Lactic Acid Market Size, Share, Trends and Forecast by Raw Material, Form, Application, and Region, 2025-2033

Lactic Acid Market Size and Share:

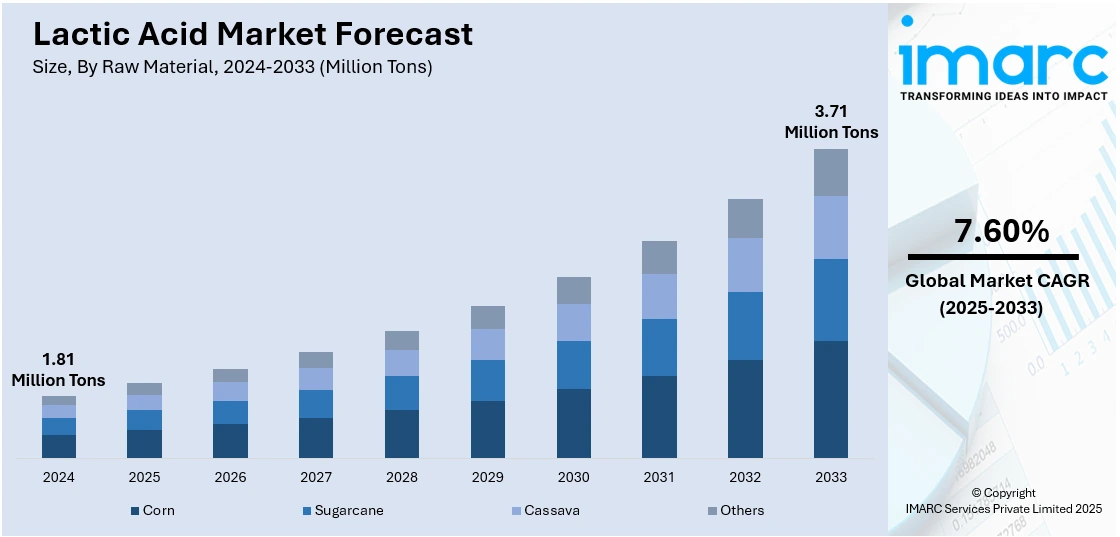

The global lactic acid market size was valued at 1.81 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 3.71 Million Tons by 2033, exhibiting a CAGR of 7.60% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.0% in 2024. The market is expanding due to rising demand for biodegradable plastics, clean-label food ingredients, and natural personal care products. Increased use in polylactic acid production, supported by renewable feedstocks and sustainable manufacturing practices, continues to drive growth across industrial and consumer-focused applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.81 Million Tons |

| Market Forecast in 2033 | 3.71 Million Tons |

| Market Growth Rate 2025-2033 | 7.60% |

The rising focus on sustainable materials and eco-friendly manufacturing is significantly boosting lactic acid market growth. Growing demand from end-use sectors particularly food and beverage, cosmetics, pharmaceuticals, and industrial packaging is driving production and innovation. In food applications, lactic acid serves as a natural preservative and flavor enhancer, aligning with the clean-label trend. Meanwhile, the shift toward biodegradable materials in packaging and agriculture is encouraging manufacturers to adopt polylactic acid (PLA), which is derived from lactic acid. Additionally, the cosmetics industry is increasing its use of lactic acid in skincare formulations due to its exfoliating and moisturizing properties. Market growth is further supported by investments in green chemistry and bio-based production processes, along with government regulations favoring sustainable practices.

The United States is emerging as a major contributor to lactic acid demand, especially in the bioplastics segment. According to NatureWorks, a leading PLA manufacturer, construction of a new USD 600 Million biopolymer production facility is underway in Georgia, with operations expected to begin by 2025. With respect to this development, the U.S. is strengthening its role in bio-based product manufacturing, supported by favorable policies and a strong agricultural base. The new facility is designed to convert locally sourced feedstocks into high-purity lactic acid for use in bioplastics, textiles, and coatings, highlighting the region’s shift toward sustainable industrial solutions.

