Latin America Solar Energy Market Size, Share, Trends and Forecast by Deployment, Application, and Region, 2026-2034

Latin America Solar Energy Market Summary:

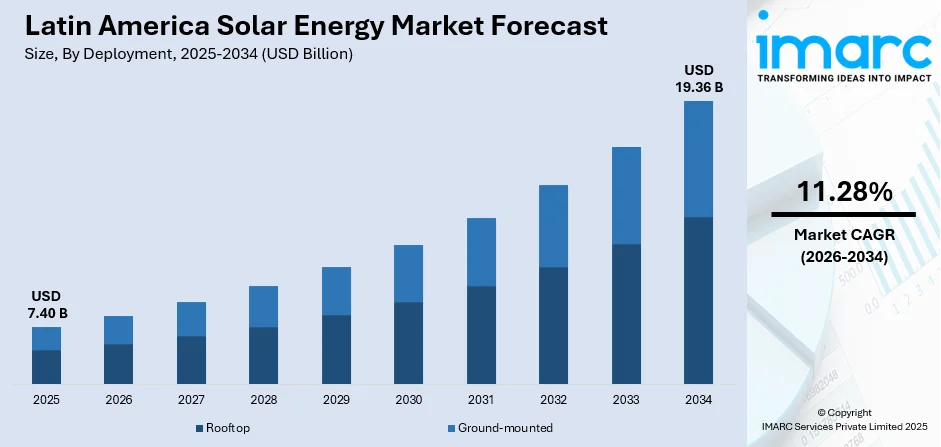

The Latin America solar energy market size was valued at USD 7.40 Billion in 2025 and is projected to reach USD 19.36 Billion by 2034, growing at a compound annual growth rate of 11.28% from 2026-2034.

The market is driven by the region's exceptional solar irradiation levels, which position it among the most favorable locations globally for photovoltaic power generation. Declining technology costs have made solar installations increasingly accessible across residential, commercial, and utility-scale applications. Supportive government policies, including tax incentives, net metering programs, and renewable energy targets, continue to accelerate adoption. Rising electricity demand from growing populations and expanding industrial activities further reinforces the transition toward clean energy sources, strengthening the Latin America solar energy market share.

Key Takeaways and Insights:

-

By Deployment: Ground‑mounted dominates the market with a share of 58% in 2025, driven by abundant land, simpler installation, and cost-effective utility-scale generation in high-irradiation zones across Latin America.

-

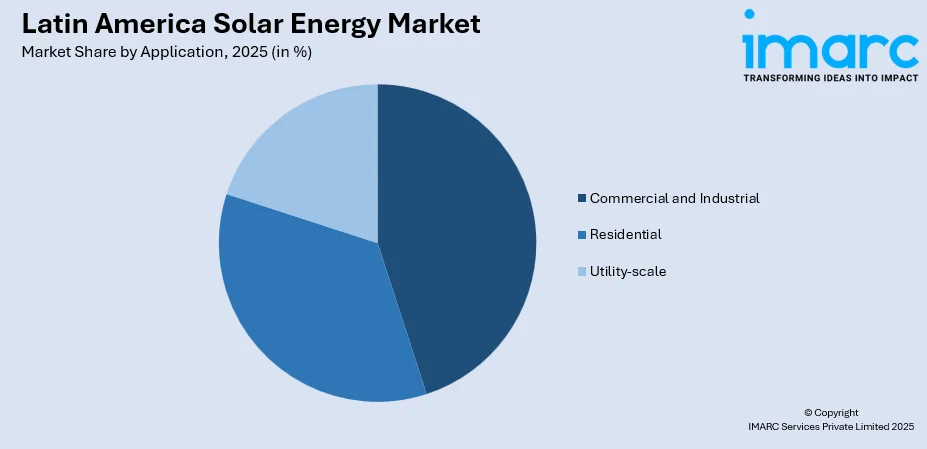

By Application: Commercial and industrial represents the market with a share of 36% in 2025, owing to corporate sustainability goals, rising electricity costs, and power purchase agreements facilitating capital-efficient solar adoption.

-

By Region: Brazil leads the market with a share of 29% in 2025, driven by favorable net metering policies, abundant solar resources, strong financing mechanisms, and rapid growth in distributed generation across multiple states.

-

Key Players: The Latin America solar energy market is moderately competitive, with international developers and regional specialists focusing on vertical integration, strategic technology partnerships, operational efficiency improvements, and expanding project pipelines to seize growth opportunities across emerging solar markets.

