Latin America Neo Banking Market Size, Share, Trends, and Forecast by Account Type, Application, and Region, 2026-2034

Latin America Neo Banking Market Overview:

The Latin America neo banking market size reached USD 17.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 420.9 Billion by 2034, exhibiting a growth rate (CAGR) of 42.85% during 2026-2034. The Latin American neo banking market is rapidly growing, driven by increasing digital adoption, financial inclusion efforts, and demand for cost-effective, user-centric banking solutions. Additionally, neo banks are expanding their reach, providing accessible services like savings, loans, and digital payments, reshaping the region’s financial landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 17.0 Billion |

| Market Forecast in 2034 | USD 420.9 Billion |

| Market Growth Rate (2026-2034) | 42.85% |

Access the full market insights report Request Sample

Latin America Neo Banking Market Trends:

Increasing Adoption of Digital-Only Banking Services

In Latin America, digital-only neo banks are seeing a significant rise in adoption due to their cost-effective models and ability to offer tailored services to digitally savvy consumers. These platforms, which operate entirely online without physical branches, are increasingly preferred by users who seek convenience, lower fees, and modern banking experiences. Moreover, with expanding internet access and smartphone penetration, these banks are meeting the needs of unbanked and underbanked populations by offering essential services like savings, loans, and payments. For instance, as per industry reports, in 2024, Chile recorded 96.1% of internet penetration, which represents heightened internet usage across the region. Additionally, the growing demand for personalized financial products and the desire for seamless, 24/7 access to banking services have propelled this shift. As more consumers turn to digital-first banking solutions, traditional banks are under pressure to innovate and match the flexibility and user-centric approach provided by neo banks. Furthermore, this trend towards digital-only platforms is expected to continue reshaping the financial landscape in Latin America, enhancing accessibility and competition within the sector.

Expansion of Digital Payment Solutions

As e-commerce and digital transactions expand rapidly in Latin America, neo banks are increasingly integrating advanced digital payment solutions to capture a larger share of the market. With a rising preference for cashless transactions, neo banks are developing and enhancing features such as contactless payments, QR code-based payments, and peer-to-peer (P2P) transfers, enabling seamless, secure financial interactions. In addition, this trend is particularly evident in countries like Brazil and Mexico, where the digital payment ecosystem is growing rapidly. For instance, according to industry reports, approximately 34% of Brazilian consumers are expected to integrate digital wallets for identity verification within the next three years. Neo banks are also tapping into cross-border e-commerce by offering competitive exchange rates and low transaction fees, facilitating international payments for consumers and businesses. By positioning themselves as reliable digital payment facilitators, neo banks are meeting the growing demand for fast, secure, and flexible transaction options. Furthermore, as digital payments become an integral part of daily life, neo banks are expected to further expand their roles in driving financial inclusion and enhancing customer experiences across Latin America.

Latin America Neo Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on account type and application.

Account Type Insights:

To get detailed segment analysis of this market Request Sample

- Business Account

- Savings Account

The report has provided a detailed breakup and analysis of the market based on the account type. This includes business account and savings account.

Application Insights:

- Enterprises

- Personal

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes enterprises, personal, and others.

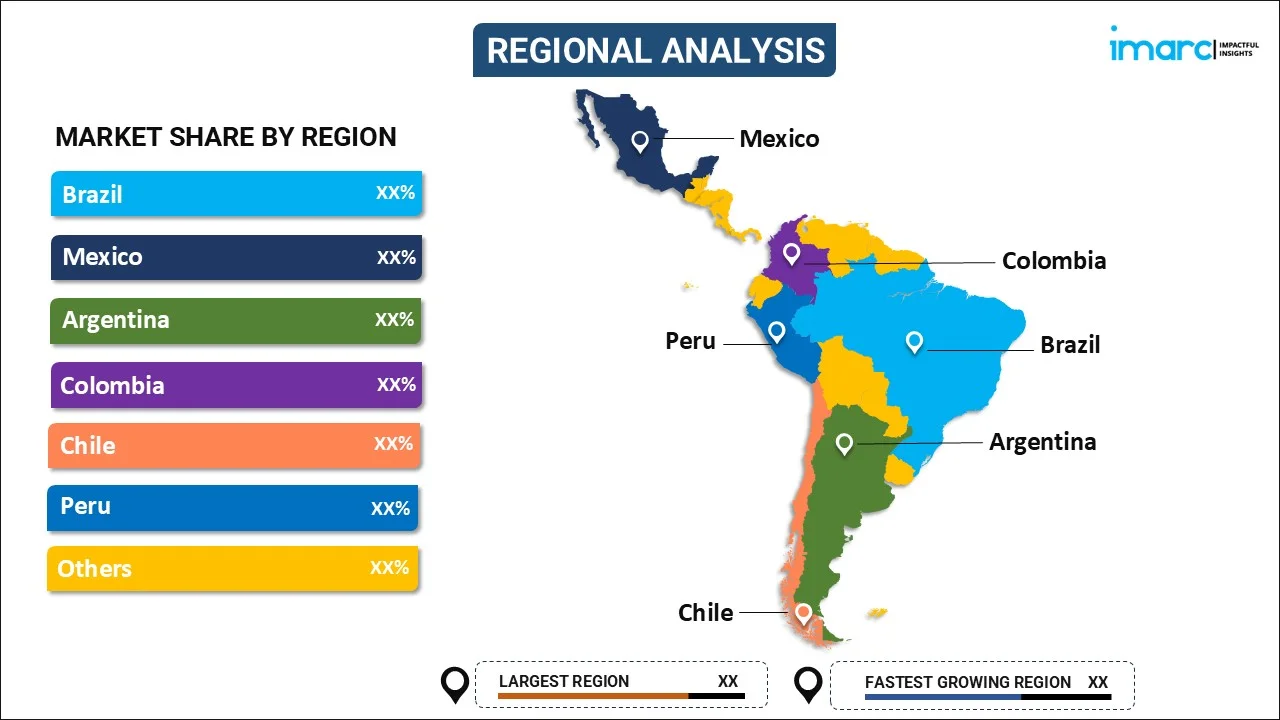

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Neo Banking Market News:

- In February 2025, Brazil's Pix announced the launch of Pix Automatico in June 2025, which enables 150 Million users to automate recurring payments like streaming and utility bills. This feature is expected to unlock USD 30 Billion in e-commerce transactions and expand Pix's reach to the unbanked.

- In October 2024, Aleph acquired a controlling interest in Localpayment, a notable payment service provider in Latin America. This acquisition combines digital advertising with local payment solutions, enabling Aleph to process billions in payments and expand its presence across 130+ countries and 640+ payment methods.

Latin America Neo Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Account Types Covered | Business Account, Savings Account |

| Applications Covered | Enterprises, Personal, Others |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America neo banking market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America neo banking market on the basis of account type?

- What is the breakup of the Latin America neo banking market on the basis of application?

- What is the breakup of the Latin America neo banking market on the basis of region?

- What are the various stages in the value chain of the Latin America neo banking market?

- What are the key driving factors and challenges in the Latin America neo banking market?

- What is the structure of the Latin America neo banking market and who are the key players?

- What is the degree of competition in the Latin America neo banking market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America neo banking market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America neo banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America neo banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)