Latin America Automotive Air Filter Market Report by Type (Air Intake Filters, Cabin Air Filters), Propulsion (ICE and Hybrid Vehicles, Electric Vehicles), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), Sales Channel (Original Equipment Manufacturer (OEM), Aftermarket), and Region 2026-2034

Latin America Automotive Air Filter Market Overview:

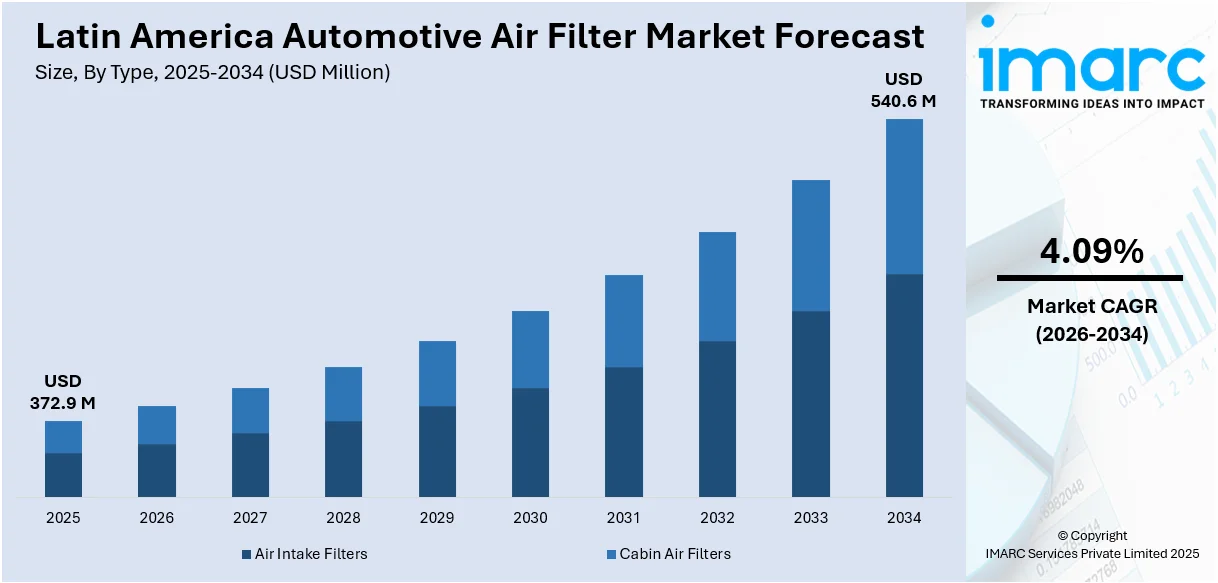

The Latin America automotive air filter market size reached USD 372.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 540.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.09% during 2026-2034. The rising vehicle production, increased awareness of air quality and health, stringent emission regulations, expanding aftermarket demand, and growing consumer preference for efficient vehicle maintenance to improve performance and fuel efficiency are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 372.9 Million |

|

Market Forecast in 2034

|

USD 540.6 Million |

| Market Growth Rate 2026-2034 | 4.09% |

Latin America Automotive Air Filter Market Trends:

Rising vehicle production:

The increasing production of vehicles across Latin America is a significant driver of the automotive air filter market. Brazil, Mexico, and Argentina are key players in the region's automotive industry, with large-scale manufacturing facilities catering to both domestic and international markets. As vehicle production grows, so does the demand for automotive components, including air filters. Both passenger and commercial vehicles require efficient air filtration systems to maintain engine health and performance. With a rise in disposable incomes and urbanization, the market for automobiles is expanding, further bolstering the need for air filters. Additionally, the shift towards electric vehicles (EVs) is also presenting lucrative opportunities for market expansion, as EVs still require cabin air filters for passenger comfort.

To get more information on this market Request Sample

Stringent emission regulations:

Stringent emission regulations implemented by governments across Latin America are propelling the demand for advanced air filtration systems. Countries like Brazil and Mexico have adopted emission standards similar to those in Europe and North America to reduce vehicular emissions and improve air quality. These regulations require vehicles to be equipped with air filters that can effectively trap pollutants and reduce harmful emissions. Automakers and consumers are increasingly opting for high-performance filters that meet these regulatory standards, ensuring that vehicles comply with environmental norms. The shift towards reducing greenhouse gas (GHG) emissions, along with increasing focus on sustainability, is bolstering the demand for more efficient air filters that contribute to cleaner engine operation.

