Language Services Market Size, Share, Trends and Forecast by Service, Component, Application, and Region, 2025-2033

Language Services Market 2024, Size and Trends:

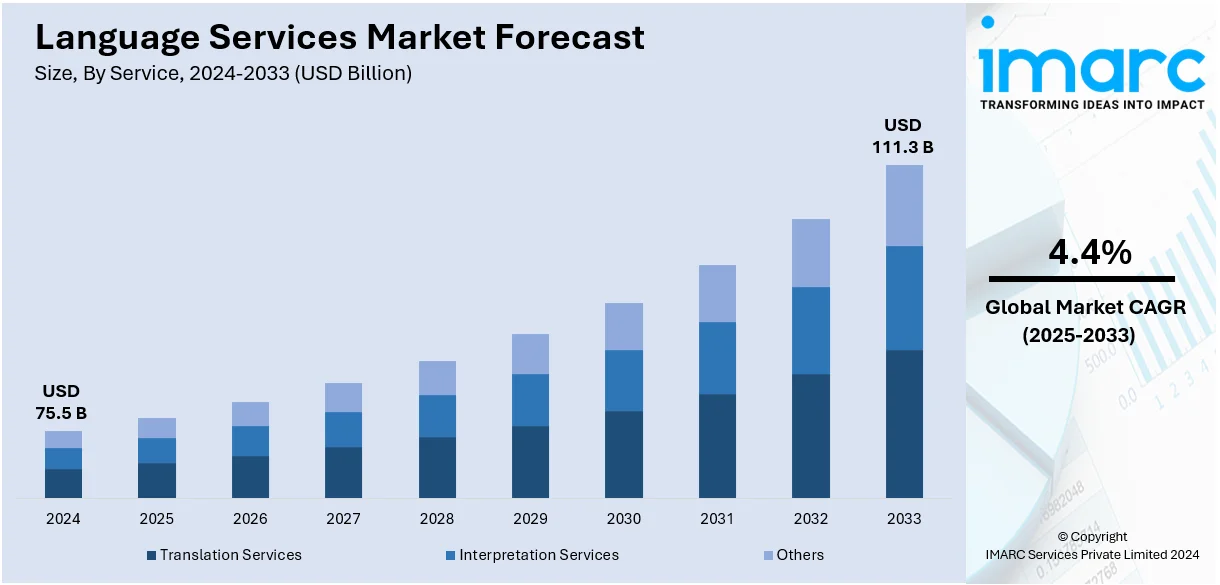

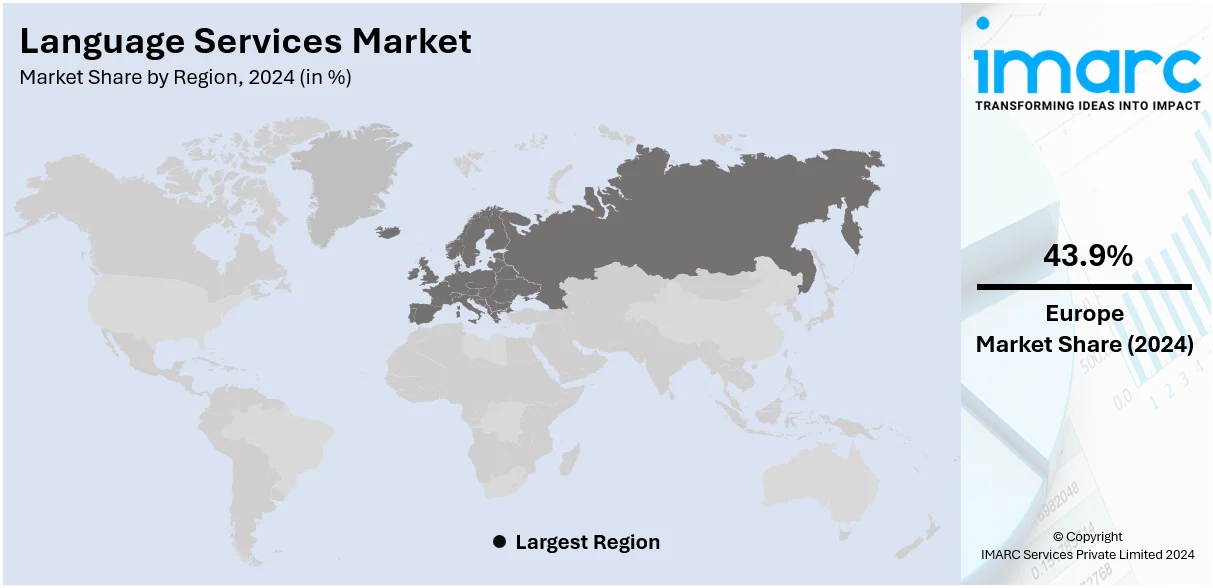

The global language services market size reached USD 75.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 111.3 Billion by 2033, exhibiting a growth rate CAGR of 4.4% during 2025-2033. Europe currently dominates the market with a market share of 43.9% in 2024. The increasing number of immigrants and international students, along with the rising demand for content in several formats, such as audio, video, and written material, is primarily driving the language services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 75.5 Billion |

