Lassi Market in India Size, Share, Trends and Forecast by Sales Channel and State, 2025-2033

Lassi Market in India Size and Share:

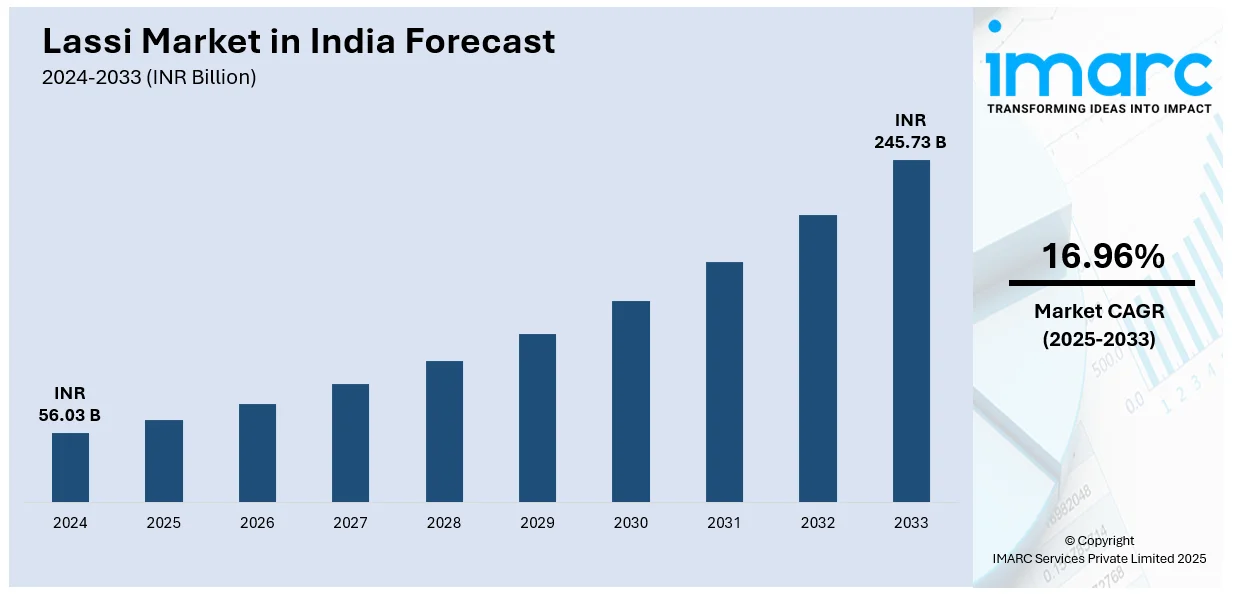

The lassi market in India market size was valued at INR 56.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach INR 245.73 Billion by 2033, exhibiting a CAGR of 16.96% from 2025-2033. The market is witnessing stable expansion, driven by increasing consumer preference for traditional and nutritious beverages. Rising health awareness, expanding retail presence, and product innovations, including flavored and packaged variants, contribute to market expansion. Growing urbanization and demand for convenience further boost industry prospects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | INR 56.03 Billion |

| Market Forecast in 2033 | INR 245.73 Billion |

| Market Growth Rate (2025-2033) | 16.96% |

The growing health consciousness among Indian consumers is a key driver for the lassi market, as it is widely recognized for its probiotic properties and digestive benefits. With an increasing preference for natural and nutritious beverages, lassi is gaining traction as a healthier alternative to carbonated and sugary drinks. Rising disposable incomes and urbanization have further contributed to the demand for packaged and ready-to-drink lassi, making it a convenient option for busy lifestyles. For instance, as per industry reports, urbanization is proliferating in India, with 35% to 37% of the population found to be dwelling in urban areas in 2024. Additionally, the influence of Ayurveda and traditional Indian dietary habits continues to reinforce the popularity of lassi as a staple beverage across different consumer demographics.

To get more information on this market, Request Sample

Expanding e-commerce channels are further propelling the growth of the Indian lassi market. The presence of lassi in supermarkets, hypermarkets, and convenience stores has increased accessibility, while the rise of online grocery platforms and quick-commerce apps has boosted sales. For instance, IMARC Group indicates that online grocery segment in India is anticipated to reach around USD 96.3 Billion by the year 2033. Additionally, aggressive marketing and branding strategies by dairy companies are enhancing consumer awareness and driving higher adoption. Innovations in packaging, such as single-serve and eco-friendly options, are making lassi more appealing to urban consumers. The introduction of flavored, fortified, and organic variants is also fueling market expansion, as brands cater to evolving consumer preferences and demand for premium, value-added dairy products.

