Latin America Mobile Commerce Market Size, Share, Trends and Forecast by Transaction Type, Payment Mode, Type of User, and Country, 2025-2033

Latin America Mobile Commerce Market Overview:

The Latin America mobile commerce market size reached USD 110.26 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 848.51 Billion by 2033, exhibiting a growth rate (CAGR) of 25.45% during 2025-2033. Key factors that are driving the market include the rising reliance on smartphones, a high number of internet users, a shift to digital payments, and increasing social media influence across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 110.26 Billion |

| Market Forecast in 2033 | USD 848.51 Billion |

| Market Growth Rate (2025-2033) | 25.45% |

Latin America Mobile Commerce Market Trends:

Rising Adoption of Smartphones

As per recent industry reports, shipments in Latin America’s smartphone market increased 20% to 33.5 million units in the second quarter of 2024. As more individuals are purchasing smartphones, they are increasingly accessing information and products online. A wide range of smartphone models at different price points makes it easier for individuals to own devices. The availability of affordable smartphones helps bridge the urban-rural divide, allowing individuals in rural areas to engage in mobile commerce. Smartphones provide user-friendly interfaces and applications, making it easier for users to browse products, compare prices, and make purchases. Mobile devices equipped with features, such as touch screens, voice recognition, and augmented reality (AR), aid in enhancing the shopping experience. In addition, smartphones make it easier for businesses to interact with customers and advertise on social media sites. This integration encourages impulse buying and immediate transactions. Smartphones make it simple for users to exchange reviews and experiences, which influences decisions to buy goods and increases consumer confidence. Online shopping is becoming more common as individuals can purchase anytime and anywhere even during breaks, commutes, and vacations. Furthermore, smartphone users can make use of a variety of digital payment options such as mobile wallets, favoring the Latin America mobile commerce market growth.

Increasing Number of Internet Users

According to the World Bank Group, around 94% of the population in Chile have internet access in 2023. The wide availability of affordable data plans in Latin America is playing a pivotal role in facilitating mobile commerce. Improving internet access in both urban and rural areas on account of the growth of broadband networks, which include fiber-optic cables and wireless technologies including fourth generation (4G) and fifth generation (5G) is favoring the market expansion. Furthermore, faster internet connections shorten the time it takes for websites and apps to load, which makes buying easier and promotes mobile commerce. The introduction of competitive pricing among telecom providers is leading to more affordable data plans, making it easier for individuals to access the internet on their mobile devices. Therefore, this is further positively influencing the Latin America mobile commerce market share. Various data plans including prepaid options and family packages provide users with choices that suit their usage patterns and financial capabilities. Enhanced internet connectivity enables users to stream videos, browse social media, and access digital content more easily, leading to an increase in consumer engagement with brands and products. Apart from this, with faster internet and better connectivity, businesses can implement responsive web designs that enhance user experiences, making it easier for consumers to navigate through mobile commerce sites and apps. Reliable internet access also allows businesses to push real time promotions and discounts directly to consumers’ mobile devices.

Social Media Influence

According to the recent industry reports, Facebook accounts for 49.3% and YouTube holds 10.56% in July 2024 in Latin America. Social media platforms allow businesses to reach consumers directly and showcase their products. Through visually appealing content and targeted ads, these platforms engage users, leading to significant traffic to mobile commerce sites. With features such as shoppable posts, stories, and integrated checkout options, the platform allows for a seamless purchasing experience. Also, algorithms analyze the behavior of users to serve them personalized ads and thus increase the chance of converting. This also allows users to easily interact with brands and discover new products without leaving their social media feeds. Thus, the integration of algorithms is creating a positive Latin America mobile commerce market outlook.

Latin America Mobile Commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on transaction type, payment mode, and type of user.

Transaction Type Insights:

.webp)

- M-Retailing

- M-Ticketing

- M-Building

- Others

The report has provided a detailed breakup and analysis of the market based on the transaction type. This includes m-retailing, m-ticketing, m-building, and others.

Payment Mode Insights:

- Near Field Communication (NFC)

- Premium SMS

- Wireless Application Protocol (WAP)

- Others

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes near field communication (NFC), premium SMS, wireless application protocol (WAP), and others.

Type of User Insights:

- Smart Device Users

- Feature Phone Users

The report has provided a detailed breakup and analysis of the market based on the type of user. This includes smart device users and feature phone users.

