Juvenile Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Age Group, and Region, 2025-2033

Juvenile Products Market Size and Share:

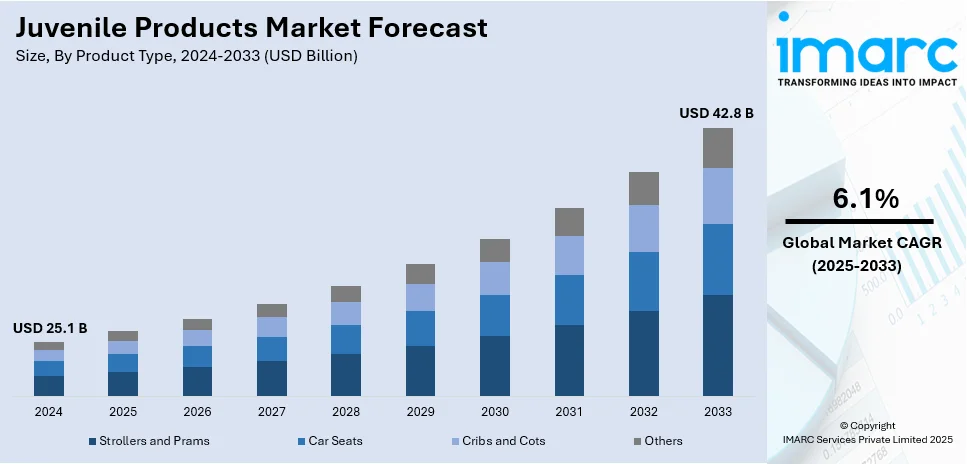

The global juvenile products market size was valued at USD 25.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 42.8 Billion by 2033, exhibiting a CAGR of 6.1% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.2% in 2024. The juvenile products market share across the region is propelled by rising birth rates, strict safety regulations, premiumization, e-commerce expansion, sustainability trends, and increasing demand for smart, ergonomic, and eco-friendly baby products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 25.1 Billion |

|

Market Forecast in 2033

|

USD 42.8 Billion |

| Market Growth Rate (2025-2033) | 6.1% |

The market growth is fueled by rising birth rates, increased disposable income, and a growing focus on infant safety and quality standards. Technological advancements lead to smart devices such as connected baby monitors and convertible strollers, while consumer demand for eco-friendly and sustainable products drives manufacturers to innovate responsibly. Strict regulatory frameworks and safety standards encourage companies to invest in high-quality designs, boosting consumer trust and brand loyalty. Shifts in retail dynamics, with an expanding e-commerce landscape and increased direct-to-consumer sales, complement traditional brick-and-mortar channels. Parental emphasis on convenience and efficiency, as well as the influence of social media and celebrity endorsements, further catalyze juvenile products market growth and the introduction of premium products catering to modern parenting needs.

The juvenile products market in the United States is driven by multiple factors. Increasing birth rates and higher disposable incomes contribute to a steady demand for essential items such as strollers, car seats, and infant care accessories. Strict safety regulations require high standards, boosting consumer confidence. Additionally, shifting consumer preferences toward sustainable and eco-friendly materials influences product development, while strong brand reputations and positive word-of-mouth further reinforce market growth. For instance, in September 2023, Dorel Juvenile, a global leader in juvenile products and baby care, announced a partnership with Babylist, the premier digital destination for expanding families, in the all-new Babylist Beverly Hills, a flagship showroom experience that was opened in August 2023. Both brands work together to provide parents with high-quality products at a variety of pricing ranges, guiding them through their child's journey from birth and beyond.

