Latin America Plant-Based Food Market Size, Share, Trends and Forecast by Type, Source, Distribution Channel, and Country, 2025-2033

Latin America Plant-Based Food Market Overview:

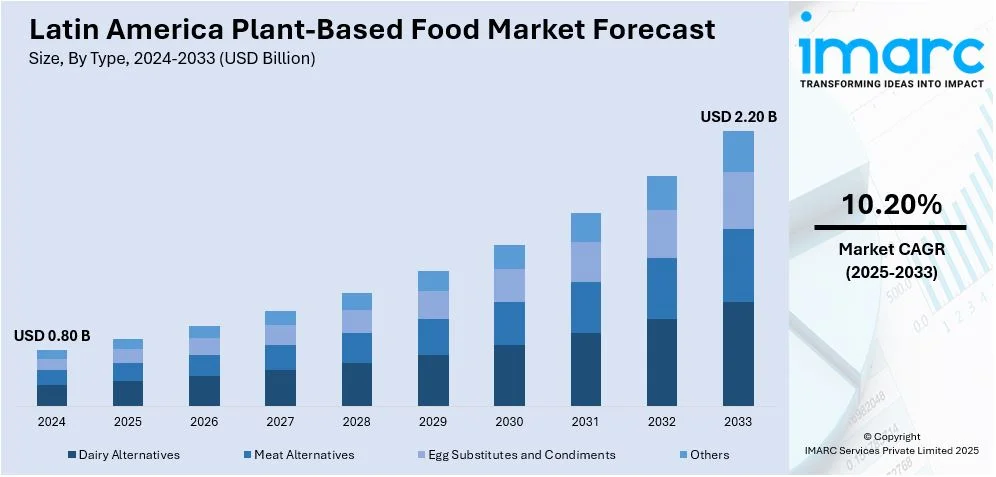

The Latin America plant-based food market size reached USD 0.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.20 Billion by 2033, exhibiting a growth rate (CAGR) of 10.20% during 2025-2033. The market is propelled by the increasing consumer awareness about health and nutrition benefits, rising demand for sustainable and eco-friendly food options, growing interest in vegan and vegetarian lifestyles and the expansion of plant-based product offerings by major food companies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.80 Billion |

| Market Forecast in 2033 | USD 2.20 Billion |

| Market Growth Rate (2025-2033) | 10.20% |

Latin America Plant-Based Food Market Trends:

Rising Health Consciousness Among Consumers

The Latin America plant-based food market is led by the increasing health awareness among consumers. People are increasingly becoming conscious of the long-term health advantages of consuming plant-based foods. This involves a reduced risk of chronic diseases like heart disease, diabetes and obesity. This move toward healthier eating is leading to consumers looking for alternatives to conventional animal-based foods increasing the demand for plant-based foods. Plant-based diets are excellent source of fibers, vitamins and antioxidants that help improve overall health. Lifestyle diseases are on the rise in Latin America. As a result, consumers are more likely to make purchases of food products that induce well-being. This awareness of health is especially seen in city dwellers where access to information relating to nutrition and well-being is higher. Consequently, plant foods companies are providing a greater variety of healthy, nutrient-rich food products that meet the demand of health-conscious consumers enabling industry growth.

Environmental Sustainability and Climate Concerns

A key driver of the Latin America plant-based food industry is the growing issue of environmental sustainability. People are increasingly aware of the environmental consequences of animal agriculture, notably its role in deforestation, climate change, and water use. As a result, there is a growing trend towards adopting plant-based diets as a means of lowering their environmental impact. Plant-based foods need fewer natural resources to produce than meat and dairy. They are therefore a more environmentally friendly option and help push up demand. With global debate on climate change picking up increasing numbers of Latin American consumers are drawing links between their diet and the environment. Governments and environmental groups within the country are also campaigning for sustainable farming practices and the consumption of vegetable-based foods as part of measures to combat climate change. This transformation is pushing consumers and enterprises towards adopting plant-based substitutes hence fueling market expansion.

