Latin America Pet Care Market Size, Share, Trends and Forecast by Product Type, Pet Type, Distribution Channel, and Country, 2025-2033

Latin America Pet Care Market Size and Share:

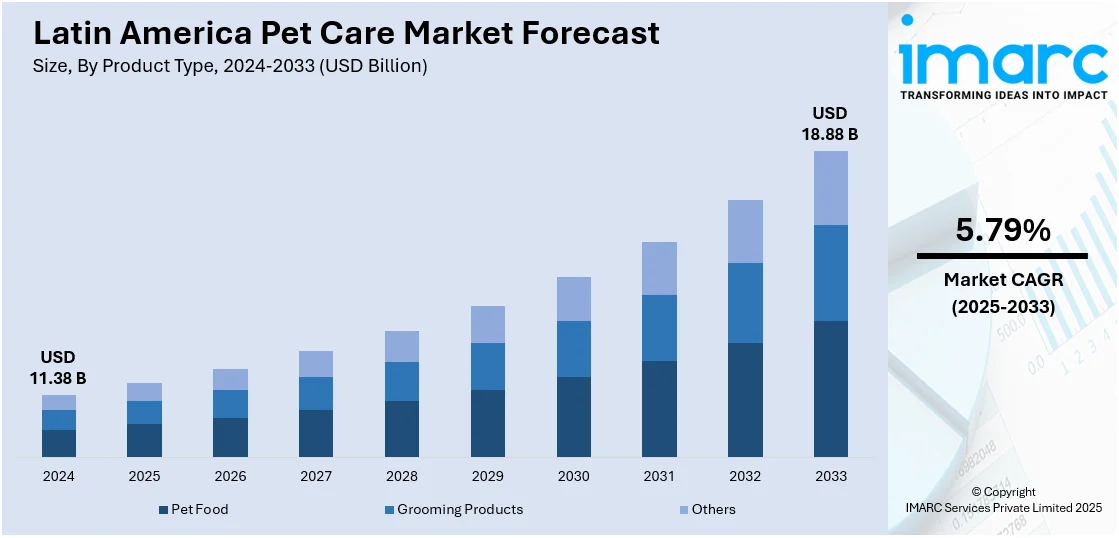

The Latin America pet care market size was valued at USD 11.38 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.88 Billion by 2033, exhibiting a CAGR of 5.79% from 2025-2033. The market’s revenue is growing due to increasing pet ownership, rising disposable incomes, demand for premium products, and heightened awareness of pet wellness, reflecting evolving consumer lifestyles and a deeper bond between pets and owners across the region. The dog segment leads in revenue share, driven by demand for specialized nutrition and healthcare products. Mars Petcare, with its prominent brands like Pedigree and Whiskas, plays a key role in this growth by expanding its production capacity and innovating in premium pet food offerings. Its sustainability efforts also contribute to its strong position in the Latin America pet care market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2033 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 11.38 Billion |

|

Market Forecast in 2033

|

USD 18.88 Billion |

| Market Growth Rate (2025-2033) | 5.79% |

The Latin America pet care market growth is based on intensifying attachment of pet owners towards their animals and their need to give them the best. Families are becoming smaller, and people seek companionship making pets an integral part of a household. The emotional bonding has translated into spending on premium pet food, grooming, and healthcare. The middle-class expansion in countries like Brazil, Mexico, and Colombia has further accelerated purchasing power, allowing consumers to invest in higher-quality pet products. For instance, in November 2024, HugWith launched four innovative pet care products which are biodegradable grooming glove wipes, dental finger wipes, eye cleaning wipes, and ear cleaning finger wipes, simplifying hygiene routines for pets and busy owners. Moreover, pet owners are becoming highly sensitive to proper nutrition and preventive healthcare, leading to a heightened demand for specialized food and advanced veterinary services. All these changes reflect an intense fundamental shift in attitudes towards pets, raising their profile in households and markets.