Lactic Acid Market Trends:

Significant Growth in the Food and Beverage (F&B) Industry

Lactic acid finds numerous applications in the food and beverage (F&B) industry. It is widely used as a natural preservative to improve the shelf life of perishable goods and inhibit the growth of bacteria, yeasts, and molds. In addition, it is used in various fermented and cultured products, such as yogurt, cheese, sauerkraut, pickles, and sourdough bread, to enhance flavor, texture, and preservation. Apart from this, the increasing product utilization in soft drinks, fruit juices, energy drinks, and alcoholic beverages to add a tangy flavor and acidity is acting as another growth-inducing factor. Moreover, the growing product application in the bakery and confectionery sector to improve dough texture, extend shelf life, and enhance the flavor of baked goods is strengthening the market growth. The global confectionery market size reached USD 198.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 266.0 Billion by 2033.

Rising Product Utilization in the Cosmetics and Personal Care Industry

Lactic acid is widely used as an exfoliating agent in skincare products to remove dead cells, unclog pores, promote skin renewal, enhance texture, reduce the appearance of wrinkles, and increase overall skin radiance. The growing application in personal care is significantly contributing to lactic acid market demand. Furthermore, the widespread product utilization in cosmetic formulations as a pH adjuster and acidifier to enhance the efficacy, absorption, and effectiveness of certain ingredients is positively influencing the market growth. Additionally, the growing product adoption in moisturizers, serums, and masks to improve hydration levels, nourish the skin, and prevent dark spots and discoloration is favoring the market growth. Apart from this, lactic acid is widely used in anti-aging products to promote the synthesis of collagen, improve skin elasticity, and provide a youthful complexion. An NCBI study with 60 patients found that combining 30% lactic acid with 12% Ferulic acid improved photoaging by 42%, compared to 27% with Ferulic acid alone.

Extensive Research and Development (R&D) Activities

The lactic acid market has witnessed several notable innovations aimed at improving its production rate and expanding its applications. The introduction of next-generation fermentation technologies, such as consolidated bioprocessing (CBP) and continuous fermentation, which simplifies the production process, reduces operation costs, and increases yield, is providing an impetus to the market growth. Additionally, the introduction of advanced purification techniques, such as membrane separation and chromatography, which allows the separation and purification of specific lactic acid isomers for targeted applications, is positively influencing the market growth. Moreover, the utilization of genetic engineering to modify lactic acid bacteria (LAB) to enhance their productivity and optimize metabolic pathways for lactic acid production is contributing to the market growth.

Lactic Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global lactic acid market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on raw material, form, and application.

Analysis by Raw Material:

- Corn

- Sugarcane

- Cassava

- Others

In 2024, sugarcane emerged as the dominant feedstock in the lactic acid market due to its high sugar content, cost-efficiency, and ready availability in key producing countries. Its suitability for fermentation made it a top choice for manufacturers aiming to produce lactic acid at scale with reduced environmental impact. Sugarcane-based lactic acid is widely used across industries, including food, beverages, pharmaceuticals, and bioplastics, offering a sustainable alternative to petroleum-based inputs. Countries such as Brazil, India, and Thailand—with strong sugarcane agriculture are encouraging its industrial use, further promoting its adoption in fermentation units. Sugarcane’s renewable nature and consistent yield have positioned it as a key enabler in supporting global bio-based product demand. As sustainability goals become central to industrial procurement, sugarcane is being increasingly integrated into production models to align with eco-friendly mandates. This trend is prompting further investment in sugarcane supply chains and biorefinery development, strengthening the lactic acid market outlook and reinforcing its influence in shaping production trends.

Analysis by Form:

- Liquid

- Solid

Liquid lactic acid continues to drive market demand due to its wide use in food processing, beverages, personal care, and chemical manufacturing. Its easy solubility and immediate usability make it ideal for applications requiring direct mixing, pH control, and preservation. In the food industry, it acts as a natural acidulant and antimicrobial agent, extending product shelf life. Additionally, liquid lactic acid is essential in producing polylactic acid (PLA), supporting the shift toward biodegradable plastics. Its compatibility with continuous fermentation processes ensures efficient production, attracting investments from industrial players seeking scalable, cost-effective, and sustainable solutions across various end-use sectors.

Solid lactic acid is gaining traction in industries where stability, concentration, and extended shelf life are key requirements. It is commonly used in animal nutrition, pharmaceuticals, and cosmetics, offering precise dosage control and reduced storage challenges. Solid-grade formats such as powder and granules are easier to handle in large-scale manufacturing and are preferred in regions with limited cold chain infrastructure. Its concentrated nature also lowers transportation costs and simplifies bulk handling. As demand rises for high-purity, long-lasting ingredients in formulations.