Increasing consumer awareness about air quality and health:

The demand for car air filters, especially cabin air filters, is rising as consumers become more conscious of the health and air quality implications. Air filtration in cars is becoming increasingly important as consumers become more aware of the negative health effects of pollution. As more people look for cleaner air while driving, the demand for cabin air filters which enhance the quality of air inside the car by removing pollutants, allergens, and particulate matter has heightened, creating a positive outlook for market expansion. This trend is especially pronounced in urban areas with higher pollution levels, where consumers are looking for ways to protect themselves from harmful airborne contaminants.

Latin America Automotive Air Filter Market News:

- In November 2023, Tecfil, Brazil’s largest automotive filter manufacturer, launched the world’s first sustainable lignin-based automotive filter, EcoLigna, in North America. Compared to traditional filters, this novel filter performs 15% better and has a paper medium that reduces CO2 emissions by 20%. The company aims to offer superior, eco-friendly products at competitive prices, reinforcing its global leadership in the filter industry.

Latin America Automotive Air Filter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, propulsion, vehicle type, and sales channel.

Type Insights:

- Air Intake Filters

- Cabin Air Filters

The report has provided a detailed breakup and analysis of the market based on the type. This includes air intake filters and cabin air filters.

Propulsion Insights:

- ICE and Hybrid Vehicles

- Electric Vehicles

A detailed breakup and analysis of the market based on the propulsion have also been provided in the report. This includes ICE and hybrid vehicles and electric vehicles.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, and heavy commercial vehicles.

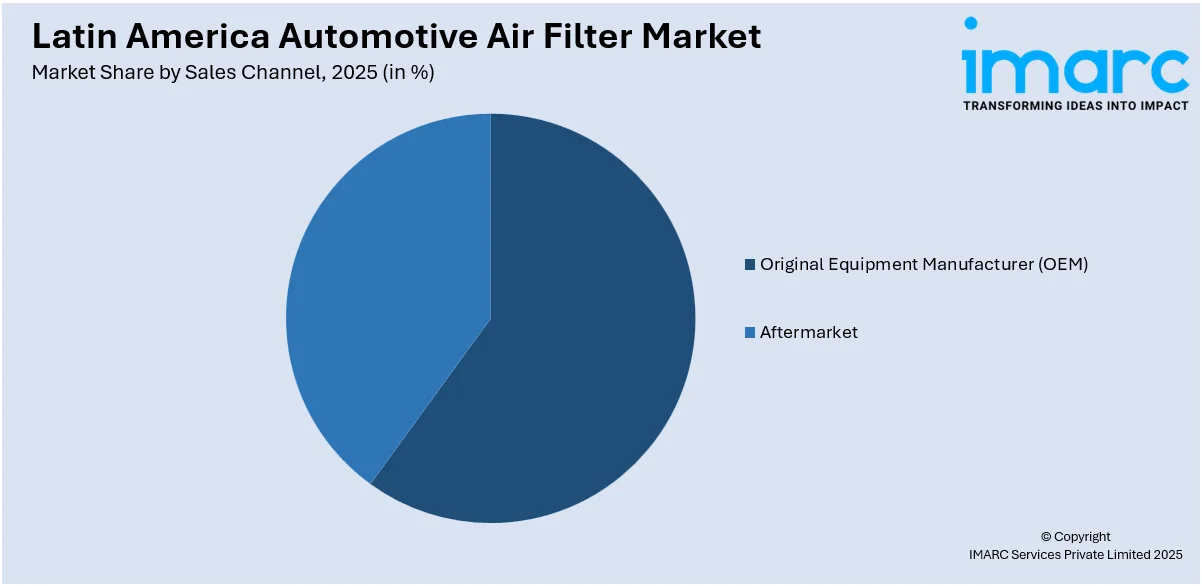

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Original Equipment Manufacturer (OEM)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes original equipment manufacturer (OEM) and aftermarket.

Regional Insights:

- Brazil

- Mexico

- Argentina

- Columbia

- Chile

- Peru

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Brazil, Mexico, Argentina, Columbia, Chile, Peru, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latin America Automotive Air Filter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air Intake Filters, Cabin Air Filters |

| Propulsions Covered | ICE and Hybrid Vehicles, Electric Vehicles |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Sales Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Regions Covered | Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Latin America automotive air filter market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Latin America automotive air filter market?

- What is the breakup of the Latin America automotive air filter market on the basis of type?

- What is the breakup of the Latin America automotive air filter market on the basis of propulsion?

- What is the breakup of the Latin America automotive air filter market on the basis of vehicle type?

- What is the breakup of the Latin America automotive air filter market on the basis of sales channel?

- What are the various stages in the value chain of the Latin America automotive air filter market?

- What are the key driving factors and challenges in the Latin America automotive air filter?

- What is the structure of the Latin America automotive air filter market and who are the key players?

- What is the degree of competition in the Latin America automotive air filter market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Latin America automotive air filter market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Latin America automotive air filter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Latin America automotive air filter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)