Jerky Snacks Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Jerky Snacks Market 2024, Size and Overview:

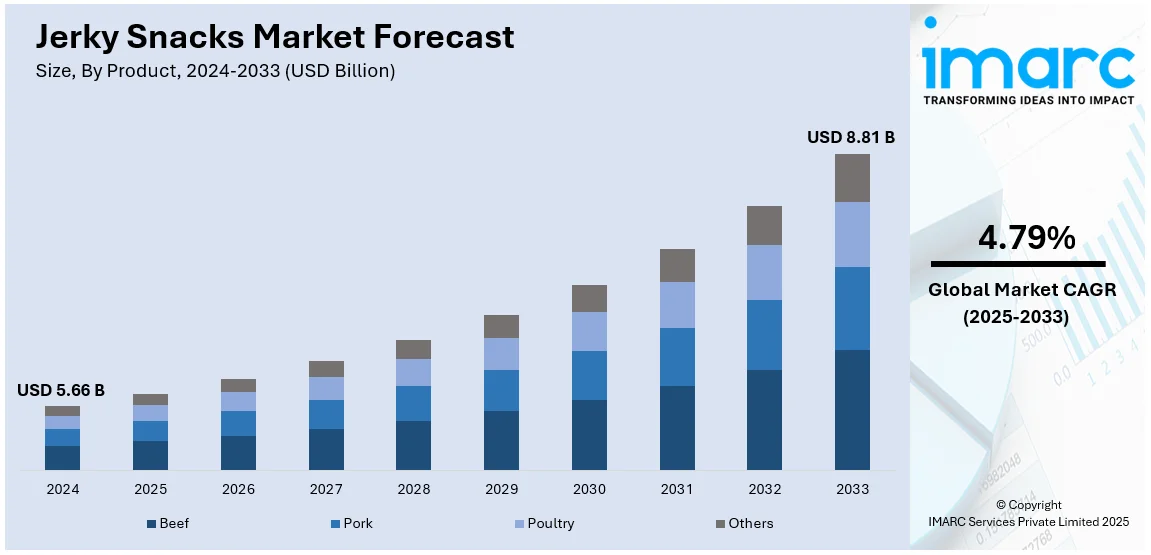

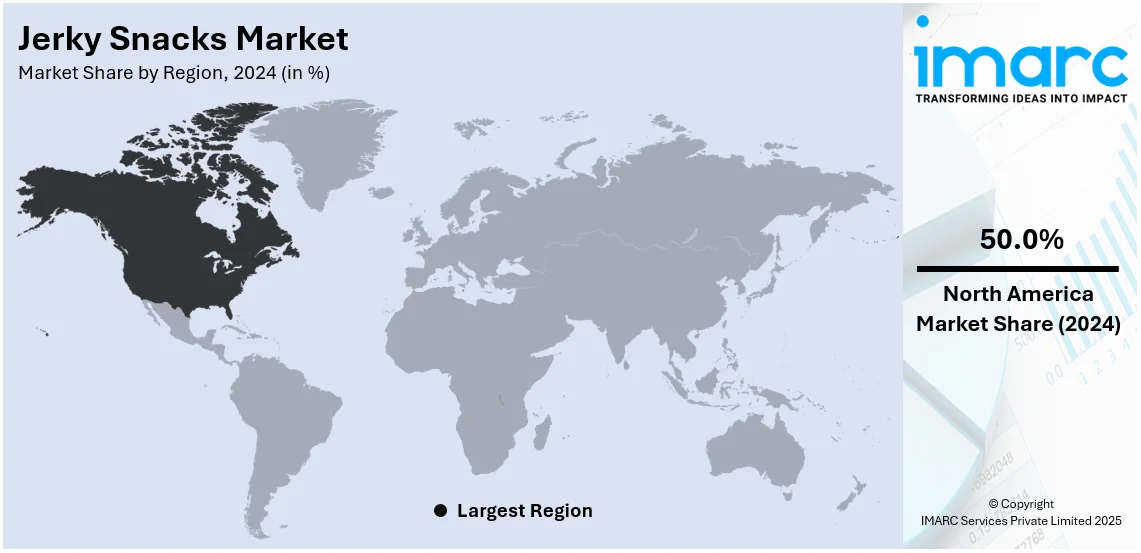

The global jerky snacks market size was valued at USD 5.66 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.81 Billion by 2033, exhibiting a CAGR of 4.79% from 2025-2033. North America currently dominates the market, holding a market share of over 50.0% in 2024. The emerging trend of healthy snacking, rising demand for high-grade protein and exotic flavors, and new product launches by key players represent some of the key factors driving the expansion of the jerky snacks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.66 Billion |

