Kids Furniture Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033

Kids Furniture Market Size and Share:

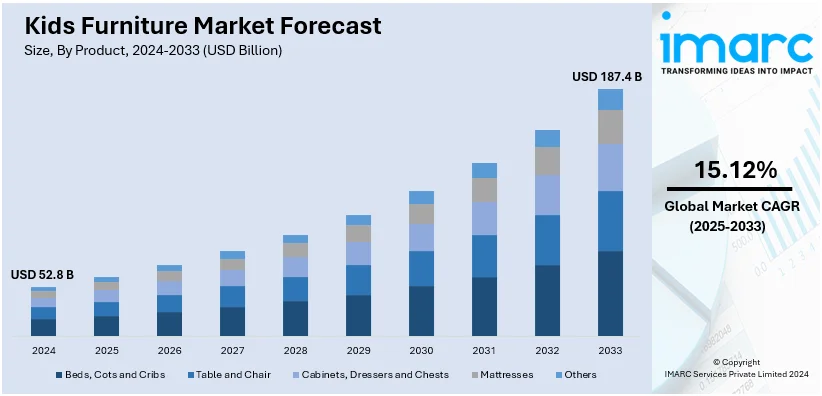

The global kids furniture market size was valued at USD 52.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 187.4 Billion by 2033, exhibiting a CAGR of 15.12% during 2025-2033. North America currently dominates the market, holding a significant market share of over 33.6% in 2024. The growing emphasis on child development and welfare, the rise in families' disposable income, shifting consumer preferences, changing trends in interior design and the expansion of online retail and e-commerce platforms are some of the elements driving the market toward growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.8 Billion |

| Market Forecast in 2033 | USD 187.4 Billion |

| Market Growth Rate (2025-2033) | 15.12% |

The kids' furniture market is growing due to the increasing demand for functional, safe, and aesthetically appealing designs tailored to children. Rising disposable incomes and a focus on creating child friendly spaces in homes are fueling purchases of themed and modular furniture. The growing influence of e-commerce platforms and retail channels is enhancing accessibility to a variety of styles and price ranges driving consumer interest. For instance, in September 2024, Smartsters, a leading children's furniture brand in India announced its partnership with HomeTown to expand its retail presence across 18 locations nationwide. This collaboration aims to enhance accessibility to innovative kids' furniture aligning with Smartsters' mission to support children's development through practical design solutions while reaching a wider audience of families. The growing preference for ecofriendly materials aligns with sustainable practices appealing to environmentally conscious buyers. The expanding education sector and the trend of customized furniture for study and play purposes further contribute to the market's steady growth.

The United States kids furniture market is being driven by increasing consumer spending on child specific furnishings emphasizing safety, comfort and functionality. Growing awareness of ergonomic designs for study and play is influencing buying decisions along with rising demand for themed and customizable furniture. The surge in online retail channels has improved accessibility and convenience for consumers expanding the market reach. Ecofriendly and non-toxic materials are becoming essential due to heightened environmental and safety concerns. For instance, in August 2024, POLYWOOD launched a new series of kids' outdoor furniture featuring pieces like Adirondack chairs and picnic tables in fourteen vibrant colors. Crafted from recyclable lumber the collection emphasizes durability and eco-friendliness with a 20-year warranty ensuring sustainable play for the next generation. Additionally, a growing focus on creating personalized and multi-functional spaces for children in modern households is propelling demand for innovative furniture designs tailored to kids' needs.

Kids Furniture Market Trends:

Increasing Focus on Child Development and Well-Being

The increasing focus on child development and well-being is driving the kids furniture market in several ways. With the growing awareness among parents and caregivers of the crucial role that the environment plays in a child's development, they are opting for a well-designed and child-friendly furniture that can have a positive impact on their physical, cognitive, and emotional growth. For instance, a 2023 survey data by a consulting firm found that 63% of U.S. parents prioritize safety and ergonomics when purchasing furniture for their children. Besides this, parents are actively seeking furniture that adheres to stringent safety standards, such as rounded edges, non-toxic materials, and sturdy construction. They also look for ergonomic designs that support proper posture and promote healthy habits. Moreover, due to the growing focus on child development and well-being, manufacturers are developing specialized kids furniture, such as adjustable height desks and chairs, to support proper posture during study and play.

Rising Disposable Income Level of Families

The rising disposable income of families is propelling the kids furniture market by enabling parents to invest more in high-quality and aesthetically appealing furniture for their children. According to an industrial report, the global average household income has risen annually by 2.5% from 2019 to 2024, which has led to the availability of more funds to be allocated by parents towards upgrading their children's living conditions. More disposable incomes translate to a concern for the welfare and comfort of the children, even the furniture they use. For instance, in the United States, an average family spends around USD 11.21 per year on children's furniture, which would include beds, desks, and storage solutions. Such spending may be small compared to total expenditures, but it represents an increase in the desire to invest in durable furniture with safety features. Additionally, inflating income levels allow families to explore a wider range of options in terms of design, style, and materials. Parents can choose from a variety of aesthetic options that match their preferences and home decor. This leads to a greater demand for customized and aesthetically pleasing kids furniture, further driving the market growth.

