Latin America Last Mile Delivery Market Size, Share, Trends and Forecast by Delivery Mode, Application, Destination, Service Type, Vehicle Type, Mode of Operation, and Region, 2025-2033

Latin America Last Mile Delivery Market Overview:

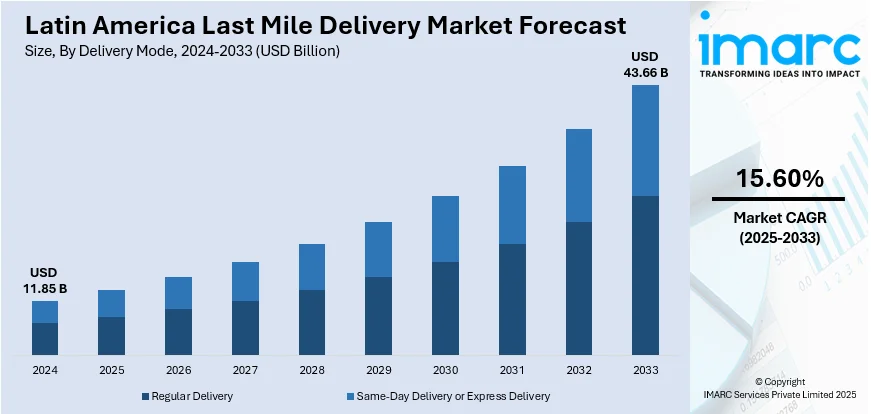

The Latin America last mile delivery market size reached USD 11.85 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.66 Billion by 2033, exhibiting a growth rate (CAGR) of 15.60% during 2025-2033. The rapid e-commerce growth, increasing urbanization, rising consumer demand for fast and flexible deliveries, advancements in logistics technology, expansion of same-day and next-day delivery services, and the proliferation of digital payment and tracking systems are some of the major factors positively impacting the Latin America last mile delivery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.85 Billion |

| Market Forecast in 2033 | USD 43.66 Billion |

| Market Growth Rate (2025-2033) | 15.60% |

Latin America Last Mile Delivery Market Trends:

Increased Investment in Logistics

The rise in logistics technology investments is positively influencing the Latin America last-mile delivery market outlook. According to Brazilian’s National Logistics Plan 2035, the latest national transport planning initiative, the national logistics plan (NLP) 2025, created by the Brazilian Enterprise for planning and logistics (EPL) focused solely on freight transport, covering land and water transport modes. NLP 2025 indicated that passenger and air transport would be analyzed in subsequent studies, which are being addressed in NLP 2035. Moreover, technologies like route optimization, automated warehousing, and real-time tracking are being widely adopted, allowing companies to address the region's unique logistical challenges, such as difficult terrain, urban congestion, and varying infrastructure quality. Along with this, route optimization tools minimize delivery times by identifying the most efficient routes, while automated warehouses streamline sorting and dispatching, leading to faster order processing. Besides, real-time tracking improves customer transparency, enabling end-users to monitor deliveries and fostering greater trust in delivery services. These advancements increase the reliability and speed of last-mile logistics, meeting growing consumer demand for rapid delivery. This tech-driven transformation is a cornerstone in the region’s last-mile market, enabling companies to scale operations and expand their reach across Latin America.

Supportive Government Initiatives in Infrastructure

The governments are actively investing in infrastructure improvements that directly support Latin America last-mile delivery market growth. According to the government of Brazil, the Pro Trilhos program was launched to update regulations and encourage private sector involvements in constructing and operating railways and terminals. Since its inception, Pro Trilhos has expanded to 15 states, with 27 agreements signed for new railway installations nationwide. The program is anticipated to bring an investment of R$ 133.24 Billion for these projects, adding approximately 10,000 kilometers of track to Brazil's rail network, which aims to reduce carbon emissions and improve the efficiency of commodity transport. It ultimately eases transport for last-mile delivery services. In Mexico and other nations, infrastructure investments target critical areas like highways, bridges, and rural accessibility, which are essential for efficient distribution. These initiatives reduce transit times, cut down operational costs, and make deliveries more reliable, especially in remote or underserved regions by boosting connectivity. As infrastructure continues to improve, last-mile logistics is set to grow, driven by government-backed improvements that enhance delivery capabilities across Latin America.

