Latin America Digital Remittance Market Size, Share, Trends and Forecast by Type, Channel, End Use, and Country, 2025-2033

Latin America Digital Remittance Market Overview:

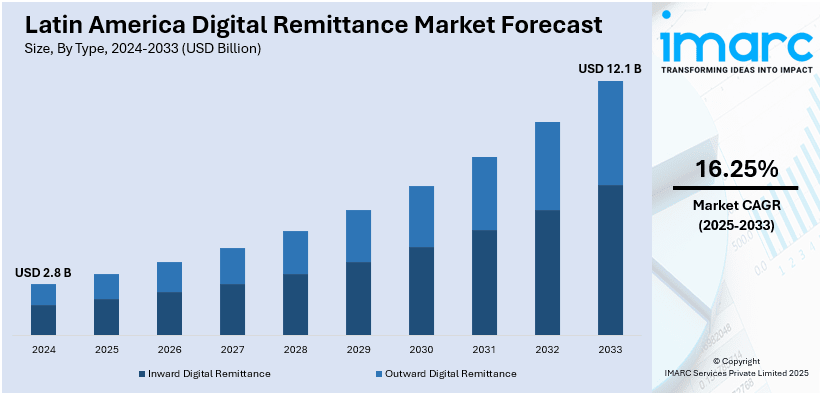

The Latin America digital remittance market size reached USD 2.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.1 Billion by 2033, exhibiting a growth rate (CAGR) of 16.25% during 2025-2033. The rising smartphone penetration, increasing internet access, growing migration patterns, lower transaction costs, high speed, and convenience of usage of digital platforms attracting users, government initiatives for financial inclusion, and improved mobile banking infrastructure are some of the factors propelling the market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 12.1 Billion |

| Market Growth Rate 2025-2033 | 16.25% |

Latin America Digital Remittance Market Trends:

Rising Smartphone Penetration and Internet Access

With increasing smartphone usage and improved internet connectivity, more individuals in Latin America have access to digital platforms. According to industry reports, there were 187.9 million internet users in Brazil in January 2024. Brazil’s internet penetration rate stood at 86.6 percent of the total population at the start of 2024. In line with this, there were 39.79 million internet users in Argentina at the start of 2023, when internet penetration stood at 87.2%. Moreover, there were 5.55 million internet users in Paraguay at the start of 2023, when internet penetration stood at 81.4%. This expanded access allows users to send and receive remittances easily through mobile apps, enhancing convenience and speed. The proliferation of affordable smartphones, combined with broader internet availability, is enabling previously unbanked populations to participate in the digital remittance space, contributing significantly to the market's growth.

Government Initiatives and Financial Inclusion

Governments in Latin America are actively promoting digital financial inclusion by encouraging the use of digital payment systems and remittances. Policies aimed at reducing cash dependency and fostering financial education have led to the growth of digital remittances. Additionally, central banks and regulatory bodies are implementing frameworks that ensure safe and secure digital transactions, which increases trust in these platforms. For instance, in November 2023, BS2, the first Brazilian digital bank specialized in companies, launched a unique solution that allowed companies and individuals to have access to international payments and receipts in real time from Brazil to abroad and vice versa, BS2 Easy Pay.

Latin America Digital Remittance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, channel, and end use.

Type Insights:

- Inward Digital Remittance

- Outward Digital Remittance

The report has provided a detailed breakup and analysis of the market based on the type. This includes inward digital remittance and outward digital remittance.

Channel Insights:

- Bank Transfer

- Money Transfer Operators

- Online Platforms

- Others

A detailed breakup and analysis of the market based on the channel have also been provided in the report. This includes bank transfer, money transfer operators, online platforms, and others.

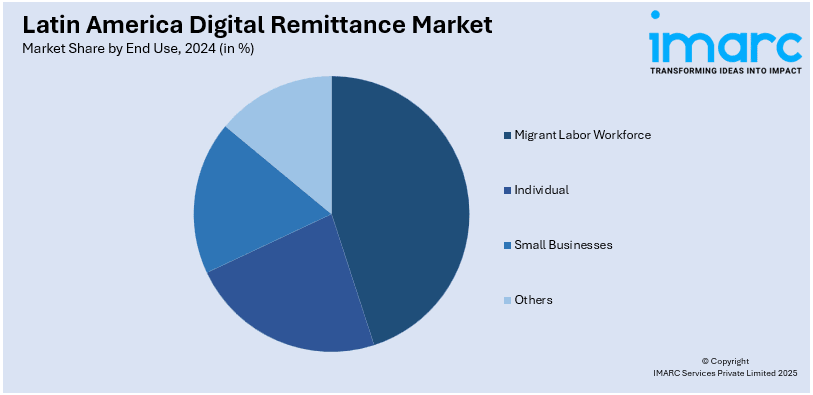

End Use Insights:

- Migrant Labor Workforce

- Individual

- Small Businesses

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes migrant labor workforce, individual, small businesses, and others.

Country Insights:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Digital Remittance Market News:

- In October 2023, TerraPay, a global cross-border payments network, and Nequi by Bancolombia, a digital financial platform with customers in Colombia, announced their partnership to transform remittances for Nequi’s customers. This partnership enabled Colombians to receive remittances from their relatives and friends in over 200 countries using only one connection.

- In February 2024, Ebury, a FinTech company specializing in transactions for SMEs, announced the expansion of its partnership with Nium, a real-time global payments provider, to offer global remittance service in Brazil. Collaboratively, Nium and Ebury intend to enable businesses to send or receive fast, reliable, and affordable cross-border payments to and from Brazil. This builds on the duo’s existing partnership in Europe, in which London-based FinTech Ebury leverages Nium’s global payments infrastructure to send international supplier and payroll payments around the world.

- In April 2024, FastSpring, a prominent merchant of record for international SaaS and software firms, has partnered with EBANX, a global technology company focused on payment solutions for emerging markets. This collaboration aims to improve the payment experience for users within FastSpring's product offerings in Latin America by integrating the local payment method, Pix. It is anticipated that by 2026, Pix will represent 40% of the overall value of digital commerce in Brazil, sharing equal market share with credit cards..

Latin America Digital Remittance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Inward Digital Remittance, Outward Digital Remittance |

| Channels Covered | Bank Transfer, Money Transfer Operators, Online Platforms, Others |

| End Uses Covered | Migrant Labor Workforce, Individual, Small Businesses, Others |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America digital remittance market performed so far and how will it perform in the coming years?

- What is the breakup of the Latin America digital remittance market on the basis of type?

- What is the breakup of the Latin America digital remittance market on the basis of channel?

- What is the breakup of the Latin America digital remittance market on the basis of end use?

- What is the breakup of the Latin America digital remittance market on the basis of country?

- What are the various stages in the value chain of the Latin America digital remittance market?

- What are the key driving factors and challenges in the Latin America digital remittance market?

- What is the structure of the Latin America digital remittance market and who are the key players?

- What is the degree of competition in the Latin America digital remittance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America digital remittance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America digital remittance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America digital remittance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)