Lawful Interception Market Size, Share, Trends and Forecast by Network Technology, Device, Communication Content, Service, End-User, and Region, 2025-2033

Lawful Interception Market Size and Share:

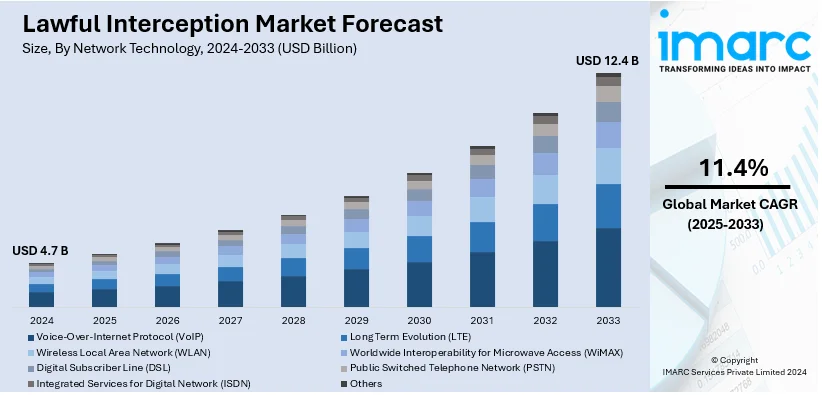

The global lawful interception market size was valued at USD 4.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.4 Billion by 2033, exhibiting a CAGR of 11.4% from 2025-2033. North America currently dominates the market, holding a market share of over 33.5% in 2024. The growth of the North American region is driven by advanced communication infrastructure, stringent regulatory frameworks, increasing cybersecurity concerns, and high adoption of lawful interception technologies by law enforcement and intelligence agencies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.7 Billion |

| Market Forecast in 2033 | USD 12.4 Billion |

| Market Growth Rate 2025-2033 | 11.4% |

The increasing prevalence of sophisticated cyberattacks and criminal activities conducted through digital platforms is prompting governments and organizations to adopt advanced interception solutions for enhanced security. Besides this, continuous advancements in artificial intelligence (AI) and machine learning (ML) are improving the efficiency and real-time capabilities of lawful interception systems, making them indispensable for modern surveillance efforts. In addition, the widespread deployment of 5G technology and the rapid adoption of the Internet of Things (IoT) devices are creating complex communication environments, driving the demand for more robust and versatile interception technologies. Furthermore, the growing use of encryption by individuals engaged in illegal activities is driving the need for advanced surveillance tools capable of decrypting and analyzing such communications effectively.

The United States is a key region in the market, driven by the implementation of robust legal mandates, such as the Communications Assistance for Law Enforcement Act (CALEA), requiring telecommunication service providers to enable interception capabilities, ensuring compliance across networks. In addition, the increasing frequency and sophistication of cybercrimes, including ransomware attacks and data breaches, are driving demand for lawful interception solutions to ensure real-time threat detection and prevention. Apart from this, the widespread deployment of 5G networks and the adoption of IoT devices is creating a more complex communication landscape, necessitating advanced interception technologies to monitor and analyze data effectively. According to the GSMA, North America remains a worldwide frontrunner in 5G technology. Over 55% of connections in the region were 5G by the middle of 2024.

Lawful Interception Market Trends:

Increasing Cybersecurity Threats

One of the most significant market drivers for the lawful interception industry is the escalation of cybersecurity threats globally. The global cybersecurity market size reached USD 299.6 Billion in 2024. As digital transformation sweeps across sectors, including finance, healthcare, and critical infrastructure. The volume and sophistication of cyberattacks have also risen exponentially. The Identity Theft Resource Center (ITRC) Annual Data Breach Report recorded 2,365 cyberattacks resulting in data compromises in 2023, reflecting a rise from 1,584 incidents in 2022 and 754 in 2018. From ransomware attacks on essential services to nation-state-sponsored cyber espionage, the stakes have never been higher. Its tools provide governments and authorized agencies the ability to monitor, detect, and act upon these threats in real-time. They allow the capture and analysis of data packets transmitted across networks, helping in the identification of malicious activities and actors. Additionally, the rising prevalence of cybersecurity threats justifies greater investments in solutions, to combat current risks and to prepare for emerging challenges in cybersecurity. The growing cybersecurity threats effectively create a growing demand for more advanced and comprehensive capabilities.

