Latin America Medical Gases & Equipment Market Report by Product (Medical Gases, Medical Gas Equipment), End User (Hospitals, Ambulatory Care, and Others), and Country 2026-2034

Market Overview:

Latin America medical gases & equipment market size reached USD 1.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2034, exhibiting a growth rate (CAGR) of 8.05% during 2026-2034. The growing number of surgical procedures, both elective and emergency, which enhances the demand for medical gases & equipment in operating rooms and recovery settings, is primarily driving the regional market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.4 Billion |

|

Market Forecast in 2034

|

USD 2.8 Billion |

| Market Growth Rate 2026-2034 | 8.05% |

Access the full market insights report Request Sample

Medical gases & equipment play a vital role in healthcare, providing essential support for various medical procedures and patient care. These gases, such as oxygen, nitrous oxide, and medical air, are administered to patients for respiratory therapy, anesthesia, and diagnostic purposes. The equipment associated with medical gases includes regulators, flow meters, and delivery systems tailored to specific medical applications. Oxygen concentrators, ventilators, and anesthesia machines are crucial components in ensuring patients receive the appropriate gas concentrations during treatments. Medical gases & equipment are integral in emergencies, surgery, and critical care, contributing to the maintenance of proper physiological functions. Stringent safety standards and regulatory guidelines govern the production, handling, and administration of medical gases to ensure patient well-being and the effectiveness of medical interventions. The continuous advancement of technology and adherence to quality control standards further enhance the reliability and precision of medical gas delivery systems in healthcare settings.

Latin America Medical Gases & Equipment Market Trends:

The medical gases & equipment market in Latin America is witnessing robust growth, primarily driven by the escalating demand for advanced healthcare services. Furthermore, the increasing prevalence of chronic diseases necessitates the utilization of medical gases and equipment, fostering market expansion. Additionally, the rising geriatric population, often afflicted by respiratory ailments, propels the need for respiratory therapies and supplementary medical gases. In tandem with this, technological advancements in medical gas delivery systems and equipment contribute significantly to market acceleration. Moreover, the ongoing emphasis on healthcare infrastructure development bolsters the adoption of medical gases and equipment. The burgeoning awareness regarding the importance of infection control measures in medical settings amplifies the utilization of medical gases, further fueling market growth. In addition, stringent regulatory standards mandating the use of certified and safe medical gases propel market dynamics. The synergistic effect of these drivers creates a conducive environment for the sustained growth of the medical gases & equipment market in Latin America, as it becomes an indispensable component of modern healthcare systems.

Latin America Medical Gases & Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country level for 2026-2034. Our report has categorized the market based on product and end user.

Product Insights:

To get detailed segment analysis of this market Request Sample

- Medical Gases

- Pure Medical Gases

- Medical Gas Mixtures

- Biological Atmosphere

- Medical Gas Equipment

- Compressors

- Cylinders

- Hose Assemblies Valves

- Masks

- Vacuum Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes medical gases (pure medical gases, medical gas mixtures, and biological atmosphere), and medical gas equipment (compressors, cylinders, hose assemblies valves, masks, vacuum systems, and others).

End User Insights:

- Hospitals

- Ambulatory Care

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, ambulatory care, and others.

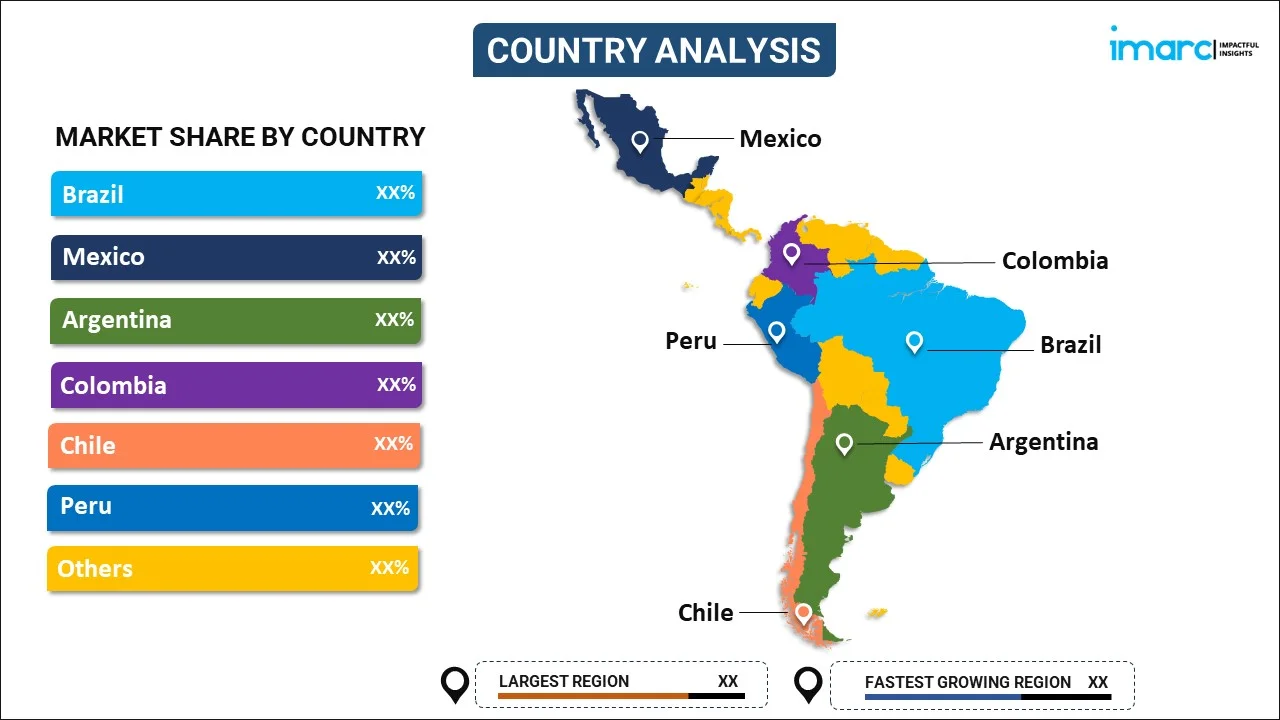

Country Insights:

To get detailed regional analysis of this market Request Sample

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Medical Gases & Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Users Covered | Hospitals, Ambulatory Care, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America medical gases & equipment market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Latin America medical gases & equipment market?

- What is the breakup of the Latin America medical gases & equipment market on the basis of product?

- What is the breakup of the Latin America medical gases & equipment market on the basis of end user?

- What are the various stages in the value chain of the Latin America medical gases & equipment market?

- What are the key driving factors and challenges in the Latin America medical gases & equipment?

- What is the structure of the Latin America medical gases & equipment market and who are the key players?

- What is the degree of competition in the Latin America medical gases & equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America medical gases & equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America medical gases & equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America medical gases & equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)