Laminate Flooring Market Report Size, Share, Trends and Forecast by Type, Sector, and Region, 2025-2033

Laminate Flooring Market Size and Share:

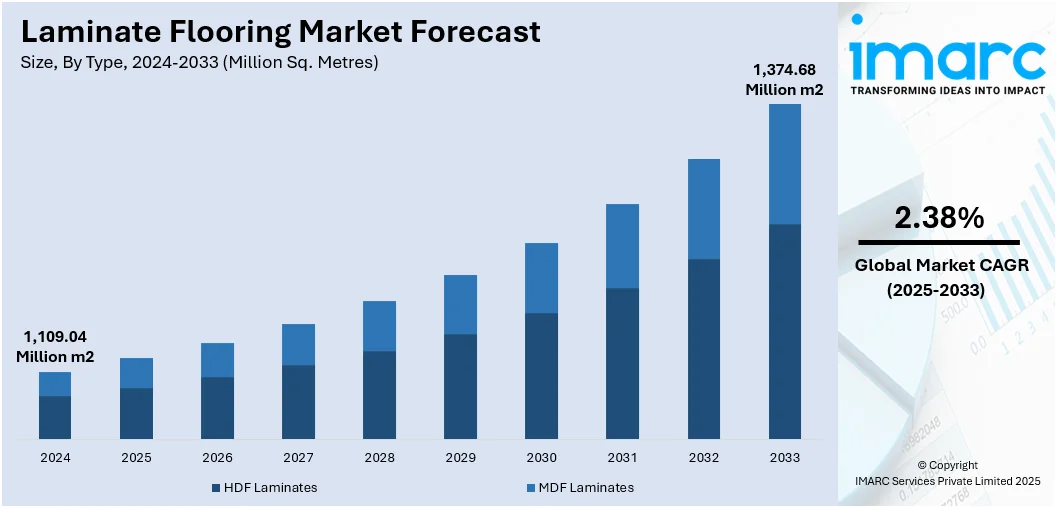

The global laminate flooring market size reached 1,109.04 Million Sq. Metres in 2024. The market is expected to reach 1,374.68 Million Sq. Metres by 2033, exhibiting a growth rate (CAGR) of 2.38% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of around 38.7% in 2024. The market is fueled by increasing demand for affordable and aesthetic flooring solutions across residential and commercial construction. Apart from that, rapid urbanization, especially in emerging economies, has led to a rise in renovation and remodeling activities, increasing the product uptake. Besides this, the growing preference for environmentally friendly materials has encouraged manufacturers to innovate with recyclable and sustainable laminate flooring options, which is further augmenting the laminate flooring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1,109.04 Million Sq. Metres |

|

Market Forecast in 2033

|

1,374.68 Million Sq. Metres |

| Market Growth Rate 2025-2033 |

2.38%

|

The market is supported by rising demand for cost-effective flooring solutions that replicate the appearance of wood and stone without the associated maintenance. Moreover, advancements in printing and embossing technologies have significantly enhanced visual authenticity and surface textures, increasing consumer appeal. Besides this, growth in multifamily housing and public infrastructure projects has also elevated demand. One notable multifamily residential project in India is the Vamsiram Manhattan Residential Complex, located in Hyderabad, Telangana. The development spans approximately 5.69 hectares and entails the construction of eight high-rise residential towers, each with 47 stories, comprising a total of 978 apartments and covering a built-up area of 549,510.98 square meters. Construction began in the third quarter of 2024 and is scheduled for completion by the fourth quarter of 2029. In addition, expansion of organized retail, particularly in emerging economies, has improved product visibility and accessibility. Furthermore, one of the emerging laminate flooring market trends is the increasing do-it-yourself home improvement, which is supporting sales through easy-to-install product formats.