Another driver is the rise in tailored products and services catering to specific consumer needs. Companies are innovating with breed-specific diets, wellness supplements, and high-tech products, such as pet wearables. For example, in March 2024, PetPace launched the PetPace Health 2.0, an AI-powered smart dog collar that monitors vitals, detects medical issues, and integrates GPS tracking to enhance canine health and safety solutions. Furthermore, the Latin America pet care market forecast highlights the increasing impact of digital platforms, which are expected to transform the market by enhancing accessibility to pet care, with e-commerce expanding the availability of a wide range of products. This, coupled with marketing strategies emphasizing the health benefits of premium products, has encouraged pet owners to upgrade their purchases. The pet care market is also being influenced by governmental and societal efforts to promote responsible pet ownership, which has fostered a supportive environment for the industry’s growth.

Latin America Pet Care Market Trends:

Humanization of Pets

The trend of humanizing pets continues to redefine the pet care landscape in Latin America. Pet owners view their animals as integral family members, which has elevated demand for high-end, human-grade pet food and wellness products. Premiumization has become a key focus area, with brands offering tailored nutrition options, including grain-free and breed-specific formulations. Accessorizing is highly being experienced in the use of pet clothing and high-end bedding, following on from a more developed market lead. The influence of social media to further fuel this trend with regards to the consideration of pets as lifestyle companions has become a more pressing factor. Increasingly, the urban space can witness pet-friendly establishments, restaurants, and event spaces springing up as this cultural change sets into modern life.

E-Commerce Expansion

The rapid expansion of e-commerce is significantly boosting the Latin American pet care market. Consumers are increasingly turning to online platforms for convenience, variety, and competitive pricing. E-commerce pet care offers access to a wide range of premium pet care products, including food, grooming items, and healthcare essentials, which were previously unavailable in local stores. Subscription models for pet food and health products are gaining popularity, ensuring continuous product supply. Major players like Nestlé Purina have capitalized on this trend by enhancing their online presence and partnering with regional e-commerce giants. This shift to digital shopping is further accelerating as internet penetration increases, providing pet owners across Latin America with easier access to high-quality pet care solutions.

Focus on Sustainable Products

Sustainability is becoming a core element in lapet (Latin America pet markets), driven by heightened environmental awareness among consumers. Many pet owners are seeking eco-friendly options, from biodegradable packaging to organic pet food. For example, in August 2024, Mars Petcare, in collaboration with Big Idea Ventures, AAK, and Bühler, launched the Next Generation Pet Food Program pilot to drive innovation and develop sustainable pet food solutions, focusing on eco-friendly ingredients and processes. Moreover, brands are investing in reducing their carbon footprint and adopting practices like zero-waste manufacturing. Plant-based and insect-based protein options are gaining traction as sustainable alternatives to traditional pet food, reflecting consumer demand for ethical and environmentally conscious products. Certifications for sustainability, including organic and fair-trade labels, are also influencing purchasing decisions, positioning brands that prioritize eco-responsibility as market leaders.

Latin America Pet Care Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Latin America pet care market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, pet type, and distribution channel.

Analysis by Product Type:

- Pet Food

- Dry

- Wet

- Grooming Products

- Shampoos and Conditioners

- Combs and Brushes

- Clippers and Scissors

- Others

- Others

The pet food segment includes dry food and wet food. Dry food remains the preferred choice for its convenience, affordability, and long shelf life, while wet food gains popularity for its higher moisture content, nutrient-rich formulations, and appeal to pets with specific dietary needs, especially seniors and picky eaters.

The grooming products segment include shampoos and conditioners, combs and brushes, clippers and scissors, among others. These products promote pet hygiene, coat health, and even appearance. Pet humanization and premiumization trends rise the demand for natural and gentle grooming solutions, even breed-specific solutions, toward diverse pet care needs.

The others segment includes grooming accessories such as wipes, dental care products, and deodorizers. Increasing awareness of holistic pet care and hygiene solutions drives this segment, as pet owners seek to maintain overall health, cleanliness, and odor control as part of their pets' daily care routines.