Evolving Interior Design Trends

The evolving interior design trends are propelling the kids furniture market by influencing the demand for stylish and innovative furniture that seamlessly integrates with the overall home decor. As interior design trends continue to evolve, parents and caregivers are seeking kids furniture that serves its functional purpose and also enhances the aesthetics of the living space. With a growing emphasis on cohesive and visually appealing home interiors, parents are looking for kids furniture that complements the overall design theme and style of their homes. This has led to the escalated demand for kids furniture with modern and contemporary designs, incorporating elements such as sleek lines, minimalist aesthetics, and high-quality materials. Moreover, as open-concept living spaces and multifunctional furniture is gaining popularity, there is a need for kids furniture that is versatile, adaptable, serve multiple purposes or have modular features to accommodate changing needs and preferences of parents. For instance, Crate & Kids launched its debut collection with celebrity designer Jeremiah Brent on September 10 2024, featuring over 80 timeless furniture and decor pieces. This collaboration emphasizes sophistication, functionality, and heirloom quality, blending style with everyday practicality. The collection reflects the demand for high-quality, versatile furniture that aligns with current trends in home interiors, demonstrating how the market is evolving to meet consumer preferences for both form and function.

Kids Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global kids furniture market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product, material, and application.

Analysis by Product:

- Beds, Cots and Cribs

- Table and Chair

- Cabinets, Dressers and Chests

- Mattresses

- Others

Beds, cots, and cribs leads the market with around 32.6% of market share in 2024. Beds, cots, and cribs play a significant role in driving the kids furniture market due to their essentiality in providing a comfortable and safe sleeping environment for children. They often have safety features such as side rails, sturdy construction, and proper mattress support to minimize the risk of accidents and falls during sleep. As parents prioritize their child's well-being and development, the demand for quality and durable furniture items increases. These products cater to different age groups and specific needs, ranging from cribs for infants to beds and cribs for toddlers and older kids. With a focus on safety features, attractive designs, and functional versatility, beds, cots and cribs contribute to the growth of the kids furniture market by fulfilling the fundamental requirement of creating a cozy and secure space for children to sleep and rest.

Analysis by Material:

- Wood

- Polymer

- Metal

Wood leads the market with around 55.4% of market share in 2024. Wood is mostly used to make kids furniture due to its unique qualities and attributes like durability, strength, and natural beauty. It provides a sturdy and long-lasting foundation for various furniture pieces such as beds, cribs, tables, and chairs. Wood offers a wide range of design options, allowing for versatile and aesthetically pleasing furniture designs. It can be shaped, carved, and finished in various ways to create unique and visually appealing pieces that match different styles and themes. Wood is also a versatile material that can be crafted into different designs, finishes, and colors to match different styles and preferences. Moreover, wood is considered a safer and healthier option compared to materials like plastic or metal, as it is free from harmful chemicals and allergens. The timeless appeal and eco-friendly nature of wood make it a popular choice, driving the demand for wood-based kids furniture in the market.

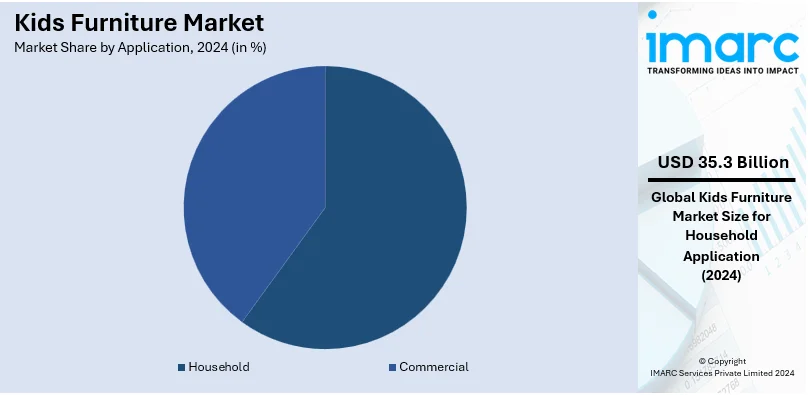

Analysis by Application:

- Commercial

- Household

Household leads the market with around 66.9% of market share in 2024. The household sector plays a crucial role in propelling the kids furniture market. As families expand and children grow, there is a need for suitable furniture to accommodate their needs. Parents invest in kids furniture such as beds, cribs, desks, storage units, and chairs to create functional and comfortable spaces for their children within their homes. Additionally, changing lifestyle trends, evolving interior design preferences, and the desire to provide an aesthetically pleasing environment for children also contribute to the demand for kids furniture. The household sector's focus on creating nurturing and well-equipped living spaces for children drives the growth of the kids furniture market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.6%. North America drives the kids furniture market due to several factors. Firstly, the region has a large and affluent consumer base, with families willing to invest in high-quality and stylish furniture for their children. Additionally, North America has a strong focus on child safety standards and regulations, leading to the demand for certified and safe kids furniture. Besides this, changing lifestyles, increasing urbanization, and smaller living spaces necessitate the need for functional and space-saving furniture solutions. Lastly, the influence of media, trends, and the desire to create visually appealing and well-designed children's spaces further drive the growth of the kids furniture market in North America.

Key Regional Takeaways:

United States Kids Furniture Market Analysis

In 2024, United States accounted for a share of 91.00% of the North America market. This kids' furniture market in the United States is growing well because of a combination of both growing household incomes and increased adoption of personalized home decoration for children. Increasing demand for sustainable and eco-friendly materials is a major market driver, as parents are becoming more environmentally conscious in their choices. In October 2024, Babyletto launched the Pogo All-Stages Collection, including the 8-in-1 Crib and Tambour Dresser, which is designed for newborn to five years of age and focuses on style, functionality, and sustainability. Market leaders include Pottery Barn Kids and Wayfair, with the rise in e-commerce continuing to fuel sales. Multifunctional furniture solutions, like storage beds and desks, have a growing demand that will propel the industry. A greater emphasis on children's health and safety standards in homes and other types of living structures would also maintain its growth curve.

Europe Kids Furniture Market Analysis

In Europe, the children's furniture market is doing well due to rising disposable incomes and increased child-centric design focus. Germany, France, and the UK were the main drivers of this market. A study by retailer Next found that UK parents spend an average of USD 6,729 on decorating their child's nursery and bedrooms before they reach the age of 10, with an initial USD 1,088.63 spent on new furniture and decor before the birth. Parents also tend to redecorate children's rooms every two years, spending around USD 1.143 per redecorating session, amounting to a further USD 5,715 before their child's 10th birthday. Consumer demand for sustainable and adaptable products is evident, including manufacturers' investment in eco-friendly material such as reclaimed wood, non-toxic paints. Furniture that combines form with function, such as the convertible crib and multi-purpose storage units, is particularly sought after. The industry key players, such as IKEA and Mamas & Papas, continue to innovate with the increasing demand. Strict regulatory standards for child safety further fuel market growth.

Asia Pacific Kids Furniture Market Analysis

The kids' furniture market in the Asia Pacific is rapidly growing, led by urbanization, higher income levels, and a greater focus on children's comfort and design. A report states that China and India are the largest contributors to the market in the region, as more and more young families seek good quality furniture for their children. For example, XMB, for more than 35 years engaged in solid pine furniture, has established itself firmly in developed markets like China and Japan, known for prompt feedback, competitive prices, and high-quality products. Locally, XMB's brand is very well known in all of China. Compared to other products, educational and children's furniture have a great leader like Yucai Holding Group in China, producing desks, chairs, and creative play facilities. The company's design and manufacturing capabilities combined with its emphasis on smart classrooms and educational furniture position it as the market leader. These trends suggest increasing demand for innovative, functional, and high-quality children's furniture across the region.

Latin America Kids Furniture Market Analysis

The Latin American market for kids' furniture is growing, mainly due to urbanization, a rapidly growing middle class, and increased consumer spending on furniture and home decor. The entry of global brands like IKEA is accelerating market expansion. For example, in January 2022, IKEA reported that its second store will open in Mexico in Puebla. This is a store of over 11,000 square meters and it will include a restaurant which can accommodate 380 clients. Already, the first store in Mexico City has gained good ground; hence, this new store will further increase IKEA's market share in the area. Latin American consumers increasingly seek affordable yet fashionable furniture for kids, with an increased emphasis on functionality and space optimization. Brands are taking advantage of this trend, and expansions of retail and growth of e-commerce further fuel the market.

Middle East and Africa Kids Furniture Market Analysis

The kids' furniture market in the Middle East and Africa is rising steadily in response to changing lifestyles; rising disposable income; higher urbanization; and enhanced concern on children's development, education, and well-being. For example, in Saudi Arabia, IKEA makes use of its brand recognition and corporate social responsibility practices to increase attention and revenue. The "Let's Play for Change" was a campaign encouraging children to play and be developed by the company. For every soft toy sold, IKEA Saudi Arabia provides two riyals toward the education of children at the Disabled Children's Association. This campaign has gained much traction and, in three years, close to SR1 million (USD 266,200) was collected to raise the standard of education for children with disabilities. These efforts depict the gradual merging of social causes into business strategies to help form closer community bonds while at the same time selling the product. With a growing middle class and consumer awareness, the Middle East and Africa are now a prime markets for children's furniture. Brands such as IKEA are now in a better position to expand sales while creating social value.

