Latin America Biodiesel Market Size, Share, Trends and Forecast by Feedstock, Application, Type, Production Technology, and Country, 2025-2033

Latin America Biodiesel Market Size and Share:

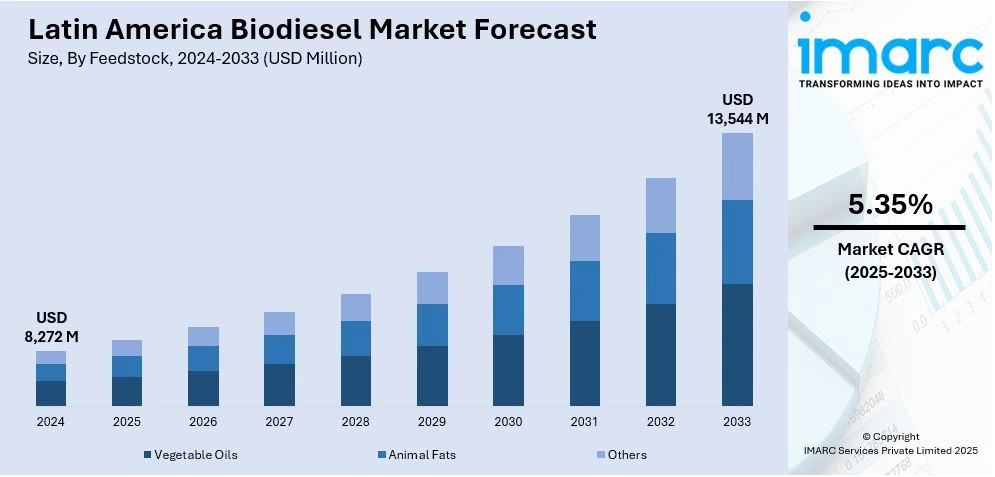

The Latin America biodiesel market size was valued at USD 8,272 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 13,544 Million by 2033, exhibiting a CAGR of 5.35% from 2025-2033. Brazil currently dominates the overall market, driven by strong government mandates for renewable energy use, growing environmental awareness, and increasing demand for sustainable fuels in transportation. Brazil’s leadership, supported by its established production infrastructure and feedstock availability, positions the region as a key player in biodiesel innovation and expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8,272 Million |

|

Market Forecast in 2033

|

USD 13,544 Million |

| Market Growth Rate (2025-2033) | 5.35% |

Consumers and companies looking for alternatives to conventional diesel are driving the market in Latin America due to the rising need for greener fuels. Moreover, biofuels are being prioritized by several industries, including transportation and agriculture, to minimize carbon emissions and air pollution as environmental consciousness grows. In line with this, cleaner-burning fuels are in high demand as a result of biodiesel's inclusion in national fuel requirements in nations like Brazil. As per the International Energy Agency (IEA), the demand for biofuel is expected to increase by 23% globally, reaching 200 Billion liters by 2028. In addition, renewable diesel and ethanol account for two-thirds of this trend, with emerging Latin American countries playing a major role in the growth and consumption.

Advances in feedstock availability and production technologies are also propelling the Latin American biodiesel sector. The region's agricultural sector plays a crucial role, with an abundance of feedstocks like soybeans, sugarcane, and palm oil available for biodiesel production. Countries like Argentina and Brazil are optimizing their biodiesel output by utilizing these abundant resources, improving production efficiency and cost-effectiveness. Furthermore, the use of waste oils and fats as feedstock is gaining traction, reducing reliance on primary crops and enhancing the sustainability of biodiesel production. This trend promotes the circular economy model, encouraging the repurposing of waste into valuable biofuels.

Latin America Biodiesel Market Trends:

Government Support for Renewable Energy Initiatives

Government plays a crucial role in favoring the renewable energy sector by allowing large-scale sustainable energy projects and promoting innovation. Also, they create the foundation for clean energy developments through policies, incentives, funding, etc. For instance, in October 2024, Avalon BioEnergy launched a USD 380 Million Agriculture-Sustainable Aviation Fuel (SAF) biorefinery in Uruguay, with government backing. Concurrently, this facility establishes Uruguay as a clean energy leader in the region by combining green hydrogen, biodiesel, and sustainable farming methods. Such government-backed programs lower carbon emissions, draw investments, generate employment, etc., and promote the expansion of environmentally benign energy sources. Ultimately, they aid in the world's shift from fossil fuels to sustainable energy systems.