Lassi Market in India Trends:

Rising Demand for Packaged and Flavored Lassi

The Indian lassi market is currently experiencing a notable inclination towards packaged varieties from conventional homemade consumption mainly because of transforming customer choices and heightening urbanization. Customers are currently preferring ready-to-drink lassi offered in convenient packaging, typically impacted by magnifying disposable incomes and busy lifestyles. For instance, as per industry reports, per capita disposable income in India is anticipated to reach around INR 2.14 Lakhs during the time period 2023 to 2024. Moreover, the data revealed that disposable income elevated by 8% in FY2024. Apart from this, prominent firms are actively launching high-end and unique flavors, mainly including cardamom, mango, or rose to cater to the taste of younger population. In addition to this, the robust requirement for organic as well as preservative-free lassi is significantly fueling, as health-conscious user are navigating for nutritious and natural beverage options. This trend is further incentivizing manufacturers to actively emphasize on value-added and premium offerings.

Expansion of Organized Retail and Online Distribution

The magnifying presence of both e-commerce websites and modern retail formats is substantially impacting the Indian lassi market. For instance, as per industry reports, the e-commerce future prospects is depicting strong landscape, with growth rate estimated to be 185 through the year 2025. In line with this, India is set to emerge as third biggest consumer sector worldwide by 2030. Moreover, convenience stores, supermarkets, and hypermarkets are offering better availability as well as visibility to branded products of lassi. In addition to this, quick-commerce applications and online grocery platforms are making it convenient for customers to procure lassi from the comfort of their homes. This rapid inclination in distribution channels is facilitating several companies to proliferate their foothold beyond metro cities to tier 2 and 3 markets. In addition to this, firms are also increasingly utilizing digital marketing strategies to endorse their products and boost engagement with health-conscious customers.

Increasing Popularity of Functional and Health-Focused Lassi

With growing awareness of digestive health and immunity, consumers are seeking functional dairy beverages, including probiotic and fortified lassi. Manufacturers are launching variants enriched with probiotics, added vitamins, and reduced sugar content to cater to health-conscious buyers. For instance, as per industry reports, in August 2024, Amul launched its new high-protein dairy portfolio to address the transforming dietary demands. This product line also involves high-protein lassi with 15 grams of protein incorporated in a pack of 200ml. Additionally, the demand for lactose-free and plant-based alternatives is emerging, driven by dietary preferences and health concerns. Brands are investing in research and development to enhance nutritional value while maintaining the authentic taste of traditional lassi. This focus on health benefits is expected to further accelerate market growth in the coming years.

Lassi Market in India Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the lassi market in India market, along with forecasts at the country and state levels from 2025-2033. The market has been categorized based on sales channel.

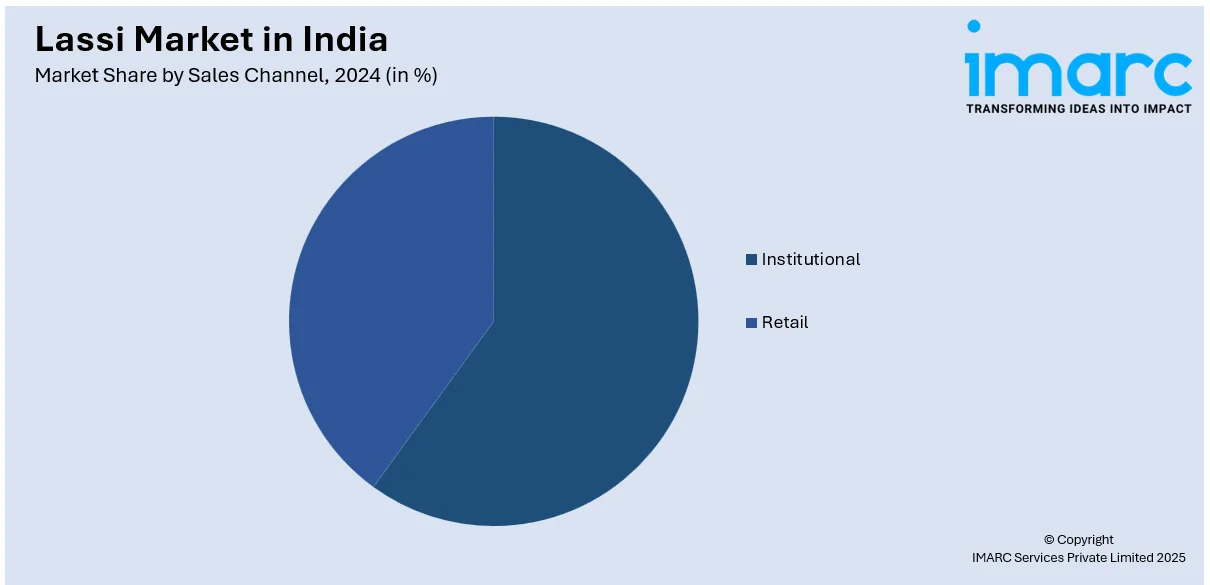

Analysis by Sales Channel:

