Laboratory Filtration Market Size, Share, Trends and Forecast by Product Type, Technique, End User, and Region, 2025-2033

Laboratory Filtration Market Size and Share:

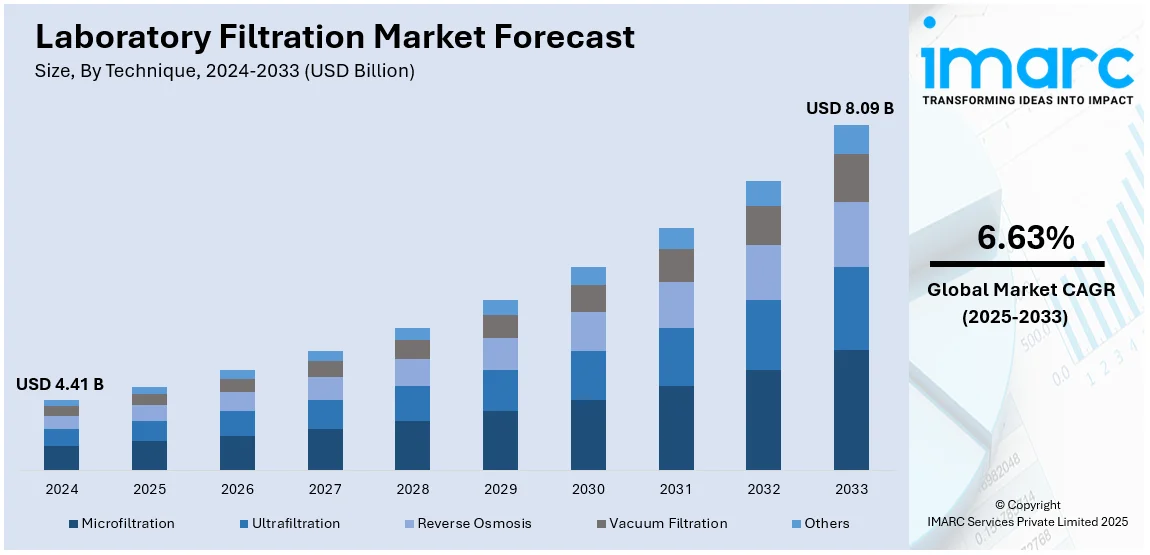

The global laboratory filtration market size was valued at USD 4.41 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.09 Billion by 2033, exhibiting a CAGR of 6.63% from 2025-2033. North America currently dominates the market, holding a market share of over 47.09% in 2024. The growth of the North American region is driven by increasing biopharmaceutical production, strict regulatory requirements, and high adoption of innovative filtration technologies in laboratories. The region's increasing laboratory filtration market share is further attributed to robust investments in life sciences research and the rising demand for high-purity filtration solutions across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.41 Billion |

|

Market Forecast in 2033

|

USD 8.09 Billion |

| Market Growth Rate (2025-2033) | 6.63% |

Pharmaceutical and biotechnology firms are dedicating significant funds to research and development (R&D), necessitating top-notch filtration systems to ensure the purity and dependability of experiments and procedures. Moreover, the increasing manufacturing of biologics such as monoclonal antibodies, vaccines, and cell therapies, necessitating sophisticated filtration technologies to maintain sterility and avoid contamination, is presenting a positive market perspective. In addition, regulatory agencies are implementing stringent regulations for the production of drugs and biologics, resulting in an increased demand for filtration systems that can adhere to these elevated standards. Apart from this, advancements in technology are driving the creation of more effective and accurate filtration systems, allowing for enhanced separation of particles and microorganisms. Furthermore, the increasing adoption of single-use systems, known for their convenience, lower contamination risks, and reduced cleaning expenses, is driving the market expansion in laboratories and production facilities.

The United States is an essential part of the market, propelled by a strong pharmaceutical and biotechnology industry that greatly fuels the need for laboratory filtration systems. These sectors depend significantly on cutting-edge filtration technologies to ensure sterility, purity, and adherence to regulations throughout drug development, production, and quality assurance stages. According to the IMARC Group, the biotechnology market in the US is projected to have a compound annual growth rate (CAGR) of 9.50% between 2024 and 2032. In addition, significant investments made by the country in research programs for innovative medications and treatments require accurate and dependable filtration systems. Filtration is crucial for maintaining the integrity of experiments, preparing samples, and scaling up processes, fostering innovation in the pharmaceutical and biotechnology sectors.

