Latin America Wind Energy Market Size, Share, Trends and Forecast by Location of Deployment, and Region, 2026-2034

Latin America Wind Energy Market Summary:

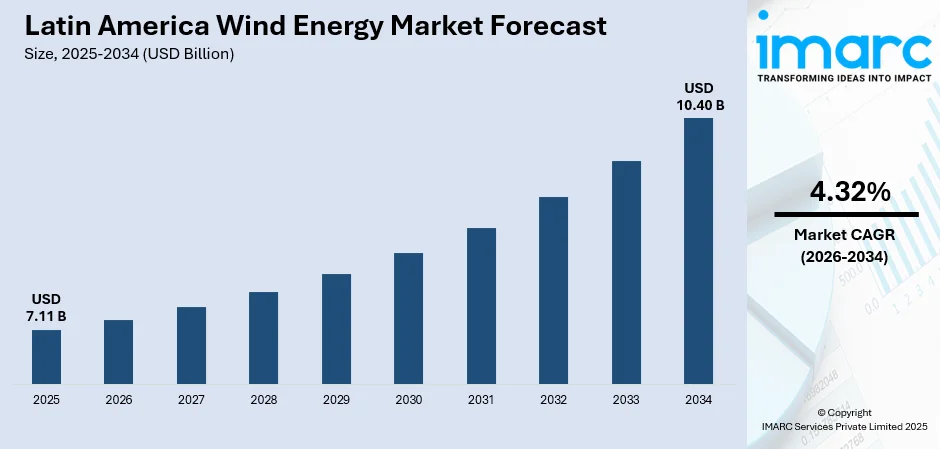

The Latin America wind energy market size was valued at USD 7.11 Billion in 2025 and is projected to reach USD 10.40 Billion by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034.

The Latin America wind energy market is currently growing at a healthy rate, which can be accredited to the supporting government policies for the usage of wind energy within the region. Increased spending in this sector is also contributing to the fast growth in wind infrastructure development, especially in regions with exemplary wind conditions. Corporate demand for clean energy through the Power Purchase Agreement model is also changing the Latin America wind energy market structure.

Key Takeaways and Insights:

-

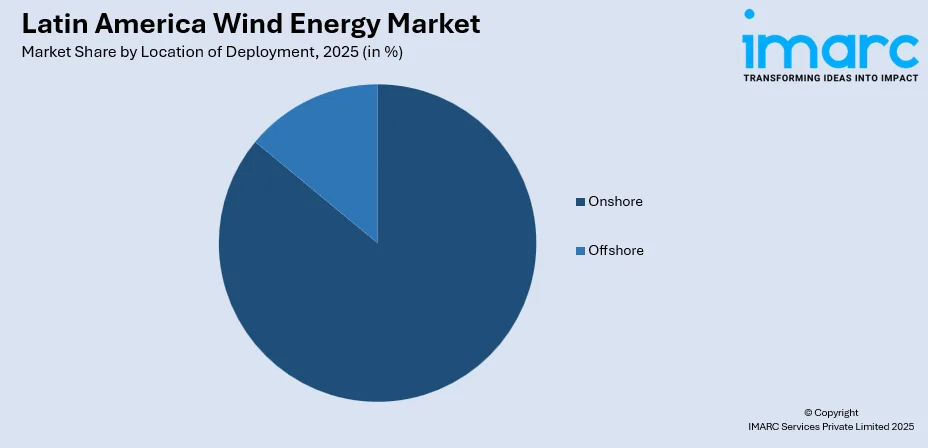

By Location of Deployment: Onshore dominates the market with a share of 86% in 2025, owing to its proven technology maturity, lower installation costs compared to offshore alternatives, and established supply chain infrastructure across the region. The extensive land availability in wind-rich areas of northeastern Brazil and Patagonia continues supporting onshore expansion.

-

By Region: Brazil leads the market with a share of 34% in 2025, driven by exceptional wind resources in the northeastern states, supportive regulatory frameworks including competitive energy auctions, and substantial capacity additions from major wind complexes. The country's commitment to renewable energy targets continues attracting significant investments.

-

Key Players: Key players drive the Latin America wind energy market by expanding project portfolios, advancing turbine technologies, and strengthening regional partnerships. Their investments in manufacturing capabilities, grid integration solutions, and long-term service agreements enhance operational efficiency and accelerate the energy transition across the region.

To get more information on this market Request Sample

The Latin America wind energy market is undergoing growth since governing agencies in the region are implementing ambitious renewable energy targets and establishing regulatory frameworks to attract investments. Brazil has emerged as a global leader in onshore wind development, with the country adding significant capacity to its national grid annually and ranking among the top five nations worldwide for new wind installations. The region benefits from exceptional wind resources, particularly in Brazil's northeastern states, Argentina's Patagonia region, and Chile's Atacama Desert. In January 2025, Brazilian President Luiz Inácio Lula da Silva enacted a landmark law establishing the regulatory framework for offshore wind energy, providing incentives and guidelines for projects within territorial waters. This legislation positions Brazil to leverage its estimated offshore wind potential, signaling a new era of marine renewable energy development in Latin America and attracting international investors seeking opportunities in emerging clean energy markets.