Regulatory Compliance and Standardization

Another key driver is the increasing standardization and regulatory requirements imposed by governments and international bodies. Along with this, laws and regulations mandate telecommunication providers and internet services to build lawful interception capabilities into their networks. In 2024, 66.2% of the global population, equivalent to 5.35 Billion people, are internet users. This marks a 1.8% annual growth, with 97 Million new users coming online for the first time in 2023. These legal frameworks ensure that companies have the necessary systems in place to comply with lawful interception requests, thereby creating a steady market for solutions and services in this industry. In confluence with this, standardization also simplifies the process of data collection and analysis, making it more efficient for law enforcement agencies to perform their duties. Therefore, regulatory compliance acts as a significant pull factor for businesses to invest in the sector.

Technological Advancements in Communication

The rapid evolution of communication technologies is another contributing factor to the growth of the lawful interception market. With the advent of 5G, Internet of Things (IoT), and encrypted communication platforms, there is an ever-increasing complexity in the types of data that need to be intercepted and analyzed. The global internet of things (IoT) market size reached USD 887.6 Billion in 2023. These new technologies often outpace traditional methods, necessitating continuous updates and improvements in interception capabilities. In 2023, there were 1.28 Million private 5G IoT connections worldwide, accounting for 5% of the total 25.6 Million 5G IoT connections. In addition, companies in this industry are therefore compelled to innovate and adapt swiftly to keep up with the changing landscape. The complexity of modern communication systems thereby creates an ongoing need for advanced and flexible solutions, which drives market growth.

Lawful Interception Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global lawful interception market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on network technology, device, communication content, service, and end-user.

Analysis by Network Technology:

- Voice-Over-Internet Protocol (VoIP)

- Long Term Evolution (LTE)

- Wireless Local Area Network (WLAN)

- Worldwide Interoperability for Microwave Access (WiMAX)

- Digital Subscriber Line (DSL)

- Public Switched Telephone Network (PSTN)

- Integrated Services for Digital Network (ISDN)

- Others

The worldwide interoperability for microwave access (WiMAX) holds the largest share in the market due to its ability to provide cost-effective and high-speed broadband connectivity over long distances. WiMAX technology is widely adopted for its scalability, enabling seamless integration across various communication networks and supporting both fixed and mobile applications. Its efficient use of spectrum and ability to deliver uninterrupted data services in diverse geographic areas have made it a preferred choice for telecommunications infrastructure. Moreover, WiMAX's compatibility with existing networks ensures seamless upgrades without significant infrastructure overhauls, driving its adoption. The technology’s robustness in handling high volumes of data traffic further enhances its appeal, especially in regions with growing demand for reliable and fast internet services. These factors collectively position WiMAX as the leading segment in network technologies within the lawful interception market.

Analysis by Device:

- Mediation Devices

- Routers

- Intercept Access Point (IAP)

- Gateways

- Switches

- Management Servers

- Others

Mediation devices dominate the market owing to their critical role in facilitating lawful interception across diverse communication networks. These devices act as intermediaries, collecting, filtering, and processing intercepted data to ensure compatibility with various protocols and formats. Their ability to seamlessly integrate with existing telecommunication infrastructure makes them essential for enabling real-time monitoring and compliance with legal requirements. Mediation devices also offer advanced capabilities such as data correlation and duplication removal, ensuring only relevant information is transmitted to law enforcement agencies. Their adaptability to emerging technologies, including 5G and encrypted communications, further enhances their significance. Additionally, their robust performance in handling large volumes of data traffic with precision and efficiency is positioning mediation devices as an indispensable component in lawful interception systems, driving their widespread adoption across the market.

