Latin America Pallet Market Report by Type (Wood, Plastic, Metal, Corrugated Paper), Application (Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, and Others), Structural Design (Block, Stringer, and Others), and Country 2025-2033

Market Overview:

The Latin America pallet market size reached 344.5 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 513.3 Million Units by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 344.5 Million Units |

| Market Forecast in 2033 | 513.3 Million Units |

| Market Growth Rate (2025-2033) | 4.30% |

A pallet is a flat structure made of wood, plastic pallet, metal, or other materials used for storing and transporting goods. It is a lightweight, cost-efficient structure used to lift and place heavy-weight goods on trucks, ships, and planes by forklift. It uses stretch wraps, pallet collars, adhesives, and other stabilizing materials to secure goods from transportation damage. It can be constructed using different methods, including stringer, block, and panel decks. It assists in improving warehouse operational efficiency by allowing easy movement of stacked goods using forklifts and pallet jacks. It enables safe product delivery and makes the loading and unloading process simpler.

Latin America Pallet Market Trends:

There is an increase in the adoption of pallets in warehouses and distribution centers to sort and organize products according to destination, product type, and shipping methods. This, coupled with rising preferences for online shopping among the masses and significant growth in the e-commerce industry, represent one of the major factors strengthening the market growth in the Latin American region. Moreover, pallets are employed in the food and beverage (F&B) industry to move food products from one place to another, reduce material handling time and make food processing safer and more efficient. This, along with the growing inclination towards packaged ready to eat (RTE) food products on account of hectic lifestyles and the expanding purchasing power of individuals, is influencing the market positively in the region. In addition, the increasing utilization of pallets in the pharmaceutical industry to help protect pharmaceutical products from damage during transportation and storage and prevent them from moisture, dust, and other contaminants is favoring the growth of the market. Apart from this, the rising number of construction activities in residential and commercial areas is driving the use of pallets in the construction industry to transport building materials, such as bricks, lumber, and concrete blocks. Furthermore, key players operating in the region are introducing multiple-trip pallets, which provide a lower cost per trip, minimize solid waste, and enhance operational efficiency. Besides this, the growing demand for plastic pallets in different industry verticals as they are lightweight, durable, and cost effective, is creating a positive outlook for the market in the region.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Latin America pallet market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on type, application and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the Latin America pallet market based on the type. This includes wood, plastic, metal, and corrugated paper. According to the report, wood represented the largest segment.

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the Latin America pallet market based on the application has also been provided in the report. This includes food and beverages, chemical and pharmaceuticals, machinery and metal, construction, and others. According to the report, food and beverages accounted for the largest market share.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the Latin America pallet market based on the structural design. This includes block, stringer, and others. According to the report, block represented the largest segment.

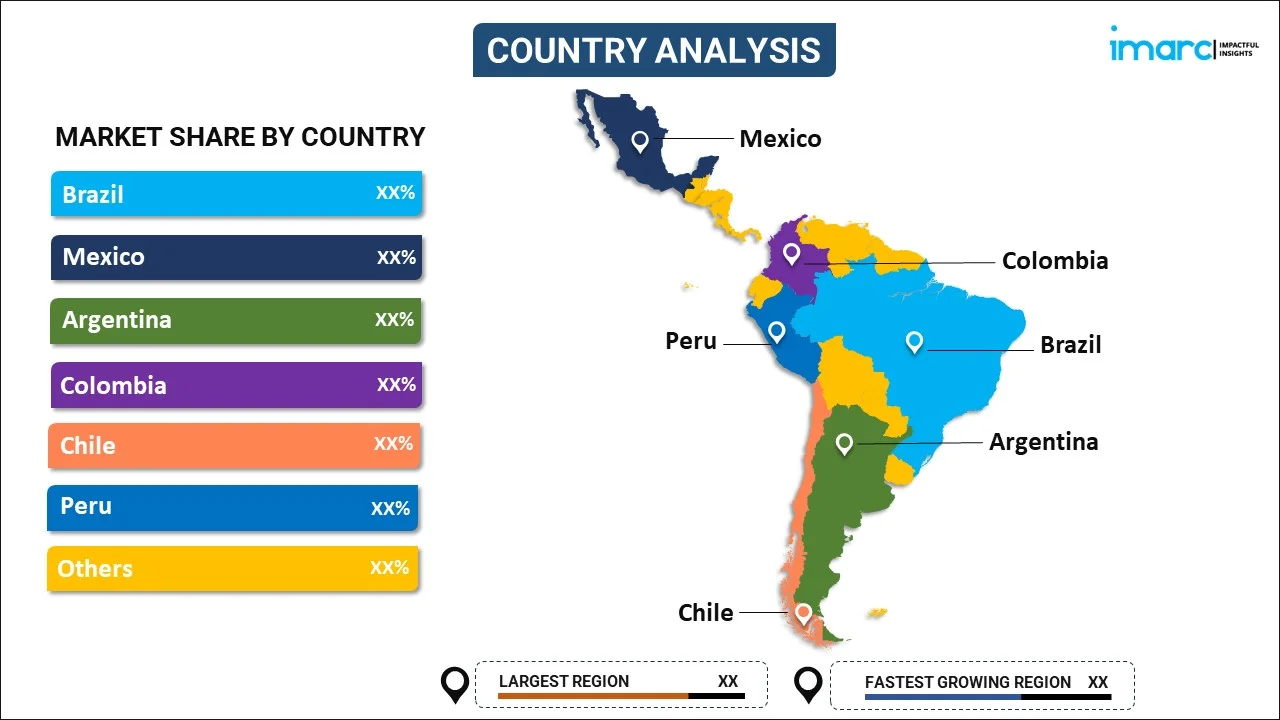

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Latin America pallet market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Segment Coverage | Type, Application, Structural Design, Country |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America pallet market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Latin America pallet market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Latin America pallet market reached a volume of 344.5 Million Units in 2024.

We expect the Latin America pallet market to exhibit a CAGR of 4.30% during 2025-2033.

The emerging trend of automated handling systems, along with the rising demand for pallets, as they simplify the process of loading and unloading and ensure the safe delivery of goods, is primarily driving the Latin America pallet market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Latin American nations, resulting in the temporary closure of numerous manufacturing units for pallets.

Based on the type, the Latin America pallet market can be categorized into wood, plastic, metal, and corrugated paper. Currently, wood accounts for the majority of the total market share.

Based on the application, the Latin America pallet market has been segregated into food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others. Among these, food and beverages currently hold the largest market share.

Based on the structural design, the Latin America pallet market can be bifurcated into block, stringer, and others. Currently, block exhibits a clear dominance in the market.

On a regional level, the market has been classified into Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)