Juvenile Products Market Trends:

Growing Demand for Eco-Friendly and Sustainable Products

Sustainability is another tremendous influence on juvenile products. The growing consciousness among consumers and environmental regulations has compelled companies to rethink their policies and products. Eco-friendly options, organic cotton, bamboo diapers, BPA-free bottles, and eco-friendly packaging are what parents prefer these days. A 2023 survey by Mylo revealed that 85.9% of parents prefer to buy chemical-free products for their babies, indicating a shift toward natural baby care products. In response to the demands of the customers, companies have started using sustainable materials and reduced carbon footprints and earned credibility through certification from organizations like OEKO-TEX and GOTS (Global Organic Textile Standard). In contrast, regulatory bodies around the world are tightening their opinions toward the harmful chemicals used, which have become opportunities for brands to innovate with safer and non-toxic alternatives. Sustainable choice has everything from furniture to toys, travel gear, and the raw material sources for the products: both ethically sourced timber and recyclable plastics. A true green pledge will inspire transparency among consumers and resonate more with the lifestyle-conscious consumer. It is expected that sustainability will continue to drive the market decisions of consumers hence, brands that will take on green innovation will have an upper hand in the economy against their competitors at large.

Rise of Smart and Connected Baby Products

In the juvenile goods industry, technology is causing a revolution as smart and connected baby products are becoming more and more popular. Parents resort more often to AI solutions to attain more convenience and safety: sleep monitors, bottle warmers with temperature sensors, swing baby seats connected with apps, etc. Smart baby monitors provide high-definition camera feeds, motion detection, and biometric tracking, giving live updates on a child's well-being, thus reducing parental anxiety. Parents are increasingly adopting AI-powered baby monitors with biometric tracking, with brands like Owlet reporting over 50% growth in sales year-over-year. Wearables, like smart socks and heart rate monitors, have hit the market enough to begin offering data-backed health insights. With the synergetic use of AI and IoT in baby care products, smart connectivity through smartphones enables remote observation and automation. Manufacturers invest greatly in research and development due to the increasing buying capacities of the millennial parents, who are also tech-savvy in their own right. However, with increasing concerns for data security and privacy, the companies must introduce strong encryption and adhere to digital safety standards all across the globe.

E-Commerce and DTC Expansion

The entire juvenile products industry has been revolutionized with the new mode of shopping, which is online shopping, e-commerce and direct-to-consumer brands coming to find momentum. Parents do not visit any physical retail outlets for buying baby-care essentials, strollers, cribs, toys, etc., but buy them online with more convenience, lower pricing, and a wider array of product choice. From diapers to organic baby food to customized clothing in a box, subscription-based services are springing up, providing hassle-free shopping options. Whatever the subscription may be, be influenced sufficiently with social networks and other marketing channels to push product sales into common households. For instance, a 2024 report highlights that 68% of millennial parents make purchases based on social media recommendations. Established brands are improving their online presence, while newer entrants rely on digital-first approaches to build customer loyalty. Personalization, AI-based recommendation engines, and virtual try-on services further enhance customer engagement in online travel. Whenever traditional retail faces some kind of challenge, the companies that have digital transformed themselves, and developed an omnichannel strategy, will remain on top in the long-distance race in the competitive juvenile market.

Juvenile Products Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global juvenile products market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on product type, distribution channel, and age group.

Analysis by Product Type:

- Strollers and Prams

- Car Seats

- Cribs and Cots

- Others

Strollers and prams leads the market with around 27.1% of the market share in 2024. Strollers and prams dominate the juvenile products market due to their essential role in infant mobility and convenience for parents. Increasing urbanization, rising disposable incomes, and higher birth rates in emerging economies drive demand. Consumers prioritize safety, comfort, and multifunctionality, leading to innovations such as lightweight, foldable, and all-terrain strollers. Premium models with advanced suspension, smart connectivity, and ergonomic designs are gaining traction. Evenflo, a trusted pioneer in the design and manufacturing of infant and children's products, announced the launch of the Hummingbird™ Ultra-Lightweight Carbon Fiber Stroller. The Hummingbird, weighing only 9 pounds, provides parents with a game-changing combination of durability and simplicity because of its revolutionary carbon fiber frame, one-handed compact fold, and smooth maneuverability.

