Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034

Market Overview:

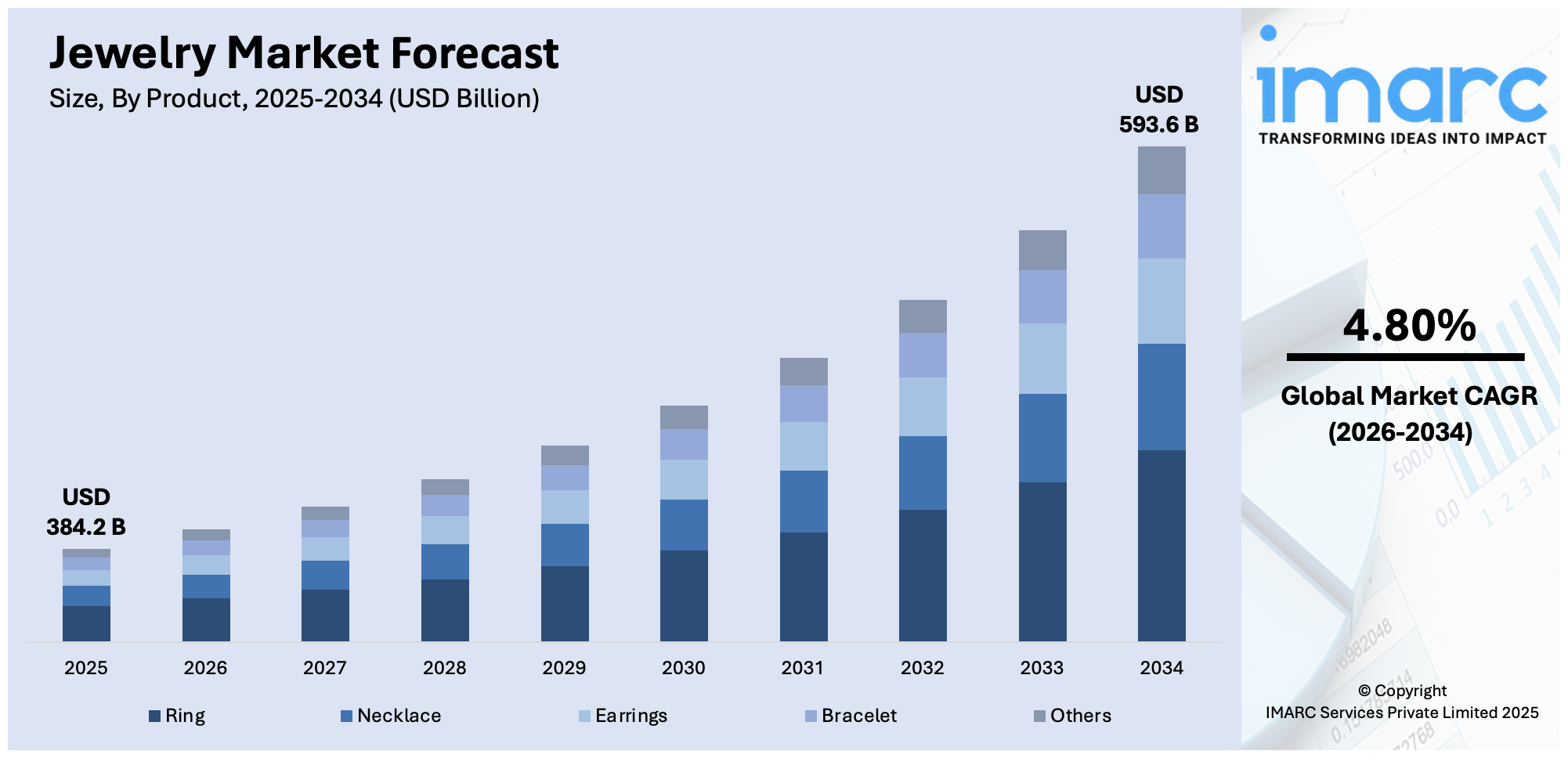

The global jewelry market size reached USD 384.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 593.6 Billion by 2034, exhibiting a growth rate (CAGR) of 4.80% during 2026-2034. The rising demand for jewelry among individuals, the changing trends and consumer preferences, various technological advancements, and the increasing disposable income of individuals in developing nations are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 384.2 Billion |

| Market Forecast in 2034 | USD 593.6 Billion |

| Market Growth Rate (2026-2034) | 4.80% |

Jewelry refers to decorative items that are worn for personal adornment. It is a broad term that includes various accessories manufactured from precious metals, gemstones, and other materials. It includes items such as necklaces, bracelets, earrings, rings, and brooches that are crafted using techniques such as metalworking, stone setting, enameling, and filigree. In addition, precious metals including gold, silver, and platinum are often used as the base material, while gemstones such as diamonds, rubies, emeralds, and sapphires add color and brilliance to the product. It can be worn as a form of self-expression, a symbol of status or wealth, or as a sentimental token.

