Latin America Generic Drug Market Report by Segment (Unbranded Generics, Branded Generics), Therapy Area (Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, and Others), Drug Delivery (Oral, Injectables, Dermal/Topical, Inhalers), Distribution Channel (Retail Pharmacies, Hospital Pharmacies), and Country 2025-2033

Latin America Generic Drug Market Size:

The Latin America generic drug market size reached USD 37.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 64.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.94% during 2025-2033. The market is presently experiencing growth because of local production of drugs, prevalence of chronic diseases, healthcare policies and favorable government initiatives, and the growing awareness among people, along with the ease of availability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 37.2 Billion |

|

Market Forecast in 2033

|

USD 64.2 Billion |

| Market Growth Rate 2025-2033 | 5.94% |

Latin America Generic Drug Market Analysis:

- Major Market Drivers: The growing prevalence of chronic diseases, along with favorable healthcare policies and governmental support, is stimulating the growth of the market.

- Key Market Trends: The focus of the industry investors to produce medicines locally and meet domestic requirements represents one of the major market trends.

- Competitive Landscape: Some of the key market players in the Latin America generic drug industry are also provided in the report.

- Challenges and Opportunities: The regulatory complexity is impacting the overall growth of the market. Nonetheless, the expansion of the healthcare coverage is projected to overcome these hindrances and offer lucrative growth opportunities.

Latin America Generic Drug Market Trends:

Rising Focus on Local Production of Medicines

The need for affordable treatment options has encouraged local as well as foreign pharmaceutical companies to financially support the production of generic drugs in the Latin America region. This has not only helped in reducing costs, but also in improving efficiency of supply chain and ensuring a steady availability of essential drugs to reduce chronic diseases in the country. According to the World Bank Organization’s research paper ‘Pharmaceuticals in Latin America and the Caribbean’ [January 2022 edition], majority of the countries in the Latin American region produce and export pharmaceutical products. Mexico and Uruguay have a strengthened pharmaceutical industry that meets 42-46% of the domestic demand for medicine. This is followed by Brazil and Argentina, which meets around 35% of the internal demand.

Healthcare Policies and Government Support

With the rising burden of non-communicable diseases, governing agencies in the region are prioritizing the inclusion of generic drugs in formularies used by public health programs. This policy shift is intended to manage and control the spiraling healthcare costs associated with long-term chronic disease management. By prioritizing generics, health authorities are able to stretch limited healthcare budgets for covering larger populations and a wider array of health services, thereby improving the overall health outcomes of their communities. This policy-driven demand for generics is crucial in shaping market strategies of pharmaceutical companies, focusing on volume-driven growth through expanded access and affordability. For instance, in February 2024, the Institute of Drug Technology (Farmanguinhos) partnered with the Brazilian unit of the German pharmaceutical company Boehringer Ingelheim in Rio de Janeiro for obtaining registration of a generic product of Jardiance®, empagliflozin 10 mg and 25 mg, with the Brazilian Health Regulatory Agency (Anvisa). This drug will help in reducing the risk of cardiovascular deaths and slowing down loss of kidney function.

Awareness and Ease of Availability

With the increasing awareness among individuals about the associated benefits of generic drugs like reliability and cost-effectiveness, there is a rise in the sales of generic drugs across the Latin American region. It is also because of the growing focus on preventive healthcare facilities in the region. Moreover, key players are focusing on offering better healthcare services to people suffering from different disorders. Sanofi, for example, streamlined its Consumer Healthcare portfolio in Latin America by accepting an agreement with HYPERA S.A. (Hypera Pharma) on 13 July 2021 for the divestiture of 8 brands that are commercialized in the region. This agreement also includes four prescription products from the General Medicine portfolio.

The Growing Prevalence of Chronic Diseases Across the Region

Latin American region is at the moment witnessing a rise in the prevalence of chronic disorders, which include hypertension, diabetes and cardiovascular diseases (CVDs). This can be mainly accredited to the rapid urbanization, unhealthy diet, sedentary lifestyle and the aging population. The prevalence of these diseases has contributed to the overall need for medications, which burdens both public and private healthcare systems. The demand for generic drugs, as a result, is rising in the region because these drugs offer cost-effective alternative to branded medications that are relatively expensive and cater long-term and sustainable treatment options. This, along with equitable access to essential medicines, is also the reason why governing agencies are supporting generic drugs in the region.