Rising Shift Towards Reducing Fossil Fuel Dependence

The global shift towards reducing fossil fuel dependence is accelerating the transition to cleaner, renewable energy sources, particularly biodiesel, which offers a sustainable alternative to conventional fuels. This transition is increasingly urgent as countries seek to meet climate goals and reduce environmental harm. Bolivia’s launch of its first biodiesel plant in March 2024 exemplifies this trend. With a production capacity of 1,500 b/d, the plant utilizes oil seeds, palm oil, and recycled cooking oil to produce biodiesel. This helps Bolivia reduce its reliance on imported crude oil, strengthen energy security, and lower its carbon footprint. By investing in biodiesel, Bolivia enhances its role in Latin America’s biodiesel market, contributing to global efforts to curb fossil fuel dependence.

Expansion of Biodiesel Production Capacities

Expanding biodiesel production capacities is necessary to meet the growing demand for renewable energy, especially as more industries and governments prioritize sustainability. Increasing production capacity ensures a reliable and continuous supply of biodiesel, a renewable replacement for fossil fuels. Congruent with these trends, in July 2024, BASF expanded its sodium methylate production capacity to 90,000 tons annually at its facility in Guaratinguetá, Brazil. This expansion reflects BASF's commitment to the South American biodiesel market and addresses the region's increasing demand for sustainable energy solutions. They also boost further technological advancements, making biodiesel more convenient and efficient. Such investments are crucial for decreasing environmental impact, supporting long-term growth in biodiesel production, and promoting a cleaner energy mix.

Latin America Biodiesel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the biodiesel market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on feedstock, application, type, and production technology.

Analysis by Feedstock:

- Vegetable Oils

- Animal Fats

- Others

Vegetable oils held the largest Latin America biodiesel market share, driven by the region's large-scale production and availability of feedstocks like soybean, palm, and sunflower oils. Brazil, as the largest producer of biodiesel in Latin America, uses soybean oil as a primary feedstock, adding over 65% of the country’s biodiesel production. The dominance of vegetable oils is further supported by government policies such as the National Biodiesel Program, which promotes the use of locally sourced vegetable oils for the production of biodiesel. As per industry reports, soybean oil remains the dominant feedstock in Brazil's biodiesel production, with over 5.1 Million cubic meters consumed in 2023. In contrast, approximately 441 thousand cubic meters of bovine fat were used, emphasizing the crucial role of vegetable oils in driving the growth and sustainability of the region’s biodiesel sector.

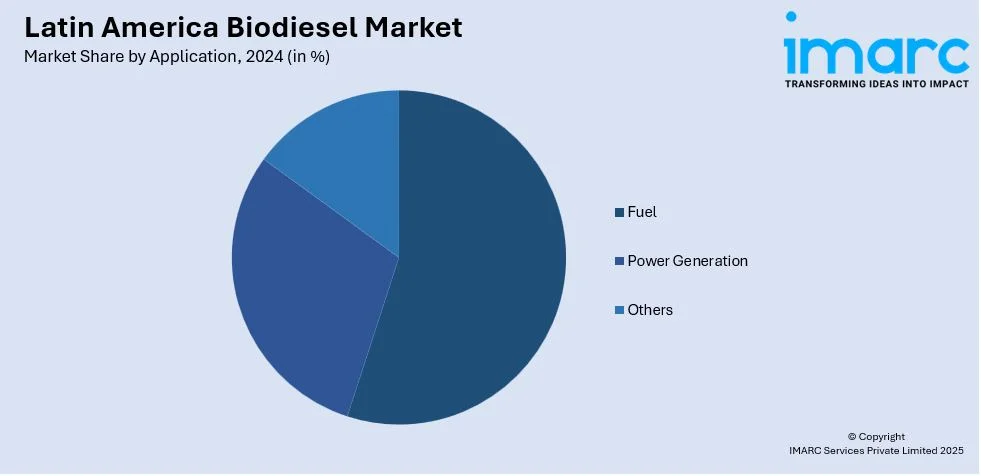

Analysis by Application:

- Fuel

- Power Generation

- Others

Fuel dominates the overall market, driven by strong regional policies and a push towards cleaner energy sources. Brazil, the largest producer and consumer of biodiesel in the region, plays a central role with its National Program for the Production and Use of Biodiesel (PNPB), which has significantly increased the mandatory biodiesel blending rate. Brazil raised the biodiesel blend to 14%, and plans are in place to increase this further by 15%. The growing demand for renewable fuels in the transportation sector, supported by government initiatives, drives the segment’s growth. This move aligns with Latin America's commitment to lowering carbon emissions and increasing security of energy.

Analysis by Type:

- B100

- B20

- B10

- B5

B20, a mix of 20% biodiesel and 80% conventional diesel, leads the market, primarily driven by Brazil’s extensive use of this blend in its transportation sector. Brazil, the largest producer of biodiesel in the region, has integrated B20 as the standard for commercial vehicles under its National Program for the Production and Use of Biodiesel (PNPB). The widespread adoption of B20 is supported by Brazil’s dedication to decreasing greenhouse gas emissions and its reliance on renewable energy sources. Additionally, the economic benefits of using domestically produced biodiesel over imported fossil fuels further contribute to B20’s market dominance in the region.