To get more information on this market Request Sample

The market is primarily driven by the rising demand for fine and intricate Jewelry. In addition, the increasing purchasing power of individuals, and the growing popularity of fast fashion have led to the availability of fashion jewelry made of plated alloys and crystal stones through online platforms influencing the market growth. Moreover, manufacturers are actively using digital marketing to promote their products, create brand awareness, and foster long-term relationships with existing customers representing another major growth-inducing factor. Furthermore, international retail groups are acquiring local brands to expand their consumer base and increase market share. Besides this, diamond jewelry is gaining popularity globally as it serves as a valuable investment option that can be utilized in times of inflation, market fluctuations, and economic instability thus accelerating the market growth. The impact of the COVID-19 pandemic and government-imposed lockdowns has also contributed to an increase in investments in diamond jewelry to navigate the changing market conditions.

Jewelry Market Trends/Drivers:

Rising disposable incomes of individuals

The increasing demand for jewelry due to the growing disposable incomes of individuals is influencing market growth. As economies expand, individuals have more financial resources to invest in luxury goods such as jewelry. In addition, consumers are willing to spend on premium jewelry pieces that convey status, sophistication, and exclusivity accelerating the market growth. Besides this, the expanding middle-class families in emerging markets, are particularly influential in driving the market's growth. Moreover, the rising demand for unique and personalized pieces among individuals is augmenting the market growth. Along with this, modern consumers seek jewelry that reflects their individual style and personality, and value exclusivity, craftsmanship, and creativity, leading to escalating demand for bespoke designs and customizations propelling the market growth. Furthermore, jewelry retailers and designers are responding to these preferences by offering personalized options, such as engravings, birthstone customization, and mix-and-match collections.

Several technological advancements

Computer-aided design/computer-aided manufacturing (CAD/CAM) technology has revolutionized the design and production processes, allowing jewelry makers to create intricate and complex designs with precision. In addition, CAD software allows designers to visualize and modify designs quickly, reducing time-to-market and enhancing creativity thus propelling the market growth. Besides this, three-dimensional (3D) printing technology is gaining prominence, allowing rapid prototyping and the production of intricate jewelry pieces influencing market growth. Along with this, the incorporation of laser technology for quick, accurate, precision cutting and engraving in jewelry manufacturing is propelling market growth. It enables jewellers to create intricate patterns, add personalization, and even achieve unique textures on various materials, including metal, gemstones, and acrylic. Furthermore, the integration of augmented reality (AR) and virtual reality (VR) technologies enhances the shopping experience of customers and offers a virtual try-on jewelry, visualizing looks and fits without physically wearing it providing convenience and helping in the decision-making process for potential buyers creating a positive market outlook.

Changing fashion trend

Fashion trends in jewelry are constantly evolving, reflecting the ever-changing tastes and preferences of consumers. In addition, the changing demand from minimalist designs to sustainable materials is augmenting market growth. Also, clean lines, simple shapes, and understated elegance are defining minimalist jewelry, leading consumers to incline toward delicate pieces that can be worn every day, complementing various outfits effortlessly. Minimalist jewelry not only adds a touch of sophistication but also allows for versatility in styling. Moreover, the growing awareness of environmental and social issues led consumers to seek out jewelry created from recycled or upcycled materials representing another major growth-inducing factor. Besides this, sustainable practices such as using conflict-free gemstones and fair-trade gold are also becoming important considerations for buyers accelerating the market growth. Brands that prioritize eco-friendly and ethical manufacturing processes are gaining traction in the market.

Jewelry Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global jewelry market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on product and material.

Breakup by Product:

- Necklace

- Ring

- Earrings

- Bracelet

- Others

Ring dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes necklaces, rings, earrings, bracelet, and others. According to the report, the ring represented the largest segment.

Rings hold a special significance as they are often associated with engagements, weddings, and other meaningful occasions. In addition, this emotional connection, combined with evolving fashion trends, is escalating the demand for rings. Moreover, rings are available in a variety of designs, materials, and gemstone options, catering to diverse consumer preferences from classic solitaire engagement rings to intricate cocktail rings representing another major growth-inducing factor. Besides this, the increasing customization trend, allows consumers to create unique and personalized ring designs, augmenting the market growth. Along with this, the expanding e-commerce and online jewelry retailers are contributing to the popularity of rings. Consumers now have access to a vast selection of rings from around the world, allowing them to find the perfect piece conveniently propelling the market growth. Online platforms also offer customization options and virtual try-on features, further enhancing the shopping experience.