Latin America Wind Energy Market Trends:

Emergence of Offshore Wind Regulatory Frameworks

A fundamental change in the regional energy environment is being marked by the establishment of comprehensive legal frameworks by Latin American governments to facilitate offshore wind development. By passing laws that specify acceptable areas, encourage investment incentives, and require community engagement for marine wind projects, Brazil has taken the lead. In an effort to draw in international developers looking for fresh prospects, Chile and Colombia are also pushing their regulatory agendas. These coordinated developments are opening doors for foreign investors, promoting knowledge transfer, and establishing the area as a potential hub for offshore renewable energy investments in the upcoming decades.

Technological Advancements in Wind Turbine Design

Continuous advancements in turbine technology are helping the Latin American wind business as manufacturers introduce higher-capacity models with bigger rotors and taller towers. In order to maximize energy capture in a variety of wind conditions, modern turbines with capacities between four and six megawatts are increasingly common in new installations. While smart grid integration technologies maximize performance monitoring, advanced blade materials employing lightweight composites improve durability and efficiency. Artificial intelligence and predictive maintenance systems are two examples of digital solutions that are lowering operating costs and increasing capacity factors across wind farms in the area.

Growth of Corporate Power Purchase Agreements

Corporate buyers are increasingly driving wind energy development through long-term power purchase agreements as companies pursue decarbonization objectives and energy cost stability. The liberalization of energy markets in Brazil, Chile, and other countries has enabled large industrial consumers to contract directly with wind generators. Mining operations, data centers, and manufacturing facilities are securing renewable electricity supplies through bilateral agreements, providing revenue certainty for project developers. This trend is accelerating market maturation and expanding the customer base beyond traditional utility procurement mechanisms throughout Latin America.

Market Outlook 2026-2034:

The Latin America wind energy market is poised for sustained expansion as countries pursue ambitious renewable energy targets and energy security objectives. Continued policy support through competitive auctions, tax incentives, and grid priority access will underpin capacity additions across established and emerging markets. The market generated a revenue of USD 7.11 Billion in 2025 and is projected to reach a revenue of USD 10.40 Billion by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034. Infrastructure investments in transmission networks and grid modernization will facilitate the integration of variable renewable generation, while technological innovations in turbine design and energy storage solutions will enhance project economics and operational reliability.

Latin America Wind Energy Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Location of Deployment | Onshore | 86% |

| Region | Brazil | 34% |

Location of Deployment Insights:

Access the comprehensive market breakdown Request Sample

- Onshore

- Offshore

Onshore dominates with a market share of 86% of the total Latin America wind energy market in 2025.

The onshore wind segment maintains its dominant position in the Latin America wind energy market due to the proven technology maturity and established infrastructure supporting land-based installations. The region benefits from exceptional wind resources across diverse geographical zones, including Brazil's northeastern trade wind corridors, Argentina's Patagonia region, and Chile's coastal areas. Lower installation and maintenance costs compared to offshore alternatives, combined with well-developed supply chains for turbine components and experienced local workforces, continue driving onshore project development throughout the region. The availability of vast land areas suitable for large-scale wind farm deployment further reinforces the segment's leading position.

Investment in onshore wind infrastructure remains robust as governments implement supportive policies and competitive energy auctions that provide revenue certainty for project developers. Brazil's northeastern states of Bahia, Rio Grande do Norte, and Piauí host some of the largest wind complexes in South America, with capacity factors exceeding regional averages due to consistent wind patterns and favorable atmospheric conditions. In April 2024, ArcelorMittal and Casa dos Ventos announced a joint venture for a wind power project in Bahia with capacity to meet significant industrial electricity requirements.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil leads with a share of 34% of the total Latin America wind energy market in 2025.

Brazil maintains its leadership position in the Latin America wind energy market through sustained capacity additions and a favorable regulatory environment supporting renewable energy development. The country has established itself as a prominent global market for new wind installations, with the northeastern region hosting the majority of operational wind farms due to its outstanding natural conditions. Exceptional wind resources characterized by high capacity factors, combined with government policies including competitive energy auctions and tax incentives, continue attracting substantial domestic and international investments into the Brazilian wind sector. The well-established supply chain infrastructure and growing local manufacturing capabilities further strengthen the country's competitive advantages.

The country is advancing its position in both onshore and offshore wind development as energy transition priorities gain momentum across public and private sectors. Brazil's installed wind capacity has grown significantly over the past decade, with major complexes operating throughout the northeastern states as some of South America's largest wind facilities. The ongoing expansion of transmission networks and grid modernization initiatives are enhancing the integration of wind-generated electricity into the national power system.

Market Dynamics:

Growth Drivers:

Why is the Latin America Wind Energy Market Growing?