Analysis by Communication Content:

- Voice Communication

- Video

- Text Messaging

- Facsimile

- Digital Pictures

- File Transfer

- Others

Voice communication is the largest segment in the market owing to its extensive utilization in personal and professional interactions, positioning it as a key focus for lawful interception. The segment's prevalence is due to the essential requirement for overseeing voice calls to avert and examine unlawful actions, such as criminal plots, terrorism, and organized crime. Voice data delivers immediate intelligence, offering actionable insights to law enforcement agencies, particularly valuable in urgent situations. The incorporation of cutting-edge technologies facilitates effective interception, even within encrypted or VoIP communications, guaranteeing adherence to legal and security requirements. Additionally, the ability to capture metadata, such as call duration, participants, and geolocation, further strengthens its role in surveillance. As traditional telephony and modern internet-based voice services converge, the scope of interception expands, reinforcing the importance of voice communication within lawful interception systems and driving its significant market share.

Analysis by Service:

- Professional Services

- Managed Services

- System Integrators

Managed services lead the market in the service segment due to their ability to provide comprehensive and cost-effective solutions for lawful interception. Organizations prefer managed services as they offer end-to-end operational support, reducing the need for in-house expertise and infrastructure. These services ensure continuous monitoring and compliance with rapidly changing legal and technical requirements. Providers of managed services deliver regular updates, system maintenance, and technical support, ensuring uninterrupted operations and adaptability to new challenges such as encrypted communication. The scalability of managed services allows organizations to customize solutions based on their unique needs, from small-scale deployments to large, complex networks. Additionally, managed services often include advanced analytics and reporting tools, enabling law enforcement agencies to derive actionable insights efficiently. Their reliability, flexibility, and capacity to streamline operations have solidified the position of managed services as the largest segment in the lawful interception market, meeting the growing demand for specialized and agile solutions.

Analysis by End-User:

- Government & Public Affairs

- Law Enforcement Agencies

- Small & Medium Enterprises

Law enforcement agencies hold the largest segment due to their crucial role in ensuring national security and public safety. These organizations depend significantly on legal interception technologies to address various threats, such as terrorism, cybercrime, organized crime, and other unlawful actions. The interception tools' real-time monitoring features allow law enforcement to collect vital intelligence, oversee suspect communications, and effectively thwart potential threats. As communication channels grow more complex, law enforcement agencies are implementing sophisticated solutions that can intercept encrypted and multi-protocol messages. These systems are designed to meet legal requirements, guaranteeing safe and approved access to communication information. Moreover, the incorporation of analytics and AI-powered tools improves investigative efficiency, enabling agencies to swiftly process and examine vast amounts of data. The essential demand for proactive and dependable monitoring solutions establishes law enforcement agencies as the primary end-user in the lawful interception sector.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market share of 33.5%. North America holds the largest market share owing to its sophisticated communication infrastructure, strong legal systems, and elevated adoption rates of innovative interception technologies. The area's emphasis on national security and counter-terrorism initiatives is driving considerable investments in monitoring systems. Moreover, the existence of prominent technology suppliers in the area fosters ongoing innovation and the creation of sophisticated systems. The incorporation of AI and data analytics into legal interception tools improves the effectiveness and precision of surveillance activities. In addition, the growing prevalence and complexity of cybercrimes, such as ransomware attacks and data breaches, are boosting the need for lawful interception solutions to facilitate real-time threat detection and prevention. In 2024, a ransomware attack on Blue Yonder, a provider of supply chain software, interrupted operations for significant clients such as Starbucks, impacting 11,000 locations throughout North America. The assault affected the systems for employee payments and scheduling, while customer services were not impacted. This event underscored the weaknesses in cybersecurity and the ongoing danger.

Key Regional Takeaways:

United States Lawful Interception Market Analysis

The US lawful interception market is driven by several key factors, with national security concerns and regulatory compliance being paramount. The growing prevalence of cybercrime, terrorism, and organized crime necessitates the implementation of robust monitoring systems. A notable example of this is the record number of complaints received by the Internet Crime Complaint Center (IC3) in 2023, which registered 880,418 complaints and reported potential losses exceeding USD 12.5 Billion. This highlights the increasing need for interception capabilities to combat rising cybersecurity threats. Additionally, the U.S. government mandates communication service providers (CSPs) to equip their networks with lawful interception capabilities under regulations like the Communications Assistance for Law Enforcement Act (CALEA). The rapid adoption of digital communication platforms, mobile networks, and IoT devices further drives the demand for sophisticated monitoring tools. Technological advancements, including AI-driven analytics and cloud-based solutions, also enhance the effectiveness of these systems. As cyber threats continue to evolve, investment in scalable, secure, and efficient lawful interception technologies remains critical for law enforcement agencies across the nation.