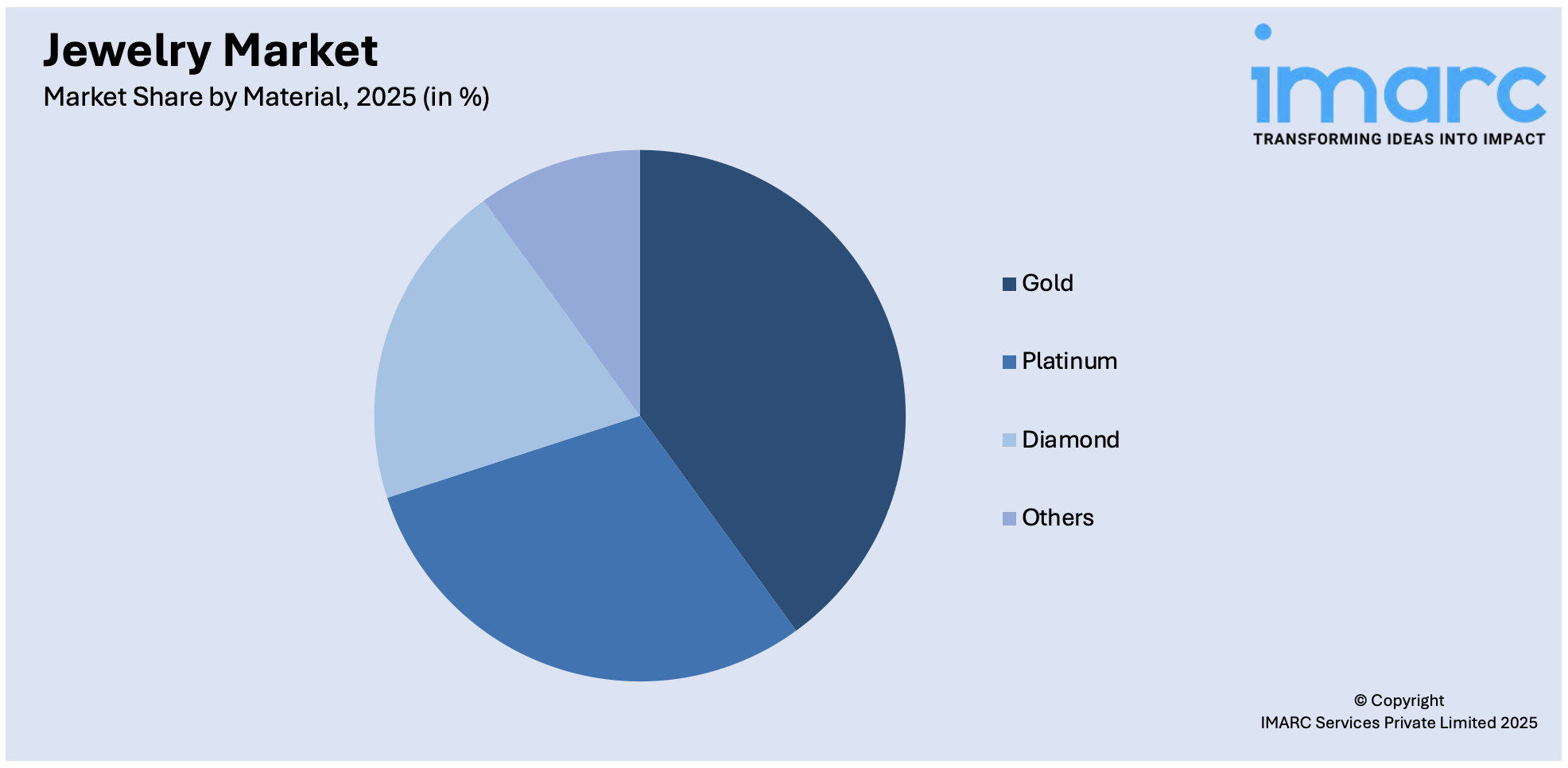

Breakup by Material:

Access the comprehensive market breakdown Request Sample

- Gold

- Platinum

- Diamond

- Others

Gold holds the largest share of the market

A detailed breakup and analysis of the market based on the material has also been provided in the report. This includes gold, platinum, diamond, and others. According to the report, gold accounted for the largest market share.

Gold is regarded as a symbol of luxury, wealth, and prestige, making it a sought-after material for jewelry across cultures and geographies. The rising demand for gold jewelry for its timeless appeal, durability, intrinsic value, as a fashion statement, or with cultural and emotional significance, among consumers is making it a popular choice for special occasions, weddings, and gifting. Moreover, individuals perceive gold jewelry as a tangible asset that can retain or appreciate in value over time, making it a desirable purchase influencing market growth. Besides this, gold holds cultural and sentimental significance in many societies that are deeply ingrained in traditions, rituals, and celebrations, making it a cherished metal for special occasions such as weddings, festivals, and milestone events accelerating the market growth. Along with this, the emotional value attached to gold jewelry further propels the market, as consumers often seek to preserve and pass down these precious pieces as heirlooms. Furthermore, gold has established a reputation as a safe haven investment, during times of economic uncertainty, when currencies and other assets may fluctuate, gold serves as a reliable store of value creating a positive market outlook. Investors turn to gold as a hedge against inflation, currency devaluation, and market volatility, contributing to sustained demand and market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report Asia Pacific was the largest market for jewelry.