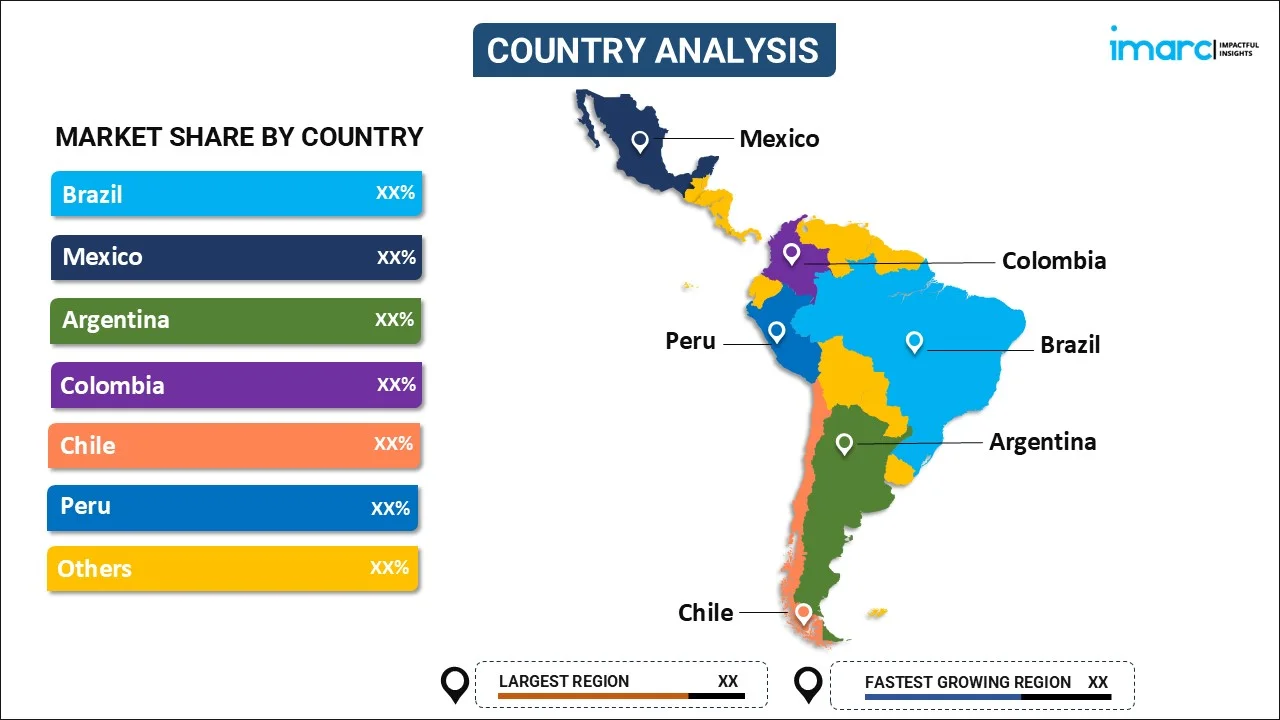

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Mobile Commerce Market News:

- February 04, 2025: Moove successfully acquired Kovi, a Brazilian company, to enhance its presence in the mobile commerce sector across Latin America, thereby bolstering its vehicle financing services tailored for gig economy drivers. Supported by Uber, Moove and Kovi achieved a revenue of USD 275 Million in 2024, operating a fleet of 36,000 vehicles. This acquisition combines Moove's international expertise with Kovi's established local network, thereby improving mobility solutions within the region.

Latin America Mobile Commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transaction Types Covered | Transaction Types Covered M-Retailing, M-Ticketing, M-Building, Others |

| Payment Modes Covered | Near Field Communication (NFC), Premium SMS, Wireless Application Protocol (WAP), Others |

| Type of Users Covered | Smart Device Users, Feature Phone Users |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America mobile commerce market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America mobile commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America mobile commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile commerce market in Latin America was valued at USD 110.26 Billion in 2024.

The Latin America mobile commerce market is projected to exhibit a CAGR of 25.45% during 2025-2033, reaching a value of USD 848.51 Billion by 2033.

The market is driven by growing smartphone usage, increased mobile internet access, and a shift in consumer behavior toward digital transactions. Urbanization and rising digital literacy encourage mobile shopping. Additionally, improvements in mobile app interfaces and payment security are enhancing user experience, making mobile commerce a preferred choice for both consumers and retailers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)