To get more information on this market, Request Sample

In the United States, demand for laminate flooring is driven by a preference for resilient, scratch-resistant flooring options suitable for high-traffic areas. The expansion of suburban housing developments and remodeling projects, particularly in kitchens and living spaces, continues to support market growth. Energy-efficient construction standards are pushing demand for underlay-compatible laminates that contribute to insulation. Additionally, state-level incentives and regulations are playing a growing role in shaping demand for eco-friendly construction materials, including laminate flooring. On the East Coast, New York stands out with its implementation of Local Law 97, which sets strict carbon emissions limits for large buildings. This regulation is closely tied to the goals of the state’s Climate Leadership and Community Protection Act (CLCPA), which aims to cut greenhouse gas emissions by 40% by 2030. These policies are prompting developers and property owners to adopt low-emission, sustainable materials across new construction and retrofitting projects. As a result, environmentally certified laminate flooring products are gaining stronger traction in the market.

Laminate Flooring Market Trends:

Significant growth in the construction industry

Laminate flooring finds extensive applications in the construction of residential and commercial spaces. It is increasingly being utilized in living rooms, bathrooms, hallways, retail stores, offices, restaurants, and hotels due to its cost-effectiveness, low maintenance, high durability, and excellent resistance against scratches and stains. Furthermore, the escalating population across the globe and the elevating levels of urbanization are also bolstering the demand for residential spaces, which is creating a positive impact on the market. According to an industry report, the global population is expected to reach 9.7 Billion by 2050, with urban areas driving most of the growth in construction activity. In addition to this, various companies in the construction sector are building both residential and commercial establishments to cater to the growing demand.

Rising Demand for Eco-Friendly Flooring Options

The rising demand for eco-friendly flooring options due to increasing environmental concerns is providing an impetus to the laminate flooring market growth. Laminate flooring can mimic the appearance of natural wood and stones, which aids in minimizing deforestation activities and overutilization of resources. Moreover, the rising concerns regarding the increasing carbon footprints and elevating levels of global warming are prompting builders to shift to eco-friendly flooring options, like laminate flooring. According to an industry report, buildings account for 39% of global energy-related carbon emissions, with 11% attributed to construction materials and processes. Reports also indicate that 2021 was the sixth-warmest year on record, with the global surface temperature recorded at 0.84°C above the 20th-century average of 13.9°C, and 1.04°C higher than pre-industrial levels. In response to growing environmental concerns, several governments have initiated awareness campaigns to encourage both laminate flooring manufacturers and consumers to choose environmentally responsible renovation and construction materials. As part of this trend, in November 2021, LL Flooring introduced its Duravana hybrid resilient flooring—an innovative and sustainable product category that combines the features of traditional flooring with advanced technologies to deliver enhanced performance. Similar product developments by established players are expected to contribute to the growth of the laminate flooring market in the coming years.

Extensive Research and Development (R&D) Activities

The market is witnessing extensive R&D activities aimed at enhancing the performance, aesthetics, and sustainability of the products. In line with this, various manufacturers are also utilizing high-definition (HD) printing to produce laminate flooring with highly detailed, intricate patterns and vibrant colors at affordable prices, which is contributing to market expansion. Apart from that, major companies operating in the hard surface flooring market are focused on adopting new technologies and solutions to sustain their position in the market. For instance, in April 2023, Bjelin Sweden AB, a Sweden-based manufacturer of hardwood flooring, launched its Hardened Wood 3.0 range—an upgraded collection featuring enhanced colors, formats, and technologies. This product line reflects ongoing innovation within the laminate and hardwood flooring segment. Furthermore, the implementation of stringent certification standards is contributing to the expansion of the laminate flooring market. The North American Laminate Flooring Association (NALFA), for example, has introduced a certification seal that signifies a product's adherence to high-quality benchmarks. Flooring that carries the NALFA certification has successfully passed ten comprehensive performance tests, assessing factors such as resistance to water, light, and stains, as well as durability under impact. These tests are conducted by independent, third-party laboratories to ensure that certified laminate flooring meets rigorous industry standards. Meanwhile, in countries like India, where 370 projects were LEED-certified in 2024, according to the Green Business Certification Inc. (GBCI), the use of sustainable and certified materials like laminate flooring is rising sharply, encouraging global adoption of such eco-forward solutions. Such innovations are projected to positively impact the laminate flooring market outlook.

