Latin America Online Grocery Market Report by Product Type (Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, and Others), Business Model (Pure Marketplace, Hybrid Marketplace, and Others), Platform (Web-Based, App-Based), Purchase Type (One-Time, Subscription), and Region 2025-2033

Market Overview:

The Latin America online grocery market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.1 Billion by 2033, exhibiting a growth rate (CAGR) of 10.95% during 2025-2033. The rising digital connectivity, changing consumer lifestyles, urbanization, competitive pricing, the transformative impact of the COVID-19 pandemic, and expanding logistics are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.8 Billion |

|

Market Forecast in 2033

|

USD 10.1 Billion |

| Market Growth Rate (2025-2033) | 10.95% |

Online grocery refers to the practice of purchasing or selling food and household items through digital platforms, typically websites or mobile applications, offered by supermarkets, grocery stores, or dedicated online grocery retailers. Consumers can browse a wide range of products, add items to their virtual carts, and proceed to checkout for home delivery or scheduled pickup. This convenient approach allows customers to shop for groceries from the comfort of their homes, providing them with flexibility and saving time. Online grocery shopping has gained significant popularity in recent years, driven by advancements in technology and changing consumer preferences for convenient and contactless shopping experiences.

The Latin America online grocery market is experiencing substantial growth due to the increasing internet penetration and smartphone usage across the region, which has expanded the potential customer base for online shopping. Besides this, as consumers become more comfortable with digital transactions, they are increasingly turning to online platforms for their grocery needs, creating a positive market outlook. Moreover, the expanding urbanization and changing lifestyles have led to busier schedules, making the convenience of online grocery shopping an attractive proposition. In addition to this, the COVID-19 pandemic accelerated the adoption of online shopping, as safety concerns prompted consumers to seek contactless alternatives, thereby strengthening the market growth. Furthermore, the expanding logistics and delivery infrastructure in the region, ensuring efficient and timely deliveries represents another factor supporting the growth of online grocery services. Apart from this, competitive pricing, a wider product selection, and various promotional offers provided by online grocery platforms are enticing consumers to explore and make purchases through digital channels, fueling the market growth.

Latin America Online Grocery Market Trends/Drivers:

Increasing digital connectivity and device penetration

The expanding availability of digital devices, particularly smartphones, and improved internet connectivity has played a pivotal role in driving the growth of the online grocery market in Latin America. With a growing number of individuals gaining access to smartphones and the internet, there has been a notable increase in the online user base. This surge in digital connectivity has enabled consumers to explore and engage with online platforms for various services, including grocery shopping. E-commerce companies leverage this trend by offering user-friendly mobile apps and websites, providing consumers with a convenient and accessible way to shop for groceries from the comfort of their homes. The prevalence of digital devices has widened the potential customer base and contributed to making online grocery shopping a part of mainstream consumer behavior, thus propelling the market growth.

Changing consumer lifestyles and urbanization

Urbanization and shifts in consumer lifestyles are driving the demand for more convenient shopping solutions. As urban areas continue to grow, and consumer lifestyles become busier, traditional grocery shopping methods that involve physical visits to stores are becoming less practical. Online grocery shopping provides an effective solution for this evolving consumer landscape. It offers the convenience of browsing through a wide range of products and placing orders without the need to travel to a physical store. This factor has been particularly appealing to working professionals, families with time constraints, and individuals seeking a hassle-free way to purchase groceries. The ability to shop online eliminates the need to navigate through traffic, find parking, and spend time in queues, aligning well with the fast-paced urban lifestyle, contributing to the increasing product adoption among consumers.

Latin America Online Grocery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Latin America online grocery market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on product type, business model, platform and purchase type.

Breakup by Product Type:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Staples and cooking essentials represent the most popular product type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vegetables and fruits, dairy products, staples and cooking essentials, snacks, meat and seafood, and others. According to the report, staples and cooking essentials represented the largest segment.

The surge in online sales of staples and cooking essentials, driven by the convenience of sourcing essential items from the comfort of one's home, saving time and effort, is acting as one of the key factors fueling the market growth. In line with this, the increasing reliance on digital platforms for various needs has led consumers to embrace online grocery shopping for items such as grains, oils, and spices, which is creating a favorable outlook for market growth. Moreover, the COVID-19 pandemic has heightened health and safety concerns, motivating consumers to opt for contactless shopping options, thereby accelerating the adoption of online platforms for purchasing everyday cooking necessities.

