Latin America Organic Fertilizers Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Latin America Organic Fertilizers Market Size and Share:

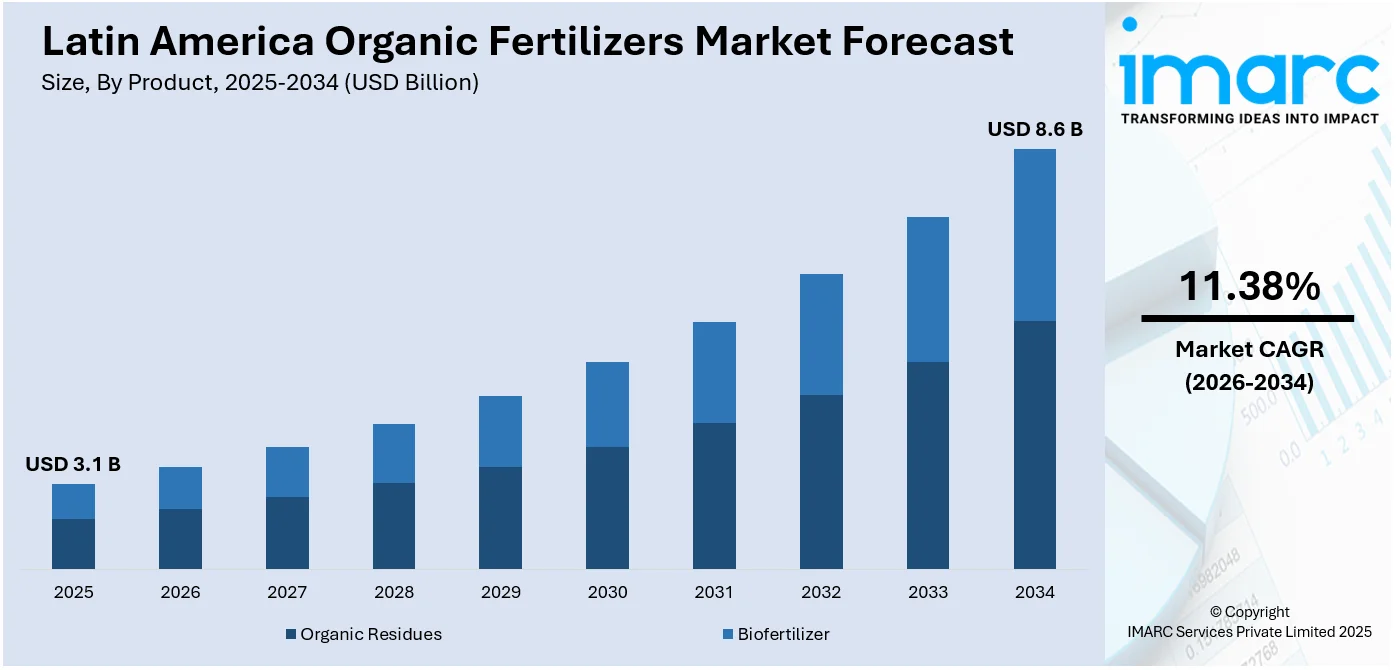

The Latin America organic fertilizers market size reached USD 3.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 8.6 Billion by 2034, exhibiting a growth rate (CAGR) of 11.38% during 2026-2034. The rising consumer demand for chemical-free food, government incentives for sustainable farming, increasing soil degradation, expanding organic farmland, growing awareness of environmental impacts, stringent regulations on synthetic fertilizers, and the adoption of biofertilizers and biopesticides to enhance crop yields are some of the major factors positively impacting the Latin America organic fertilizers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.1 Billion |

| Market Forecast in 2034 | USD 8.6 Billion |

| Market Growth Rate (2026-2034) | 11.38% |

Latin America Organic Fertilizers Market Trends:

Rising Demand Towards Sustainable Agricultural Practices

The organic fertilizer market in Latin America is growing due to the increasing focus on sustainable agricultural practices. Organic farming is widely practiced in countries like Brazil, Argentina, and Mexico, with government support through subsidies and certification programs. According to an industry report, it was found that the area of organic farming in Latin America increased by 60% from 2018 to 2024, reaching 10 million hectares in 2024. The shift to organic alternatives is also driven by the region's growing awareness of health degradation because of synthetic fertilizers. In line with this, farmers are now adopting compost, manure-based, and biofertilizers to rejuvenate the biodiversity of the soil and, thereby, reduce chemical dependency. Also, there is a global demand for organic food export, which results in large-scale farmers following organic production. This further leads to a higher demand for the product, which is facilitating the Latin America organic fertilizer market growth. Investments in research on microbial inoculants and organic nutrient blends are enhancing product efficiency. The market is also benefitting from slow-release organic formulations for improved nutrient absorption and reduction of leaching, thus making organic fertilizers a viable replacement for synthetic inputs in high-yield farming systems.

To get more information on this market Request Sample

Growth of Biofertilizers and Microbial-Based Products

The growing adoption of biofertilizers due to their ability to improve soil fertility without harming the environment is positively influencing the Latin America organic fertilizers market outlook. Biofertilizers containing nitrogen-fixing bacteria (rhizobium, azospirillum), phosphate-solubilizing microbes (pseudomonas, bacillus), and mycorrhizal fungi are being developed to optimize nutrient availability. Countries like Brazil and Argentina are leading in microbial-based product registrations, driven by regulatory approvals and collaborations between research institutes and agribusinesses. The expansion of precision agriculture technologies is also fostering the use of biofertilizers, as farmers integrate them with data-driven nutrient management strategies. The increased commercialization of tailored biofertilizers for crops such as soybeans, coffee, and sugarcane increases growth in the market. Innovations in carrier materials such as lignite and polymer-based formulations are making effective strides in improving shelf life and stability of microbial biofertilizers to address storage and application challenges. On September 11, 2024, Stoller Argentina released a biofertilizer called BlueN based on the nitrogen fixer species Methylobacterium symbioticum SB23. This innovative foliar-applied product is suitable for organic farming and can be mixed with most foliar pesticides, providing an alternative to traditional nitrogen fertilizers.

Latin America Organic Fertilizers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Organic Residues

- Farm Yard Manure

- Crop Residues

- Green Manure

- Others

- Biofertilizer

- Azotobacter

- Rhizobium

- Azospirillum

- Blue-Green Algae

- Azolla

- Mycorrhiza

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes organic residues (farm yard manure, crop residues, green manure, and others) and biofertilizers (azotobacter, rhizobium, azospirillum, blue-green algae, azolla, mycorrhiza, and others).

Application Insights:

Access the comprehensive market breakdown Request Sample

- Grains and Cereals

- Oilseeds

- Fruits and Vegetables

- Turf and Ornamentals

- Others

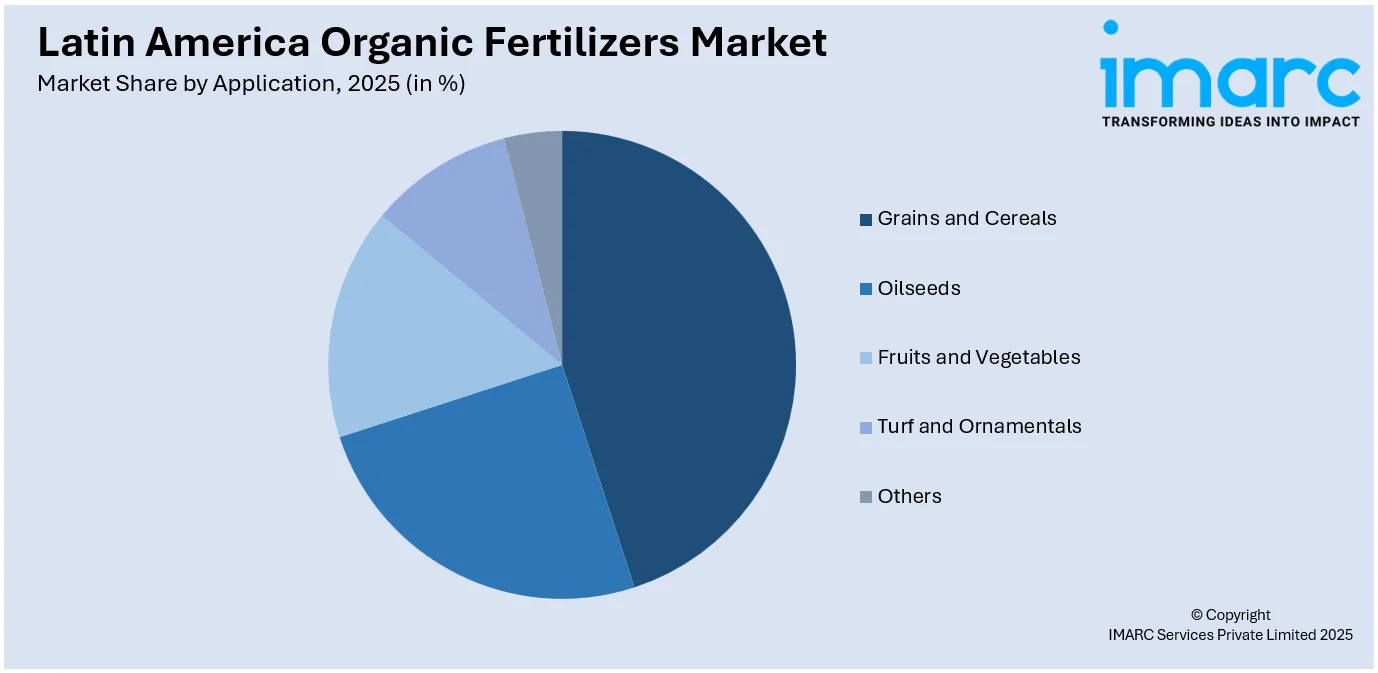

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes grains and cereals, oilseeds, fruits and vegetables, turf and ornamentals, and others.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Organic Fertilizers Market News:

- April 22, 2024: WIPO GREEN announced its support for the adoption of bio-inputs in Latin American agriculture, addressing the dual challenge of increasing food production sustainably and mitigating environmental impacts. Through its climate-smart agriculture project, WIPO GREEN facilitated a collaboration between Argentine peach producer Tomás Gomez and Agro Sustentable, a national firm specializing in certified organic products, to trial biofertilizers and biopesticides. This program seeks to address the rising demand from consumers for environmentally friendly agricultural products and to advance sustainable farming methods.

- July 18, 2024: Terraplant introduced MinerOxi+, Brazil's inaugural 3-in-1 organomineral fertilizer. This innovative product integrates organic matter, essential minerals, and oxides to address environmental challenges and promote sustainable agriculture. MinerOxi+ offers immediate soil pH correction upon application, enhancing nutrient availability and eliminating the need for farmers to mix separate products.

Latin America Organic Fertilizers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Grains and Cereals, Oilseeds, Fruits and Vegetables, Turf and Ornamentals, Others |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America organic fertilizers market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America organic fertilizers market on the basis of product?

- What is the breakup of the Latin America organic fertilizers market on the basis of application?

- What is the breakup of the Latin America organic fertilizers market on the basis of region?

- What are the various stages in the value chain of the Latin America organic fertilizers market?

- What are the key driving factors and challenges in the Latin America organic fertilizers market?

- What is the structure of the Latin America organic fertilizers market and who are the key players?

- What is the degree of competition in the Latin America organic fertilizers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America organic fertilizers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America organic fertilizers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America organic fertilizers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)