KVM Switch Market Size, Share, Trends and Forecast by Switch Type, Enterprise Size, Vertical, and Region, 2025-2033

KVM Switch Market Size and Share:

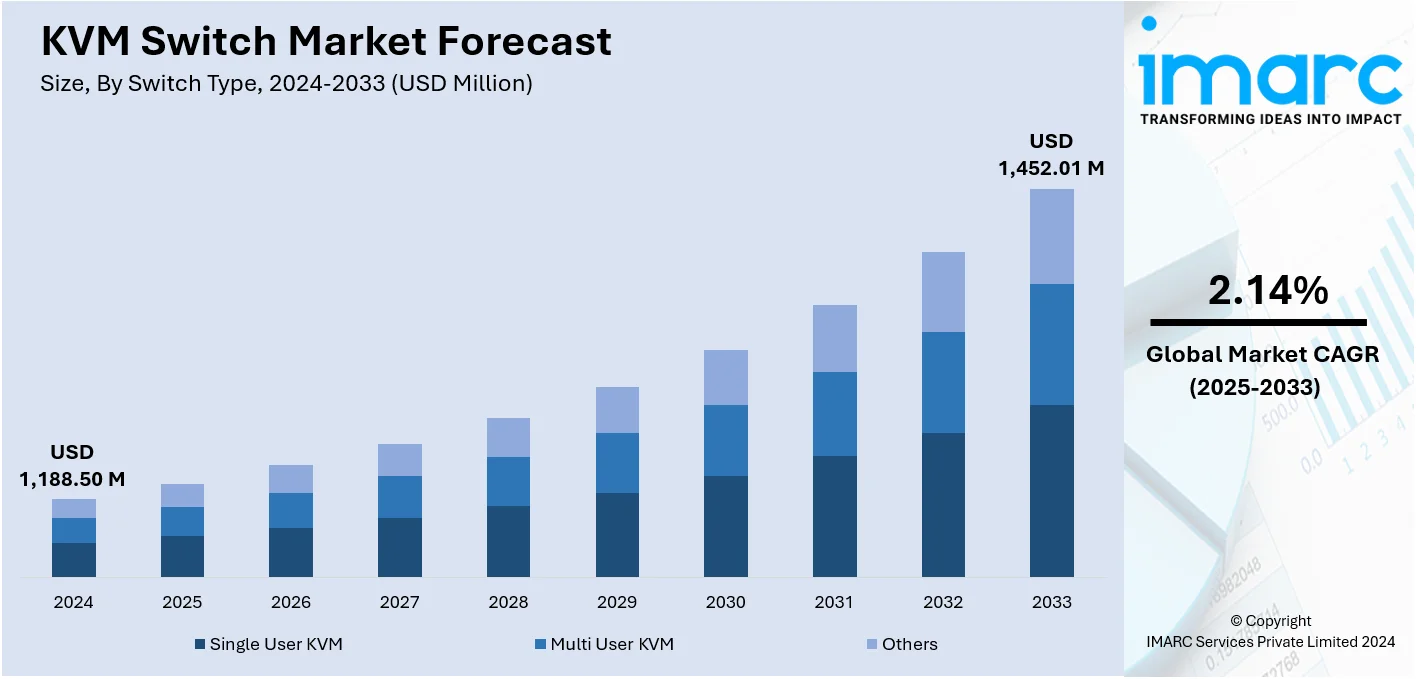

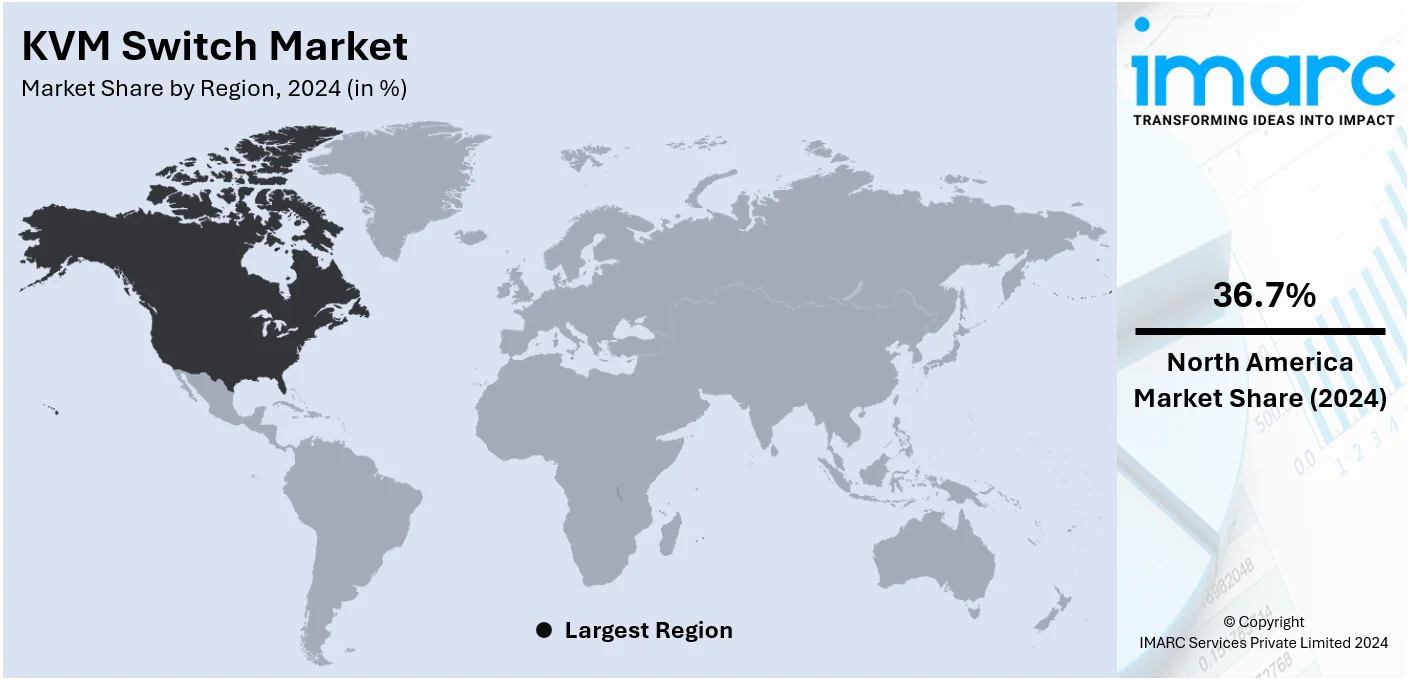

The global KVM switch market size was valued at USD 1,188.50 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,452.01 Million by 2033, exhibiting a CAGR of 2.14% from 2025-2033. North America currently dominates the market, holding a market share of over 36.7% in 2024. Extensive research and development (R&D) activities, the increasing adoption of data server infrastructure, and the introduction of wireless KVM switches represent some of the key factors driving the KVM switch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,188.50 Million |

|

Market Forecast in 2033

|

USD 1,452.01 Million |

| Market Growth Rate 2025-2033 | 2.14% |

The KVM switch market is experiencing robust growth, driven by the increasing demand for efficient data center management and advancements in IT infrastructure. The rise of virtualization and remote management solutions has significantly boosted the adoption of KVM switches, as businesses seek streamlined operations and improved system control. Innovations in IP-based KVM switches have enhanced scalability, enabling seamless management of larger systems across multiple locations. Industry-specific requirements, such as secure access in financial and government sectors, and the growing integration of high-resolution and multi-user capabilities are further propelling market expansion. Additionally, according to the KVM switch market forecast, the adoption of cloud computing and edge computing is driving demand for advanced KVM solutions, as organizations require efficient ways to manage distributed IT environments.