Europe Lawful Interception Market Analysis

In Europe, the lawful interception (LI) market is driven by stringent regulatory frameworks, including the European Union’s Data Retention Directive and the General Data Protection Regulation (GDPR), which set clear guidelines for data access and monitoring. The increasing risk of cyber-attacks, terrorism, and organized crime further fuels the demand for effective surveillance systems. Moreover, the rapid adoption of emerging technologies, including Artificial Intelligence (AI), has had a significant impact. In 2021, only 8% of European enterprises were using AI, but by January 2023, industry experts estimate this figure had at least doubled, with some sectors seeing as much as 75% of enterprises adopting AI technologies. This growth in AI usage is influencing the development of more advanced interception systems capable of handling encrypted communications and evolving cyber threats. As mobile and internet services continue to expand, the need for scalable and efficient lawful interception tools grows. The EU’s emphasis on secure communication infrastructures and increased public and private sector investments further drives the market.

Asia Pacific Lawful Interception Market Analysis

The lawful interception market within the Asia-Pacific area is propelled by the growing need for secure communications as a result of escalating cyber threats and criminal behavior. Countries such as China, India, and Japan are prioritizing the enhancement of national security by upgrading their interception abilities. A recent examination of cyber threats in India, utilizing data from around 8.5 million endpoints, underscores the increasing necessity for sophisticated monitoring systems to address these dangers. Moreover, the growth of mobile networks and internet users in the region increases the need for interception solutions. Adherence to data privacy regulations and cybersecurity standards is an additional influencing element. As APAC continues to embrace cloud-based solutions and IoT technologies, the need for scalable and cost-effective interception systems remains critical. Investments by law enforcement agencies and government initiatives further support market growth across the region.

Latin America Lawful Interception Market Analysis

In Latin America, the legal interception sector is shaped by growing security issues such as cybercrime, drug smuggling, and terrorism. Nations such as Brazil and Mexico are concentrating on enhancing their surveillance systems to tackle these threats. For example, in Brazil, the private security sector, overseen by the Federal Police, comprises 2,471 specialized firms offering contracted surveillance services and 1,154 firms that employ security guards directly. This indicates a growing demand for secure monitoring systems. Additionally, the region’s increasing adoption of mobile and internet services and evolving regulatory frameworks further drive the need for advanced interception solutions.

Middle East and Africa Lawful Interception Market Analysis

In the Middle East and Africa, the legal interception market is propelled by increasing security dangers including organized criminal activity, online crime, and terrorist acts. Governments are placing greater emphasis on deploying sophisticated surveillance systems to track communications. In the UAE, where 99% of consumers enjoy internet access, the demand for strong interception solutions has increased considerably. The extensive adoption of mobile devices and online services, along with governmental efforts to improve cybersecurity, additionally boosts the need for efficient monitoring solutions. Moreover, changing regulatory frameworks and legal standards are driving the implementation of secure and scalable lawful interception systems throughout the region.

Competitive Landscape:

Major participants in the market are concentrating on technological improvements to boost interception precision and effectiveness. They are putting money into AI and ML to facilitate instantaneous data analysis and enhance threat detection skills. Collaboration with telecom companies and government bodies is being emphasized to guarantee smooth integration of interception solutions. Businesses are broadening their offerings to incorporate multi-protocol support and features for managing encrypted communications, responding to the growing intricacy of contemporary networks. Initiatives are also focused on securing adherence to local regulations and data protection laws. Moreover, significant players are improving their managed service offerings and delivering scalable, tailored solutions to meet the varied requirements of law enforcement and intelligence agencies globally. In 2024, Europol published a position paper outlining difficulties brought about by privacy-improving technologies at home routing for lawful interception by law enforcement agencies. These technologies hinder access to communication data during international travel, complicating efforts to combat crime. Europol called for balanced solutions to address these barriers while respecting privacy.