Latin America Last Mile Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on delivery mode, application, destination, service type, vehicle type, and mode of operation.

Delivery Mode Insights:

- Regular Delivery

- Same-Day Delivery or Express Delivery

The report has provided a detailed breakup and analysis of the market based on the delivery mode. This includes regular delivery, same day delivery or express delivery.

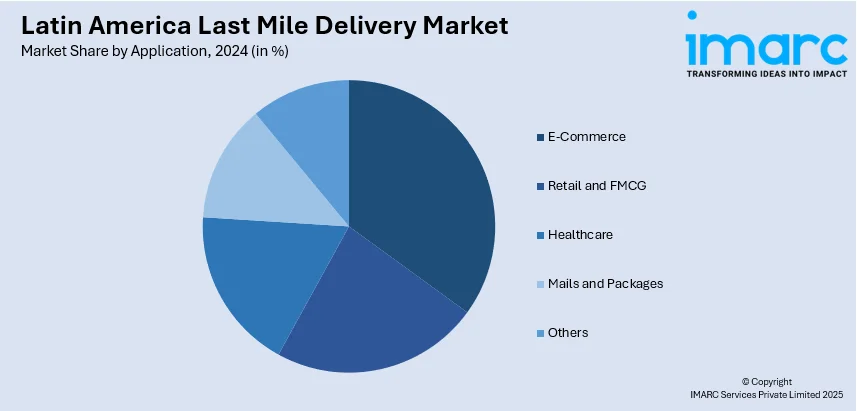

Application Insights:

- E-Commerce

- Retail and FMCG

- Healthcare

- Mails and Packages

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes e-commerce, retail and FMCG, healthcare, mails and packages, and others.

Destination Insights:

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

Service Type Insights:

- Business-To-Business (B2B)

- Business-To-Consumer (B2C)

- Customer-To-Customer (C2C)

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes business-to-business (B2B), business-to-consumer (B2C), and customer-to-customer (C2C)

Vehicle Type Insights:

- Motorcycle

- LCV

- HCV

- Drones

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes motorcycle, LCV, HCV, and drones.

Mode of Operation Insights:

- Non-autonomous

- Autonomous

A detailed breakup and analysis of the market based on the mode of operation have also been provided in the report. This includes non-autonomous and autonomous.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others,

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Last Mile Delivery Market News:

- On June 2023, Toyota Tsusho Corporation (Toyota Tsusho) disclosed its investment of approximately 3 Million USD in MOOVA Inc. (MOOVA) as the leading contributor in a 5 Million USD funding round in June 2023. MOOVA operates a digital platform that enhances last-mile delivery logistics in the Latin American region.

- On July 2024, Chazki, a Peruvian technology company known for its e-commerce and retail transportation and delivery services, declared its merger with Lok, a Mexican startup that specializes in developing a major network of smart lockers throughout Latin America. This strategic partnership is designed to position Chazki as the top logistics provider in the region and to increase its market share in Mexico threefold within the next two years.

Latin America Last Mile Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Delivery Modes Covered | Regular Delivery, Same-Day Delivery or Express Delivery |

| Applications Covered | E-Commerce, Retail and FMCG, Healthcare, Mails and Packages, Others |

| Destinations Covered | Domestic, International |

| Service Types Covered | Business-To-Business (B2B), Business-To-Consumer (B2C), Customer-To-Customer (C2C) |

| Vehicle Types Covered | Motorcycle, LCV, HCV, Drones |

| Mode of Operations Covered | Non-autonomous, Autonomous |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America last mile delivery market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America last mile delivery market on the basis of delivery mode?

- What is the breakup of the Latin America last mile delivery market on the basis of application?

- What is the breakup of the Latin America last mile delivery market on the basis of destination?

- What is the breakup of the Latin America last mile delivery market on the basis of service type?

- What is the breakup of the Latin America last mile delivery market on the basis of vehicle type?

- What is the breakup of the Latin America last mile delivery market on the basis of mode of operation?

- What is the breakup of the Latin America last mile delivery market on the basis of region?

- What are the various stages in the value chain of the Latin America last mile delivery market?

- What are the key driving factors and challenges in the Latin America last mile delivery market?

- What is the structure of the Latin America last mile delivery market and who are the key players?

- What is the degree of competition in the Latin America last mile delivery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America last mile delivery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America last mile delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America last mile delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)