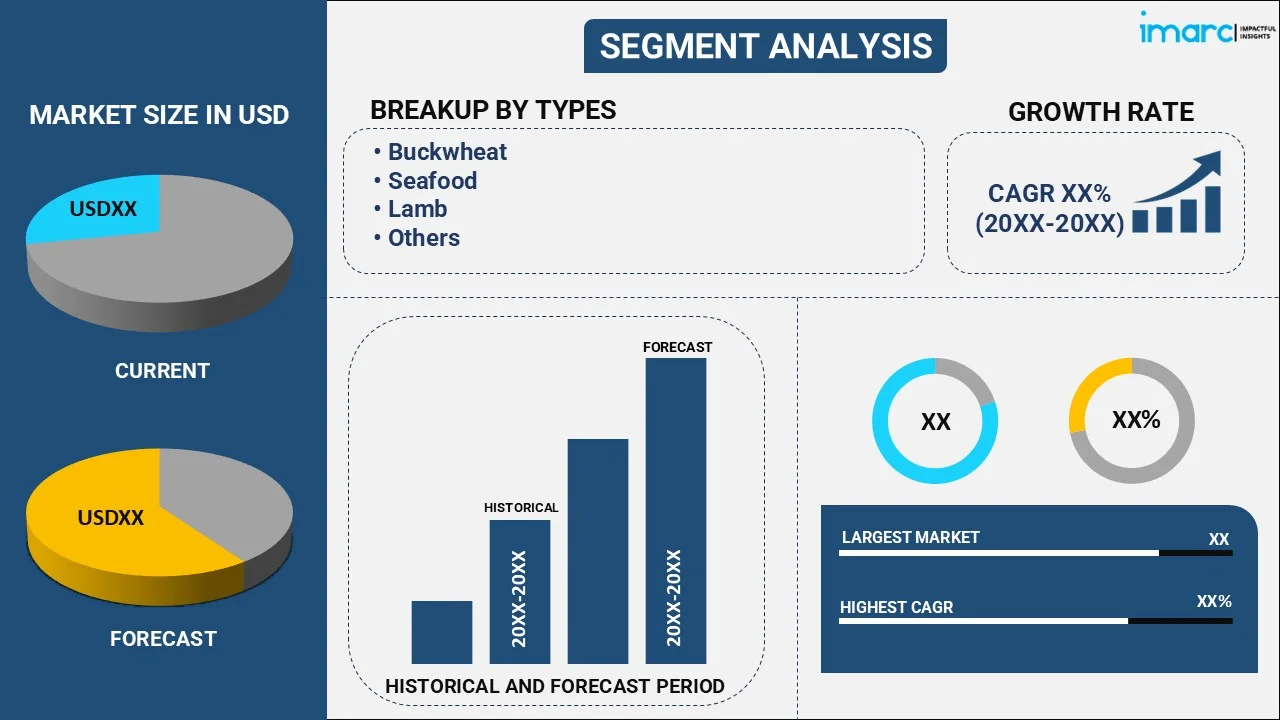

Kosher Food Market Report by Type (Buckwheat, Seafood, Lamb, Pulses, and Others), Application (Culinary Products, Snacks and Savory, Bakery and Confectionery Products, Meat, Beverages, Dietary Supplements), Distribution Channel (Supermarkets and Hypermarkets, Grocery Stores, Online Stores), and Region 2025-2033

Market Overview:

The global kosher food market size reached USD 22.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 29.6 Billion by 2033, exhibiting a growth rate (CAGR) of 2.95% during 2025-2033. North America currently exhibits a clear dominance, accounting for the largest market share owing to the presence of a diverse population, comprising a substantial Jewish community, along with the changing dietary and cultural preferences. Moreover, the increasing regulations promoting transparency in food labeling, religious organizations endorsing kosher products, and the kosher certification's potential boost to export markets are some of the factors propelling the market demand.

Market Size & Forecasts:

- Kosher food market was valued at USD 22.1 Billion in 2024.

- The market is projected to reach USD 29.6 Billion by 2033, at a CAGR of 2.95% from 2025-2033.