|

Market Forecast in 2033

|

USD 111.3 Billion |

|

Market Growth Rate (2025-2033)

|

4.4% |

The impact of globalization on the language services market demand is enormous. As businesses expand internationally, the need to communicate across language barriers grows. According to a recent study, it was found that 72.4 percent of consumers would be more likely to buy a product with information in their own language. This preference is not limited to just e-commerce. It extends to a variety of industries, including healthcare, legal, and education. The same report found that 42% of consumers never purchase products and services in other languages, hence they are more likely to trust a company that provides content in their own language, which highlights the importance of effective communication in fostering brand loyalty. These statistics underscore how essential language services are in ensuring that businesses remain competitive on a global scale.

United States is a major market disruptor with a share of 87.70% in North America in 2024. It focuses on technological advancements in machine translation (MT) and artificial intelligence (AI) to accelerate the language services market growth. In 2024, AI-translation startup DeepL secured $300 million in investment, bringing its valuation to $2 billion, highlighting the significant investment in AI-driven language solutions. American businesses are integrating AI tools into their language service workflows as these tools have significantly improved efficiency and reduced costs. Moreover, AI can handle larger volumes of work while maintaining quality through human intervention, making the industry more efficient and accessible to clients.

Language Services Market Trends:

International Business Expansion

As various organizations are expanding globally, the escalating demand for localization services to adapt services, products, and content to local languages and cultures is bolstering the market growth. Moreover, this trend is specifically prevalent among industries, such as e-commerce. For instance, according to a report generated by the Harvard Business Review, of the internet users surveyed, 90% indicated that, when offered language options, they always chose to browse a website in their native language. Furthermore, in the "Can't Read, Won't Buy – B2C" report, which generally involved surveying over 8,000 individuals across 29 countries, it was stated that 65% of respondents prefer content in their mother tongue. In line with this, 40% of them did not purchase a product or service if it was not offered in their language. Consequently, businesses entering into new ventures require effective communication tools, such as language services, to facilitate participants from different backgrounds to understand and collaborate. For example, one of the digital marketers explained how he saw an increase of nearly 60% in new users and 47% in search traffic after localizing his website into several languages. This, in turn, will continue to fuel the language services market demand in the coming years.

Rising Technological Innovations

Numerous advancements in natural language processing (NLP), artificial intelligence, and machine learning (ML) are contributing to the language services market share. Moreover, these technologies are improving the accuracy, efficiency, and accessibility of language services, thereby acting as another significant growth-inducing factor. For example, in June 2023, Google News Initiative (GNI) launched the Indian Languages Program, a new solution designed to help local news publishers in India. Moreover, GNI is used to authorize publishers via several components, including access to training, technical support, and funding to assist in improving digital operations and reaching more readers. Besides this, it supports a total of nine languages, including Tamil, Kannada, Telugu, Malayalam, Gujarati, Bengali, Hindi, English, and Marathi. With the help of these services, various companies are now able to reach audiences across the globe at a minimal cost through the web. They are collaborating and partnering with key players to expand their product portfolio, thereby propelling the language services market revenue. For example, in June 2023, Acolad, one of the companies that offer content and language solutions, signed an agreement with Phrase, a cloud-based localization technology. Under this partnership, Acolad integrated end-to-end localization management capabilities of Phrase into its localization services, further improving its product offering. Additionally, with the development of AI-related technologies, Acolad and Phrase assisted clients with comprehensive language solutions that enhanced linguistic consistency, streamlined translation processes, optimized project management workflows, etc. In line with this, AppTek, one of the leaders in Neural Machine Translation (NMT), Automatic Speech Recognition (ASR), Natural Language Understanding (NLU) technologies, etc., partnered with TransPerfect to improve customer workflows by minimizing project turnaround times.