To get more information on this market Request Sample

Latin America solar energy market is experiencing robust expansion fueled by multiple converging factors that position the region as a global renewable energy leader. The region benefits from some of the highest solar irradiation levels worldwide, particularly in desert and semi-arid areas that provide optimal conditions for photovoltaic installations. Governments across the region have implemented comprehensive policy frameworks encompassing tax exemptions, financing programs through national development banks, and streamlined permitting processes for solar projects. As per sources, in December 2025, Colombia’s Ministry of Mines and Energy launched Gecelca Solar with an initial 650 MW solar portfolio to cut electricity costs for more than 150,000 households. Moreover, the substantial decline in solar panel manufacturing costs and installation expenses has democratized access to clean energy across various consumer segments. Additionally, growing energy security concerns and the imperative to reduce carbon emissions are accelerating the shift from conventional power sources toward sustainable solar solutions. Corporate power purchase agreements are increasingly driving commercial and industrial adoption as businesses seek to stabilize long-term energy costs while meeting environmental commitments.

Latin America Solar Energy Market Trends:

Bifacial Module Technology Gaining Prominence

The adoption of bifacial solar panel technology is accelerating across Latin American utility-scale projects, with these modules now representing the dominant choice for ground-mounted installations. In December 2025, Atlas Renewable Energy commissioned Brazil’s 315 MW Luiz Carlos Solar Park for ArcelorMittal, using 516,000 bifacial modules to supply renewable electricity for industrial operations. Furthermore, bifacial panels capture sunlight from both sides, enhancing energy yield particularly in high-albedo environments common to the region's desert landscapes. The technology offers improved performance in low-light conditions and reduces the levelized cost of electricity over project lifetimes. Developers are increasingly specifying bifacial configurations to maximize returns from favorable irradiation conditions prevalent across the continent.

Integration of Battery Energy Storage Systems

Energy storage integration with solar installations is emerging as a critical trend addressing grid stability and curtailment challenges across the region. Battery energy storage systems enable developers to capture excess generation during peak sunlight hours and dispatch electricity during evening demand periods. This hybrid approach enhances project economics by accessing higher-value electricity markets and providing ancillary grid services. The combination of declining battery costs and regulatory frameworks supporting storage deployment is driving substantial investment in solar-plus-storage configurations throughout the region. As per sources, in December 2025, Chilean renewable platform T Power secured USD 325 Million to develop a 141-MW/677 MWh battery energy storage system and refinance a co-located 141-MW solar project.

Expansion of Corporate Power Purchase Agreements

Corporate procurement of solar energy through long-term power purchase agreements is reshaping the commercial and industrial segment across Latin America. As per sources, CODELCO secured US$765 Million via MIGA guarantee for five renewable energy PPAs in Chile, advancing its transition to 100% clean energy by 2030. Further, major manufacturers, retailers, and technology firms are entering direct offtake arrangements with solar developers to secure predictable electricity costs and advance sustainability objectives. These agreements provide project developers with revenue certainty that supports financing while enabling corporate buyers to access renewable electricity at competitive rates. The trend reflects broader global momentum toward corporate renewable energy procurement and decarbonization commitments.

Market Outlook 2026-2034:

The Latin America solar energy market is set for sustained revenue growth as the region leverages abundant solar resources and a progressively favorable investment environment. Expansion of transmission networks and grid modernization will increase solar capacity in underserved areas. Strong policy support and evolving financing mechanisms are expected to attract significant international capital. Growth will be fueled by both large-scale utility projects and distributed generation across residential and commercial sectors, reinforcing Latin America’s position as a prime destination for renewable energy investment and development. The market generated a revenue of USD 7.40 Billion in 2025 and is projected to reach a revenue of USD 19.36 Billion by 2034, growing at a compound annual growth rate of 11.28% from 2026-2034.

Latin America Solar Energy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Deployment |

Ground‑mounted |

58% |

|

Application |

Commercial and Industrial |

36% |

|

Region |

Brazil |

29% |

Deployment Insights:

- Rooftop

- Ground-mounted

Ground-mounted dominates with a market share of 58% of the total Latin America solar energy market in 2025.

