Kids Scooter Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Kids Scooter Market Size and Share:

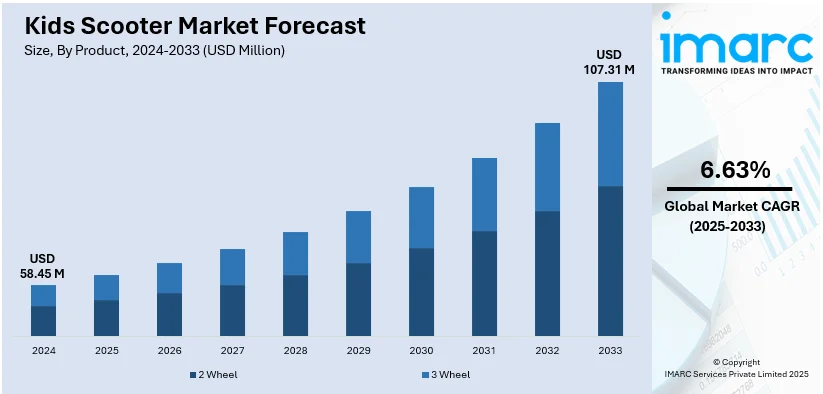

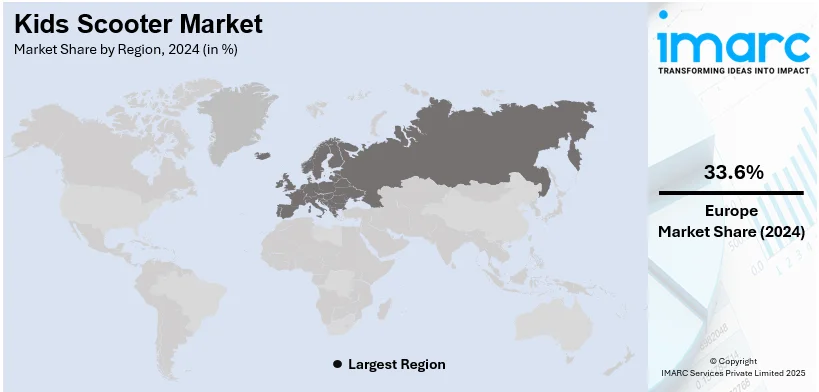

The global kids scooter market size was valued at USD 58.45 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 107.31 Million by 2033, exhibiting a CAGR of 6.63% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 33.6% in 2024. The kids scooter market share across the region is propelled by the increasing parental focus on outdoor activities for children, rising awareness of health benefits associated with physical exercise, and the escalating popularity of scooters as a convenient and eco-friendly mode of transportation for kids.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 58.45 Million |

|

Market Forecast in 2033

|

USD 107.31 Million |

| Market Growth Rate (2025-2033) | 6.63% |

The kids scooter market is driven by increasing parental focus on outdoor activities to enhance children's physical fitness and coordination. Rising disposable incomes enable higher spending on premium and electric scooters with advanced safety features. Urbanization and the popularity of eco-friendly transport options also contribute to kids scooter market growth. Manufacturers are introducing lightweight, foldable, and customizable designs to attract younger consumers. Additionally, e-commerce expansion and social media influence are boosting product visibility further propelling sales across various regions. For instance, in November 2024, Lifelong Online launched a new range of kids' scooters and tricycles on Blinkit featuring vibrant designs and safety features like LED-lit wheels. These products prioritize quality and accessibility supporting active play with quick 10-minute delivery to families across India.

The U.S. kids scooter market is driven by growing awareness of outdoor recreational activities that promote physical fitness and motor skills development. Parents increasingly prefer scooters with advanced safety features, lightweight designs, and adjustable components. Rising disposable incomes support demand for premium and electric scooters. The expansion of e-commerce and retail channels enhances accessibility, while social media trends influence purchasing decisions. For instance, as per the report published by US Cesus Bureau, U.S. retail e-commerce sales for Q4 2024 reached $308.9 billion, up 2.7% from Q3 2024, and 9.4% from Q4 2023, representing 16.4% of total retail sales ($1,883.3 billion). Annual e-commerce sales for 2024 were $1,192.6 billion, up 8.1% from 2023, accounting for 16.1% of total sales. Additionally, increasing concerns over childhood obesity and screen time reduction encourage parents to invest in active play equipment like scooters.