|

Market Forecast in 2033

|

USD 8.81 Billion |

| Market Growth Rate (2025-2033) | 4.79% |

The global jerky snacks market is witnessing substantial expansion due to an increasing consumer preference for convenient, protein-packed, and nutritious snack choices. As health-conscious consumers seek alternatives to traditional snacks, jerky offers a high-protein, low-carbohydrate, and gluten-free option, aligning with popular dietary trends such as keto and paleo. The increasing popularity of on-the-go snacking, along with the rise in outdoor and adventure activities, has further boosted the market, as jerky provides a portable and long-lasting snack. Additionally, innovative flavor profiles and the introduction of plant-based jerky options are attracting a broader consumer base, including vegetarians and vegans. The growing availability of jerky through online retail platforms and supermarkets also contributes to expansion of the jerky snacks market share, catering to the global demand for premium and diverse snack offerings.

The jerky snacks market in the United States is experiencing robust growth with a 78.70% market share, driven by several key factors. Health-conscious consumers are increasingly seeking high-protein, low-carbohydrate, and gluten-free snack options, with jerky aligning well with these dietary preferences. The rise of on-the-go lifestyles has further propelled this trend, as jerky offers a convenient and portable snack solution. Furthermore, the growth of retail channels such as supermarkets, convenience stores, and e-commerce platforms has improved the availability of jerky products to a wider consumer base. The development of unique flavor varieties and the launch of plant-based jerky alternatives have also appealed to a broader audience, including vegetarians and vegans, further driving the jerky snacks market growth.

Jerky Snacks Market Trends:

Increased Demand for Health-Conscious Options

As per the recent jerky snacks market trends, clean and healthy jerky products, increasingly steered toward health-conscious consumers, have begun to displace traditional jerky, criticized for its high sodium and preservative content. Consumers increasingly seek healthier, low-sodium, low-sugar, and high-protein options in line with dietary trends such as keto, gluten-free, and paleo diets and preferences for natural, non-GMO, and hormone-free meats. According to the 2022 Mondelez International report, 68% of consumers checked nutrition labels when buying snacks; therefore, consumers are highly aware of nutritional clarity in purchasing preferences. Consumers require jerky to be low on sodium, containing fewer preservatives, and offering high protein levels. A 2023 Acosta Group study states that clean-label products are at the helm for retail sales: younger consumers take notice and have a greater possibility of buying such clean-label brands. The focus on nutritional value and ingredient transparency is making brands innovate to offer jerky that not only tastes good but also supports the health objectives of consumers. Many jerky brands now use grass-fed beef, turkey, or chicken, while some add more superfoods, such as turmeric, chia seeds, or collagen peptides, to enhance the health benefits. That helps increase the demand of jerky among fitness enthusiasts and athletes, all of whom target a healthy alternative to snack at their convenience which is rich in proteins but free of artificial ingredients.

Expansion of Plant-Based Jerky

As the plant-based movement gains worldwide momentum, the jerky producers are diversifying their product portfolios to include a plant-based offering. Meatless jerky is made from various types of plant-based proteins, which include soy, mushrooms, lentils, and even pea protein, in imitation of the taste, texture, and protein content that traditional jerky offers. Vegan jerky offers not only vegetarian and vegan clients but also growing flexitarians who look for more sustainable, ethical, and environmentally conscious choices. Additionally, a 2021 study published in the journal Foods found that consumers' attitudes toward plant-based meat alternatives positively and significantly affected their purchase behavior. In response to increasing awareness of the impact of food choices on the environment, the need for plant-based jerky is gaining momentum because the consumer has now become conscious about the footprint animal-based foods impose on the planet. Furthermore, innovation in flavor profiles is encouraging this shift because manufacturers of jerky are pushing the boundaries in using bold seasonings and different cooking techniques in an effort to achieve a broader spectrum of consumer preferences. As this plant-based snack market continues growing, the plant-based jerky snacks demand will rise both in relation to dietary choice and sustainability issues.