Laminate Flooring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global laminate flooring market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on type and sector.

Analysis by Type:

- HDF Laminates

- MDF Laminates

MDF laminates leads the market with around 63.7% of market share in 2024, due to their cost-effectiveness and smooth and uniform surface, which allows for consistent adhesion of laminate sheets, thus enabling a seamless finish and enhancing the visual appearance of the product. Various key market players are introducing MDF boards with enhanced features to cater to the escalating demand from the construction sector. For instance, in April 2024, Century Plyboards commenced the commercial dispatch of Medium-Density Fibreboards (MDF) from its newly established wholly owned subsidiary, Century Panels, located in Badvel, YSR Kadapa district, Andhra Pradesh. This development has enabled the company to double its MDF production capacity from 900 to 1,900 cubic meters. Additionally, the ease of installation, machinability, and printability of MDF laminates provide enhanced design flexibility and customization options, which is contributing to their growing demand worldwide.

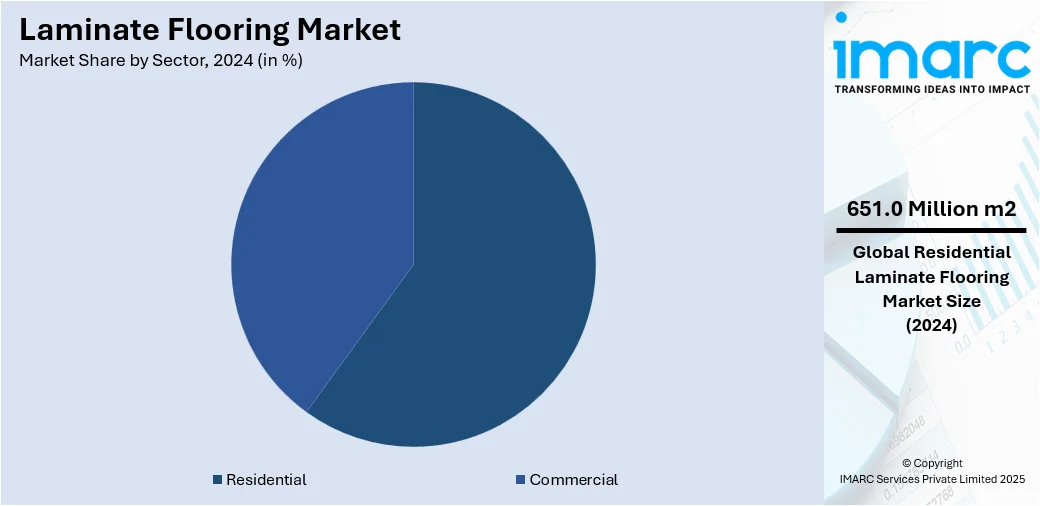

Analysis by Sector:

- Residential

- Commercial

Residential leads the market with around 58.7% of market share in 2024, due to the increasing construction of houses, apartments, and residential complexes. Additionally, the escalating population across the globe is further bolstering the demand for residential spaces. Moreover, the government authorities are taking numerous initiatives to accommodate the rising urban population. For instance, under the Pradhan Mantri Awas Yojana, the Government of India approved the construction of 361,000 homes in November 2021. With this addition, the total number of sanctioned housing units under the scheme reached 11.4 Million. It is anticipated that the Indian Government's affordable housing program will continue to support the growth of the residential construction sector from a short- to medium-term perspective, which will subsequently aid the growth of the laminate flooring market.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 38.7%. Asia Pacific represents a leading market for laminate flooring due to the increasing construction activities. In line with this, laminate flooring is widely selected as a cost-effective, durable, and user-friendly flooring material in residential, commercial, and industrial projects. Additionally, the presence of key manufacturers in the region along with their ongoing efforts to expand is also contributing to the region’s growth. For instance, CFL Flooring announced the expansion of its manufacturing capacity in Vietnam to support the development of hybrid resilient flooring products. Similarly, in November 2022, PJ Chonburi Parawood Co. Ltd. (PJ Wood) expanded its production operations with the objective of manufacturing wooden building components for the global export market, specifically laminated boards and coverings. The company initially planned to introduce its flooring products to the domestic market through a direct-to-consumer distribution model.