Kids Scooter Market Trends:

Rising Environmental Awareness

As environmental awareness increases, parents prefer eco-friendly transportation like scooters for their children as a viable choice for a ride. According to industry reports, a significant 80% of global consumers are ready to spend more on sustainable products. Data from the Environmental Protection Agency (EPA) indicates that air pollution is increasing, with particulate matter concentrations rising by 15% over the last ten years. This concerning development highlights the urgent need to prioritize efforts aimed at reducing emissions within the transportation sector. As a result, parents are increasingly turning to scooters, which produce zero emissions and contribute to cleaner air in urban areas. This orientation towards environmentally friendly solutions is in line with growing social tendency of sustainability, which in turn stimulates the demand of kids scooters to the parents interested in reduction of their environmental footprint and, at the same time, want to provide pleasurable and risk-free means of transportation for their kids.

Rising Parental Emphasis on Outdoor Activities

Due to the growing prevalence of sedentary lifestyles among children, parents are encouraging scooter rides to promote physical activities which lead to good health outcomes as a whole. As reported by the Centers for Disease Control and Prevention (CDC), there's approximately a 33% likelihood that a child will participate in physical activity on a daily basis. This low figure indicates the need for additional recreational alternatives. Scooter riding engages children and makes the exploring process of the natural surroundings fun. Since the parents become more and more aware of the significance of physical activity to be done on a regular basis to prevent of obesity and to promote the overall health of their children, there has been a rise in demand for scooters as an outdoor recreation device, thus creating a positive kids scooter market outlook across the world.

Increasing Focus on Eco-friendly Transportation

The kids scooter market is also driven by the intensifying eco-friendly modes of transportation. Due to the recent rise of environmental awareness, more parents are looking for new ways of transport for their children, apart from conventional means. Based on the research commissioned by the Environmental Protection Agency (EPA), transportation is the source of the largest amount of the greenhouse gas emission in the United States. For example, in 2022, greenhouse gas emissions in the U.S. rose by 0.2% compared to the previous year. Hence, an increase in the demand for such cleaner options like scooters which are much less harmful to the environment is observed. As a result, in the last few years, several kids' scooters have been sold with the aim or being a greener and eco-friendly mode of transportation for short distances.

Kids Scooter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global kids scooter market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and distribution channel.

Analysis by Product:

- 2 Wheel

- 3 Wheel

3 wheel stands as the largest component in 2024, holding around 66.8% of the market. 3-wheel scooters dominate the kids scooter market due to numerous as it offers an enhanced stability feature that allows kids to elevate their balance and ride with confidence hence protecting them from accidents. Additionally, adjustable handlebars and ergonomic design scooters allow children to adjust to their changes properly and grow comfortably. Besides those, the improvement in handling and control as well as the level of convenience fuel the desire for 3-wheel scooters from parents with kids who still can't handle 2-wheeler effectively. According to recent data from the Consumer Product Safety Commission (CPSC), sales of 3-wheel scooters have risen by 25% over the past year. This trend highlights the increasing demand and popularity of these scooters in the dynamic market.

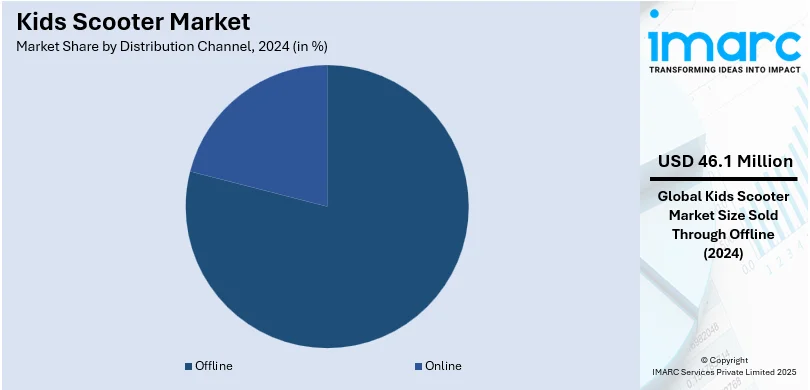

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with around 78.9% of market share in 2024. Offline distribution channels drive the kids scooter market demand as brick-and-mortar stores provide a tactile shopping environment which enables customers to try out scooters, compare features and make an informed choice before buying. On the other hand, offline retailers provide personalized customer service and highly professional advice, which results in trust and confidence of consumers. For instance, apart from online stores, brick-and-mortar stores contribute to immediate product availability and the absence of shipping delays to make last-minute purchasing easy. According to recent U.S. census data, over 80% of consumers still prefer shopping in physical stores, highlighting the ongoing importance of brick-and-mortar locations in the kids' scooter market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest kids scooter market share of over 33.6%. Europe dominates the market due to the implementation of stringent safety regulations and the high-quality standards which guarantee that the scooters comply with high-quality requirements, therefore consumers feel secure and trust which in turn boost demand. Apart from this, setting an example of outside activities and healthy lives fosters the popularity among children of riding scooters. Moreover, Europe with its strong infrastructure and urban planning systems has become very favorable environment to scooter transportation, where the bike lanes and pedestrian-friendly places are normally located. According to Eurostat, the statistical agency of the European Union, the market for children's scooters in Europe is expected to grow by 6% annually over the next five years, driven by strong demand and consistent budgets.