Breakup by Business Model:

- Pure Marketplace

- Hybrid Marketplace

- Others

Hybrid marketplace represents the most widely used business model

The report has provided a detailed breakup and analysis of the market based on the business model. This includes pure marketplace, hybrid marketplace, and others. According to the report, hybrid marketplace represented the largest segment.

The growing demand for hybrid marketplace online grocery is propelled by their unique ability to offer a comprehensive shopping experience that combines the convenience of online ordering with the familiarity of traditional retail. Concurrent with this, these platforms allow customers to choose between home delivery and in-store pickup, catering to varying preferences. Additionally, they often feature a wider product selection, including locally sourced items and specialty products, enhancing customer choices. The integration of physical stores with digital platforms addresses the need for flexibility while also meeting the growing demand for convenient and personalized grocery shopping experiences, which is presenting lucrative opportunities for market expansion.

Breakup by Platform:

- Web-Based

- App-Based

Web-based accounts for the majority of the market share

A detailed breakup and analysis of the market based on the platform has also been provided in the report. This includes web-based and app-based. According to the report, the web-based segment accounted for the largest market share.

The accessibility and ease of use of web-based online grocery shopping contribute to their increasing preference among individuals. As consumers increasingly rely on the Internet for their shopping needs, web-based platforms provide a straightforward and familiar interface for browsing and purchasing groceries, bolstering the market growth. Furthermore, these platforms offer a seamless shopping experience, allowing customers to access a wide array of products, compare prices, and read reviews. In addition to this, the compatibility with various devices and the absence of the need to download dedicated apps make web-based online grocery shopping a convenient option for a broad range of consumers, which is contributing to its growing popularity.

Breakup by Purchase Type:

- One-Time

- Subscription

One-time accounts for the majority of the market share

A detailed breakup and analysis of the market based on the purchase type has also been provided in the report. This includes one-time and subscription. According to the report, the one-time segment accounted for the largest market share.

The rising demand for one-time purchase online grocery due to its flexibility and suitability for certain consumer preferences represents one the key factors impelling the market growth. This option appeals to customers who prefer to make individual purchases as needed, without committing to recurring subscriptions or long-term commitments. Moreover, it caters to those who seek specific products without the intention of setting up regular deliveries, offering a convenient alternative to traditional in-store shopping for occasional grocery needs. This growing demand driven by the desire for autonomy in choosing when and what to purchase, aligning well with the diverse shopping habits and preferences of consumers in the digital age, is aiding in market expansion.