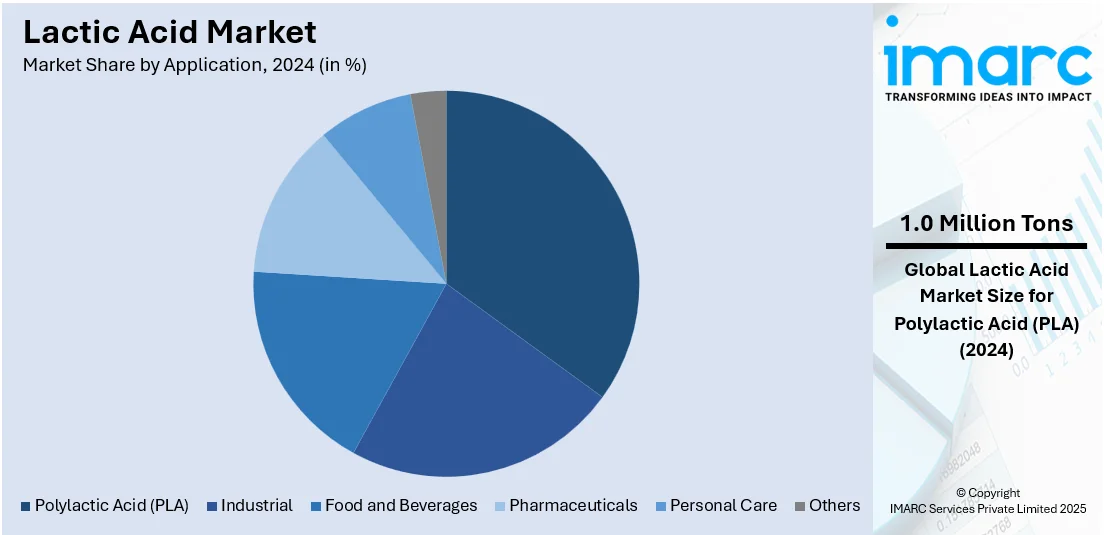

Analysis by Application:

- Industrial

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid (PLA)

- Others

In 2024, polylactic acid (PLA) led the lactic acid market, accounting for 34.6% of the total share, driven by its increasing use in sustainable packaging, disposable products, and biodegradable materials. PLA, derived from lactic acid, is widely adopted as a renewable alternative to traditional plastics across multiple industries, including packaging, agriculture, textiles, and healthcare. The rising demand for compostable and low-impact materials is pushing brands and manufacturers to integrate PLA into their product lines. Regulatory measures aimed at reducing plastic waste and promoting circular economy practices are further boosting PLA demand, especially in food packaging and e-commerce shipping solutions. Companies are also exploring PLA in medical applications for sutures and implants, given its biocompatibility. This surge in demand for PLA is directly fueling the need for high-purity lactic acid, prompting production capacity expansions. The strong downstream pull from PLA applications continues to be one of the most significant growth drivers in the lactic acid industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America dominated the lactic acid market with a 35.0% share, driven by expanding applications in bioplastics, pharmaceuticals, and food processing. The region benefits from an abundant supply of corn, a key feedstock for lactic acid production, and a robust fermentation infrastructure. U.S.-based companies are increasing their investment in PLA production and bio-based chemicals to meet rising consumer and regulatory demand for sustainable alternatives. Supportive policies promoting biodegradable materials, and the reduction of single-use plastics are encouraging industrial use of lactic acid across packaging and consumer goods. In addition, the presence of major biotechnology firms and ongoing R&D efforts are enhancing product quality and process efficiency. The region is also witnessing rising demand for lactic acid in personal care formulations, meat preservation, and dietary supplements. With well-established logistics and growing regional production capacity, North America is not only serving domestic needs but also positioning itself as a key exporter in the global lactic acid value chain.