Latin America Generic Drug Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on segment, therapy area, drug delivery, and distribution channel.

Breakup by Segment:

- Unbranded Generics

- Branded Generics

Branded generics account for the majority of the Latin America generic drug market share

The report has provided a detailed breakup and analysis of the market based on the segment. This includes unbranded generics and branded generics. According to the report, branded generics represented the largest segment.

Branded generics can be marketed how branded drugs are, however, they are relatively affordable. These generic drugs attach proprietary names to generic drug molecules, whereas ordinary generic drugs are usually known by their chemical name. Apart from this, it becomes very problematic for a person to remember the generic names of medications as there are many medications which are available in combinations, therefore the companies have given a brand name that can be easily remembered to avoid confusion. Besides this, branded generic medications undergo through the same Food and Drug Administration (FDA) approval process like other generics.

Breakup by Therapy Area:

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

Central nervous system holds the largest share of the industry

A detailed breakup and analysis of the market based on the therapy area have also been provided in the report. This includes central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others. According to the report, central nervous system accounted for the largest market share.

The central nervous system (CNS) is responsible for receiving, processing, and responding to sensory information. It is made up of the brain and spinal cord and is referred to as the processing center of the body. It communicates with various body parts by delivering and receiving impulses or messages. It is situated inside the dorsal (back) body cavity and encompasses the inside of the head and the back of the trunk. It also aids in controlling a person's body temperature, respiration, heart rate, and the release of certain hormones. Inadequate care for the central nervous system can also result in twitching in the muscles, memory loss, headaches, seizures, and loss of consciousness. Additionally, a variety of treatments, including surgery, supportive care, rehabilitation, and diverse generic medications are used to treat CNS conditions.

Breakup by Drug Delivery:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

Oral represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the drug delivery. This includes oral, injectables, dermal/topical, and inhalers. According to the report, oral represented the largest segment.

Oral form of drugs include capsules, tablets, liquids, and chewable. These medications are a preferred choice, driven by their ease of use and convenience. Pills or liquids taken by mouth are usually easier to administer and do not require any professional assistance as compared to injections or other routes. Besides this, oral medications can be less expensive than other formulations, such as injectables, which require sterile manufacturing processes. Furthermore, rising preferences for oral medications over other forms due to their non-invasiveness route of administration is propelling the Latin America generic drug market growth.

Breakup by Distribution Channel:

- Retail Pharmacies

- Hospital Pharmacies

Retail pharmacies exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail pharmacies and hospital pharmacies. According to the report, retail pharmacies accounted for the largest market share.

Retail pharmacies facilitate access to a wide range of generic drugs to patients suffering from various diseases. The specialists in such stores also offer advice that relates to specific health issues and various other factors affecting patients. They provide drugs to individuals as prescribed by their physicians. In addition, the stores also deal with over-the-counter (OTC) products and other health-related drugs. Owing to these factors, retail pharmacies are fundamental in healthcare because they ensure easy access to drugs, a broad spectrum of drugs, and additional health-related services. Moreover, existing trends which exhibit an increased preference for convenience have catalyzed the Latin America generic drug demand for generic drugs in such stores. As per the Euromonitor International, between 2020 and 2023, the number of pharmacy outlets in Latin America grew by 7%, showcasing 14,598 new stores in just three years.

