Kyphoplasty Market Report by Product (Balloon Catheters, Bone Access Devices, Cement Application Products, Bone Cement, Cement Mixing Systems, Instruments), Indication (Osteoporosis, and Others), Application (Kyphosis, Spinal Fractures, Vertebral Alignment Restoration), End User (Hospitals and Clinics, Ambulatory Surgical Centers), and Region 2025-2033

Kyphoplasty Market Size, Share Analysis, and Industry Forecast:

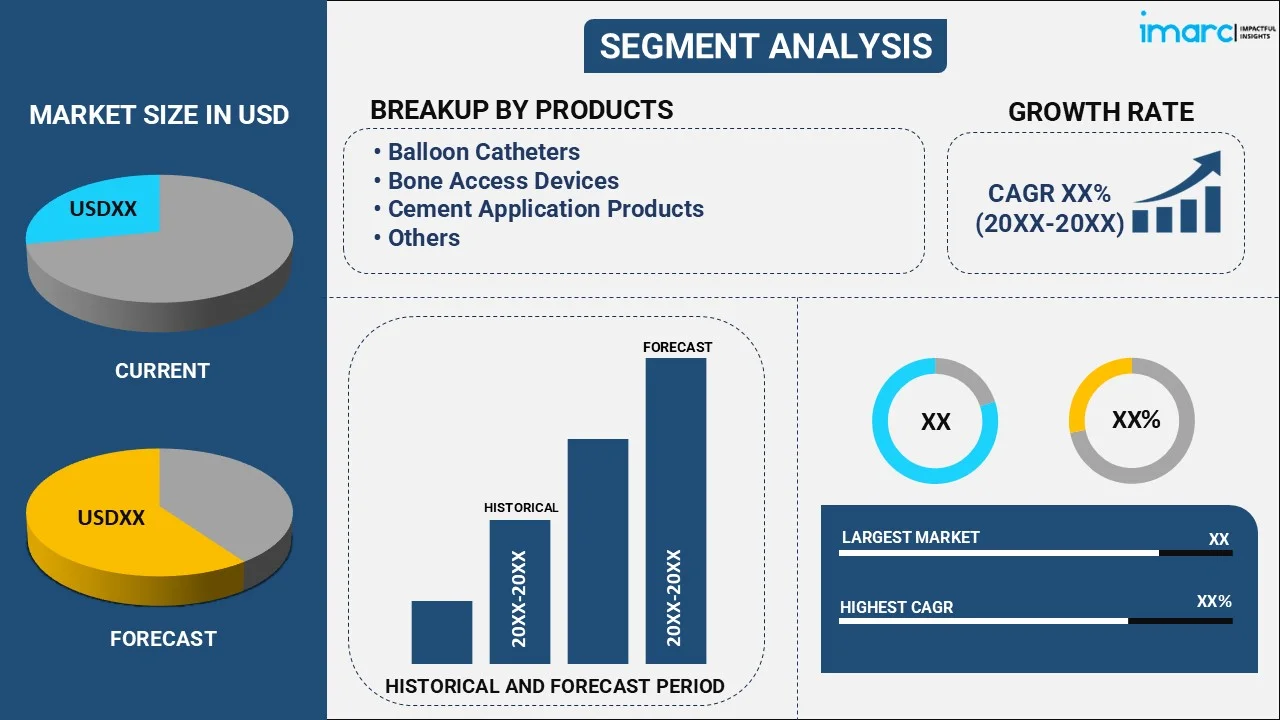

The global kyphoplasty market size reached USD 712.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,069.4 Million by 2033, exhibiting a growth rate (CAGR) of 4.39% during 2025-2033. The rising prevalence of osteoporosis across the globe, the growing preference for minimally invasive surgical procedures among patients, and various technological advancements in the healthcare sector represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 712.4 Million |

| Market Forecast in 2033 | USD 1,069.4 Million |

| Market Growth Rate (2025-2033) |

4.39%

|

Kyphoplasty is a minimally invasive surgical procedure to treat vertebral compression fractures (VCFs) in the spine. VCFs are fractures of the vertebrae, which are the small bones that make up the spine. These fractures can occur due to osteoporosis, trauma, or other medical conditions. During kyphoplasty, a small incision is made in the back, and a narrow tube is inserted into the fractured vertebra. A small balloon is then inserted through the tube and inflated to create a cavity inside the vertebra. It requires small incisions and involves less pain, scarring, and recovery time than traditional open surgery. The procedure is performed under local or general anesthesia and has a high success rate, with most patients experiencing significant pain relief and improved mobility after the procedure. Owing to these benefits, kyphoplasty is widely preferred by patients and professionals across the globe.