Premium and Gourmet Offerings

As per the jerky snacks market forecast, the jerky snacks market is moving towards premium and gourmet offerings, as consumers are seeking higher-quality and more flavorful options. This trend is fueled by a growing desire for artisanal products that focus on quality, sourcing practices, and innovative flavor options. nalNew Product Innovation Report noted that 21% of millennials wish more premium items were available on the market. Premium jerky is increasingly produced with superior quality meats coming from environmentally sustainable sources like grass-fed beef, free-range turkey, and heritage pork for discerning customers ready to spend the extra for such a premium snack. Also, gourmet jerky brands offer exotic and robust flavors such as whiskey-infused, honey mustard, or chipotle lime to thrill the taste buds of consumers more eager for these more elaborate offerings. Specialty food stores and online retailers are typically the places to purchase these high-end products. It is in those places that a consumer goes for a more distinguished and indulgent snacking experience. With such an emphasis on authenticity, small-batch production, and distinct packaging, there has come into existence a niche market for gourmet jerky since consumers have lately been trending toward products with higher premium quality and craftsmanship.

Jerky Snacks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global jerky snacks market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Beef

- Pork

- Poultry

- Others

Based on the jerky snacks market outlook, beef jerky holds the dominant share of the global market, accounting for 52.0% of the industry. This is primarily due to beef’s widespread popularity as a protein source, its rich flavor, and its versatility in various jerky products. Consumers’ preference for beef jerky is driven by its traditional appeal and the high protein content that makes it a favored choice for health-conscious individuals, athletes, and those following high-protein diets. Additionally, beef jerky is widely available in various flavor profiles and is often marketed as a convenient, on-the-go snack. The strong consumer loyalty to beef jerky, combined with the product’s established market presence, ensures its continued dominance in the jerky snacks industry. This segment's growth is supported by innovations in flavor and packaging, further enhancing beef jerky’s market position.

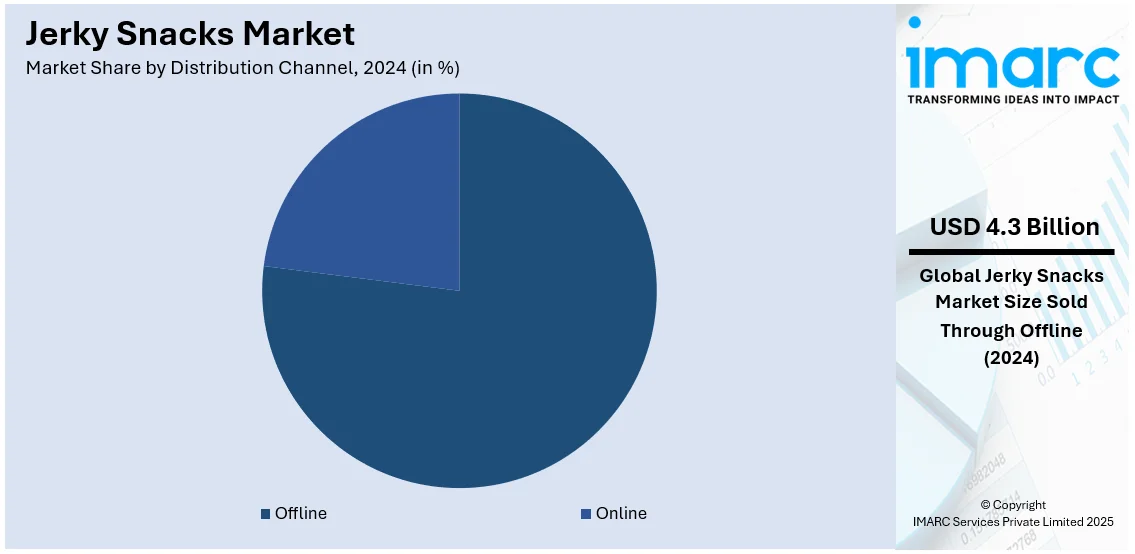

Analysis by Distribution Channel:

- Offline

- Online

Offline distribution channels dominate the jerky snacks market, accounting for 76.8% of the total market share. This is largely due to the widespread availability of jerky products in brick-and-mortar stores such as supermarkets, hypermarkets, convenience stores, and specialty retailers. These physical stores provide consumers with easy access to a wide variety of jerky options, including different flavors, protein types, and packaging sizes. The strong presence of jerky in offline retail outlets also benefits from impulse buying behaviors, as jerky is often placed in high-traffic areas like checkout counters. Moreover, in-store promotions and the opportunity to sample products play a key role in boosting sales through offline channels. Despite the growing popularity of e-commerce, offline retail continues to be the dominant channel due to its extensive reach and consumer preference for in-person shopping experiences.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the jerky snacks market, holding a dominant 50.0% market share. The region’s strong growth is driven by high consumer demand for convenient, high-protein snacks, with jerky being a popular choice due to its nutritional benefits and portability. The prevalence of busy lifestyles in North America, along with the growing trend toward health-conscious eating, has fueled jerky’s popularity as a snack option. The region also benefits from a robust retail infrastructure, making jerky products easily accessible in supermarkets, convenience stores, and online platforms. Innovations in flavor, packaging, and the introduction of plant-based jerky options have also contributed to North America's market leadership. As a result, North America continues to dominate the jerky snacks industry, supported by a broad consumer base and increasing demand for protein-rich, on-the-go snacks.

Key Regional Takeaways:

United States Jerky Snacks Market Analysis

The U.S. jerky snacks market is going great, based on the growing demand for protein-rich and on-the-go food options. Based on a recent report by the U.S. Department of Agriculture, in 2023, the total beef production reached around 27.4 billion pounds, which contributes to the jerky snacks market size. Beef jerky constitutes about 80% of North America's meat jerky market, showing the greater consumer preference for beef as a protein source. Growing consumer interest in healthy snacks and high-protein foods has provided a strong growth impetus for the market. Beef jerky ranks as one of the most successful products, not only for being a top-seller but also for innovative variants such as plant-based jerky and newer options like turkey or chicken jerky. It has leading market positions in both Jack Link's and Slim Jim brands, satisfying more traditional tastes, as well as innovative consumer choices. Increased spending power for the consumer means there is increased growth in premium and organic jerky snacks. Further government-supported measures to expand meat industry production and exporting are also boosting U.S. leadership in jerky snacks around the world.

Europe Jerky Snacks Market Analysis

The European jerky snacks market is growing as healthy eating and protein-based snacking increase in demand. According to the European Commission, the agricultural production of beef in the European Union was about 6.4 million tons in 2023, thereby supporting the growth of the meat-based snack industry, including jerky. The UK, Germany, and France have seen a notable rise in consumption. Countries are witnessing a healthy increase in Germany as the country largely prefers its snacking to be more about meat. Innovative flavors, like spicy and exotic varieties, are helping expand the market. Trend towards clean-label products has made natural jerky options a growing segment. International partnerships have convinced local producers to diversify their products. Growing e-commerce platforms are also making jerky snacks more accessible to European consumers. Increased investment in animal protein and plant-based jerky production further strengthens Europe's position in the jerky snack market.

Asia Pacific Jerky Snacks Market Analysis

The jerky snacks market in Asia Pacific is rapidly growing because of the increased disposable incomes and a trend towards protein-packed snacks. Industrial reports have shown that, in 2023, China's meat production was at about 96.41 million metric tons. It had grown by 4.5% from 2022, which includes pork, poultry, beef, and mutton/lamb, which are leading to the demand for jerky snacks. Major. Growth is noted in countries such as China, Japan, and Australia due to a rising demand for healthy and convenient food options. Innovative protein sources such as chicken, fish, and plant-based jerky attract consumers who care about health, particularly the younger generations. Penetration for market is driven by rising e-commerce and modern retail channels. Products tailored to local tastes, such as sweet and savory flavors, promote their sale. Regional and global companies cooperation; innovation with local flavor adaptations is causing competitive innovation.

Latin America Jerky Snacks Market Analysis

Jerky snacks are on the rise across Latin America as protein-rich snacks become popular in wake of changing dietary habits and a developing middle-class force. The Food and Agriculture Organization estimated Brazil's beef production in 2023 to be around 10.57 million metric tons, which indicated robust supply for the jerky snack. Brazil, Argentina, and Mexico majorly contributed to the regional market, and beef jerky was the dominant product. Rising disposable incomes and healthy snacking have been contributing to this market growth. The region is also experiencing the rise of plant-based jerky options, driven by increasing health consciousness. Expansions of regional production capacity and export opportunities for jerky snacks are supporting the growth of the market. Local manufacturers, with a focus on local tastes, also offer jerky in the form of regional flavors to be preferred by consumers in the Latin American region.