Laboratory Filtration Market Trends:

Rising R&D Activities

The demand for new drugs, therapies, and vaccines is rising because of the increase in research and development efforts, which is contributing to growth within the biotechnology and pharmaceutical industries. The items required include laboratory filtration products. These are required to maintain sterility, precision, and dependability in research activities that are necessary to create biologics, tailored therapies, and vaccines. According to reports, in 2020, universities and colleges in Spain allocated about 477.6 million euros for biotechnology-associated research and development, which was the highest amount since 2009. During the period of analysis, universities increased their biotech R&D expenditures by about 50%. Additionally, growing investments in advanced filtration technologies, an expanding scope of biopharmaceutical pipelines, and stringent regulatory requirements for the development of drugs and vaccines further fuel the market growth.

Growing Prevalence of Chronic Diseases

The rise in chronic illnesses and the aging demographic are major factors contributing to the expansion of the laboratory filtration market. An article from the National Center for Chronic Disease Prevention and Health Promotion estimates that around 129 million individuals in the United States have at least one significant chronic condition, such as heart disease, cancer, diabetes, obesity, and hypertension. These circumstances demand regular diagnostic testing and oversight, calling for filtration systems to prepare samples with great accuracy and dependability for precise outcomes. Moreover, the elderly population leads to a greater incidence of chronic illnesses, which escalates the need for sophisticated healthcare options. The utilization of advanced filtration technologies to enhance diagnostic precision and adhere to strict healthcare standards. These factors are further positively influencing the laboratory filtration market forecast.

Technological Advancements

The incorporation of automated systems and robotics in laboratories is improving accuracy, minimizing human mistakes, and boosting efficiency, thus revolutionizing laboratory processes. Automated filtration systems are capable of processing vast amounts of samples with reliable precision, greatly speeding up the research and development process in multiple areas, such as biopharmaceuticals, chemical engineering, and materials science. For example, in December 2023, ABB Robotics collaborated with XtalPi to create automated lab workstations in China, designed to enhance R&D efficiency in biopharmaceuticals, chemical engineering, and new energy materials. These advancements minimize manual work and operational expenses while guaranteeing adherence to stringent regulatory requirements. Automated filtration systems can handle a large volume of samples, thus speeding up the research and development process in laboratories and boosting the laboratory filtration market revenue.

Laboratory Filtration Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global laboratory filtration market, along with forecast at the global, regional, and country levels from 2025-2033 The market has been categorized based on product type, technique, and end user.

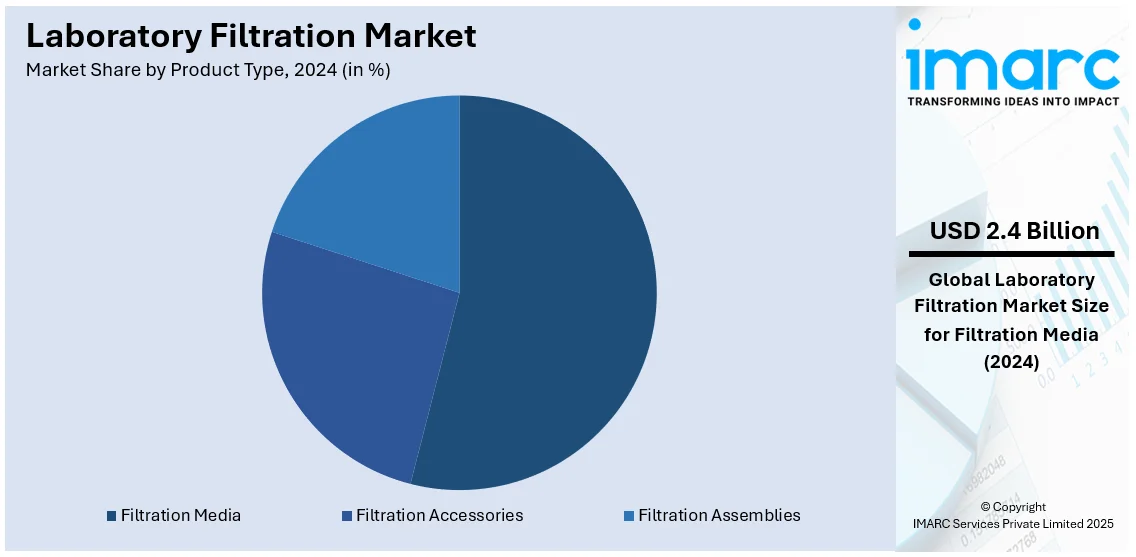

Analysis by Product Type:

- Filtration Accessories

- Filter Funnels

- Filter Holders

- Filter Flasks

- Filter Dispensers

- Cartridges

- Filter Housings

- Seals

- Vacuum Pumps

- Others

- Filtration Media

- Glass Microfiber Filter Papers

- Cellulose Filter Papers

- Membrane Filters

- Quartz Filter Papers

- Syringeless Filters

- Syringe Filters

- Filtration Microplates

- Capsule Filters

- Others

- Filtration Assemblies

Filtration media stands as the largest component in 2024, holding 53.5% of the market share. As per the laboratory filtration market forecast, filtration media refer to materials employed in filtration methods to eliminate particles, pollutants, and impurities from fluids (liquids or gases). These media are designed to permit the fluid to flow while efficiently capturing or eliminating undesirable materials, guaranteeing the intended purity level. They are essential in numerous applications, such as drug discovery, biotechnology, and environmental testing, where accuracy and cleanliness are crucial. The increasing investment in research and development for drug discovery and creation requires high-quality filtration media to guarantee purity, precision, and consistency in experiments, thus boosting demand. Filtration media like membrane filters, depth filters, and activated carbon filters are designed for particular uses, increasing their effectiveness. The increasing occurrence of chronic illnesses and the corresponding advancement of biologics, vaccines, and tailor-made medications also drive the need for sophisticated filtration materials. Moreover, strict regulatory standards and the growing emphasis on sustainability are driving advancements in eco-friendly and reusable filtration materials.

Analysis by Technique:

- Microfiltration

- Ultrafiltration

- Reverse Osmosis

- Vacuum Filtration

- Others

Microfiltration leads the market with 36.5% of the market share in 2024. According to the laboratory filtration market overview, microfiltration (MF) is a widely used technique essential for separating particles and microorganisms from fluids. It employs membrane filters with pore sizes typically ranging from 0.1 to 10 micrometers, making it particularly effective for removing bacteria, suspended solids, and larger particles. High purity and sterility are critical for producing drugs, biologics, and vaccines, driving the need for microfiltration to eliminate microorganisms and particulates. This technique is indispensable in biopharmaceutical manufacturing, where contamination-free processes are paramount. MF is also widely applied in sample preparation, effectively removing particulates that could interfere with analytical techniques such as chromatography and spectroscopy, ensuring accurate and reliable results. Additionally, microfiltration is employed in environmental testing, food and beverage processing, and water purification, emphasizing its versatility. The growing adoption of disposable filtration systems in laboratories and increasing regulatory requirements for sterility further enhance the demand for MF in various industries.

Analysis by End User:

- Pharmaceutical and Biopharmaceutical Companies

- Academic and Research Institutes

- Hospitals and Diagnostic Laboratories

- Others

Pharmaceutical and biopharmaceutical companies lead the market because of their significant utilization of filtration technologies in drug creation, manufacturing, and quality control procedures. These businesses depend on sophisticated filtration systems to guarantee the purity and effectiveness of their products, adhere to strict regulatory standards, and uphold contamination-free settings. The expanding portfolio of biologics, vaccines, and personalized medicines enhances the need for filtration solutions, especially for sterile filtration, virus filtration, and ultrafiltration uses. Biopharmaceutical companies, specifically, gain advantages from filtration systems with high capacity designed for the manufacturing of monoclonal antibodies, recombinant proteins, and cell and gene therapies. Moreover, the rising incidence of chronic illnesses and the worldwide focus on drug development stimulate investments in advanced filtration technologies. Partnerships between filtration system suppliers and pharmaceutical companies to create tailored, effective solutions further strengthen this supremacy. This trend is supported by the increasing emphasis on sustainability, encouraging reusable and energy-saving filtration systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 47.09%. According to the laboratory filtration market statistics, the well-established pharmaceutical and biopharmaceutical manufacturing industries in North America drive the need for advanced laboratory filtration to ensure product quality and strict compliance with the regulatory environment. Meanwhile, intense R&D activities in these industries require highly reliable filtration equipment for sample preparation, purification, and analysis. Moreover, nanofiltration and ultrafiltration among other developments in membrane technology enhance the performance and effectiveness of laboratory filtration equipment. In addition, the introduction of novel membrane filter products and related filtration systems is expected to drive regional market growth through the forecast period. For example, in November 2021, DuPont Water Solutions (DWS) launched the TapTec LC HF-4040 reverse osmosis membrane filter, which offers high flow rates while remaining dependable.