To get more information on this market, Request Sample

Kyphoplasty Market Trends:

The market is primarily driven by the growing prevalence of osteoporosis and vertebral compression fractures (VCFs). Osteoporosis is a common condition, particularly among older adults, which is escalating the demand for kyphoplasty procedures. In addition, the shifting preferences for minimally invasive procedures represent another major growth-inducing factor. Kyphoplasty is a minimally invasive procedure that requires small incisions and involves less pain, scarring, and recovery time than traditional open surgery. Besides this, the rising awareness regarding the diagnosis of VCFs is also contributing to market growth. VCFs can be difficult to diagnose, and many patients may not be aware they have the condition. However, with improved imaging techniques and greater awareness of the symptoms and risk factors for VCFs, patients are adopting kyphoplasty as a treatment option. Moreover, the development of improved kyphoplasty devices with radiofrequency ablation or balloon kyphoplasty has made the procedure safer and more effective, thus accelerating the adoption among physicians and patients. Furthermore, the increasing health reimbursement policies are also propelling market growth. Reimbursement policies for kyphoplasty procedures vary by region, and public and private health insurers cover the cost of the procedure. This has helped to increase access to kyphoplasty among patients with weaker financial positions. Apart from this, the rising disposable incomes, the increasing healthcare expenditure, and the developing medical infrastructure are some of the other factors creating a favorable market outlook across the globe.

Kyphoplasty Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global kyphoplasty market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, indication, application, and end user.

Product Insights:

- Balloon Catheters

- Bone Access Devices

- Cement Application Products

- Bone Cement

- Cement Mixing Systems

- Instruments

The report has provided a detailed breakup and analysis of the kyphoplasty market based on the product. This includes balloon catheters, bone access devices, cement application products, bone cement, cement mixing systems, and instruments. According to the report, bone access devices represented the largest segment.

Indication Insights:

- Osteoporosis

- Others

A detailed breakup and analysis of the kyphoplasty market based on the indication has also been provided in the report. This includes osteoporosis and others. According to the report, osteoporosis accounted for the largest market share.

Application Insights:

- Kyphosis

- Spinal Fractures

- Vertebral Alignment Restoration

The report has provided a detailed breakup and analysis of the kyphoplasty market based on the application. This includes balloon kyphosis, spinal fractures, and vertebral alignment restoration. According to the report, spinal fractures represented the largest segment.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

A detailed breakup and analysis of the kyphoplasty market based on the end user has also been provided in the report. This includes hospitals and clinics and ambulatory surgical centers. According to the report, hospitals and clinics accounted for the largest market share.

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for kyphoplasty. Some of the factors driving the North America kyphoplasty market included its aging population, technological advancements and rising healthcare expenditure.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global kyphoplasty market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Alphatec Holdings TNC, Biopsybell S.r.l., Globus Medical Inc, Izi Medical Products LLC, Johnson & Johnson, Joline GmbH & Co. KG, Medtronic plc, Merit Medicals Systems, Seawon Meditech Co. Ltd., SOMATEX Medical Technologies Gm (Hologic Inc.), Spinal Elements Inc., Zavation Medical Products LLC,etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Balloon Catheters, Bone Access Devices, Cement Application Products, Bone Cement, Cement Mixing Systems, Instruments |

| Indications Covered | Osteoporosis, Others |

| Applications Covered | Kyphosis, Spinal Fractures, Vertebral Alignment Restoration |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alphatec Holdings TNC, Biopsybell S.r.l., Globus Medical Inc, Izi Medical Products LLC, Johnson & Johnson, Joline GmbH & Co. KG, Medtronic plc, Merit Medicals Systems, Seawon Meditech Co. Ltd., SOMATEX Medical Technologies Gm (Hologic Inc.), Spinal Elements Inc., Zavation Medical Products LLC,etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global kyphoplasty market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global kyphoplasty market?

- What is the impact of each driver, restraint, and opportunity on the global kyphoplasty market?

- What are the key regional markets?

- Which countries represent the most attractive kyphoplasty market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the kyphoplasty market?

- What is the breakup of the market based on the indication?

- Which is the most attractive indication in the kyphoplasty market?

- What is the breakup of the market based on application?

- Which is the most attractive application in the kyphoplasty market?

- What is the breakup of the market based on end user?

- Which is the most attractive end user in the kyphoplasty market?

- What is the competitive structure of the global kyphoplasty market?

- Who are the key players/companies in the global kyphoplasty market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the kyphoplasty market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global kyphoplasty market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the kyphoplasty industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)