing the appeal and functionality of luxury leather products, ensuring sustained market growth.

Breakup by Price:

- Premium Products

- Mass Products

The report has provided a detailed breakup and analysis of the market based on price. This includes premium and mass products.

The premium segment is driven by the increasing demand for high-quality, exclusive products that offer a sense of status and sophistication. Consumers in this segment are often affluent and seek out brands that provide exceptional craftsmanship, innovative designs, and limited-edition items. The rise of digital marketing and social media has also amplified the visibility of leather brands, making them more desirable to a global audience. Additionally, collaborations with celebrities and influencers help in creating a strong brand image and appeal among discerning customers who value uniqueness and prestige in their purchases.

The mass products segment is driven by the increasing accessibility and affordability of leather-inspired goods that cater to a broader consumer base. This segment targets middle-income consumers who aspire to own leather items but at a more affordable price point. The growth of fast fashion and retail chains offering premium-like products at lower prices has significantly boosted this market. Furthermore, the expansion of e-commerce platforms and online retail has made it easier for consumers to access a wide range of mass-market leather goods. Brand collaborations and strategic marketing campaigns also play a crucial role in attracting consumers seeking trendy and fashionable products without the premium price tag.

Breakup by Distribution Channel:

- Clothing and Sportswear Retailers

- Departmental Stores

- Supermarkets and Hypermarkets

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on distribution channel. This includes clothing and sportswear retailers, departmental stores, supermarkets and hypermarkets, online stores, and others.

The clothing and sportswear retailers segment is driven by the increasing consumer desire for premium and exclusive products that signify status and style. The focus on quality, brand heritage, and unique designs appeals to affluent customers seeking to differentiate themselves. Collaborations with high-profile designers and limited-edition releases further enhance the allure, attracting fashion-forward individuals willing to invest in high-end apparel and sportswear.

The departmental stores segment is driven by the increasing convenience and comprehensive shopping experiences they offer. These stores provide a wide array of leather brands under one roof, making it easier for consumers to explore and purchase premium products. Personalized services, such as personal shopping assistants and exclusive in-store events, add to the appeal, creating a luxurious and tailored shopping experience that affluent customers appreciate.

The supermarkets and hypermarkets segment is driven by the increasing integration of premium and leather products within their offerings. As these retailers expand their product ranges to include high-end goods, they attract a broader customer base, including those who prefer one-stop shopping for both every day and leather items. Competitive pricing and loyalty programs also play a role, making luxury goods more accessible to a wider audience.

The online stores segment is driven by the increasing demand for convenience and accessibility in leather shopping. E-commerce platforms provide a vast selection of high-end products, often with detailed descriptions and reviews, making it easier for consumers to make informed decisions. The availability of exclusive online collections, virtual try-ons, and seamless delivery services further enhances the online leather shopping experience, appealing to tech-savvy and busy customers.

The others segment, which includes specialty stores and boutiques, is driven by the increasing focus on personalized and unique shopping experiences. These outlets often offer curated selections of leather items, providing a more intimate and exclusive environment for shoppers. Expertise in specific product categories and exceptional customer service differentiate them from larger retailers, attracting discerning customers who value bespoke service and niche products.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest leather goods market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The North America region is driven by the increasing disposable income and changing consumer preferences towards high-end products. Economic stability and growth have empowered consumers to spend more on leather items, including fashion, accessories, and automobiles. Additionally, the region's strong culture of brand consciousness and status symbolization fuels the demand for luxury goods. The rapid adoption of e-commerce and digital platforms has also facilitated access to luxury brands, attracting a broader customer base. Furthermore, the rise in affluent millennial and Gen Z consumers, who prioritize experiences and premium products, significantly contributes to market growth. The influence of celebrity endorsements and social media marketing enhances brand visibility and desirability, further driving sales. Sustainable and ethically produced luxury items are increasingly preferred, aligning with growing consumer awareness and environmental consciousness. Moreover, North America's robust tourism sector, particularly in cities like New York and Los Angeles, attracts international tourists who contribute substantially to leather retail sales.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the leather goods include Adidas AG, American Leather Holdings LLC, Capri Holdings Limited, Hermès International S.A., Kering S.A., LVMH, Prada S.p.A. (Prada Holding S.P.A), Puma SE, Tapestry Inc., VIP Industries (Piramal Group), Woodland (Aero Group), etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are implementing various strategies to maintain competitiveness and adapt to evolving consumer preferences. Many are focusing on product innovation, leveraging advanced materials and technology to enhance performance, durability, and sustainability of their offerings. Additionally, there is a notable emphasis on expanding omnichannel capabilities, integrating online and offline channels to provide seamless shopping experiences and cater to diverse consumer needs. Brand collaborations and celebrity endorsements remain prevalent, serving to elevate brand image, reach new audiences, and capitalize on cultural trends. Moreover, strategic investments in marketing and advertising campaigns are being made to reinforce brand visibility and engagement across multiple touchpoints. Furthermore, efforts towards enhancing supply chain efficiency, streamlining manufacturing processes, and optimizing inventory management are evident, aiming to reduce costs, improve speed to market, and meet shifting demand dynamics effectively. Apart from this, there is a growing focus on social and environmental responsibility, with initiatives ranging from ethical sourcing and labor practices to sustainability commitments, aligning with consumer expectations and regulatory pressures.

Leather Goods Market News:

- In 2024: Adidas unveiled a new line of leather sneakers made from eco-friendly leather, showcasing its commitment to innovation and responsible manufacturing practices.

- In 2024: American Leather Holdings LLC launched a new collection of premium leather goods, targeting affluent consumers seeking luxury and exclusivity. The collection features handcrafted leather accessories, including handbags, wallets, and belts, meticulously crafted from the finest materials by skilled artisans.

Leather Goods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered |

|

| Prices Covered | Premium Products, Mass Products |

| Distribution Channels Covered | Clothing and Sportswear Retailers, Departmental Stores, Supermarkets and Hypermarkets, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, American Leather Holdings LLC, Capri Holdings Limited, Hermès International S.A., Kering S.A., LVMH, Prada S.p.A. (Prada Holding S.P.A), Puma SE, Tapestry Inc., VIP Industries (Piramal Group), Woodland (Aero Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the leather goods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global leather goods market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the leather goods industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global leather goods market was valued at USD 428.6 Billion in 2025.

We expect the global leather goods market to exhibit a CAGR of 4.47% during 2026-2034.

The rising usage of leather in manufacturing sports equipment and automotive upholstery as it is long-lasting as well as provide resistance to fire, crack, and dust, is primarily driving the global leather goods market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of leather goods.

Based on the product, the global leather goods market has been segmented into footwear and leather products, where footwear currently holds the majority of the total market share.

Based on the material, the global leather goods market can be divided into genuine leather and synthetic leather. Currently, genuine leather exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global leather goods market include Adidas AG, American Leather Holdings LLC, Capri Holdings Limited, Hermès International S.A., Kering S.A., LVMH, Prada S.p.A. (Prada Holding S.P.A), Puma SE, Tapestry Inc., VIP Industries (Piramal Group), and Woodland (Aero Group).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)