- Institutional

- Retail

The retail segment holds the largest market share in the Indian lassi market by sales channel, boosted by robust customer need for packaged dairy beverages. The rapid proliferation of modern retail formats, encompassing convenience stores, supermarkets, and hypermarkets, has substantially bolstered both product availability and visibility. In addition to this, the rapid emergence of e-commerce grocery and quick commerce platforms has significantly fortified retail sales, providing customers comprehensive range of packaged lassi varieties and ease of use. Furthermore, organized retail chains are currently making heavy investments in cold chain framework to sustain their product freshness, guaranteeing stable quality. The intense promotional tactics by leading industry firms, combined with notable inclination towards ready-to-drink dairy beverages amongst urban customers, facilitates the boosting of retail sales. Amplifying disposable incomes and transforming dietary habits toward functional dairy products are further fostering market proliferation through retail channels.

State Analysis:

- Maharashtra

- Uttar Pradesh

- Andhra Pradesh and Telangana

- Tamil Nadu

- Gujarat

- Rajasthan

- Karnataka

- Madhya Pradesh

- West Bengal

- Bihar

- Delhi

- Kerala

- Punjab

- Orissa

- Haryana

The Indian lassi market shows a major presence of Maharashtra due to its big urban population along with changing consumer choice direction toward dairy beverages. For instance, as per industry reports, 45.22% of the total population across Maharashtra dwell in urban areas. Furthermore, packaged and flavored lassi demand has risen in Mumbai and Pune and other major Maharashtra cities because people maintain hectic schedules while becoming more conscious about their health. In addition, the market accessibility for dairy products has been improved by both existing brands and comprehensive retail distribution networks. The market expands further due to rising trends of portable meal consumption and increasing quick-service restaurant activities. Moreover, the wide range of demographic groups across Maharashtra drives sales for regular lassi as well as contemporary lassi variants.

Competitive Landscape:

The competitive landscape is exhibited by the presence of both established dairy cooperatives and private sector players. Leading brands lead the market with comprehensive networks for distribution and a robust brand recognition. Regional dairy companies and local vendors also contribute significantly, catering to traditional preferences. The growing demand for packaged and flavored lassi has driven innovation, with players introducing probiotic, low-fat, and sugar-free variants. Besides, increasing investments in marketing, retail expansion, and product differentiation further intensify competition in this evolving market. For instance, in October 2024, Parle Agro announced a strategic partnership with Platinum Outdoor to boost its marketing campaign for newly launched SMOODH Lassi. This outdoor campaign spanned around 70 cities in India.

The report provides a comprehensive analysis of the competitive landscape in the lassi market in India market with detailed profiles of all major companies, including:

- GCMMF

- Mother Dairy

- Punjab State Cooperative Milk Producers' Federation Limited

- Milan Dairy Foods Private Limited

- Rajasthan Cooperative Dairy Federation Limited

Latest News and Developments:

- In October 2024, Amul announced the development of new production facilities in Punjab, Pune, and Andhra Pradesh, with a significant investment of INR 1000 Cr. The plant in Andhra Pradesh will be dedicated for processing 50 tons of lassi, along with other dairy products.

- In September 2024, Parle Agro announced the expansion of its dairy product line by unveiling its new SMOODH Lassi. This lassi blends the conventional texture with a rose flavor, targeting to offer a comforting and refreshing drink.

Lassi Market in India Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion INR, Million Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sales Channels Covered | Institutional, Retail |

| States Covered | Maharashtra, Uttar Pradesh, Andhra Pradesh and Telangana, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, Haryana |

| Companies Covered | GCMMF, Mother Dairy, Punjab State Cooperative Milk Producers' Federation Limited, Milan Dairy Foods Private Limited and Rajasthan Cooperative Dairy Federation Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lassi market in India market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the lassi market in India market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lassi market in India industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lassi market in India was valued at INR 56.03 Billion in 2024.

We expect the lassi market in India to exhibit a CAGR of 16.96% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of lassi across the nation.

The rising demand for lassi owing to its several health benefits, along with the advent of various packaging solutions to promote longer shelf-life and increased convenience, is primarily driving the lassi market in India.

Based on the sector, the lassi market in India can be segmented into retail sector and institutional sector. Currently, the retail sector holds the majority of the total market share.

On a regional level, the market has been classified into Maharashtra, Uttar Pradesh, Andhra Pradesh and Telangana, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, and Haryana, where Maharashtra currently dominates the lassi market in India.

Some of the major players in the lassi market in India include GCMMF, Mother Dairy, Punjab State Cooperative Milk Producers' Federation Limited, Milan Dairy Foods Private Limited, and Rajasthan Cooperative Dairy Federation Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)