Dominant Segments:

- Application: Meat represents the largest segment due to its cultural, religious, and culinary significance.

- Distribution Channel: Supermarkets and hypermarkets dominate the market owing to their extensive reach, diverse product offerings, and convenience.

- Region: North America leads the market, owing to the region's diverse population, including a substantial Jewish community, fuels the kosher food market demand, aligning with dietary and cultural preferences.

Key Players:

- The leading companies in the market include Blommer Chocolate Company (Fuji Oil Co. Ltd), Bob’s Red Mill Natural Foods, Cargill Incorporated, Conagra Brands Inc., Dairy Farmers of America Inc., Empire Kosher Poultry LLC (The Hain Celestial Group Inc.), General Mills Inc., Kellogg's Company, Nestlé S.A., PepsiCo Inc., The Kraft Heinz Company etc.

Key Drivers of Market Growth:

- Health Consciousness: Increased health awareness is propelling consumers towards kosher foods, which are viewed as cleaner, healthier, and more ethically sourced than their traditional counterparts.

- Religious and Cultural Significance: Demand for kosher food is always high among Jewish consumers everywhere, where it complies with dietary regulations. It carries over among non-Jewish consumers who are looking for specialty or premium products.

- Enlargement of Product Line: he availability of a wide range of kosher-certified products, including organic, gluten-free, and non-genetically modified (GMO) options, is broadening the market's appeal to a wider consumer base beyond religious observance.

- Growing Availability at Retail: Top grocery store chains and internet retailers are increasing their sales of kosher foods, making it more accessible and convenient for consumers. This trend is leading to deeper market penetration.

- Perceived Quality and Safety: Kosher food is usually linked to greater food safety and demanding quality control procedures, which increases its attractiveness in international markets that are interested in food safety and ethical sourcing.

Future Outlook:

- Strong Growth Outlook: The kosher food market will see continued growth due to escalating health consciousness, growing global Jewish populations, and increasing product innovation in kosher products.

- Market Evolution: The market is set for expansion not just in traditionally stable markets such as North America and Europe but also in emerging markets where kosher food awareness is growing, especially in Asia and Latin America.

The kosher food market is witnessing strong growth and disruption, led by a host of factors that signify evolving consumer tastes, health trends, and cultural changes. Increased demand for plant-based foods is also contributing to the market growth. As the world has seen a rise in veganism and plant-based diets, kosher food manufacturers have taken advantage of the trend by introducing a variety of kosher-certified plant-based products. These include dairy-free alternatives, plant-based meat, and vegan snacking products that are appealing to both kosher consumers and people adhering to plant-based diets for health or ethical purposes. The convergence of these trends is building a new niche in the kosher food market, with products addressing both the religious and health-oriented segments.

To get more information on this market, Request Sample

Kosher Food Market Trends:

Growing Incidence of Lactose Intolerance Among Masses

Growing incidence of lactose intolerance among masses is driving the market. Lactose intolerance, which is the inability to digest lactose present in milk products, has resulted in people looking for substitutes that suit their dietary requirements. Kosher foods, which sometimes involve the separation of dairy and meat foods, naturally have an answer for lactose intolerance in that they have a variety of pareve (neutral) and dairy-free products. In addition, as the world learns more about lactose intolerance, there is an increasing number of consumers who are attracted to kosher foods that fit their dietary needs. The product's focus on label honesty and clear distinction between dairy and non-dairy items is appealing to those looking for lactose-free products. Producers are meeting the need by creating a range of lactose-free kosher food products, such as plant-based alternatives, that appeal to a larger group of consumers. The synergy between lactose intolerance issues and practices of kosher foods helps drive the expansion of the market, appealing both to religious practice and dietary choice. IMARC Group predicts that the lactose intolerance market is expected to reach USD 22.18 Billion in 2035.