Key Regional Takeaways:

North America Kids Scooter Market Analysis

The North America kids scooter market is expanding due to increasing consumer preference for eco-friendly and cost-effective mobility solutions. Parents are actively seeking alternatives to traditional transportation that promote physical activity while aligning with sustainability goals. Urban infrastructure supports pedestrian-friendly spaces, enhancing scooter accessibility for short commutes and recreational use. The growing focus on active lifestyles drives demand for compact, easy-to-store models suited for school runs and outdoor play. Technological advancements in lightweight materials and safety features further enhance product appeal, ensuring durability and ease of use. Retailers and manufacturers emphasize the health and environmental benefits of scooters, leveraging digital marketing and social media to influence purchasing decisions. Subscription-based services and rental programs provide flexible options, reinforcing adoption trends across urban and suburban households.

United States Kids Scooter Market Analysis

In 2024, the United States accounted for over 88.60% of the kids scooter market in North America. Kids scooter adoption is rising due to parents preferring eco-friendly transportation, aligning with sustainability goals. In 2024, it is estimated that 177 million American adults engage in eco-friendly shopping, representing a year-over-year increase of 7.44%. Many parents view scooters as an alternative to traditional vehicles, reducing carbon footprints while promoting an active lifestyle. Urban planning favors pedestrian-friendly infrastructure, increasing accessibility. Schools and community initiatives emphasize eco-conscious mobility, further normalizing kids scooter usage. Parents prioritize compact, easy-to-store options for short commutes, playground visits, and school runs. Rising fuel costs drive families toward cost-effective mobility choices, making kids scooters a practical investment. Technological advancements in lightweight materials and safety features enhance product appeal. Rental and sharing programs expand accessibility, familiarizing families with eco-friendly transportation. Marketing strategies highlight environmental and health benefits, resonating with conscious consumers. Subscription-based scooter services provide affordability and flexibility, reinforcing adoption trends. Government initiatives promoting green mobility support expansion. Peer influence and social media trends further drive demand. Retailers and manufacturers introduce energy-efficient models, catering to parental preferences.

Asia Pacific Kids Scooter Market Analysis

Growing disposable income significantly contributes to the increasing demand for kids scooters, enabling more families to invest in leisure products. According to the India Brand Equity Foundation, the per capita disposable income in India was USD 2.11 thousand in 2019, increasing to USD 2.54 thousand in 2023. It is anticipated to rise to USD 4.34 thousand by 2029. Economic expansion leads to improved financial stability, allowing parents to purchase higher-quality recreational items. Urbanization fosters greater exposure to alternative transportation; positioning kids scooters as an accessible mobility option. Lifestyle shifts emphasize family-oriented activities, making scooters a popular choice for outdoor play. With rising affordability, parents opt for advanced designs featuring enhanced safety measures. Rapid industrialization supports local manufacturing, increasing product availability at competitive prices. Parents seek premium brands with durable materials and innovative features, fuelling industry expansion. Improved retail networks offer diverse product ranges, catering to varying consumer preferences. Advertising campaigns highlight performance, safety, and fun aspects, strengthening brand influence. Increased parental awareness of health benefits encourages investment in kids scooters as a form of active play. Evolving social dynamics promote experiential spending, making recreational products a priority.

Latin America Kids Scooter Market Analysis

Kids scooter adoption is increasing due to the growing online distribution channel, expanding product accessibility across diverse demographics. According to reports, the Latin America market currently boasts over 300 Million digital buyers. E-commerce platforms simplify purchasing, offering a wide range of models at competitive prices. Digital marketing strategies enhance brand visibility, influencing consumer decisions. Parents benefit from detailed product comparisons, ensuring informed purchases. Discounts and instalment payment options make scooters financially feasible for a broader audience. Online-exclusive releases create demand, driving sales momentum. Streamlined logistics and fast delivery services boost convenience, encouraging higher adoption rates. Retailers leverage social media to engage parents, showcasing product benefits through influencer collaborations. Virtual try-ons and user reviews enhance purchasing confidence.

Middle East and Africa Kids Scooter Market Analysis

Offline distribution channels like super and hypermarkets are boosting kids scooter adoption by offering accessibility and a hands-on shopping experience. For example, BinDawood Holdings announced its plans to launch 10 stores from 2022 to 2027, along with an annual goal of opening five to six stores each year until the end of 2024. Meanwhile, Lulu Group is set to introduce 21 new hypermarkets and express stores. Parents prefer physically inspecting products before making a purchase, ensuring quality, safety, and suitability for their children. Retail promotions, in-store demonstrations, and seasonal discounts attract buyers looking for mobility solutions. Hypermarkets provide a wide selection of models, catering to various age groups and price ranges. Supermarkets integrate scooter sections within toy and sporting goods aisles, increasing visibility and impulse buying. Brand partnerships with retail chains enhance product reach, making scooters readily available. The convenience of one-stop shopping, coupled with attractive in-store deals, supports demand across urban and suburban markets.