Analysis by Production Technology:

- Conventional Alcohol Trans-esterification

- Pyrolysis

- Hydro Heating

Conventional alcohol trans-esterification witnesses the highest Latin America biodiesel market demand, driven by its well-established process for producing biodiesel from vegetable oils or animal fats. This method, involving the reaction of alcohol with oils to produce glycerol and biodiesel, remains the most common and cost-effective production route in the region. Brazil, a major player, relies on this process to produce biodiesel for the transportation sector under its National Program for the Production and Use of Biodiesel (PNPB). The simplicity, scalability, and established infrastructure for conventional alcohol trans-esterification have made it the preferred method for large-scale biodiesel production, ensuring its market dominance.

Analysis by Country:

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

Brazil held the largest Latin American biodiesel market size, driven by its significant investments in renewable energy and government incentives for biofuel use. Also, it leverages abundant agricultural resources such as palm oil, soybeans, and animal fats. Its advanced ethanol infrastructure enables efficient biodiesel blending, supporting widespread adoption in Mexico. Moreover, Argentina follows closely, benefiting from vast soybean cultivation and strong export potential. At the same time, Colombia and Peru are expanding biodiesel output through palm oil initiatives, whereas Chile concentrates on alternative feedstocks and sustainability goals. Meanwhile, other nations in the region are also investing more in renewable fuels due to energy diversification initiatives and carbon reduction targets. Concurrently, these countries support the expanding biodiesel market in the region, thereby setting Latin America's position as a pioneer in biofuels.

Competitive Landscape:

Key producers like Brazil, Argentina, and Mexico influence the competitive environment of the Latin America biodiesel market forecast, with Brazil controlling the highest market share. Businesses are focusing on expanding production capacity and improving feedstock efficiency. Also, key participants are examining new technologies to reduce production costs and enhance the quality of biodiesel. This competitive environment encourages innovation, market expansion, and greater regional collaboration in the years to come.

The report provides a comprehensive analysis of the competitive landscape in the biodiesel market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: Bolivia's Biodiesel Plant II, "Heroes de Senkata," reached 84% physical progress. This initiative will help the biodiesel industry in Latin America by lowering diesel imports, generating over 1,300 jobs, and assisting Bolivia in its energy transformation with a daily production capacity of 1,500 barrels.

- October 2024: Brazil's Grupo Potencial announced a USD 109 Million investment to build the world's largest soy-based biodiesel plant in Paraná, boosting annual production from 900 million liters to 1.62 billion liters. This expansion aligns with Brazil’s renewable energy goals and strengthens its leadership in the Latin American region, positively impacting production capacity and meeting increasing industry demand.

- September 2024: Avalon BioEnergy introduced a USD 380 Million biorefinery in Uruguay for agriculture-sustainable aviation fuel. The project lowers emissions and advances sustainable energy options by combining the production of green hydrogen and biodiesel. This development improves Latin America's standing in the global market for low-carbon fuels.

- July 2024: Grupo Potencial announced a BRL 200 Million investment to build two biofuel pipelines in southern Brazil. The 55km pipelines will transport biodiesel and ethanol, enhancing distribution capacity.

- March 2024: The Olfar Group made a major contribution to the growth of the biodiesel sector in South America by exporting its first cargo of biodiesel made from soybean oil to Taiwan, this contribution strengthens the region's presence in the biodiesel trade.

Latin America Biodiesel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstocks Covered | Vegetable Oils, Animal Fats, Others |

| Applications Covered | Fuel, Power Generation, Others |

| Types Covered | B100, B20, B10, B5 |

| Production Technologies Covered | Conventional Alcohol Trans-esterification, Pyrolysis, Hydro Heating |

| Countries Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America biodiesel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Latin America biodiesel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America biodiesel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biodiesel market in the region was valued at USD 8,272 Million in 2024.

Key drivers of the biodiesel market include government mandates and incentives promoting renewable energy, increasing demand for sustainable fuel alternatives, advancements in biodiesel production technologies, and rising awareness of environmental issues. Additionally, the growing need for energy independence and reductions in greenhouse gas emissions further fuel market growth.

The biodiesel market is projected to exhibit a CAGR of 5.35% during 2025-2033, reaching a value of USD 13,544 Million by 2033.

Vegetable oils accounted for the largest Latin American biodiesel market share, supported by the region’s abundant production of key feedstocks such as palm and sunflower oils.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)