Analysis by Pet Type:

- Dog

- Cat

- Fish

- Others

As per Latin America pet care market analysis, dogs dominate the market because they are the most popular pet choice in the region, with a high adoption rate across urban and rural areas. The growing humanization trend, where pets are viewed as family members, has significantly boosted demand for premium products. Pet owners are increasingly prioritizing their dogs' health, well-being, and comfort, which fuels the demand for specialized food, grooming items, and healthcare services. Additionally, the strong emotional bond between dogs and their owners has led to more discretionary spending on high-quality products and services. As a result, the pet care industry has focused heavily on meeting the needs of dog owners, further solidifying dogs' dominance in the market.

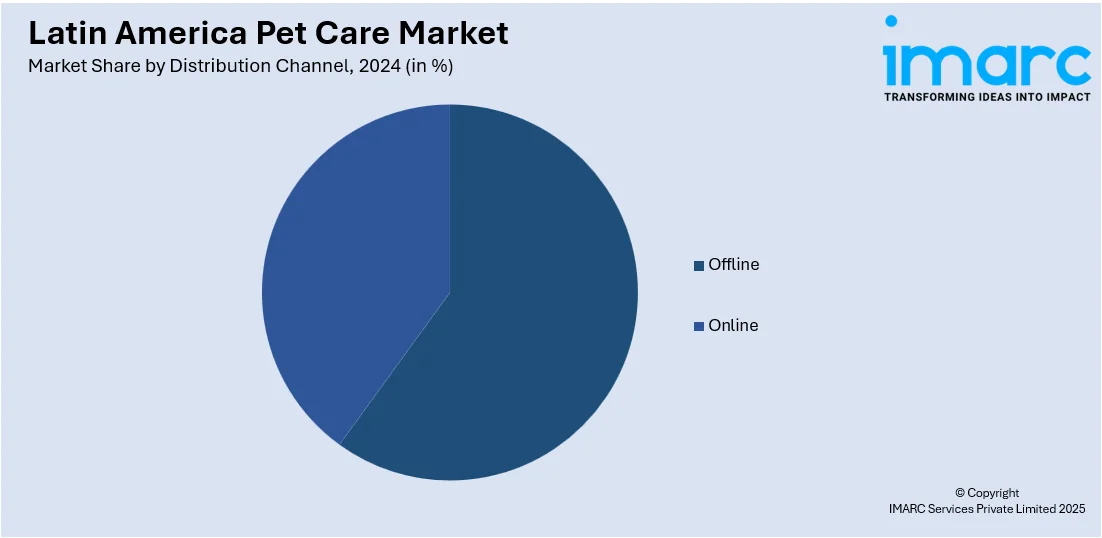

Analysis by Distribution Channel:

- Offline

- Online

The offline distribution channel dominates the pet care market, driven by physical pet stores, supermarkets, and veterinary clinics. Consumers prefer in-store purchases for personalized advice, product trials, and immediate availability. Specialized pet retailers further drive growth by offering premium products, grooming services, and tailored recommendations for pet owners.

The online channel is rapidly expanding due to convenience, competitive pricing, and a vast product range. E-commerce platforms and pet-specific websites provide easy access to premium food, grooming products, and healthcare essentials. Rising internet penetration and subscription-based delivery models further accelerate the prominence of online platform across pet care market in Latin America.

Country Analysis:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil's pet care market is driven by high pet ownership rates and rising consumer spending on pet nutrition, grooming, and healthcare products. Urbanization and the humanization of pets encourage demand for premium food and accessories, supporting steady market growth across diverse product categories.

Mexico's pet care market is expanding with boosting pet adoption and a growing middle-class population. Heightening awareness of pet health fuels demand for quality food, grooming essentials, and veterinary services. E-commerce platforms further enhance accessibility and convenience, driving the market’s consistent growth.

Argentina’s pet care market is supported by strong cultural bonds with pets and a focus on affordable nutrition and grooming solutions. Economic factors encourage demand for cost-effective products, while pet owners gradually embrace premium offerings to ensure their pets' health and well-being.