Ground-mounted represents the backbone of Latin America’s utility-scale renewable energy expansion, leveraging vast tracts of available land in desert, semi-arid, and rural regions. These configurations enable developers to deploy large-capacity systems that benefit from economies of scale in procurement, construction, and operation. The deployment model is particularly suited to the region's geography, where extensive uninhabited areas receive exceptional solar irradiation throughout the year. Ground-mounted systems also facilitate the integration of tracking technologies that optimize panel orientation to maximize daily energy capture.

The segment benefits from streamlined permitting processes for utility-scale projects in key markets and favorable economics compared to distributed generation in terms of per-megawatt installation costs. Power purchase agreements with utilities and large industrial consumers provide revenue certainty that supports project financing. Additionally, ground-mounted installations offer greater flexibility for incorporating emerging technologies such as bifacial modules and energy storage systems. According to sources, in November 2025, Enel Green Power Chile began constructing a 205 MW battery energy storage system at the Las Salinas hybrid solar-wind plant, enhancing renewable integration and grid resilience. Moreover, the continued expansion of transmission infrastructure is opening new development corridors that will sustain growth in this deployment category.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial and Industrial

- Utility-scale

Commercial and industrial leads with a share of 36% of the total Latin America solar energy market in 2025.

The commercial and industrial has emerged as a primary driver of solar energy adoption across Latin America as businesses increasingly prioritize energy cost management and environmental responsibility. Manufacturing facilities, retail chains, logistics centers, and office complexes are installing on-site solar generation to reduce dependence on grid electricity and hedge against volatile energy prices. Corporate power purchase agreements enable capital-light solar adoption for enterprises seeking to avoid upfront investment while securing long-term price certainty. As per sources, in September 2025, Scatec signed a 15-year PPA with BTG Pactual for its first 130 MW solar project in Nariño, Colombia, securing 85% of the plant’s production for corporate offtake. Moreover, the segment also benefits from favorable net metering policies that allow businesses to offset consumption with self-generated solar power.

Commercial and industrial operations with high and consistent electricity consumption profiles represent particularly attractive candidates for solar deployment, as predictable load patterns align well with solar generation curves. Additionally, multinational corporations operating in the region are implementing renewable energy procurement strategies aligned with global sustainability commitments and science-based emissions targets. The growing availability of third-party financing solutions and solar-as-a-service models is democratizing access for small and medium enterprises that previously lacked the capital for direct investment in solar assets.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil dominates with a market share of 29% of the total Latin America solar energy market in 2025.

Brazil has established itself as the dominant market within Latin America solar energy market, benefiting from a combination of favorable policy frameworks, extensive solar resources, and robust financing mechanisms. The country's net metering regulations have stimulated exponential growth in distributed generation, enabling residential and commercial consumers to become prosumers who generate their own electricity. Development bank financing programs provide attractive terms for solar project development, while federal and state-level tax exemptions reduce capital costs. Brazil's northeastern states receive particularly high solar irradiation levels that support efficient power generation throughout the year.

Brazil encompasses both utility-scale solar farms connected to the national transmission grid and distributed generation systems serving individual consumers and businesses. Auction mechanisms for long-term power purchase agreements have attracted international developers and established a competitive pipeline of large-scale projects. The country's ongoing efforts to diversify its electricity matrix beyond hydropower dependence are creating additional impetus for solar expansion. Strong local content requirements are also fostering the development of domestic solar manufacturing and installation capabilities that support job creation and economic development.

Market Dynamics:

Growth Drivers:

Why is the Latin America Solar Energy Market Growing?

Exceptional Solar Irradiation Resources

Latin America possesses some of the most favorable solar irradiation conditions globally, providing a fundamental advantage for photovoltaic power generation that drives market expansion. The Atacama Desert region offers the highest solar radiation levels recorded anywhere on Earth, enabling exceptional capacity factors for solar installations. In April 2025, ContourGlobal inaugurated the 221 MWp Quillagua solar plant with 1.2 GWh battery storage in Chile, enabling night-time solar energy delivery and long-duration grid support. Further, multiple countries across the region experience consistent sunshine patterns throughout the year with minimal seasonal variation compared to higher-latitude markets. These natural endowments translate directly into improved project economics through higher energy yields per installed megawatt. The combination of intense irradiation and extensive available land creates optimal conditions for developing utility-scale solar farms at competitive levelized costs of electricity.