In the United States, the KVM switch market is benefiting from the rapid digital transformation across various sectors, including healthcare, finance, and education. The country's strong emphasis on data security and regulatory compliance drives the adoption of KVM solutions offering advanced encryption and secure remote access. For instance, in September 2024, Black Box launched new Secure KVM remote controllers, featuring customizable digital and cost-effective analog models, enhancing operator efficiency in secure environments. Technological innovation and high levels of IT spending have enabled the development and deployment of cutting-edge KVM systems tailored to complex operational needs. Furthermore, the growing demand for remote work infrastructure has strengthened the need for reliable and scalable KVM solutions in the region.

KVM Switch Market Trends:

Rising Demand for Data Centers

One of the main factors propelling the KVM (Keyboard, Video, Mouse) switch industry is the quick growth of data centres around the world. The number of data centres is increasing dramatically as a result of the explosion of data brought about by digital transformation, cloud computing, IoT, and AI. For instance, there were 10,978 data center locations worldwide as of December 2023, as per reports. Every one of these establishments needs good server administration solutions, and KVM switches give managers an affordable way to manage several servers from a single interface. KVM switches are essential for environments handling thousands of servers since they require efficient operations. Additionally, the demand for small and sophisticated KVM switches that are suited to smaller installations is being driven by the development of edge computing.

Expanding IT Infrastructure Investments in Emerging Markets

The demand for KVM switches is being driven by the boom in IT infrastructure investments in emerging economies in Asia-Pacific, the Middle East, and Africa. For example, recent studies show that mainland China spent USD 10.2 Billion on cloud infrastructure services in Q3 2024, while India is predicted to invest USD 20 Billion in its data centre sector by 2025. Likewise, programs such as Saudi Arabia's Vision 2030 have accelerated the expansion of IT projects, including the creation of smart cities that call for sophisticated server administration solutions. KVM switches are essential for these price-conscious but quickly expanding markets because of their capacity to minimise hardware needs and maximise power usage. The strong demand for KVM solutions in these areas is a result of both private investments in corporate IT systems and government-backed IT infrastructure initiatives.

Increasing Adoption of Multi-User and Multi-Device Management Solutions

Advanced KVM switches are becoming more popular as businesses expand due to the requirement to handle intricate networks of users and devices at the same time. Multi-user KVM switches are gaining popularity in sectors including banking, healthcare, and education because they enable simultaneous access to many systems. KVM systems, for example, make it easier to handle electronic medical information across devices in the healthcare industry, and KVM switches give virtual classrooms centralised controls. According to an industry report, KVM switches are essential to banking IT systems, which may manage more than 10,000 servers per institution, in order to maintain security and operational effectiveness. With more than half of businesses preferring hybrid work patterns in 2024, the growing trend of remote IT administration also makes IP-based KVM switches—which provide remote monitoring and troubleshooting—even more essential.

KVM Switch Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global KVM switch market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on switch type, enterprise size, and vertical.

Analysis by Switch Type:

- Single User KVM

- Multi User KVM

- Others

Single user KVM leads the market with around 62.7% of market share in 2024. The segment is driven by their simplicity, efficiency, and cost-effectiveness. These switches enable a single user to control multiple computers or servers, making them ideal for small to medium-sized businesses, individual workstations, and remote setups. Their compact design and straightforward operation cater to growing KVM switch market demand in industries prioritizing streamlined IT management. Advancements in IP-based single-user KVM solutions have enhanced functionality, offering secure remote access, high-resolution support, and compatibility with modern IT infrastructures. This dominance reflects their widespread adoption across sectors requiring efficient, scalable, and reliable solutions for centralized system control.

Analysis by Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Large enterprises lead the market with around 63.3% of market share in 2024. The market is driven by their extensive IT infrastructure and complex operational requirements. These organizations rely on advanced KVM solutions to manage multiple servers and data centers efficiently, ensuring seamless operations and robust system control. The need for secure, scalable, and high-performance solutions has led large enterprises to adopt KVM switches with advanced features such as multi-user access, IP-based control, and high-resolution compatibility. With significant IT budgets and a focus on optimizing resources, large enterprises continue to drive demand for innovative KVM technologies, solidifying their market dominance.