Colombia's pet care market growth is influenced by boosting pet adoption and awareness of pet well-being. Urbanization and higher disposable incomes drive demand for specialized food, grooming products, and healthcare solutions, with a noticeable shift toward premium and sustainable offerings.

Chile's market benefits from urbanization and the growing importance of pet care. Pet owners prioritize premium nutrition, grooming products, and accessories. Amplifying adoption of cats and small dogs boosts demand for tailored food and convenience-focused solutions, reflecting evolving consumer preferences.

Peru's pet care market is experiencing growth due to rising awareness of pet health and hygiene. Increasing urbanization and adoption of pets contribute to demand for nutritious food, grooming essentials, and veterinary services, with younger generations driving interest in sustainable and high-quality products.

The others segment includes smaller Latin American countries witnessing growth due to rising pet ownership and urbanization. Improved economic conditions and awareness about pet well-being drive demand for nutrition, grooming products, and healthcare services, ensuring steady development of regional pet care markets.

Competitive Landscape:

The Latin America pet care market is highly competitive with many multinational and regional players competing for market share. Major players in the pet food segment include Nestlé Purina Petcare, Mars Petcare, and Colgate-Palmolive, whereas grooming products and healthcare are driven by both established brands and emerging local players. Key differentiators in this space include innovations in pet food formulations, premium offerings, and sustainability. Regional players are also focusing on growth opportunities arising from growing pet population and changing consumer preferences for organic, niche products. M&A, strategic collaborations, are among the popular growth strategies where regional players expand their geographical reach while offering new products through acquisitions or collaborations. The online pet shopping trend also drives e-commerce adoption for these companies.

The report provides a comprehensive analysis of the competitive landscape in the Latin America pet care market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, Nestlé Purina announced a CHF 200 million expansion of its Silao, Mexico pet food plant. Adding wet and dry food production lines, it will become Latin America's largest pet food facility, supporting regional growth, exports, and sustainability goals with renewable energy and water recycling systems.

- In April 2024, Adimax expanded its operations by opening a new manufacturing unit in Feira de Santana, Bahia, enhancing its production capacity. This move solidifies Adimax's position as a leading player in Brazil’s growing pet food market, with brands like Magnus and Fórmula Natural covering premium to economy segments.

- Latin America pet care market trends 2025 highlight the recent Peru pet safety regulations, which includes pet owners bringing dogs or cats into Peru must meet specific requirements, including a health certificate, rabies vaccination, and parasite treatments. Pets should be at least 3 months old, microchipped, and inspected by SENASA upon arrival. All documentation must be submitted for inspection at Jorge Chávez International Airport. Quarantine is avoided if requirements are met. Additional permits are needed for other animals.

Latin America Pet Care Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Pet Types Covered | Dog, Cat, Fish, Others |

| Distribution Channels Covered | Offline, Online |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America pet care market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Latin America pet care market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America pet care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pet care involves providing the necessary physical, emotional, and medical support for pets to maintain their health and well-being. It includes a wide range of activities like feeding, grooming, exercise, and medical care. Pet care products, such as pet food, grooming tools, toys, and health supplements, support these needs, enhancing the pet's quality of life. Pet care also extends to pet insurance, training, and pet sitting services. With increasing pet ownership in Latin America, the demand for comprehensive pet care is growing significantly.

The Latin America pet care market was valued at USD 11.38 Billion in 2024.

IMARC estimates the Latin America pet care market to exhibit a CAGR of 5.79% during 2025-2033.

Key factors driving the Latin America pet care market include rising pet ownership, heightening awareness of pet health, and the growing demand for high-quality pet products. The expanding middle class, coupled with evolving consumer preferences, is also fueling the shift toward premium pet foods, grooming services, and pet healthcare products. Additionally, a greater focus on pet wellness and pet insurance is contributing to market growth.

Dogs dominate the Latin America pet care market due to their high adoption rates, strong emotional bonds with owners, and the increasing trend of humanizing pets. This results in higher demand for premium food, grooming products, and healthcare, as owners prioritize their dogs' nutrition, hygiene, and overall well-being.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)