Proliferation of Digital Content

With the increasing online content, translation services play an important role in facilitating communication between users of numerous languages. They generally encompass both signed communication as well as spoken and follow the International Standards Organization (ISO) definition that states the rendering of a spoken or signed message into another language by preserving the real meaning of the source language content. Additionally, businesses across countries are seeking translation services to serve their customers and keep up with their demands. While individuals are also utilizing this type of service, the share of such usage is minimal. For example, in November 2023, Pocketalk, one of the global leaders in translation solutions, announced its partnership with CAVU International, a company renowned for its team conduct training and greater leadership. Apart from this, as per the language services market statistics, around 300 hours of video content is being uploaded on YouTube every minute, and approximately 5 billion videos are being watched daily by individuals. Along with this, about 70% of YouTube viewers are from outside the United States. This, in turn, indicates the elevating demand for video translations, where post-editing of machine translations (PEMT) is gaining widespread popularity.

Language Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global language services market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on the service, component, and application.

Analysis by Service:

- Translation Services

- Interpretation Services

- Others

As per the latest language services market outlook, Translation services led the market with a share of 70.7% in 2024. Translation services are extensively adopted to bridge communication gaps between businesses, individuals, and organizations operating in various linguistic environments. Moreover, the increasing number of international trade activities is escalating the demand for these services to translate content and documents into multiple languages to cater to audiences effectively, thereby driving growth in this segmentation. Besides this, key industry players are entering into mergers and acquisitions (M&A) activities, which is acting as another significant growth-inducing factor. For instance, in March 2023, Microsoft enhanced its language support by incorporating 13 new African languages into the Microsoft Azure Cognitive Services Translator. This allowed for the translation of text and documents to and from these languages within the entire Microsoft ecosystem of services and products. Moreover, it reflects Microsoft's commitment to linguistic accessibility and inclusivity, thereby encouraging users to engage effectively. Furthermore, American Journal Experts (AJE), a division of Research Square Company, introduced its standard translation service.

Analysis by Component:

- Software

- Hardware

Based on the recent language services market forecast, software led the market with a share of 71.3% in 2024. Software components generally include novel language processing tools that can perform various tasks that allow for deeper insights from large volumes of text data. For instance, Gengo provides software translation services that meet high-quality translation and localization services demand. In line with this, Language I/O offers AI-powered software tools that make it easy for any of the existing agents to respond quickly to multilingual support tickets, thereby catalyzing the language services market outlook in this segmentation.

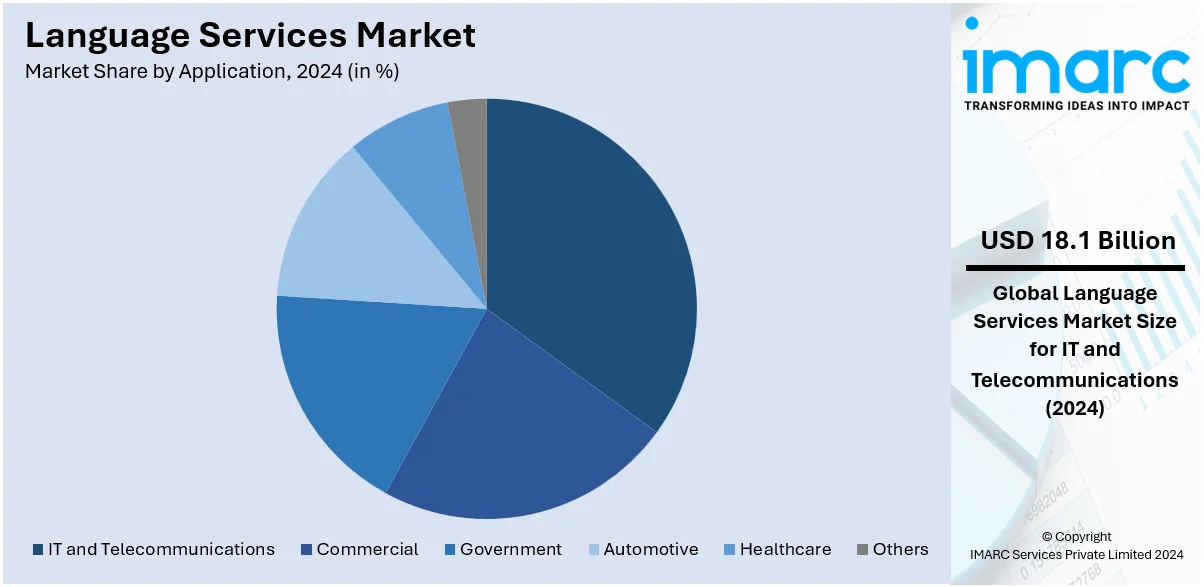

Analysis by Application:

- IT and Telecommunications

- Commercial

- Government

- Automotive

- Healthcare

- Others

IT and telecommunication sector led the market with a share of 24.0% in 2024. IT and telecommunication companies require translation and localization services to adapt their products to various cultures and languages. Effective communication is vital in IT and telecommunications during software development and multinational collaborations. Besides this, language services, including interpretation services for virtual conferences and meetings, are crucial in ensuring seamless communication among stakeholders speaking different languages. Additionally, the telecommunications industry relies on language services to reach diverse audiences worldwide. Telecom companies need to translate marketing materials, user manuals, and customer support content to serve customers in various regions effectively. For instance, Stepes offers accurate telecommunication translation services in all the major languages of countries so that telecom companies can accelerate business growth and overcome linguistic barriers. This, in turn, is considered as one of the language services market recent opportunities.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- United Kingdom

- Germany

- France

- Sweden

- Russia

- Netherlands

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- Others

- Latin America

- Brazil

- Mexico

- Others

According to the report, Europe represents the largest regional market for language services with a share of 43.9% in 2024. The rising trade and international business partnerships are primarily driving the regional market. Moreover, leading language service providers in Europe are using advanced technologies, including ML and AI, to cater to the evolving needs of individuals and organizations seeking quick and accurate language support. Besides this, government bodies across the region are relying on these services and partnering with stakeholders, thereby strengthening the market. For instance, the Translation Centre for the Bodies of the European Union is an agency that provides translation and related language services to the other decentralized EU agencies. Apart from this, continuous collaborations among industry key players and extensive investments in R&D activities to develop enhanced translation software are expanding the market potential in Europe.

Key Regional Takeaways:

North America Language Services Market Analysis

The North American language service market is experiencing significant growth, driven by the region's diverse population, booming e-commerce sector, and increasing demand for localized content. In the United States, over 67 million people speak a language other than English at home, creating a consistent need for translation and interpretation services across industries like healthcare, education, and government. The rise of online platforms has also fueled the adoption of localization strategies, as businesses aim to cater to multilingual audiences. With advancements in AI-powered tools and machine translation, the market is becoming more efficient, though human expertise remains essential for accuracy.

United States Language Services Market Analysis

United States is leading the market with a share of 87.70% in North America. The diversified population and its status as a major global economic center fuel the market for language services in the United States. There is a strong need for interpretation and translation services because the nation is home to more than 350 languages and about 25 million individuals who identify as Limited English Proficient (LEP), according to U.S. Census Bureau. The increasing need for localisation in healthcare, law, and education, which the government agencies are demanding adherence to Title VI of the Civil Rights Act, is where the market is profiting. Technology integration, such as AI-driven translation tools, into businesses' machine translation and real-time interpretation platforms is revolutionising the market. Translation and transcreation services are also required for worldwide outreach because the United States leads the world in content creation and marketing. Custom eLearning courses keep the learner focused because they put the student in the center. Corporate training programs and e-learning designed for multilingual users are also a growth driver. The market is dominated by companies such as TransPerfect and Lionbridge, while smaller businesses serving niche markets are also growing.

Europe Language Services Market Analysis

Linguistic diversity in Europe provides support to the language services market: there are 24 official EU languages, as well as regional dialects. The need for translation and interpretation services is constant due to the region's economic interconnectedness and cross-border trade, especially in sectors like technology, finance, and law. According to an industrial report, Germany has the largest percentage of translators and interpreters (18% of the EU total) among EU member states, followed by the UK (11%), Spain, France, and Poland (each at 9%). More than half of all translators and interpreters in the EU (56%) come from these five EU member states combined. Due to their strong export economies, demand is highest in countries like Germany, France, and the United Kingdom. The need for locally relevant compliance documents arises from the adoption of the General Data Protection Regulation, or GDPR. A significant market share for dubbing and subtitling services has also emerged because of the increase in media streaming platforms. Moreover, Europe is at the forefront of multilingual AI and machine learning innovation that is revolutionizing how services are delivered.

Asia Pacific Language Services Market Analysis

The market in the Asia-Pacific region is expanding quickly due to the digital economy and globalization. According to an industrial report, the region has a huge number of languages with a population of over 4.5 Billion and calls for significant localisation for companies that intend to reach out to different sectors. China, India, and Japan are the largest contributors since they have booming e-commerce and technology sectors. In Asia, there exist over 2,000 spoken languages and most countries possess more than one original language. Since more than half of the population in the region is under 35, Asia is a huge market for most enterprises. This is why global companies are entering the market and using language services more and more. The requirement for translation and interpretation is rising at a faster pace because of the increasing use of e-learning platforms and global partnerships in IT and manufacturing. In markets such as South Korea, where automation increases the efficiency of language services, AI-based solutions are particularly popular. Government initiatives to boost tourism also stimulate growth in this industry, for example, Japan's efforts to host international events.