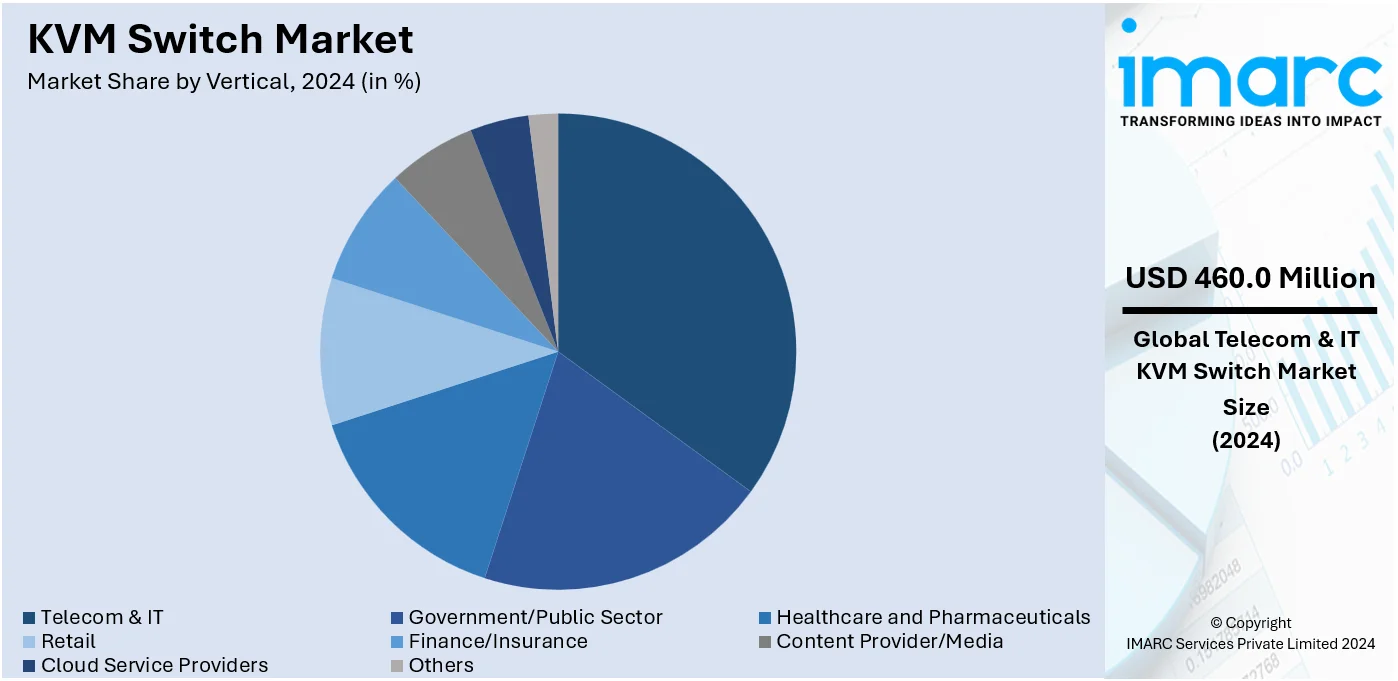

Analysis by Vertical:

- Government/Public Sector

- Telecom & IT

- Healthcare and Pharmaceuticals

- Retail

- Finance/Insurance

- Content Provider/Media

- Cloud Service Providers

- Others

Telecom and IT leads the market with around 38.7% of market share in 2024. This is due to its critical need for efficient management of extensive server infrastructures. These industries require reliable and scalable KVM solutions to oversee data centers, ensure secure remote access, and streamline operations across geographically distributed networks. Advancements in virtualization and cloud computing have further amplified demand for high-performance KVM technologies. Features like multi-user access, seamless switching, and IP-based control are essential for maintaining operational efficiency and minimizing downtime. The sector’s focus on robust IT management solidifies its position as a primary driver of KVM switch market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.7%. The region’s growth is driven by its advanced IT infrastructure and high levels of digital adoption across industries. Additionally, strong presence of technology-driven sectors such as healthcare, finance, and telecommunications fuels demand for reliable KVM solutions to manage extensive server networks and ensure secure data access, reflecting a positive KVM switch market outlook. Increased investments in data centers, coupled with a robust focus on cybersecurity and regulatory compliance, further propel market growth. The region also benefits from ongoing innovation by leading manufacturers and widespread adoption of remote work models, solidifying North America's dominance in the global KVM switch market.