Key Regional Takeaways:

United States Laboratory Filtration Market Analysis

In North America, the United States is a crucial segment, holding 86.70% market share in 2024. Laboratory filtration in the United States has been gaining pace primarily because of an increase in healthcare sector investment, which has significantly risen in recent times. According to JP Morgan, Seed and Series A funding into U.S. biopharma companies totaled USD 5.1 Billion across 105 rounds in the first half of 2024. With an expanding focus on healthcare infrastructure, there has been a surge in the demand for advanced filtration technologies that ensure the purification of water, chemicals, and biological samples, thus supporting research and diagnostics. This investment in healthcare also fuels the growth of better filtration solutions in response to the changing needs of laboratories to maintain precision and safety. In addition, the tighter the regulatory measures are, the more dependent laboratories become on filtration systems when meeting safety and quality standards. This combination of increased funding and the need for cutting-edge filtration solutions is propelling the widespread adoption of laboratory filtration across various medical and research fields.

Europe Laboratory Filtration Market Analysis

In Europe, increased chronic diseases and an aging population have further increased the demand for efficient laboratory filtration systems. For instance, the elderly population is growing in Europe, with one in every five Europeans aged 65 years or older estimated to reach nearly 30% by 2050. With the population aging, there is a resulting rising need for diagnostic tests and therapies concerning chronic illnesses like heart disease, diabetes, and respiratory disorders. It is against this demographic change that laboratories are investing in state-of-the-art filtration technologies that upgrade accurate procedures for diagnoses and protect the patient's safety. More and more laboratories are conducting complex research and clinical studies, hence increasing the demand for superior filtration systems. The growing interest in public health and the prevention of diseases has made healthcare providers take on the implementation of advanced technologies that enhance the quality of life of the elderly. Laboratory filtration systems are also very important in ensuring that tests, samples, and medical devices are safeguarded and comply strictly with health and safety regulations.

Asia Pacific Laboratory Filtration Market Analysis

In the Asia-Pacific area, the increasing focus on healthcare improvements has notably enhanced the use of laboratory filtration technologies. The Ministry of Commerce and Industry, India, reports that there are 1162 investment projects totaling USD 31.47 Billion in the healthcare sector throughout various states in India. The growing emphasis on advancing healthcare infrastructure and medical research skills has driven the need for filtration systems that improve research results, diagnostics, and safety for patients. Improvements in medical device technology, along with increasing healthcare costs, are prompting labs to adopt filtration systems that provide cleaner and safer workspaces. These advancements enable laboratories to attain improved accuracy in tests and experiments, especially in crucial areas such as pharmaceuticals and diagnostics. Furthermore, the healthcare industry's dedication to adopting advanced technologies to address new diseases and enhance public health has laid a robust groundwork for the ongoing use of filtration systems.

Latin America Laboratory Filtration Market Analysis

The expansion of the private healthcare system in Latin America has played a crucial role in the increasing use of laboratory filtration technologies. As per the International Trade Administration, Brazil boasts the largest healthcare market in Latin America, featuring 7,191 hospitals, with 62% being private institutions. With the ongoing growth of the private healthcare industry, there is increasing focus on upholding excellent standards in medical testing and diagnostics. This has resulted in a greater demand for trustworthy filtration systems to guarantee the cleanliness of samples and materials utilized in medical procedures. Laboratories in the area are putting resources into sophisticated filtration technologies to meet the need for precise and reliable diagnostic outcomes. Moreover, private healthcare organizations seek to provide competitive services, necessitating their adoption of the newest technologies in medical testing, such as filtration systems. The growing presence of private healthcare institutions is leading to an escalating need for efficient laboratory filtration systems.

Middle East and Africa Laboratory Filtration Market Analysis

The growth of hospitals and diagnostic laboratories in the Middle East and Africa has driven the demand for laboratory filtration systems. According to Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022, projected to expand further by 3-6% in facilities and 10-15% in professionals in 2023. With an expanding healthcare infrastructure, there is a growing need for high-quality filtration technologies to ensure the purity of samples and testing environments. Laboratories in the region are increasingly adopting filtration solutions to meet the rising standards of diagnostic accuracy and safety. Additionally, with the ongoing development of healthcare services to meet the needs of a growing and diverse population, filtration systems are becoming an integral part of laboratory setups. This shift is essential for ensuring the reliability of tests, improving healthcare outcomes, and complying with international standards for medical research and patient care. The rise of medical facilities is thus pushing the adoption of advanced filtration solutions across the region.