Key Regional Takeaways:

United States Laminate Flooring Market Analysis

In 2024, the United States holds a substantial share of around 80.0% of the laminate flowing share in North America. The market in the United States is experiencing steady growth, driven by increased renovation activities in both residential and commercial spaces. Notably, a recent report highlights that about 48% of homeowners plan to make renovations in 2025, with younger Americans far more likely than baby boomers to invest in home improvements. This generational shift is significantly driving demand for stylish, low-maintenance flooring options such as laminates. Growing consumer interest in durable solutions that replicate high-end materials continues to influence purchase decisions. The integration of digital design and printing technologies enhances aesthetic appeal, aligning with contemporary interior preferences. Additionally, energy-efficient building certifications and sustainable construction practices are influencing buyers to opt for eco-friendly laminate products. Advancements in underlayment and click-lock systems simplify DIY installation, while e-commerce expansion and content-driven marketing are increasing product visibility. With remote work lifestyles reshaping home design priorities, laminate flooring remains a popular choice for both functionality and visual appeal. The market is further reinforced by technological developments in moisture-resistant and sound-insulated options tailored to modern living.

Europe Laminate Flooring Market Analysis

In Europe, the market is expanding due to the region’s strong sustainability focus and evolving architectural trends. According to the U.S. Green Building Council (USGBC), Europe has over 6,000 LEED-certified projects covering nearly 113 Million gross square meters, making it one of the fastest-growing global markets for green buildings. This momentum is propelling the demand for recyclable and low-emission flooring materials such as laminates. Additionally, the popularity of minimalistic and modular interior styles is encouraging consumers to choose uniform, adaptable flooring solutions. Climate variability across the region has led to increased interest in thermally stable materials compatible with underfloor heating systems. A rise in flexible living arrangements and temporary housing is further promoting laminate flooring adoption due to its affordability and ease of installation. Renovation of heritage buildings using modern finishes and digital customization trends is also influencing product innovation and market penetration across both residential and institutional segments.

Asia Pacific Laminate Flooring Market Analysis

In the Asia Pacific region, laminate flooring demand is rising amid rapid urbanization and expanding middle-class investment in home upgrades. According to the India Brand Equity Foundation (IBEF), India must enhance its infrastructure to meet its 2025 economic growth target of USD 5 Trillion, which is contributing to increased construction activity. This development surge is fueling demand for cost-effective and visually appealing flooring materials like laminates, particularly in residential and light commercial projects. The growing influence of Western design sensibilities, combined with modern lifestyle aspirations, is reshaping interior preferences. Social media exposure and e-commerce platforms are making it easier for consumers to discover and access various laminate options. Local production capabilities are improving supply chain efficiency, and innovations in surface wear resistance and design flexibility are further increasing the appeal of laminate flooring in diverse urban and semi-urban markets.

Latin America Laminate Flooring Market Analysis

The market in the Latin America is expanding, supported by housing development and consumer demand for modern, low-cost home upgrades. A report by the National Statistical Office states that the number of households in Brazil reached 83.3 Million in 2025, underscoring the growing need for accessible and aesthetically pleasing construction materials. Laminate flooring meets this demand by offering quick installation, durability, and visual versatility. Modular construction practices and the emergence of prefabricated housing are also creating opportunities for adaptable flooring solutions. In parallel, localized production and growing retail penetration are enhancing product availability. Increased awareness of design-forward solutions among middle-income consumers is positioning laminates as a stylish yet affordable alternative across a broad range of living environments.