Key Regional Takeaways:

United States KVM Switch Market Analysis

In 2024, United States accounted for 73.90% of the market share in North America. Due to its extensive use of data centre solutions and strong IT infrastructure, the US is a major market for KVM (Keyboard, Video, and Mouse) switches. According to an industry report, with more than 5,000 data centres spread across the nation, including key hubs like Silicon Valley, Northern Virginia, and Dallas, the need for sophisticated KVM switches to effectively handle numerous servers is greatly increased. KVM switches are crucial for maximising data centre operations, as cloud computing adoption is increasing significantly in the US. The necessity for KVM-over-IP solutions, which allow administrators to control systems remotely, has increased due to the growing trend towards virtualisation and remote working.

KVM switch integration is further encouraged by federal government programs like the FedRAMP program, which places a strong emphasis on cloud service security. Because they depend on effective IT management solutions, sectors like healthcare, banking, and telecommunications also make substantial contributions. Leading companies like Avocent, Raritan, and Tripp Lite are spearheading innovation in this field by providing 4K-compatible switches and multi-user KVMs to satisfy changing demands.

Europe KVM Switch Market Analysis

Europe's sophisticated industrial and technical environment is driving the KVM switch market there. The adoption of KVM switches is fuelled by the European Union's emphasis on digital transformation, which is demonstrated by initiatives like the Digital Europe Programme, which allots significant funds to improve IT infrastructure. Europe accounts for about 17% of the worldwide data centre business, with Germany, the UK, and France leading the way thanks to their vast data centre networks. There are now about 1,200 specialised data centre locations in Europe, per recent studies. Using KVM switches to manage networked systems is essential as Industry 4.0 techniques gain traction, especially in manufacturing and logistics. Additionally, there is a strong demand for KVM-over-IP switches due to the quick growth of cloud computing and colocation services in Europe. The requirement for remote access solutions provided by KVM technology has been exacerbated by the increase in remote work throughout the region, with about 25% of the workforce working from home during the pandemic, as per reports.

Asia Pacific KVM Switch Market Analysis

The market for KVM switches is expanding significantly in Asia-Pacific due to the region's growing IT infrastructure investments and quick digitisation. With their enormous populations and growing economies, China and India are significant contributors. More than 400 sizable data centres and more than 100 service providers are located in China as per reports, and the Digital India campaign and other measures are propelling the data centre sector's remarkable growth in India. The need for effective server administration solutions, such as KVM switches, is increasing as 5G networks spread throughout nations including South Korea, Japan, and Australia. Demand for strong backend IT systems is increased by the growth of e-commerce, which accounts for nearly 60% of worldwide online retail sales in Asia, as per data by Digital Commerce 360. Furthermore, opportunities for high-performance KVM are being created by growing investments in AI and machine learning applications.

Latin America KVM Switch Market Analysis

Data centre developments and the increasing use of digital technologies are driving the KVM switch market in Latin America. The International Data Corporation estimates that in 2022, the Brazilian information technology (IT) market was worth USD 45.2 Billion, up 3% from 2021, the region's largest economy, which also serves as a hub for the expansion of data centres. Argentina and Mexico are important markets as well, using their expanding IT sectors to implement cutting-edge server administration solutions. The need for KVM-over-IP solutions has increased due to the region's growing adoption of cloud computing and hybrid IT infrastructures. Furthermore, the adoption of cutting-edge IT infrastructure, such as KVM switches, is being facilitated by government programs to support digital transformation, such as Brazil's Digital Transformation Strategy.