Latin America Language Services Market Analysis

The market for language services in Latin America is driven by the region's linguistic and cultural diversity as well as increasing trade. Although Spanish and Portuguese are widely used, the use of indigenous languages such as Guarani, Mayan, Aymara, and Quechua increase the demand for specialized services. According to an industrial data, more than 300 million of the approximately 450 million native Spanish speakers worldwide live in Latin America. Additionally, more than a 200 million people speak Brazilian Portuguese. With increased international e-commerce and more expansions in legal and health services, there is a corresponding increased requirement for translation and interpretation services. Around the world mining and collaborations involving energy also call for more technical translations of documents besides other multilingual paperwork needs. The requirement for the language localization service also spreads further with growing numbers of American firms operating within this sphere.

Middle East and Africa Language Services Market Analysis

Growing globalization and multilingual populations are driving growth in the Middle East and Africa (MEA) language services market. The demand for translation and localisation is fuelled by the importance of Arabic as a business language, which is spoken by nearly 300 million people, and the increasing use of English and French, as per an industry report. The region's expansion into media, banking, and tourism are important factors. It is high in places such as the United Arab Emirates and South Africa, where the public and private sectors require multilingual services for many users. To meet the growing demand, emerging technologies like machine translation are gaining popularity in such areas.

Competitive Landscape:

According to the emerging language services market trends, leading players are actively integrating advanced language technologies into their services. These technologies offer faster turnaround times and cost-effective solutions for clients. Companies are expanding their localization offerings to cater to the needs of global businesses. They are also expanding their multilingual user support services to aid organizations in communicating with their global user base effectively. This included providing customer service in multiple languages through various channels, including email, chat, and phone. They are also adopting collaborating strategies to enhance communication between linguists, clients, and project managers across different geographical locations.

The report provides a comprehensive analysis of the competitive landscape in the language services market with detailed profiles of all major companies, including:

- Atlas Language Service, Inc.

- Globe Language Services Inc.

- Iyuno

- LanguageLine Solutions (Teleperformance SE)

- Lionbridge Technologies, LLC

- Mars Translation Services

- RWS Group

- Semantix

- TransPerfect

- Ulatus (Crimson Interactive Inc.)

- Welocalize, Inc.

Latest News and Developments:

- April 2024: Lotte Department Store, a subsidiary of the Lotte Group, has integrated SK Telecom's (SKT) "TransTalker" AI translation system. It uses transparent LED displays to show translated conversations in a text format.

- March 2024: Google announced that it will be expanding the functions of its tool Circle to include language translation.

- March 2024: Two researchers from the University of Oberta de Catalunya (UOC), Sergi Álvarez-Vidal and Antoni Oliver, introduced a new method to assess work by AI to improve the work of translators, thereby increasing their capabilities with the potential of machine translation, and enhancing the quality of the result for all users.

Language Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Translation Services, Interpretation Services, Others |

| Components Covered | Software, Hardware |

| Applications Covered | IT and Telecommunications, Commercial, Government, Automotive, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Sweden, Russia, Netherlands, China, Japan, India, South Korea, Australia, Turkey, Saudi Arabia, Iran, Brazil, Mexico |

| Companies Covered | Atlas Language Service, Inc., Globe Language Services Inc., Iyuno, LanguageLine Solutions (Teleperformance SE), Lionbridge Technologies, LLC, Mars Translation Services, RWS Group, Semantix, TransPerfect, Ulatus (Crimson Interactive Inc.), Welocalize, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the language services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global language services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the language services industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The language service industry encompasses businesses and professionals that provide services to facilitate communication across different languages and cultures. It plays a vital role in enabling global communication in areas such as business, education, healthcare, law, and diplomacy.

The Language Services market was valued at USD 75.5 Billion in 2024.

IMARC estimates the Language Services market to exhibit a CAGR of 4.4% during 2025-2033.

The key drivers of the global language services market include globalization of businesses, rising online content creation, growing e-commerce, advancements in artificial intelligence (AI) and machine translation (MT), increasing immigration, demand for multilingual customer support, and emphasis on localization for better user experience across industries like healthcare, legal, and technology.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the market.

Some of the major players in the Language Services market include Atlas Language Service, Inc., Globe Language Services Inc., Iyuno, LanguageLine Solutions (Teleperformance SE), Lionbridge Technologies, LLC, Mars Translation Services, RWS Group, Semantix, TransPerfect, Ulatus (Crimson Interactive Inc.), Welocalize, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)