Latin America Hypodermic Syringes and Needles Market Size, Share, Trends and Forecast by Product, End Use, and Country, 2026-2034

Latin America Hypodermic Syringes and Needles Market Overview:

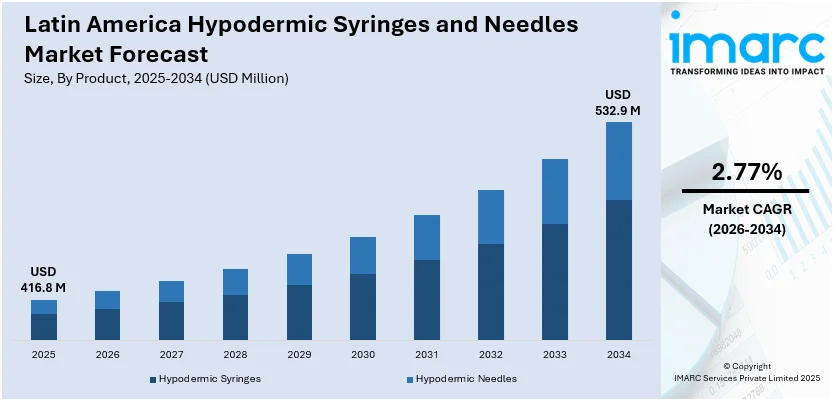

The Latin America hypodermic syringes and needles market size reached USD 416.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 532.9 Million by 2034, exhibiting a growth rate (CAGR) of 2.77% during 2026-2034. The expanding vaccination programs, increasing prevalence of chronic diseases, growing healthcare infrastructure, government initiatives for safe injection practices, technological advancements in needle design, and rising awareness about needlestick injury prevention are some of the major factors positively impacting the Latin America hypodermic syringes and needles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 416.8 Million |

| Market Forecast in 2034 | USD 532.9 Million |

| Market Growth Rate 2026-2034 | 2.77% |

Latin America Hypodermic Syringes and Needles Market Trends:

Increased Focus on Immunization and Vaccination Programs

The extensive government-led immunization and vaccination initiatives are facilitating the Latin America hypodermic syringes and needles market growth. According to an industry report, the purchase of influenza vaccines from Argentine suppliers will increase from 1.2 million to over 4 million doses by 2025, which further will improve regional access and cost efficiency. Also, Argentina's National Ministry of Health and the Pan American Health Organization (PAHO) convened to advance efforts to ensure access to safe, affordable medicines and health technologies. The increasing public health campaigns aimed at combating infectious diseases, such as influenza and COVID-19, lead to a high demand for reliable, high-quality syringes and needles. The growing emphasis on preventive healthcare bolsters the requirement for syringes and needles, thereby reinforcing market stability and fostering partnerships with global medical supply manufacturers to ensure the continuous distribution of essential medical products.

To get more information on this market Request Sample

Increased Government Spending on Healthcare

The rising government investments in healthcare infrastructure are positively influencing the Latin American hypodermic needles and syringes market outlook. Enhanced public health funding supports broader access to medical supplies, including syringes and needles, essential for routine medical procedures and vaccination drives. Governments across the Countryare prioritizing the modernization of healthcare systems, aiming to improve patient care and meet growing demand. According to the International Trade Administration (ITA) report, in 2024, the Brazil aeromedical trade mission aims to connect U.S. suppliers with Brazil's growing aeromedical sector, fostering new and existing relationships. Additionally, the Brazilian government has allocated USD 40 million for aeromedical goods and services, offering U.S. companies valuable public procurement opportunities. This increased expenditure has led to strengthened partnerships with medical device manufacturers to ensure a steady supply of quality products, fostering market growth and stability.