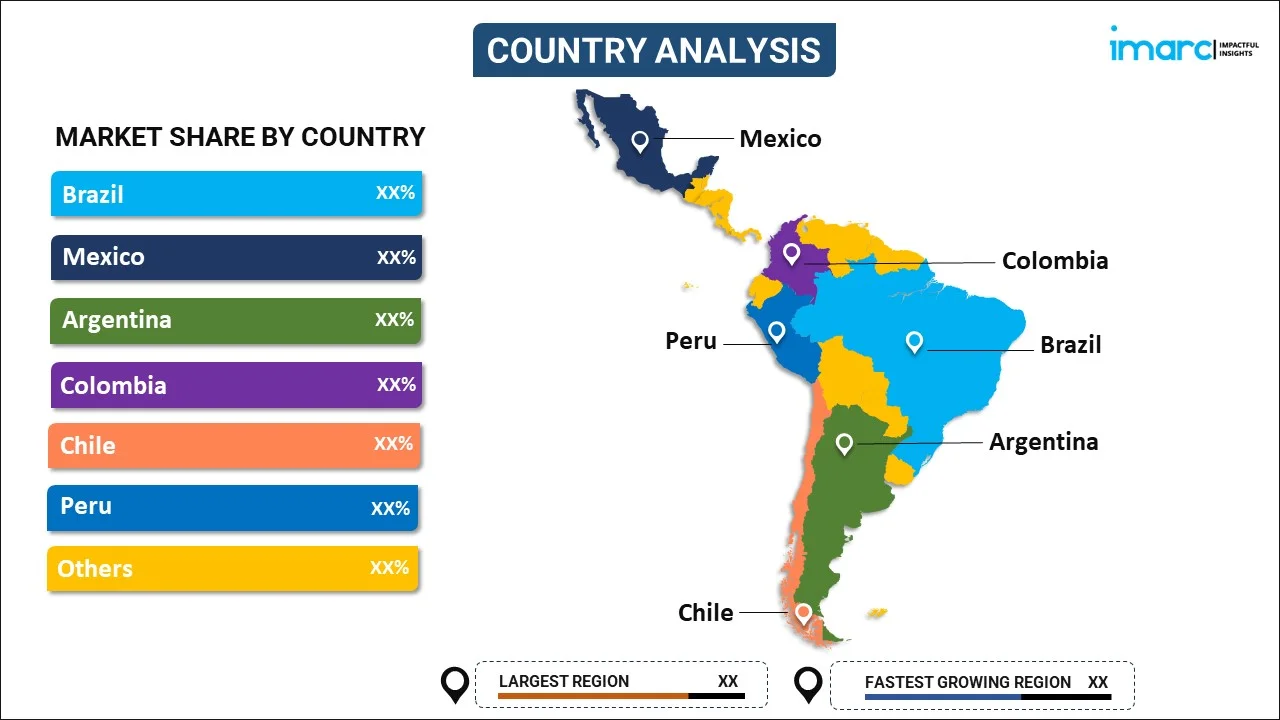

Breakup by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil holds the largest share of the market

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others. According to the report, Brazil accounted for the largest market share.

Brazil's burgeoning internet penetration rate, combined with the increasing use of smartphones, has created a vast digital consumer base eager to explore online shopping options, creating a positive outlook for market expansion. Moreover, this trend is amplified by the country's geographically diverse landscape, where convenient access to traditional grocery stores may be limited for some. Additionally, Brazil's urbanization and changing lifestyles, characterized by busier schedules and greater emphasis on convenience, align seamlessly with the advantages offered by online grocery shopping, thereby contributing to the market growth. Besides this, the COVID-19 pandemic further catalyzed this growth, as safety concerns led consumers to prefer contactless shopping methods. Furthermore, the development of efficient delivery networks and localized strategies that address the unique challenges and opportunities presented by Brazil's dynamic market, thereby nurturing sustained demand and adoption, is strengthening the market growth.

Competitive Landscape:

The competitive landscape of the Latin America online grocery market is dynamic and rapidly evolving, driven by the interplay of both local and international players. A mix of traditional retailers, e-commerce giants, and specialized online grocery platforms are vying for market share. Global players have made significant investments to establish their presence, leveraging their logistical expertise and brand recognition. Local players, on the other hand, often possess a deeper understanding of regional consumer preferences and logistical challenges, giving them a competitive edge. Some platforms emphasize partnerships with local suppliers to offer diverse product ranges. Moreover, the market's growth has spurred innovation, with companies introducing features, such as personalized recommendations, flexible delivery options, and loyalty programs, to attract and retain customers.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Latin America Online Grocery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | Web-Based, App-Based |

| Purchase Types Covered | One-Time, Subscription |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America online grocery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Latin America online grocery market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America online grocery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Latin America online grocery market was valued at USD 3.8 Billion in 2024.

We expect the Latin America online grocery market to exhibit a CAGR of 10.95% during 2025-2033.

The growing consumer awareness towards various benefits associated with online grocery solutions, such as flexible payment options, door-step delivery, continuous track of the delivery process, etc., is primarily driving the Latin America online grocery market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing sales of groceries via online platforms over conventional brick-and-mortar distribution channels to combat the risk of the coronavirus infection across numerous Latin American nations.

Based on the product type, the Latin America online grocery market has been divided into vegetables and fruits, dairy products, staples and cooking essentials, snacks, meat and seafood, and others. Currently, staples and cooking essentials exhibit a clear dominance in the market.

Based on the business model, the Latin America online grocery market can be categorized into pure marketplace, hybrid marketplace, and others. Among these, hybrid marketplace currently holds the majority of the total market share.

Based on the platform, the Latin America online grocery market has been segmented into web-based and app-based, where web-based accounts for the largest market share.

Based on the purchase type, the Latin America online grocery market can be bifurcated into one-time and subscription. Currently, one-time exhibits a clear dominance in the market.

On a regional level, the market has been classified into Brazil, Mexico, Argentina, Columbia, Chile, Peru, and others, where Brazil currently dominates the Latin America online grocery market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)