Competitive Landscape:

The kids scooter market is highly competitive, with manufacturers focusing on innovation, safety, and design to differentiate their products. Companies are introducing lightweight, foldable, and electric models to appeal to modern consumer preferences. Advanced safety features, such as anti-slip decks and adjustable handlebars, enhance usability. E-commerce and retail partnerships drive market penetration, offering wider accessibility. Customization options, including color variations and themed designs, attract younger consumers. Marketing strategies emphasize eco-friendliness, health benefits, and affordability to strengthen brand loyalty. Additionally, strategic collaborations with sporting brands and influencer endorsements enhance visibility, fueling competition among key industry players.

The report provides a comprehensive analysis of the competitive landscape in the kids scooter market with detailed profiles of all major companies, including:

- Decathlon Sports India Pvt Ltd.

- Fuzion Pro Scooter

- Globber

- iScootbike Ltd.

- Micro Scooters Ltd.

- Radio Flyer Inc.

- Razor USA LLC.

- Smoby Toys Sas

- Swifty Scooters

- Xiaomi Inc.

Latest News and Developments:

- January 2025: Segway-Ninebot introduced its latest generation of eKickScooters, featuring seven innovative models at CES 2025. As the global leader in eKickScooter sales, with over 13 million units sold, the range caters to everyone from entry-level commuters to high-performance enthusiasts.

- December 2024: EMotorad announced its partnership with Hamleys to launch 'Formula Fun,' a new division focused on children's mobility featuring licensed ride-on cars and kick scooters. With more than nine IP-licensed products available in 100 Hamleys stores, this collaboration aims to consolidate India’s diverse ₹1,000+ crore kids' mobility market.

- December 2024: EMotorad has made its entry into the children's mobility space by launching ‘Formula Fun,’ backed by an investment of approximately USD 18 million. This exclusive partnership with Hamleys allows them to offer premium ride-on vehicles that come with official licenses, further solidifying EMotorad’s position in the e-mobility industry.

- October 2024: Segway is hosting a Halloween Sales Event for kids, offering discounts of up to 50% on electric scooters, priced from USD 119.99. These scooters come equipped with safety features such as high-grip tires, various speed modes, and waterproof designs for enhanced durability. With three riding modes, children can gain confidence while enjoying the festive season.

- August 2024: Segway-Ninebot has launched the C2 Lite eKickScooter, specifically designed for children aged 6 to 10. This new addition to the C2 series focuses on combining fun, safety, and style, aiming to enhance the riding experience for young users. The C2 Lite is now available for purchase, promising an exciting introduction to micromobility for kids.

- May 2024: Xiaomi unveiled the Ninebot C2 Lite, a kids' electric scooter capable of supporting up to 50kg and offering a range of 14km. Designed with safety and enjoyment in mind, it features adjustable handlebars and a stable platform, aligning with Xiaomi’s goal of expanding into youth-friendly mobility options.

Kids Scooter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | 2 Wheel, 3 Wheel |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Decathlon Sports India Pvt Ltd., Fuzion Pro Scooter, Globber, iScootbike Ltd., Micro Scooters Ltd., Radio Flyer Inc., Razor USA LLC., Smoby Toys Sas, Swifty Scooters, Xiaomi Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the kids scooter market from 2019-2033.

- The kids scooter market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the kids scooter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kids scooter market was valued at USD 58.45 Million in 2024.

IMARC estimates the kids scooter market to reach USD 107.31 Million by 2033, exhibiting a CAGR of 6.63% during 2025-2033.

The kids scooter market is driven by increasing parental focus on outdoor activities, rising disposable incomes, and growing demand for eco-friendly mobility solutions. Urbanization, advanced safety features, and e-commerce expansion further boost sales. Social media influence, product customization, and rental services also contribute to market growth.

In 2024, Europe accounted for the largest kids scooter market share of 33.6%, driven by strong consumer preference for eco-friendly mobility solutions, well-developed urban infrastructure, and increasing emphasis on outdoor recreational activities. Government initiatives promoting sustainable transportation and high disposable incomes further support market expansion across the region.

Some of the major players in the kids scooter market include Decathlon Sports India Pvt Ltd., Fuzion Pro Scooter, Globber, iScootbike Ltd., Micro Scooters Ltd., Radio Flyer Inc., Razor USA LLC., Smoby Toys Sas, Swifty Scooters, Xiaomi Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)