Middle East and Africa Laminate Flooring Market Analysis

The market in the Middle East and Africa is gaining traction, largely driven by expanding commercial real estate and interior design modernization. According to recent reports, Saudi Arabia’s construction sector, valued at USD 1.108 Trillion, is poised to grow at a compound annual rate of 6.2% through 2028, presenting significant opportunities for building materials like laminate flooring. This growth is being propelled by increased development of retail centers, hospitality venues, and office buildings, where decorative yet functional flooring is in high demand. Climate considerations are influencing preferences for heat-resistant and low-maintenance products. Furthermore, the rise of sleek, contemporary interiors across urban hubs is driving the popularity of stylish and easy-to-install laminate options equipped with stain-resistant finishes and advanced locking mechanisms.

Competitive Landscape:

The market is characterized by intense competition driven by price, product variety, and distribution reach. Players compete through innovations in durability, water resistance, and aesthetics. Regional demand varies with climate, construction trends, and consumer preferences for eco-friendly materials. Entry barriers are moderate, with manufacturing scale, distribution partnerships, and branding acting as key differentiators. Moreover, online channels are gaining traction, pressuring traditional retail. Suppliers of raw materials, especially high-density fiberboard and decorative films, impact production costs and margins. According to the laminate flooring market forecast, demand is expected to grow steadily, supported by rising renovation activities, especially in urban housing and commercial interiors. Besides, growth in developing economies is anticipated to outpace mature markets due to increased construction activity and changing lifestyle preferences. Sustainability certifications and compliance with environmental regulations are becoming more important, affecting procurement strategies and positioning. In addition to this, product customization and hybrid formats combining laminate with waterproof cores or click-lock systems are increasingly shaping buyer expectations and influencing competitive strategies.

The report provides a comprehensive analysis of the competitive landscape in the laminate flooring market with detailed profiles of all major companies, including:

- Mohawk Industries, Inc.

- Tarkett SA

- Armstrong World Industries, Inc.

- Shaw Industries, Inc.

- Mannington Mills, Inc.

- Beaulieu International Group

Latest News and Developments:

- July 2025: In Home Flooring enhanced its customer journey by upgrading scheduling flexibility, expanding flooring options including laminate, and improving installation services. It introduced virtual consultations, DIY tools, and added more installers. The initiative aimed to deliver a seamless selection-to-installation experience, reinforcing its commitment to convenience, variety, and service quality.

- July 2025: J+J Flooring officially launched the Tides carpet collection, inspired by oceanic movement and light reflection. Though primarily focused on carpet, the product emphasized modular design and color flexibility, which aligned with growing aesthetic trends across flooring types including laminate, reinforcing consumer demand for biophilic design and visual texture.

- February 2025: Tapi Carpets & Floors launched its first in-store concession at John Lewis’ Oxford Street branch, with 16 more planned. The offering included laminate flooring from Quick-Step alongside carpets and engineered wood. The collaboration expanded consumer access to premium laminate options, supported by expert consultation and home visit services.

Laminate Flooring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Sq. Metres |

| Report Scope |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | HDF Laminates, MDF Laminates |

| Sectors Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

| Companies Covered | Mohawk Industries, Inc., Tarkett SA, Armstrong World Industries, Inc., Shaw Industries, Inc., Mannington Mills, Inc., Beaulieu International Group |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the laminate flooring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global laminate flooring market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the laminate flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The laminate flooring market was valued at 1,109.04 Million Sq. Metres in 2024.

The laminate flooring market is projected to exhibit a CAGR of 2.38% during 2025-2033, reaching a value of 1,374.68 Million Sq. Metres by 2033.

The market is driven by rising demand for cost-effective, durable flooring solutions in residential and commercial spaces, rapid urbanization, growth in renovation activities, and increasing awareness of eco-friendly building materials. Technological advancements in design and installation methods further support wider adoption across various end-use sectors.

Asia Pacific currently dominates the laminate flooring market with a market share of around 38.7%. The dominance is fueled by the region’s expanding construction industry, growing population, increasing disposable incomes, rising middle-class housing demand, and government investments in infrastructure projects, particularly in China, India, and Southeast Asian countries.

Some of the major players in the laminate flooring market include Mohawk Industries, Inc., Tarkett SA, Armstrong World Industries, Inc., Shaw Industries, Inc., Mannington Mills, Inc., Beaulieu International Group, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)