Key Regional Takeaways:

United States Lactic Acid Market Analysis

In 2024, United States accounted for 88.10% of the market share in North America. The United States lactic acid market is primarily driven by increased adoption in the development of biodegradable polymers expanding application across sustainable packaging sectors. In line with this, the growing demand for natural preservatives and pH regulators in processed foods is supporting market growth. The International Food Information Council (IFIC) reports that 63% of consumers are now more focused on ingredient labels, showing a growing inclination toward natural sweeteners, flavors, and preservatives. Furthermore, expansion of clean-label product portfolios by food and beverage manufacturers elevating the requirement for naturally derived additives such as lactic acid, is strengthening market demand. The continual advancements in fermentation technology enabling cost-effective, high-purity production, is encouraging broader industrial use of the product. Similarly, the rise of lactic acid-based formulations in personal care and cosmetic products reflecting a shift in consumer preferences toward non-toxic, plant-based ingredients, is fostering market expansion. Additionally, favorable policies promoting green chemistry and bio-based alternatives supporting domestic production, is expanding market reach. Moreover, rising pharmaceutical applications in drug formulation and delivery systems continuously diversifying end-user demand across the healthcare sector, is impacting the market trends.

Europe Lactic Acid Market Analysis

The lactic acid market in Europe is experiencing growth due to stringent EU regulations encouraging the shift away from petrochemical-based plastics. In accordance with this, accelerating demand for polylactic acid (PLA) as a sustainable alternative, is widening the market appeal. Similarly, rising awareness of carbon footprint reduction leading to increased interest in bio-based inputs across various manufacturing sectors, is driving growth in the market. The growing reliance on lactic acid in the food processing industry for antimicrobial functions and pH stabilization, is fueling expansion in the market. Furthermore, supportive funding for circular bioeconomy initiatives incentivizing regional production, is stimulating market accessibility. The expanding vegan and plant-based food segment relying heavily on lactic acid for flavor enhancement and preservation, is supporting market demand. A recent industry analysis showed that plant-based food sales in six European countries reached EUR 5.4 Billion in 2023, marking a 5.5% increase from 2022. During the same timeframe, sales volume rose by 3.5%. Besides this, increasing investment in biotechnology research augmenting the scalability of fermentation-derived lactic acid, is creating lucrative opportunities in the market.

Asia Pacific Lactic Acid Market Analysis

The Asia Pacific market is advancing attributed to rapid urbanization and increasing disposable incomes fueling demand for processed and packaged foods. In addition to this, heightened lactic acid use as a preservative and flavor enhancer, is encouraging higher product adoption. Similarly, growth in the textile and leather industries, with lactic acid serving as an eco-friendly alternative in dyeing and tanning processes, is enhancing market appeal. According to IBEF, India has four major leather sectors and contributes 13% to global leather production. It ranks second in leather footwear production and consumption, employing 4.42 Million people. The expanding pharmaceutical manufacturing across countries like India and China increasing the use in formulations and topical applications, is driving market development. Moreover, rising consumer interest in fermented and functional beverages motivating its inclusion in health-focused product lines, is augmenting product sales. Apart from this, favorable government initiatives toward sustainable agriculture propelling the use of lactic acid-based biostimulants and soil enhancers in crop production, is providing an impetus to the market.

Latin America Lactic Acid Market Analysis

In Latin America, the market is progressing propelled by the increasing demand for natural food preservatives in processed food and beverage applications. Similarly, growth in regional cosmetics and personal care industries fostering the use in skin care formulations due to its exfoliating and moisturizing properties, is fueling market development. Furthermore, expanding agricultural activities promoting the use of lactic acid in biodegradable agrochemicals and soil conditioners, is propelling market growth. According to industry reports, approximately 32% of Brazil's land possesses favorable conditions for agriculture, with 30% classified as having good potential and 2% as very good, based on soil characteristics suitable for agricultural development. Moreover, rising awareness of sustainable materials encouraging its incorporation in bio-based packaging and industrial polymers, is expanding the market scope.

Middle East and Africa Lactic Acid Market Analysis

The lactic acid market in the Middle East and Africa is experiencing growth influenced by rising investments in local food processing industries. As such, Siniora Foods announced a USD 40 Million investment to establish a food processing plant in Jeddah, Saudi Arabia. The facility will expand its cold cuts and frozen food production, aligning with the “Made in Saudi Arabia” program and rising regional processing demand. Furthermore, growth in halal and clean-label food demand encouraging the adoption of naturally derived additives, is impelling the market. Additionally, expanding pharmaceutical and cosmetic manufacturing in countries like the UAE and South Africa is augmenting demand in the market. Besides this, increased interest in bio-based construction materials and green building practices driving the use in eco-friendly polymer and coating applications, is positively influencing the market.