Growing Product Demand Among Non-Jewish Consumers

Growing product demand among non-Jewish consumers is supporting the market growth. Outside of its historical religious context, kosher certification is being sought by consumers who see it as a seal of quality, safety, and ethics. The strict rules and oversight surrounding kosher foods appeal to a wider consumer audience, representing a variety of dietary lifestyles, such as vegetarian, vegan, and allergen-free eating. Non-Jewish consumers are attracted to kosher foods based on the perceived strict regulation, traceability, and exclusion of specific additives or ingredients. Health-conscious and ethically-oriented consumers who demand openness in what they eat find kosher certification a guarantee. The trend is seen by manufacturers and is being followed as they increase their lines to include the tastes of non-Jewish consumers, essentially propelling the market beyond its traditional limits. For instance, in 2025, the Orthodox Union (OU) Kosher certification launched various new products including the snacks and beverages, along with specialty and health-focused food products.

Increased Demand for Ethically and Locally Produced Ingredients

The increased demand from consumers for ingredients that are ethically and locally produced is driving the market. Kosher certification captures these tastes well, as it tends to include strict examination of supply chains and manufacturing processes. Consumers who want to see transparency in sourcing, justice in labor, and sustainability in farming appreciate kosher products that come with these assurances. The focus of the product on quality, traceability, and ethical is aligned with the ethos of responsible sourcing of ingredients. As consumers increasingly seek to know the origin and method of production of food, kosher certification offers a familiar assurance standard. Manufacturers react by collaborating with suppliers who uphold these values and by building out their kosher-certified portfolio of products. This consistency with locally sourced and ethical ingredients appeals to socially conscious and health-oriented consumers and drives the market by responding to changing dietary and ethical trends. In 2025, The 19th Annual Kosher Food & Wine Experience (KFWE) took place on February 10 at the Meadowlands Hilton in NJ, featuring an exciting showcase of exceptional wines and spirits from the finest wine-producing areas globally. The occasion will showcase a unique preview of new wines and spirits for Passover 2025, a period when 40 percent of all kosher wines are purchased.

Kosher Food Market Growth Drivers:

Health and Wellness Awareness

The growing health awareness is a key motivator of the kosher food industry. People are becoming increasingly health-aware, preferring to eat foods that are found to be cleaner, more ethical, and safer. Kosher food is usually considered to adhere to more rigorous dietary requirements, maintaining higher levels of quality control, and encouraging ethical supply chain practices. This image resonates with both Jewish and non-Jewish consumers, especially those who follow dietary restrictions or preferences. Most kosher foods are also now being certified as organic, gluten-free, or non-GMO, and this resonates with the trend towards consuming more clean, healthy, and wholesome food. As individuals look for products conducive to a healthy lifestyle and meeting particular dietary requirements, kosher food becomes increasingly popular, with consumers increasingly looking to it for its health implications. This trend is not limited to religious circles but also finds relevance in a wider population interested in food integrity and quality.

Cultural and Religious Significance

The long-term cultural and religious significance of kosher food is a key driver of the market. Kosher food has profound historical roots among Jewish communities, where it adheres to rigorous dietary principles that are stated in the Torah. This cultural tradition creates a reliable demand for kosher products, particularly in areas with high Jewish populations such as North America and Israel. Apart from religious practice, kosher certification tends to be perceived as an indicator of purity, ethical food production, and food safety, and has appeal to consumers across different cultures. With the growing interest around the world in learning and respecting religious dietary codes, kosher food is not only being consumed by Jewish populations but also by individuals interested in specialty products for their perceived quality and safety. The cultural significance of kosher food, coupled with the increasing tendency to undertake ethical and socially responsive food production, guarantees its dominance in the global food industry.

Diversification of Product Line and Innovation

The diversification of kosher-certified products and constant innovation in foods are imperative drivers of the market. As tastes change among consumers, food companies are introducing new and varied kosher-certified products to meet a broad range of tastes and dietary requirements. These include not only conventional kosher foods such as meat, dairy products, and baked goods but also increasingly a variety of kosher-certified plant-based, vegan, and gluten-free foods. These innovations are appealing to a wider consumer audience, especially those who are not necessarily looking for kosher food for religious purposes but are attracted to it because of ethical sourcing, perceived quality, and health benefits. New product lines are also being created to meet global food trends, including plant-based proteins and organic products, which remain extremely popular among health-aware consumers.