Competitive Landscape:

Major participants in the market are concentrating on strategic actions to enhance their market standing and address changing industry needs. This entails developing advanced filtration techniques to enhance efficiency, precision, and scalability in various applications. Companies are making substantial investments in research efforts to create advanced filtration systems tailored to pharmaceutical, biotechnology, and industrial needs. Through broadening their range of products and establishing partnerships or purchasing other firms, they can expand their market reach and grow their user base. Major companies are highlighting sustainable practices by providing reusable and environment-friendly filtration products to tackle ecological issues. In 2024, Sartorius introduced the Vivaflow® SU, an advanced tangential flow filtration (TFF) cassette aimed at research scientists. This disposable, integrated cassette simplifies usability, optimizes ultrafiltration procedures, and boosts sustainability by cutting plastic usage by 30.5%. It streamlines molecule concentration and rebuffering, removing complicated calculations and reducing waste.

The report provides a comprehensive analysis of the competitive landscape in the laboratory filtration market with detailed profiles of all major companies, including:

- 3M Company

- Agilent Technologies, Inc.

- Cantel Medical Corp.

- Danaher Corporation

- GE Healthcare Inc.

- GEA Group

- MACHEREY-NAGEL GmbH & Co. KG

- MANN + HUMMEL Group

- Sartorius AG

- Sigma-Aldrich Corporation

- Sterlitech Corporation

- Thermo Fisher Scientific

Latest News and Developments:

- October 2024: Asahi Kasei Medical has launched the Planova™ FG1, a next-generation virus removal filter, enhancing laboratory filtration for biopharmaceutical production. Featuring seven times the flux of previous models, it boosts productivity and shortens virus filtration time. The FG1 ensures high protein filtration and virus removal without prefilters, aligning with CIP and SIP processes. This innovation addresses growing global demand for biotherapeutics.

- June 2024: Cytiva has introduced Supor Prime sterilizing grade filters, enhancing laboratory filtration for high-concentration biologic drugs. The innovation boosts yields, reduces blockages, and minimizes filtration losses, addressing the growing demand for self-administered subcutaneous therapies.

- June 2024: Asahi Kasei, a Japan-based ammonia and cellulose fiber business, developed a hollow-fiber membrane method for producing sterile water for injection. The membrane system was created as an alternative to traditional distillation procedures for producing water for injection (WFI).

- March 2024: Asahi Kasei Medical Co., Ltd. launched Planova BioEX, their next-generation hollow-fiber membrane viral filters. Planova BioEX filters are specifically designed to meet the urgent need in downstream biopharmaceutical processing for strong virus filters that not only improve safety.

- February 2024: Freudenberg Performance Materials launched a new line of 100% synthetic wetlaid non-woven products produced in Germany. The innovative materials can be created from numerous polymer-derived fibers, such as ultra-fine microfibers. These wetlaid substances are meant for applications in filtration and various industrial processes.

Laboratory Filtration Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Techniques Covered | Microfiltration, Ultrafiltration, Reverse Osmosis, Vacuum Filtration, Others |

| End Users Covered | Pharmaceutical and Biopharmaceutical Companies, Academic and Research Institutes, Hospitals and Diagnostic Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Agilent Technologies, Inc., Cantel Medical Corp., Danaher Corporation, GE Healthcare Inc., GEA Group, MACHEREY-NAGEL GmbH & Co. KG, MANN + HUMMEL Group, Sartorius AG, Sigma-Aldrich Corporation, Sterlitech Corporation, Thermo Fisher Scientific, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the laboratory filtration market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global laboratory filtration market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the laboratory filtration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The laboratory filtration market was valued at USD 4.41 Billion in 2024.

IMARC estimates the laboratory filtration market to exhibit a CAGR of 6.63% during 2025-2033, reaching a value of USD 8.09 Billion by 2033.

The laboratory filtration market is experiencing growth due to advancements in pharmaceutical research, increasing demand for high-purity filtration, and rising investments in biotechnology. Key drivers include stringent regulatory standards, expanding drug development pipelines, and the need for precise sample preparation in laboratories.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the laboratory filtration market include 3M Company, Agilent Technologies, Inc., Cantel Medical Corp., Danaher Corporation, GE Healthcare Inc., GEA Group, MACHEREY-NAGEL GmbH & Co. KG, MANN + HUMMEL Group, Sartorius AG, Sigma-Aldrich Corporation, Sterlitech Corporation, Thermo Fisher Scientific, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)