Competitive Landscape:

The key players are focusing on research and development to create innovative and functional designs that serve the changing needs of children and parents. This includes incorporating features like adjustable heights, modular configurations, and interactive elements. Additionally, marketing and advertising strategies have played a crucial role. Key players have effectively utilized digital platforms, social media, and influencers to reach their target audience. They have highlighted the unique selling points of their products, such as safety certifications, eco-friendly materials, and ergonomic designs, to build trust and attract customers. Furthermore, collaborations with renowned children's brands, designers, or licensed characters have helped create appealing and themed furniture collections, thus increasing consumer interest. Moreover, the rising penetration of online platforms are offering a seamless and convenient shopping experience, providing customization options, and ensuring prompt customer service and satisfaction.

The report has provided a comprehensive analysis of the competitive landscape in the global kids furniture market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ashley Furniture Industries LLC

- Babyletto

- Boingg

- C&T International Inc.

- Casa Kids

- Circu Magical Furniture

- Crate and Barrel Holdings Inc. (Otto GmbH & Co KG)

- Dream On Me Inc.

- Flexa4dreams A/S

- Inter IKEA Systems B.V.

- Rooms to Go (p.r.) Inc.

- Wayfair Inc.

- Williams-Sonoma Inc.

Latest News and Developments:

- October 2024: Babyletto announced that they launched the Pogo All-Stages Collection, featuring the versatile 8-in-1 Crib and Tambour Dresser. Designed for ages newborn to five, the collection prioritizes style, functionality, and sustainability.

- September 2024: Crate & Kids launched its debut collection with Jeremiah Brent on September 10, 2024. Featuring over 80 timeless furniture and decor pieces, the collaboration emphasizes sophistication, functionality, and heirloom quality, blending style with everyday practicality.

- July 2024: Crate & Kids has partnered with the Smithsonian to launch a space exploration-themed collection for kids, featuring bedding, lighting, and art inspired by archival images from the National Air and Space Museum. The collection includes 44 exclusive pieces, available in-store and online.

- January 2024: IKEA Ballymun unveiled a new Children's Department featuring whimsical room sets like circus tents, rocket ships, slides, and giant dollhouses. Designed to inspire creativity, it offers families a magical space for exploration, play, and unforgettable moments of joy.

- January 2024: Pottery Barn Kids launched an exclusive collaboration with AERIN, featuring a children’s home furnishings collection designed by Aerin Lauder. The collection includes baby gifts, décor, and furniture crafted in AERIN's signature style.

Kids Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Beds, Cots and Cribs, Table and Chair, Cabinets, Dressers and Chests, Mattresses, Others |

| Materials Covered | Wood, Polymer, Metal |

| Applications Covered | Commercial, Household |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ashley Furniture Industries LLC, Babyletto, Boingg, C&T International Inc., Casa Kids, Circu Magicsl Furniture, Crate and Barrel Holdings Inc. (Otto GmbH & Co KG), Dream On Me Inc., Flexa4dreams A/S, Inter IKEA systems B.V., Rooms to Go (p.r.) Inc., Wayfair, Williams-Sonoma Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the kids furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global kids furniture market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the kids furniture industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Kids furniture includes specially designed furniture items tailored for children, focusing on safety, functionality, and aesthetics. These products, such as beds, chairs, tables, and storage solutions, cater to children's needs while complementing home interiors.

The kids furniture market was valued at USD 52.8 Billion in 2024.

IMARC estimates the global kids furniture market to exhibit a CAGR of 15.12% during 2025-2033.

The market is driven by rising disposable incomes, increasing awareness of ergonomic designs, demand for eco-friendly materials, and evolving interior design trends focused on child-friendly spaces.

In 2024, beds, cots and cribs represented the largest segment by products, driven by their essential role in providing safe sleeping environments.

Wood leads the market by materials owing to its durability, aesthetic versatility, and eco-friendly attributes.

The household segment is the leading segment by application, driven by the focus on creating functional and nurturing living spaces for children.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global kids furniture market include Ashley Furniture Industries LLC, Babyletto, Boingg, C&T International Inc., Casa Kids, Circu Magical Furniture, Crate and Barrel Holdings Inc. (Otto GmbH & Co KG), Dream On Me Inc., Flexa4dreams A/S, Inter IKEA systems B.V., Rooms to Go (p.r.) Inc., Wayfair, Williams-Sonoma Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)