Innovation and Product Diversification

Increased innovation and product diversification are critical in the formulation of the Latin America plant-based food market. Consumer interest in plant-based product lines is further growing. Due to this, food companies are spending heavily on research and development (R&D) to formulate more diversified and attractive products. From meat alternatives and dairy to seafood alternatives that are frequently prepared using soy, pea protein or coconut these are formulated to please a wide array of palates and dietary types making plant foods more convenient. For instance, in December 2024, Marfrig launched a gourmet plant-based hamburger under the brand Revolution in Brazil with plans for international sales starting next year. This follows a joint venture with Archer Daniels Midland to develop more plant-based products. The move positions Marfrig alongside competitors like Beyond Meat and Impossible Foods in the growing market. The growing number of plant-based products in grocery stores and restaurants is also leading to consumer uptake. Companies are now creating products that successfully match the texture and flavor of their animal-based counterparts in innovative combinations of flavors. This is also assisting in crossing taste barriers that might have kept some consumers away in the past. Along with this, the progress in food technology is enhancing the nutritional composition of plant foods making them increasingly competitive with animal foods and building a positive industry scenario as a whole.

Latin America Plant-based Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, source and distribution channel.

Type Insights:

- Dairy Alternatives

- Meat Alternatives

- Egg Substitutes and Condiments

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes dairy alternatives, meat alternatives, egg substitutes and condiments and others.

Source Insights:

- Soy

- Almond

- Wheat

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes soy, almond, wheat and others.

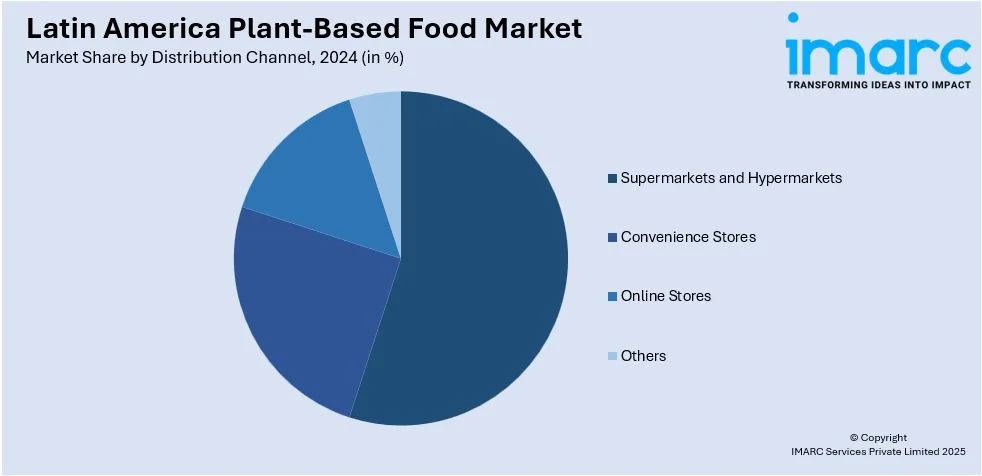

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major country markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Plant-based Food Market News:

- 5 July 2024: Switzerland-based multinational food and drink company Nestlé has introduced Maggi Rindecarne, a plant-based meat substitute, in Chile. With its first meat extender, Nestlé aims to expand its product line to offer an affordable method of protein consumption to Latin American consumers.

- 1 May 2024: NotCo, a Chile-based FoodTech company, has developed a plant-based turtle soup using artificial intelligence (AI) for consumers in Latin America and Asia. The company has reproduced this popular meal in an effort to increase public awareness about the endangered animal.

Latin America Plant-based Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dairy Alternatives, Meat Alternatives, Egg Substitutes and Condiments, Others |

| Sources Covered | Soy, Almond, Wheat, Others |

| Distribution Channel | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America plant-based food market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America plant-based food market on the basis of type?

- What is the breakup of the Latin America plant-based food market on the basis of source?

- What is the breakup of the Latin America plant-based food market on the basis of distribution channel?

- What is the breakup of the Latin America plant-based food market on the basis of country?

- What are the various stages in the value chain of the Latin America plant-based food market?

- What are the key driving factors and challenges in the Latin America plant-based food market?

- What is the structure of the Latin America plant-based food market and who are the key players?

- What is the degree of competition in the Latin America plant-based food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America plant-based food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America plant-based food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America plant-based food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)