Kosher Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global kosher food market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, application and distribution channel.

Breakup by Type:

- Buckwheat

- Seafood

- Lamb

- Pulses

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes buckwheat, seafood, lamb, pulses, and others.

Buckwheat has gained traction due to its versatile nature as a gluten-free alternative and its inclusion in kosher-friendly recipes. Its nutritional benefits and rising popularity among health-conscious consumers have fueled its market share.

Seafood appeals to kosher consumers due to its health benefits and being a staple in Jewish culinary traditions. The growth of sustainably sourced kosher seafood options has further bolstered its market expansion, appealing to environmentally conscious consumers.

Lamb has grown within the kosher food market due to its significance in various Jewish festivals and occasions. Its unique flavor profile and adaptability in kosher recipes have contributed to its market rise as consumers seek diverse options beyond traditional choices.

Breakup by Application:

- Culinary Products

- Snacks and Savory

- Bakery and Confectionery Products

- Meat

- Beverages

- Dietary Supplements

Meat dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes culinary products, snacks and savory, bakery and confectionery products, meat, beverages, and dietary supplements. According to the report, meat represented the largest segment.

Meat has emerged as a pivotal driver of growth in the kosher food market due to its cultural, religious, and culinary significance. The meticulous kosher slaughtering process, known as shechita, assures consumers of its adherence to Jewish dietary laws, enhancing its appeal among observant Jews. Additionally, meat is central in traditional Jewish meals and festivals, stimulating consistent demand.

The increasing availability of a diverse range of kosher-certified meats, including beef, poultry, and exotic options, has broadened consumer choices, attracting a wider demographic. Moreover, the growth of online platforms and global distribution networks has facilitated easier access to kosher meat products, bridging geographical gaps.

As the kosher food market expands beyond religious boundaries, the meat segment's prominence persists, driven by its cultural resonance, religious observance, and evolving consumer preferences for quality, traceability, and ethical sourcing.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

Supermarkets and hypermarkets dominate the market

The report has provided a detailed breakup and analysis of the market based on distribution channel. This includes supermarkets and hypermarkets, grocery stores, and online stores. According to the report, supermarkets and hypermarkets represent the largest segment.

Supermarkets and hypermarkets play a catalytic role in propelling the kosher food market growth. Their extensive reach, diverse product offerings, and convenience have significantly expanded the accessibility of kosher products to a broader consumer base.

These retail giants dedicate specialized sections or aisles exclusively for kosher products, catering to Jewish and non-Jewish consumers seeking quality-assured and culturally sensitive food choices. This strategic placement enhances the visibility and awareness of kosher offerings.

Furthermore, the global presence of supermarkets and hypermarkets ensures that kosher products can reach markets locally and internationally, addressing the demands of Jewish communities worldwide. The convenience of one-stop shopping, combined with diverse kosher options, empowers consumers to incorporate kosher choices seamlessly into their shopping routines.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest kosher food market share.

North America has emerged as a significant growth driver in the market. The region's diverse population, including a substantial Jewish community, fuels the kosher food market demand, aligning with dietary and cultural preferences.

The presence of kosher-certified offerings in mainstream supermarkets and specialty stores across the continent has increased accessibility for Jewish and non-Jewish consumers, expanding the market's reach. Moreover, the proactive engagement of food manufacturers and producers in obtaining kosher certifications to tap into this consumer base further offers a favorable kosher food market outlook.

Additionally, the region's innovative food industry continually introduces new kosher options, ranging from traditional favorites to contemporary trends. This dynamic landscape resonates with a broader audience seeking quality, authenticity, and transparency in food choices. The region's trendsetter role and commitment to catering to diverse dietary needs solidify its pivotal contribution to the expanding kosher food market.