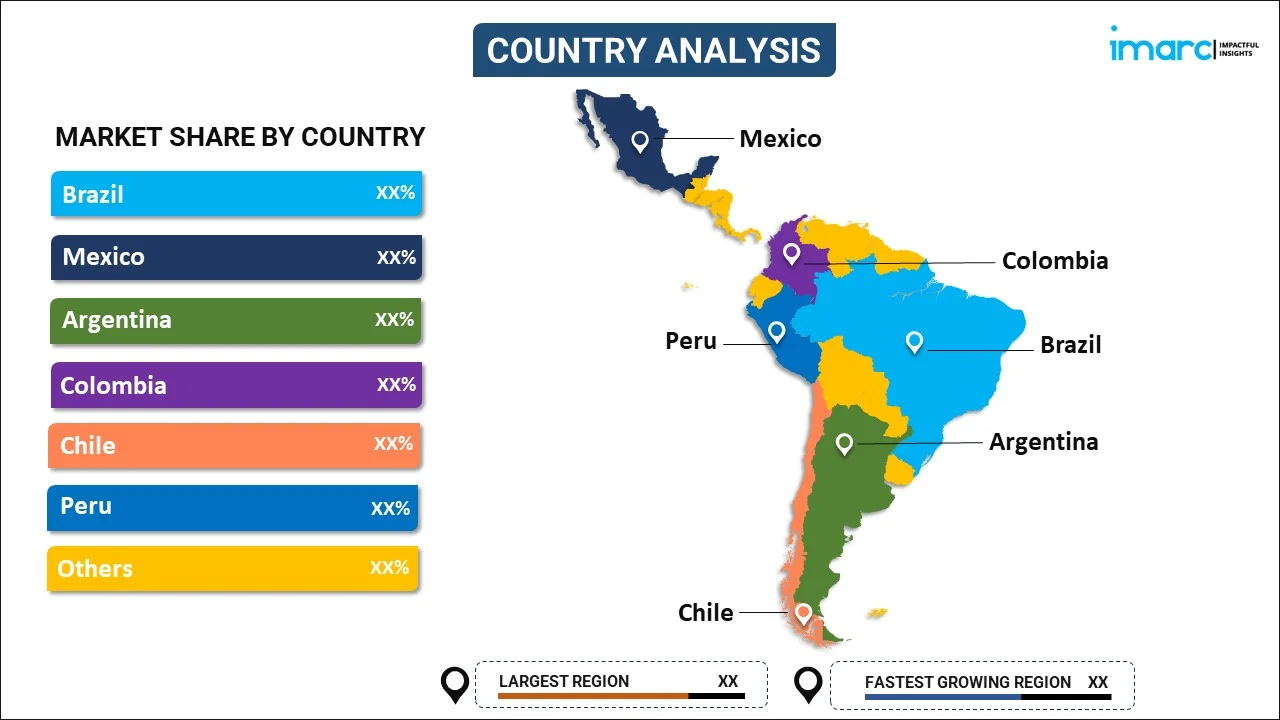

Breakup by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major markets in the country, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others. According to the report, Brazil was the largest market for generic drug in the Latin America.

Brazil is the main market share holder in the generic drugs market, driven by the growing number of chronic disease patients. Additionally, government initiatives to enhance drug approvals, trials, and their application are further bolstering the market growth. On 5 March, Brazil’s Fundação Oswaldo Cruz (Fiocruz), a national public health foundation, unveiled an agreement with Boehringer Ingelheim that would allow Fiocruz to manufacture and market generic empagliflozin, a diabetes drug, to be used in Brazil's public health system.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- Key players in the market are focusing on improving drugs efficacy and cost-efficiency. They are introducing generic drugs with enhanced performance for various disease types among individuals, thereby increasing Latin America generic drug market revenue. In line with this, they are engaging in partnerships, collaborations, and mergers and acquisitions (M&As) with governing authorities to expand the reach of their products. On 17 October 2023, the Pan American Health Organization (PAHO) and the International Agency for Research on Cancer (IARC) launched the first edition of the Latin America and the Caribbean Code Against Cancer. The new Code, which forms part of the World Code Against Cancer, helps in lowering the burden of cancer in the region by providing recommendations based on the most recent scientific evidence.

Latin America Generic Drug Market News:

- 29 March 2021: Biocon Pharma partnered with Brazil’s Libbs Farmaceutica to launch generic drugs in Latin America. This partnership, which marks the entry of Biocon’s generic formulations into Latin America, builds upon a successful association with Libbs.

Latin America Generic Drug Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Latin America Generic Drug Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Unbranded Generics, Branded Generics |

| Therapy Areas Covered | Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, Others |

| Drug Deliveries Covered | Oral, Injectables, Dermal/Topical, Inhalers |

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America generic drug market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Latin America generic drug market?

- What is the breakup of the Latin America generic drug market on the basis of segment?

- What is the breakup of the Latin America generic drug market on the basis of therapy area?

- What is the breakup of the Latin America generic drug market on the basis of drug delivery?

- What is the breakup of the Latin America generic drug market on the basis of distribution channel?

- What are the various stages in the value chain of the Latin America generic drug market?

- What are the key driving factors and challenges in the Latin America generic drug market?

- What is the structure of the Latin America generic drug market, and who are the key players?

- What is the degree of competition in the Latin America generic drug market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America generic drug market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America generic drug market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America generic drug industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)