Asia Pacific has a rich cultural heritage with a deep-rooted tradition of jewelry craftsmanship and appreciation. Countries such as India, China, and Thailand have a long history of producing exquisite jewelry pieces, often embedded with cultural and symbolic significance. This heritage, combined with the region's skilled artisans and craftsmanship, is creating a strong foundation for the growth and prominence of the jewelry market in Asia Pacific. Moreover, the rising consumer base with a growing middle class and increasing disposable income represents another major growth-inducing factor. Also, the rising demand for luxury goods, including jewelry. Besides this, Asia Pacific has become a global hub for jewelry manufacturing and trade. The region's competitive advantage in terms of low-cost labor and access to raw materials has attracted international jewelry brands to establish production facilities and sourcing networks in Asia Pacific countries such as China, and India further creating a positive market outlook.

Competitive Landscape:

Key players in the jewelry market are actively taking strategic initiatives to strengthen their position and maintain a competitive edge. They are focusing on product innovation and differentiation to stand out in a crowded market and investing in research and development (R&D) to create unique and exclusive designs that cater to evolving consumer preferences. Moreover, they are establishing a strong brand identity and investing heavily in marketing and advertising campaigns to create brand awareness and maintaining a favorable brand image. They use various channels such as social media, celebrity endorsements, and collaborations with influencers to reach a wider audience and connect with consumers on an emotional level. Besides this, many market leaders are expanding their retail footprint by opening new stores and boutiques in high-traffic locations. Additionally, they are embracing the omni-channel approach, integrating online and offline sales channels to provide a seamless shopping experience for customers.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Buccellati (Compagnie Financière Richemont SA)

- Cartier

- Chow Tai Fook Jewellery Company Limited

- Damas Jewellery

- Graff

- Harry Winston Inc (The Swatch Group)

- HStern

- Louis Vuitton Malletier SAS

- Pandora A/S

- Rajesh Exports Ltd.

- Signet Jewelers

- Swarovski AG

- Titan Company

Recent Developments:

- In August 2022, Pandora, a jewel maker, announced that the company would move ahead with its lab-made diamonds and stop selling mined diamonds. As lab-created diamonds are available to more individuals and reduce carbon emissions, while launching a collection using unmined gems in North America to attract young consumers with cheaper and sustainable stones.

- Harry Winston Inc (The Swatch Group) introduced new jewelry collections featuring colored gemstones and unique designs and strengthened its presence in the high-end watch market by launching new timepiece models, combining exquisite craftsmanship with Swiss precision.

- In 2021, Graff a prominent diamond jewelry brand, acquired the Firebird Diamond, a 20.69-carat pink diamond, further enhancing its portfolio of exceptional gemstones, and also collaborated with notable designers and artists, such as Sarah Ho and Jose Maria Serrano, to create limited-edition jewelry collections that combine craftsmanship with artistic expression.

Jewelry Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Necklaces, Rings, Earrings, Bracelets, Others |

| Materials Covered | Gold, Platinum, Diamond, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Buccellati (Compagnie Financière Richemont SA), Cartier, Chow Tai Fook Jewellery Company Limited, Damas Jewellery, Graff, Harry Winston Inc (The Swatch Group), HStern, Louis Vuitton Malletier SAS, Pandora A/S, Rajesh Exports Ltd., Signet Jewelers, Swarovski AG, Titan Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the global jewelry market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global jewelry market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the jewelry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global jewelry market to exhibit a CAGR of 4.80% during 2026-2034.

The rising consumer emphasis on physical appearances, along with the growing popularity of imitation jewelry, is primarily driving the global jewelry market.

The sudden outbreak of the COVID-19 pandemic has led to the shifting consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of jewelry.

Based on the product, the global jewelry market has been divided into necklace, ring, earrings, bracelet, and others. Currently, ring exhibits clear dominance in the market.

Based on the material, the global jewelry market can be segmented into gold, platinum, diamond, and others. Among these, gold currently holds the majority of the total market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global jewelry market include Buccellati (Compagnie Financière Richemont SA), Cartier, Chow Tai Fook Jewellery Company Limited, Damas Jewellery, Graff, Harry Winston Inc (The Swatch Group), HStern, Louis Vuitton Malletier SAS, Pandora A/S, Rajesh Exports Ltd., Signet Jewelers, Swarovski AG, and Titan Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)