Competitive Landscape:

Top companies are vital in strengthening the market's growth through their strategic efforts and industry leadership. They prioritize innovation in product development, introducing a diverse range of kosher-certified offerings that cater to evolving consumer preferences, including dietary restrictions, ethical considerations, and health-conscious choices. These companies collaborate with reputable kosher certifying agencies to ensure the highest standards of compliance and transparency in their products. Moreover, top players actively engage with consumers through educational campaigns, highlighting the benefits of kosher certification beyond religious observance. They leverage their brand reputation to resonate with a broader audience, including health-focused, eco-conscious, and socially responsible consumers. Through partnerships with retailers, online platforms, and distribution networks, top kosher food companies amplify their market reach, making their products easily accessible to diverse demographics. By embodying innovation, quality, and ethical sourcing, these companies contribute significantly to the market's growth while driving a paradigm shift in how kosher food is perceived and consumed.

The report has provided a comprehensive analysis of the competitive landscape in the kosher food market. Detailed profiles of all major companies have also been provided.

- Blommer Chocolate Company (Fuji Oil Co. Ltd)

- Bob’s Red Mill Natural Foods

- Cargill Incorporated

- Conagra Brands Inc.

- Dairy Farmers of America Inc.

- Empire Kosher Poultry LLC (The Hain Celestial Group Inc.)

- General Mills Inc.

- Kellogg's Company

- Nestlé S.A.

- PepsiCo Inc.

- The Kraft Heinz Company

Recent Developments:

- July 2025: Eshbal Functional Food Inc. is expanding its presence in North America by acquiring companies and adding staff. The food company that emphasizes gluten-free and “health-focused” products, headquartered in Israel with a North American office in Vancouver, has entered into a binding letter of intent to purchase a 55% stake in Dare to Be Different Foods, based in New York.

- March 2025: Feastables, the worldwide snack brand established in 2022 by YouTube personality and influencer Jimmy Donaldson (known as MrBeast), has finalized the kosher certification procedure for its chocolate items. The certification for kosher was overseen by The Union of Orthodox Jewish Congregations of America ("Orthodox Union" or "OU").

- March 2025: Manischewitz, a celebrated kosher food brand with a legacy spanning over 130 years, is introducing its inaugural “Deli on Wheels,” a mobile Jewish deli providing traditional Jewish dishes throughout the year. This effort seeks to broaden the reach of both traditional and contemporary Jewish flavors to shoppers throughout the year.

- June 2025: Starter & Stone, a contemporary pizzeria specializing in sourdough, announced its opening at the Lakewood area of Toms River, providing handcrafted pizzas along with a simplified selection of sides and salads to the neighborhood.

Kosher Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Buckwheat, Seafood, Lamb, Pulses, Others |

| Applications Covered | Culinary Products, Snacks and Savory, Bakery and Confectionery Products, Meat, Beverages, Dietary Supplements |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blommer Chocolate Company (Fuji Oil Co. Ltd), Bob’s Red Mill Natural Foods, Cargill Incorporated, Conagra Brands Inc., Dairy Farmers of America Inc., Empire Kosher Poultry LLC (The Hain Celestial Group Inc.), General Mills Inc., Kellogg's Company, Nestlé S.A., PepsiCo Inc., The Kraft Heinz Company etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, kosher food market forecast, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global kosher food market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the kosher food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kosher food market was valued at USD 22.1 Billion in 2024.

The kosher food market is projected to exhibit a CAGR of 2.95% during 2025-2033, reaching a value of USD 29.6 Billion by 2033.

The market is driven by, rising demand for food products that meet religious and dietary standards, increasing awareness regarding health and wellness, and growing Jewish populations. In addition to this, the expanding popularity of kosher certification among non-Jewish consumers seeking higher-quality and ethical food options is facilitating market expansion.

North America currently dominates the kosher food market in 2024. The dominance is fueled by the increasing demand for certified kosher foods, growing awareness regarding health and ethical eating habits, and the widespread availability of kosher products in major retail chains across the region.

Some of the major players in the kosher food market include Blommer Chocolate Company (Fuji Oil Co. Ltd), Bob’s Red Mill Natural Foods, Cargill Incorporated, Conagra Brands Inc., Dairy Farmers of America Inc., Empire Kosher Poultry LLC (The Hain Celestial Group Inc.), General Mills Inc., Kellogg's Company, Nestlé S.A., PepsiCo Inc.,and The Kraft Heinz Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)