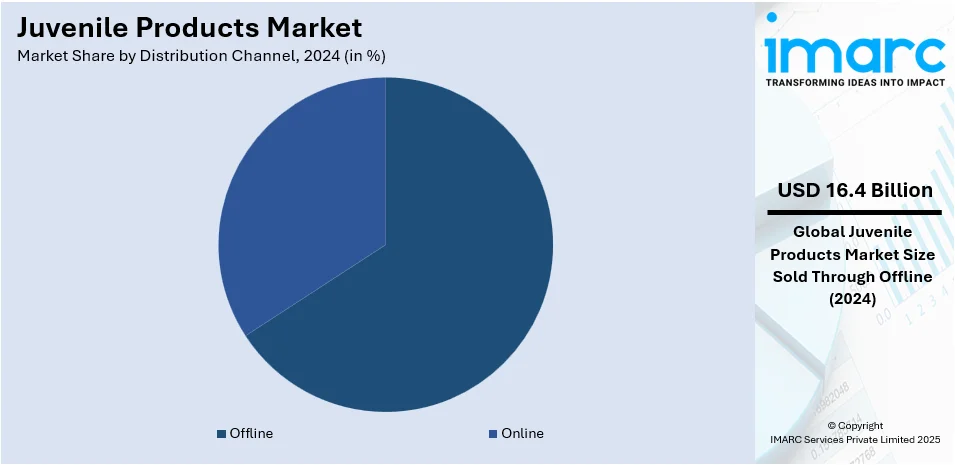

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with around 65.5% of the market share in 2024. The offline channel holds the largest share of the juvenile products market due to consumer preference for physical inspection before purchase, especially for safety-critical items like strollers, car seats, and cribs. Specialty stores, supermarkets, and brand-exclusive outlets provide hands-on product trials, expert guidance, and immediate availability. Retailers build trust through in-store promotions, warranties, and after-sales support. Premium and luxury brands leverage offline channels for brand positioning. Additionally, regulatory compliance and safety concerns drive parents to trusted brick-and-mortar stores. Despite e-commerce growth, offline stores remain dominant due to personalized service, product assurance, and the convenience of immediate purchases.

Analysis by Age Group:

- 0-1 Year

- 2-4 Year

- 5-7 Year

- >8 Year

0-1 year leads the market with around 38.5% of the market share in 2024. The 0–1 year segment holds the largest share in the juvenile products market due to the high demand for essential infant care items such as strollers, cribs, car seats, feeding accessories, and diapers. Newborns require frequent product replacements, driving recurring purchases. Parents prioritize safety, comfort, and hygiene, leading to increased spending on premium and certified products. Hospital recommendations and government regulations further influence purchasing decisions, especially for car seats and sleep solutions. Additionally, baby showers and gifting culture boost sales in this category. The critical growth phase of infants ensures sustained demand, making this segment the most significant in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Poland

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.2%. The market in North America is driven by rising birth rates, increasing disposable income, and a strong focus on child safety. Stringent safety regulations from agencies like the Consumer Product Safety Commission (CPSC) and the National Highway Traffic Safety Administration (NHTSA) push demand for certified products. Parents prioritize convenience, leading to innovations in lightweight strollers, smart baby monitors, and ergonomic car seats. E-commerce expansion, brand loyalty, and premiumization trends further boost sales. Sustainability concerns are driving demand for eco-friendly materials. Additionally, the growing influence of social media and celebrity endorsements accelerates consumer awareness and preference for branded products. For instance, in February 2023, SleepOvation Baby, an FDA-registered medical device company, revealed that its crib mattress had been posted for sale. This listing allowed parents to shop with confidence, knowing that SleepOvation Baby's crib mattress is both safe and helpful for babies.

Key Regional Takeaways:

United States Juvenile Products Market Analysis

In 2024, the United States accounted for over 92.50% of juvenile products market in North America. The juvenile products market in the U.S. is witnessing phenomenal growth due to buoying spending from consumers and rising birth rates. As put forth by the Center for Disease Control and Prevention (CDC), as many as 3,596,017 live births in the United States, in 2023 alone, drive an increasing demand for essential baby products including car seats from Cradle Station, strollers, and cribs. An industrial report stated that the U.S. juvenile products industry was around USD 7 billion in 2023, which shows growing panic over safety and obsession towards high-end products, as well as an ever-expanding market. Demand is made to be smart and green while baby gear haunts thus stimulating innovation in this segment. E-commerce websites are still a priority along with online sales accounting for substantial revenue-continuing sales within the several products. The giants such as Graco and Chicco reign across the field while advancements in multifunctional and ergonomic designs take competitive performances to higher dimensions. State safety regulations and consumer awareness continue to suffice and thus mold growth in the market, ensuring an unending juvenile products demand.