Middle East and Africa Jerky Snacks Market Analysis

The Middle East and Africa jerky snacks market is rising due to the increased consumption of protein-snacking products and the growth of convenience foods. As reported by the Department of Agriculture, Land Reform, and Rural Development, South Africa has approximately 430 abattoirs slaughtering cattle, pigs, and sheep every year to supply the country's local jerky snacks market. The emerging growth leaders in countries like South Africa, Saudi Arabia, and the UAE come through with higher disposable incomes and a trend toward healthy eating patterns with protein snacking. Local producers expand their lines with exotic proteins, such as camel and ostrich jerky, complementing more conventional beef and chicken jerky offerings. Popularity of international brands with a flavor twist encourages the growth process. The demand for plant-based jerky is also on the rise, fueled by health and dietary preferences.

Competitive Landscape:

The global jerky snacks market is highly competitive, with a wide range of companies competing for market share across different regions. Key market participants include established brands which have a strong market presence due to their wide product offerings, brand recognition, and extensive distribution networks. These companies dominate the market through their diverse flavors, protein types (including beef, turkey, and plant-based alternatives), and convenient packaging. Additionally, new entrants and smaller brands are capitalizing on consumer trends toward health and sustainability by offering organic, gluten-free, and plant-based jerky options, tapping into the growing demand for clean-label products. To stay competitive, companies are increasingly focusing on product innovation, premium offerings, and expanding their reach through e-commerce platforms and retail partnerships.

The report provides a comprehensive analysis of the competitive landscape in the jerky snacks market with detailed profiles of all major companies, including:

- Chef’s Cut Real Jerky Co.

- Frito-Lay North America Inc. (PepsiCo Inc.)

- Jack Link's LLC

- Oberto Snacks Inc. (Premium Brands Holdings Corporation)

- Old Trapper Smoked Products Inc.

- Tillamook Country Smoker

Latest News and Developments:

- September 2024: Old Trapper showcased new packaging and flavor trends at the 2024 NACS Tradeshow, October 8-10. The company highlights re-designed gusseted bags for 15 oz beef sticks, aligning with consumer demand for convenience and diverse flavors like teriyaki.

- August 2024: Tillamook Country Smoker has introduced Tajín® Flavored Beef Jerky, blending premium beef jerky with tangy, spicy Tajín Clásico seasoning. Available on Amazon and Tillamook's website, it highlights bold flavors and clean label ingredients.

- July 2024: Oberto introduced Pulled Pork Jerky, the first in its category, emphasizing innovation and natural ingredients. Available nationwide in August, the launch aligns with its strategy to expand the USD 3 billion meat snacks market.

- June 2024: Jack Link’s celebrated National Jerky Day with a 400-foot-tall Sasquatch drone show over the Hudson River. A live QR code offered 50% off a Sasquatch® Care Package on Amazon until June 12th.

- January 2024: Frito-Lay, along with Jack Link's, has released Fritos Chili Cheese Beef Jerky, Meat Sticks, and Combos as well as Flamin' Hot Cheese Stick & Meat Combos, as it extends its 2023 launch.

Jerky Snacks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Beef, Pork, Poultry, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Chef’s Cut Real Jerky Co., Frito-Lay North America Inc. (PepsiCo Inc.), Jack Link's LLC, Oberto Snacks Inc. (Premium Brands Holdings Corporation), Old Trapper Smoked Products Inc., Tillamook Country Smoker, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the jerky snacks market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global jerky snacks market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the jerky snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The jerky snacks market was valued at USD 5.66 Billion in 2024.

IMARC Group estimates the market to reach USD 8.81 Billion by 2033, exhibiting a CAGR of 4.79% from 2025-2033.

Key factors driving the jerky snacks market include increasing demand for high-protein, low-carb, and gluten-free snack options, the rise of on-the-go snacking, health-conscious consumer trends, and innovation in flavors and product offerings. Additionally, the expansion of retail channels and the growing popularity of plant-based alternatives further boost market growth.

North America currently dominates the jerky snacks market, accounting for the largest market share. The region benefits from a strong consumer preference for protein-rich snacks, a well-established retail infrastructure, and the widespread availability of jerky products across supermarkets, convenience stores, and online platforms.

Some of the major players in the jerky snacks market include Chef’s Cut Real Jerky Co., Frito-Lay North America Inc. (PepsiCo Inc.), Jack Link's LLC, Oberto Snacks Inc. (Premium Brands Holdings Corporation), Old Trapper Smoked Products Inc., Tillamook Country Smoker, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)