Increased Focus on Sustainability and Eco-Friendly Solutions

An important market trend for hypodermic syringes and needles market in Latin America is the increased focus on sustainability. With increasing awareness of environmental issues, healthcare organizations, and manufacturers are prioritizing eco-friendly materials and practices. According to industry reports, in 2024, Latin America established the Environmental Alliance of America, which hosts the region's first eco-labeling program. It is supported by the UN Environment Programme (UNEP) and funded by Germany. This initiative aims to promote sustainable trade and empower over 450 million people with better-informed consumer choices. The program provides clear, reliable information on the environmental impact of products, strengthening the connection between producers and consumers. This growing focus on sustainability results in the development of biodegradable and recyclable syringes and needles, which help reduce medical waste and environmental harm. Additionally, regulatory bodies are actively encouraging the adoption of greener technologies in manufacturing processes. As a result, market participants are investing in research and development to create innovative, sustainable solutions, contributing to a more eco-conscious healthcare system.

Latin America Hypodermic Syringes and Needles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product and end use.

Product Insights:

- Hypodermic Syringes

- Conventional Syringes

- Safety Syringes

- Retractable Safety Syringes

- Non-retractable Safety Syringes

- Hypodermic Needles

- Conventional Needles

- Safety Needles

The report has provided a detailed breakup and analysis of the market based on the product. This includes hypodermic syringes (conventional syringes and safety syringes [retractable safety syringes and nonretractable safety syringes]) and hypodermic needles (conventional needles and safety needles).

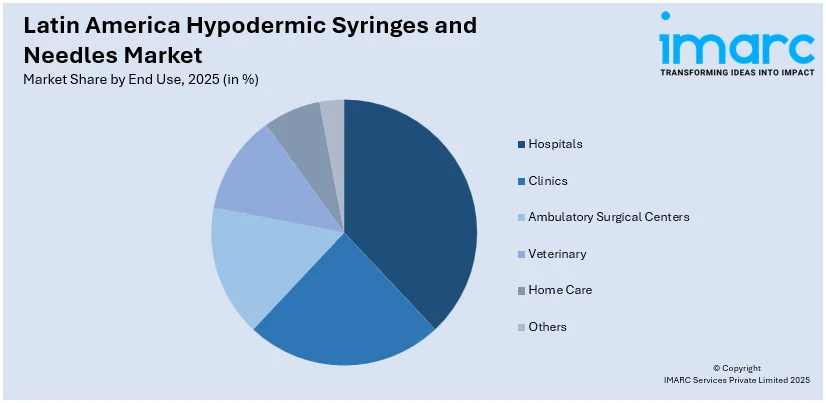

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Veterinary

- Home Care

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hospitals, clinics, ambulatory surgical centers, veterinary, home care and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Hypodermic Syringes and Needles Market News:

- September 2024: The FDA has approved B. Braun Medical's Introcan Safety 2 Deep Access IV Catheter, extending the catheter's dwell length to roughly 5.7 days as opposed to the typical long catheter's 3.8 days. This innovative catheter reduces blood exposure and cleanup with its multi-access blood control and automatic passive needlestick protection. It is intended for individuals with challenging vascular access.

- August 28, 2024: The Brazilian Secretariat of International Trade (SECEX) initiated an antidumping investigation into imports of hypodermic needles from China. The investigation, prompted by Becton Dickinson Indústrias Cirúrgicas Ltda., focuses on products under NCM code 9018.32.19, with an alleged dumping margin of 16.93 USD/kg (261.7%). Stakeholders were invited to participate by September 17, 2024.

Latin America Hypodermic Syringes and Needles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Uses Covered | Hospitals, Clinics, Ambulatory Surgical Centers, Veterinary, Home Care, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America hypodermic syringes and needles market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America hypodermic syringes and needles market on the basis of product?

- What is the breakup of the Latin America hypodermic syringes and needles market on the basis of end use?

- What is the breakup of the Latin America hypodermic syringes and needles market on the basis of country?

- What are the various stages in the value chain of the Latin America hypodermic syringes and needles market?

- What are the key driving factors and challenges in the Latin America hypodermic syringes and needles market?

- What is the structure of the Latin America hypodermic syringes and needles market and who are the key players?

- What is the degree of competition in the Latin America hypodermic syringes and needles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America hypodermic syringes and needles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America hypodermic syringes and needles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America hypodermic syringes and needles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)