The report provides a comprehensive analysis of the competitive landscape in the lawful interception market with detailed profiles of all major companies, including:

- Aqsacom, Inc.

- BAE Systems plc

- Ericsson

- EVE compliancy solutions B.V.

- IPS S.p.A.

- Matison

- Squire Technologies Ltd

- SS8 Networks, Inc.

- TraceSpan Communications Ltd.

- Utimaco Inc.

- Vocal Technologies Ltd.

Latest News and Developments:

- October 2024: Trovicor, a Germany-based lawful interception company, has restructured its operations and rebranded as Datafusion.ai. Since 2019, the company has been under the ownership of French cybersecurity experts Stéphane Salies and Olivier Bohbot, focusing on adapting its business strategy to evolving industry demands.

Lawful Interception Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Network Technologies Covered | Voice-Over-Internet Protocol (VoIP), Long Term Evolution (LTE), Wireless Local Area Network (WLAN), Worldwide Interoperability for Microwave Access (WiMAX), Digital Subscriber Line (DSL), Public Switched Telephone Network (PSTN), Integrated Services for Digital Network (ISDN), Others |

| Devices Covered | Mediation Devices, Routers, Intercept Access Point (IAP), Gateways, Switches, Management Servers, Others |

| Communication Contents Covered | Voice Communication, Video, Text Messaging, Facsimile, Digital Pictures, File Transfer, Others |

| Services Covered | Professional Services, Managed Services, System Integrators |

| End-Users Covered | Government & Public Affairs, Law Enforcement Agencies, Small & Medium Enterprises |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Aqsacom, Inc., BAE Systems plc, Ericsson, EVE compliancy solutions B.V., IPS S.p.A., Matison, Squire Technologies Ltd, SS8 Networks, Inc., TraceSpan Communications Ltd., Utimaco Inc., Vocal Technologies Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lawful interception market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global lawful interception market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lawful interception industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Lawful interception is the authorized monitoring and collection of telecommunications or internet traffic by law enforcement agencies or authorized entities, typically for purposes such as criminal investigation, national security, or public safety. It is carried out in compliance with local laws, regulations, and judicial or administrative processes.

The lawful interception market was valued at USD 4.7 Billion in 2024.

IMARC estimates the global lawful interception market to exhibit a CAGR of 11.4% during 2025-2033.

The global lawful interception market is driven by rising security concerns, increased cybercrime, and advancements in communication technologies. The expansion of 5G networks, widespread use of encrypted messaging apps, and the growing regulatory requirements push governments to implement interception solutions. Additionally, increasing investments in surveillance infrastructure and the integration of AI for efficient data analysis further propel market growth.

In 2024, worldwide interoperability for microwave access (WiMAX) represented the largest segment by network technology, driven by its widespread adoption in emerging markets, cost-effective deployment, and robust performance in delivering high-speed broadband connectivity across remote and urban areas.

Mediation devices lead the market by device owing to their critical role in managing and processing intercepted data, ensuring compatibility with various network technologies, and facilitating seamless data transfer to law enforcement agencies for analysis and investigation.

Voice communication is the leading segment by communication content attributed to its widespread use in criminal activities, critical importance in real-time surveillance, and advanced interception technologies enabling efficient monitoring of calls across traditional and modern communication networks.

Managed services hold the biggest market share accredited to their ability to provide cost-effective, scalable solutions, ease of deployment, and continuous support for lawful interception operations, enabling organizations to comply with regulations without extensive in-house infrastructure or expertise.

Law enforcement agencies is the leading segment by end-user, driven by their critical need for real-time surveillance, advanced analytical tools to combat cybercrime, terrorism, and organized crime, and stringent regulations mandating efficient interception capabilities for ensuring public safety.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global lawful interception market include Aqsacom, Inc., BAE Systems plc, Ericsson, EVE compliancy solutions B.V., IPS S.p.A., Matison, Squire Technologies Ltd, SS8 Networks, Inc., TraceSpan Communications Ltd., Utimaco Inc., Vocal Technologies Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)