Declining Solar Technology Costs

The sustained reduction in solar photovoltaic system costs has transformed the technology from a premium energy source into a competitive mainstream power generation option across Latin America. Solar panel manufacturing efficiencies, improved module technologies, and global supply chain optimization have driven dramatic price declines over the past decade. Installation and balance-of-system costs have similarly decreased as the regional solar industry has matured and developed local expertise. These cost reductions have expanded the addressable market to include consumer segments and geographic areas previously considered economically unfeasible. As per sources, in 2024, Latin America’s renewable LCOE fell 8%, with single-axis solar PV achieving the lowest costs in Brazil, Chile, and Mexico, enhancing competitiveness and enabling growing merchant market opportunities. Additionally, the improved affordability of solar systems has democratized access to clean energy across residential, commercial, and industrial applications throughout the region.

Supportive Government Policy Frameworks

Comprehensive government incentive programs and regulatory frameworks have created a favorable investment climate for solar energy development across Latin American markets. Tax exemptions on solar equipment imports reduce upfront capital requirements for project developers and consumers. National development bank financing programs offer attractive lending terms specifically designed to support renewable energy investments. In October 2025, Colombia approved COP 8.35 Trillion (~USD 2.1 Billion) for its Colombia Solar program, aiming to equip 1.3 Million low-income households with rooftop PV systems by 2030. Further, net metering and distributed generation regulations enable consumers to offset electricity consumption with self-generated solar power while receiving fair compensation for excess production. These policy mechanisms reduce investment risks, improve project returns, and signal long-term government commitment to renewable energy expansion that encourages sustained capital deployment.

Market Restraints:

What Challenges the Latin America Solar Energy Market is Facing?

Grid Infrastructure Limitations

Insufficient transmission and distribution infrastructure constrains solar energy expansion in many Latin American markets. Bottlenecks in the electricity grid limit the ability to evacuate power from high-irradiation regions to major consumption centers. Curtailment of solar generation occurs when grid capacity cannot accommodate available output, reducing project revenues and investor returns.

Financing Access Constraints

Access to affordable project financing remains challenging for the developers in certain markets, particularly for smaller-scale installations. Higher perceived country risks and currency volatility increase borrowing costs compared to mature renewable energy markets. Limited availability of long-term local currency financing exposes projects to foreign exchange risks that complicate financial structuring.

Policy and Regulatory Uncertainty

Evolving regulatory frameworks and policy adjustments create uncertainty for solar energy investors in some Latin American markets. Changes to net metering compensation structures or incentive programs can alter project economics after investment decisions have been made. Political transitions may bring shifts in energy policy priorities that affect the long-term outlook for renewable energy development.

Competitive Landscape:

The Latin America solar energy market is highly dynamic, featuring established international developers, regional renewable specialists, and emerging local players. Companies are focusing on expanding project pipelines, securing long-term power purchase agreements, and enhancing operational efficiency across multiple markets. Strategic collaborations with technology providers and financial institutions enable integrated solutions addressing end-to-end customer needs. Vertical integration is increasingly adopted to capture value and differentiate offerings. Competitive intensity is fostering innovation in project development, financing models, and technology deployment, ultimately benefiting consumers through improved service quality, efficient project execution, and competitive pricing, strengthening the region’s renewable energy landscape.

Recent Developments:

-

In November 2025, Iberdrola inaugurated the Noronha Verde project in Fernando de Noronha, Brazil. The 22 MWp solar plant, paired with a 49 MWh battery storage system, aims to make the island Latin America’s first inhabited oceanic island with a fully sustainable energy model, with the first phase operational in April 2026.

Latin America Solar Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployments Covered | Rooftop, Ground-mounted |

| Applications Covered | Residential, Commercial and Industrial, Utility-Scale |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Latin America solar energy market size was valued at USD 7.40 Billion in 2025.

The Latin America solar energy market is expected to grow at a compound annual growth rate of 11.28% from 2026-2034 to reach USD 19.36 Billion by 2034.

Ground-mounted held the largest share of the Latin America market, supported by abundant land availability, simpler installation compared to rooftop systems, and cost-effective utility-scale power generation in high-irradiation regions, driving significant market growth.

Key factors driving the Latin America solar energy market include exceptional solar irradiation resources across the region, declining solar technology and installation costs, supportive government policy frameworks, rising electricity demand, and growing corporate sustainability commitments.

Major challenges include grid infrastructure limitations causing transmission bottlenecks, financing access constraints particularly for smaller projects, policy and regulatory uncertainty across certain markets, currency volatility affecting project economics, and curtailment issues in regions with high renewable penetration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)