Competitive Landscape:

The lactic acid market is witnessing increased competition as companies focus on expanding production capacities, improving fermentation technologies, and investing in sustainable raw materials to meet rising global demand. Firms are prioritizing bio-based processes and product diversification to cater to growing applications in packaging, food, and personal care. Strategic collaborations and regional expansion efforts are also shaping industry dynamics. These developments are expected to significantly influence the lactic acid market forecast, supporting continued growth across various end-use sectors.

The report provides a comprehensive analysis of the competitive landscape in the lactic acid market with detailed profiles of all major companies, including:

- Cellulac plc

- Corbion N.V.

- Dupont De Nemours Inc.

- Foodchem International Corporation

- Galactic

- Godavari Biorefineries Ltd. (Somaiya Group).

- Henan Jindan Lactic Acid Technology Co. Ltd.

- Jungbunzlauer Suisse AG

- Musashino Chemical Laboratory Ltd.

- Spectrum Chemical Mfg. Corp.

- Vaishnavi Bio Tech International Limited

- Vigon International Inc. (Azelis Americas LLC)

Latest News and Developments:

- November 2024: Mirailab Bioscience launched Biotin and Clostridium Butyricum Plus, a supplement combining 50μg biotin with 25 Billion lactic acid and butyric acid bacteria per capsule. It supports skin, hair, and gut health, targeting beauty-conscious users and pregnant women.

- August 2024: Brenntag acquired Brazil-based PIC and PharmaSpecial, enhancing its Life Science presence and entering the soft gel capsule market. PharmaSpecial’s portfolio includes lactic acid, glycolic acid, isopropyl alcohol, etc., supporting Brenntag’s growth in specialty chemicals. The deal augments regional innovation capabilities and aligns with Brenntag’s global pharmaceutical and personal care strategy.

- April 2024: SK Geo Centric announced a new microbial fermentation technology to produce lactic acid with reduced chemical byproducts and costs. Developed by SK Innovation’s research team, the method enhances PLA sustainability and market competitiveness, supporting expansion into packaging, agriculture, transport, and medical sectors.

- April 2024: ICHIMARU PHARCOS launched Fermentage ALOEVERA, a lactic acid bacteria-fermented aloe vera ingredient designed to combat YURAGI skin caused by seasonal changes. Rich in lactate and potassium ions, it improves skin moisture, texture, and reduces inflammation. The product is COSMOS APPROVED and IECIC2021 listed.

Lactic Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Raw Materials Covered | Corn, Sugarcane, Cassava, Others |

| Forms Covered | Liquid, Solid |

| Applications Covered | Industrial, Food and Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cellulac plc, Corbion N.V., Dupont De Nemours Inc., Foodchem International Corporation, Galactic, Godavari Biorefineries Ltd. (Somaiya Group)., Henan Jindan Lactic Acid Technology Co. Ltd., Jungbunzlauer Suisse AG, Musashino Chemical Laboratory Ltd., Spectrum Chemical Mfg. Corp., Vaishnavi Bio Tech International Limited and Vigon International Inc. (Azelis Americas LLC) etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the lactic acid market from 2019-2033.

- The lactic acid market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the lactic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The lactic acid market was valued at 1.81 Million Tons in 2024.

The lactic acid market is projected to exhibit a CAGR of 7.60 % during 2025-2033, reaching a value of 3.71 Million Tons by 2033.

Key factors driving the lactic acid market include growing demand for biodegradable plastics, increased use in food preservation, rising consumer preference for natural ingredients, expanding applications in personal care and pharmaceuticals, and supportive government policies promoting sustainable and bio-based product development across industries.

In 2024, North America dominated the lactic acid market, accounting for the largest market share of 35.0%. The growth is driven by strong demand for bioplastics, extensive corn-based feedstock availability, supportive environmental regulations, advancements in fermentation technologies, and increased use in food processing, personal care, and pharmaceutical applications.

The lactic acid market segmentation covered in the report includes raw material, form, and application.

Some of the major players in the lactic acid market include Cellulac plc, Corbion N.V., Dupont De Nemours Inc., Foodchem International Corporation, Galactic, Godavari Biorefineries Ltd. (Somaiya Group)., Henan Jindan Lactic Acid Technology Co. Ltd., Jungbunzlauer Suisse AG, Musashino Chemical Laboratory Ltd., Spectrum Chemical Mfg. Corp., Vaishnavi Bio Tech International Limited, and Vigon International Inc. (Azelis Americas LLC).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)