Supportive Government Policies and Renewable Energy Targets

Governments across Latin America are implementing comprehensive policy frameworks to accelerate renewable energy adoption and achieve carbon neutrality objectives. Brazil, Mexico, Argentina, Chile, Colombia, and other countries have established ambitious targets for clean energy generation, creating stable investment environments for wind project developers. Competitive energy auctions provide revenue certainty through long-term power purchase agreements, while tax credits and financial incentives reduce project costs and improve returns. Grid priority access for renewable sources ensures the integration of wind-generated electricity into national transmission systems, promoting sustainable energy mixes. Cross-border energy agreements and regional cooperation initiatives are facilitating renewable energy sharing between Latin American nations, supported by international development banks providing financial assistance and technical expertise. These coordinated policy efforts are creating a favorable landscape for sustained wind energy market expansion throughout the region.

Rising Investments in Renewable Energy Infrastructure

Investment flows into the Latin America wind energy sector continue expanding as both public and private entities recognize the economic and environmental benefits of clean electricity generation. Government spending on transmission infrastructure and grid modernization is addressing historical bottlenecks that constrained renewable energy integration, while development finance institutions are providing concessional loans for wind projects. Private sector investments are accelerating through corporate power purchase agreements as industrial consumers pursue decarbonization strategies and energy cost management objectives. International energy companies are establishing regional partnerships with local developers to access project pipelines and share technical expertise. The liberalization of energy markets in key countries has created direct purchasing opportunities for large consumers, stimulating project development beyond traditional utility procurement. In January 2025, São Paulo Metro announced a fifteen-year agreement to self-produce wind and solar energy from a complex in Piauí, demonstrating the expanding corporate appetite for renewable electricity supplies in Latin America.

Declining Wind Turbine Technology Costs and Efficiency Improvements

Technological advancements in wind turbine design and manufacturing are driving substantial cost reductions that improve project economics across the Latin American market. The cost of electricity from onshore wind has decreased significantly over the past decade as turbine efficiency gains, supply chain optimization, and manufacturing scale economies lower capital requirements. Modern turbines featuring larger rotors, taller towers, and advanced control systems are achieving higher capacity factors, maximizing energy production from available wind resources. Digital technologies including predictive maintenance, remote monitoring, and artificial intelligence applications are reducing operational expenses and minimizing downtime. Component manufacturing localization in countries such as Brazil is further reducing costs and lead times while creating regional employment opportunities. These technological improvements are making wind energy increasingly competitive with conventional generation sources, supporting continued market growth and deployment acceleration throughout Latin America.

Market Restraints:

What Challenges the Latin America Wind Energy Market is Facing?

Limited Transmission Infrastructure and Grid Integration Challenges

Inadequate transmission infrastructure remains a significant barrier to wind energy expansion in Latin America, with grid bottlenecks constraining the integration of new generating capacity. Many wind-rich regions lack sufficient transmission lines to evacuate power to demand centers, leading to curtailment and stranded investments. Grid modernization requirements and the capital-intensive nature of transmission upgrades create delays in connecting new wind projects to national networks.

Environmental Concerns and Land Use Conflicts

Wind farm development faces challenges related to environmental impacts and competition for land resources across the region. Concerns regarding effects on bird and bat populations, visual impacts on landscapes, and noise from turbine operations generate community opposition to projects. Land use conflicts in areas inhabited by indigenous communities and agricultural regions create permitting delays and require extensive stakeholder engagement processes.

Financial Constraints and Regulatory Uncertainties

High upfront capital requirements, along with financing challenges, pose obstacles for wind project development, particularly for smaller developers with limited access to competitive funding. Currency volatility in several Latin American countries is also increasing project risks and affecting investment returns. Regulatory uncertainties arising from policy changes and inconsistent implementation of renewable energy frameworks create hesitancy among investors seeking long-term revenue stability.

Competitive Landscape:

The Latin America wind energy market exhibits a moderately fragmented competitive structure with international turbine manufacturers, regional project developers, and energy utilities participating across the value chain. Global leaders in wind turbine technology maintain significant market presence through equipment supply agreements and turnkey project solutions, leveraging technical expertise and established service networks. Regional developers are expanding portfolios through strategic acquisitions, joint ventures, and long-term offtake agreements with industrial consumers. Competition intensifies as new entrants target emerging opportunities in offshore wind development and green hydrogen production. Market participants differentiate through technology innovation, financing capabilities, and local supply chain partnerships that enhance project competitiveness and execution reliability across diverse Latin American markets.

Recent Developments:

-

In September 2025, Colbún's Horizonte wind farm in Chile entered full commercial operation as the country's largest wind facility with installed capacity to generate electricity using 140 turbines.

Latin America Wind Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Location of Deployments Covered | Onshore, Offshore |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America wind energy market size was valued at USD 7.11 Billion in 2025.

The Latin America wind energy market is expected to grow at a compound annual growth rate of 4.32% from 2026-2034 to reach USD 10.40 Billion by 2034.

Onshore dominated the market with a share of 86%, driven by proven technology maturity, established supply chains, and lower installation costs compared to offshore alternatives across the region.

Key factors driving the Latin America wind energy market include supportive government policies and renewable energy targets, rising investments in renewable infrastructure, declining wind turbine technology costs, and growing corporate demand for clean energy solutions through power purchase agreements.

Major challenges include limited transmission infrastructure and grid integration bottlenecks, environmental concerns and land use conflicts, high upfront capital requirements, currency volatility in some countries, and regulatory uncertainties affecting investment decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)