Europe Juvenile Products Market Analysis

The juvenile products market in Europe is progressing steadily and steadily due to the rising awareness of child safety and increasingly stringent regulatory standards. According to an industrial report, approximately 3.66 million babies were born in the European Union in 2023, resulting in the demand for essential baby products. As per industry estimates, the European juvenile products market is valued at several billion dollars, and the sales accounted for Germany, France, and the UK. Besides, Germany's strong economy and high parental spending create demand for high-quality strollers, car seats, and baby monitors. Apart from that, the EU safety regulations like EN 1888 regarding strollers stimulate product innovation and premium offerings. Another trend being followed by parents who keep baby products safe and environmental-friendly is organic textiles and melt-graded feeding utensils or BPA-free. Such companies are Bugaboo and Britax, which invest in smart baby gear that is integrated with IoT technology for more solutions. Further government-backed incentives for child-rearing only work toward the further enhancement of the market in Europe.

Asia Pacific Juvenile Products Market Analysis

Increasing birth rates and growing disposable income are among the factors propelling the growth of juvenile products across the Asia Pacific. With 2023 marking the emergence of over 9 million newborns in China as recorded by the National Bureau of Statistics of China, demand for baby care items is further fueled. In India, too, supported by government schemes such as the Maternity Benefit Program initiative that promotes infant care-the juvenile products market is gaining traction. E-commerce, especially platforms like Alibaba & Flipkart, is doing extremely well in selling baby products like strollers, cribs, and feeding accessories. Premiumization is increasingly occurring in markets such as Japan and South Korea, where parents like buying high-end technologically sophisticated baby products. Local manufacturers are collaborating with global brands to enhance their product offerings, generating a favorable juvenile products market outlook. Yet another factor stimulating demand for compact, multifunctional baby products in the urban domain is the rising trend of nuclear families.

Latin America Juvenile Products Market Analysis

Latin America's juvenile products market is growing as birth rates stabilize and parents spend more money. Based on data available, in 2023 Brazil had around 2.6 million births, fuelling demand for fundamental infant products like baby strollers, cribs, and baby car seats. Brazil's baby care market had a size of USD 2.8 billion in 2023, leading the region in sales, based on an industry report. Mexico is a close second, with growing investments in infant safety products. Penetration of e-commerce is on the rise, with online platforms such as MercadoLibre facilitating greater access to international brands. Eco-friendly baby products are gaining popularity, especially in Argentina and Chile, where the use of eco-friendly materials and ethical manufacturing takes precedence. Local brands compete with international brands by providing low-cost yet quality products. Government policies requiring more stringent child safety measures, like Brazil's car seat regulations, also fuel market expansion. The working parents trend also creates demand for automated baby care technology, such as intelligent monitors and self-rocking cradles.

Middle East and Africa Juvenile Products Market Analysis

The Middle East and Africa youth products market is expanding due to high fertility rates and rising urbanization. Industrial report indicates that in 2023, Africa experienced about 46.1 million births, with Niger having the highest crude birth rate in Africa. Population growth is set to persist, with estimates counting more than 49 million births in 2030. Increasing disposable income in Gulf nations and growing retail networks in Africa underpin market growth. Premium baby product sales are dominated by the UAE and Saudi Arabia, with parents choosing quality and safety. E-commerce sites Noon and Jumia provide easy access to international brands, boosting product availability. African local manufacturers emphasize cheap and long-lasting baby necessities to meet price-conscious consumers. Government policies supporting maternal and child health further increase demand for regulated and certified children's products, which ensures continued market growth in the region.