Middle East and Africa KVM Switch Market Analysis

The increased emphasis on digital transformation and rising IT investments are driving the KVM switch market in the Middle East and Africa. Leading the way are the nations of the Gulf Cooperation Council (GCC), such as Saudi Arabia and the United Arab Emirates, which have made large investments in data centres as part of their Vision 2030 projects. Demand for sophisticated KVM solutions is being driven by the region's increasing use of cloud computing and virtualisation. Server management tool adoption in Africa is being driven by the growing IT and telecommunications sectors, especially in South Africa and Nigeria. In order to improve data centre security and efficiency and aid in the region's digital development, governments and private businesses are progressively implementing KVM switches.

Competitive Landscape:

The KVM switch market is highly competitive, driven by advancements in IT infrastructure and the increasing need for efficient data center management. Key players focus on innovation, offering enhanced features such as multi-user access, high-resolution support, and seamless switching between devices. The market is segmented by product type, including analog, digital, and IP-based KVM switches, catering to diverse industry requirements. Companies are expanding their global presence through strategic partnerships, acquisitions, and product launches to gain a competitive edge. For instance, in November 2024, AV Access launched the 4KIPJ200 KVM over IP solution, featuring ultra-low latency, scalability, and advanced capabilities, making it an ideal choice for command and control center applications. Additionally, the growing adoption of virtualization and remote management solutions intensifies competition, as businesses seek reliable, scalable, and cost-effective KVM solutions to optimize operations.

The report provides a comprehensive analysis of the competitive landscape in the KVM switch market with detailed profiles of all major companies, including:

- ATEN International Co. Ltd.

- Belkin International Inc.

- Black Box Corporation

- Dell Technologies Inc.

- D-Link Corporation

- Emerson Electric Co.

- Fujitsu Limited

- Guntermann & Drunck GmbH

- Hewlett Packard Enterprise Development LP

- IHSE GmbH

- Schneider Electric SE

- Eaton Corporation plc

Latest News and Developments:

- August 2024: IOGEAR released Single-User KVM Switches. These provide connectivity and access at better resolutions. These devices are being used more and more by IT experts and staff in small and medium-sized businesses.

- July 2024: StarTech introduced Single-User KVM Switches with security features. In smaller IT systems, this safeguards the user's source and keeps an eye on data. In these launches, security and access control are becoming more and more important.

- May 2024: Anker launched a new KVM switch for desktop and laptop which can be purchased from Amazon in North America and Europe.

- June 2024: Eaton declared the launch of its Eaton NetDirector® KVM over IP switches in North America. The unique new switch provides operators of data centers and distributed IT environments the ability to control connected IT equipment from any location at any time.

- September 2024: AV Access announced the launch of iDock C20, which is an all-in-one USB-C KVM switch docking station created for efficient home office and gaming with innumerable peripherals.

KVM Switch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Switch Types Covered | Single User KVM, Multi User KVM, Others |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Verticals Covered | Government/Public Sector, Telecom & IT, Healthcare and Pharmaceuticals, Retail, Finance/Insurance, Content Provider/Media, Cloud Service Providers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ATEN International Co. Ltd., Belkin International Inc., Black Box Corporation, Dell Technologies Inc., D-Link Corporation, Emerson Electric Co., Fujitsu Limited, Guntermann & Drunck GmbH, Hewlett Packard Enterprise Development LP, IHSE GmbH, Schneider Electric SE, Eaton Corporation plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the KVM switch market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global KVM switch market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the KVM switch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The KVM switch market was valued at USD 1,188.50 Million in 2024.

IMARC estimates the KVM switch market to reach USD 1,452.01 Million in 2033, exhibiting a CAGR of 2.14% during 2025-2033.

The market is driven by the increasing demand for efficient IT management, advancements in data center infrastructure, and the rise of virtualization technologies. Growing adoption of remote work models and enhanced cybersecurity requirements further boost demand. Additionally, technological innovations and the need for scalable solutions in diverse industries fuel market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the KVM switch market include ATEN International Co. Ltd., Belkin International Inc., Black Box Corporation, Dell Technologies Inc., D-Link Corporation, Emerson Electric Co., Fujitsu Limited, Guntermann & Drunck GmbH, Hewlett Packard Enterprise Development LP, IHSE GmbH, Schneider Electric SE, Eaton Corporation plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)