Competitive Landscape:

The juvenile products market is driven by key players such as Dorel Industries, Artsana Group, Goodbaby International, Newell Brands, and Stokke. Companies compete on product innovation, safety compliance, brand reputation, and pricing strategies. Market trends show increasing demand for eco-friendly materials, smart baby products, and ergonomic designs. E-commerce is intensifying competition, with direct-to-consumer brands like BabyBjörn and Nuna gaining traction. Regional players in Asia-Pacific and Latin America are expanding, challenging established brands. Regulatory compliance, especially in North America and Europe, remains a critical factor. Mergers and acquisitions are shaping the competitive landscape, with companies investing in technology-driven solutions like IoT-enabled baby monitors and convertible strollers to differentiate their offerings and capture market share. For instance, in November 2024, Momcozy, the renowned pregnancy and baby brand trusted by over 3 million mothers worldwide, announced the release of two unique strollers that will alter family adventures just in time for the busy Christmas season.

The report provides a comprehensive analysis of the competitive landscape in the juvenile products market with detailed profiles of all major companies, including:

- Dorel Industries Inc.

- Goodbaby International Holdings Ltd.

- Britax

- Chicco

- Stokke

- BeSafe

- Emmaljunga

- Peg Perego

- Combi Corporation

- Bugaboo International B.V.

- RECARO Kids s.r.l.

Latest News and Development:

- October 2024: Stokke unveiled a rebranded Stokke® JetKids™, introducing new colors and playful sticker sets for its BedBox™ and BackPack. Inspired by aerial photography, the refreshed lineup features Coral Pink, Arctic Blue, and more, enhancing children's travel experiences with customizable, adventure-themed designs.

- August 2024: Goodbaby International Group, formerly Evenflo, announced its rebranding. The company, operating CYBEX, gb, and Evenflo brands, aims for global expansion. The Piqua facility will launch two new juvenile products in late 2024, enhancing efficiency and automation while increasing labor hiring.

- July 2024: Mubadala Capital has agreed to acquire a majority stake in Bugaboo Group from Bain Capital, which will retain a minority stake. The deal aims to expand Bugaboo’s presence in the juvenile products market, strengthening its leadership in premium strollers and parenting solutions.

- January 2024: RECARO partners with AVOVA to enhance child safety seating. The partnership includes the creation, manufacturing, and international marketing of high-end strollers and child seats under the RECARO brand. It further aims to elevate safety, comfort, and innovation while expanding RECARO’s market position with modern designs and premium materials.

- April 2022: Chicco introduced its ‘Advanced’ Baby Moments baby cosmetics range, formulated with natural ingredients for enhanced skin nourishment. The new line emphasizes gentle care and safety for infants, aligning with growing consumer demand for natural baby skincare products.

Juvenile Products Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Strollers and Prams, Car Seats, Cribs and Cots, Others |

| Distribution Channels Covered | Offline, Online |

| Age Groups Covered | 0-1 Year, 2-4 Year, 5-7 Year, >8 Year |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Poland, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia, United Arab Emirates |

| Companies Covered | Dorel Industries Inc., Goodbaby International Holdings Ltd., Britax, Chicco, Stokke, BeSafe, Emmaljunga, Peg Perego, Combi Corporation, Bugaboo International B.V., RECARO Kids s.r.l., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the juvenile products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global juvenile products market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the juvenile products industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The juvenile products market was valued at USD 25.1 Billion in 2024.

The juvenile products market is projected to exhibit a CAGR of 6.1% during 2025-2033, reaching a value of USD 42.8 Billion by 2033.

The market growth is fueled by increasing birth rates, rising disposable incomes, stringent safety regulations, technological innovations, retail expansion, and consumer demand for premium and sustainable products. Shifts in purchasing behavior, especially towards digital platforms, boost industry momentum, driving continuous innovation and broadening market opportunities while fostering long-term consumer trust globally.

North America currently dominates the juvenile products market, accounting for a share of 36.2%. Birth rates, disposable incomes, safety regulations, technological innovations, and evolving consumer preferences significantly drive growth in the market.

Some of the major players in the juvenile products market include Dorel Industries Inc., Goodbaby International Holdings Ltd., Britax, Chicco, Stokke, BeSafe, Emmaljunga, Peg Perego, Combi Corporation, Bugaboo International B.V. and RECARO Kids s.r.l.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)