Japan Wound Care Market Size, Share, Trends and Forecast by Product Type, Wound Type, End User, and Region, 2025-2033

Japan Wound Care Market Size and Share:

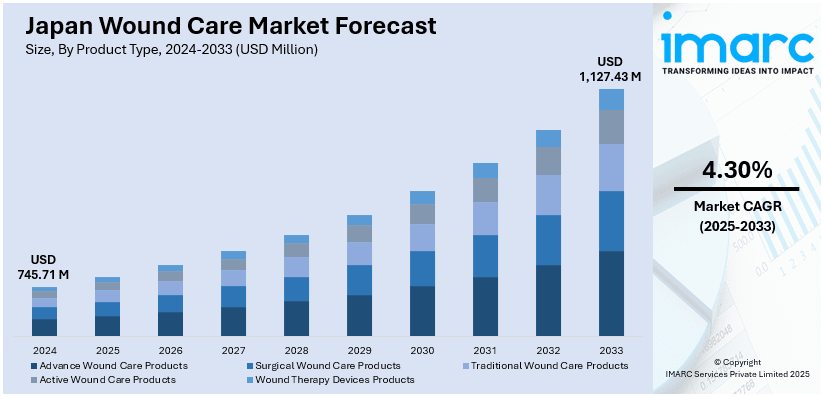

The Japan wound care market size was valued at USD 745.71 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,127.43 Million by 2033, exhibiting a CAGR of 4.30% from 2025-2033. The market is primarily driven by increasing prevalence of chronic conditions like diabetes, advancements in wound care technologies, growing awareness about infection control, rising healthcare spending, government initiatives to improve healthcare infrastructure, and a shift towards minimally invasive treatments, contributing to the market's robust growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 745.71 Million |

|

Market Forecast in 2033

|

USD 1,127.43 Million |

| Market Growth Rate (2025-2033) | 4.30% |

The market in Japan is majorly driven by the increased incidence of lifestyle diseases, including diabetes and obesity, which has further increased the incidence of chronic wounds, creating a continued need for effective wound management solutions. The aging population in Japan primarily influences the increased prevalence of chronic wounds, such as pressure ulcers and diabetic foot ulcers, consequently increasing demand for advanced wound care products. Further, the improvement of healthcare infrastructure in Japan, along with increased investments in medical technology, makes the market expand. For instance, on August 26, 2024, Japan's Ministry of Health, Labour and Welfare announced its "Global Health Vision 2024," aiming at addressing global health challenges through innovation, equitable access to healthcare, and strengthened international collaboration. This strategy prioritizes pandemic preparedness, health system resilience, and advancing universal health coverage. It strengthens Japan's stance as the leader in global health to serve the United Nations Sustainable Development Goals.

Moreover, increasing awareness among healthcare providers and patients about superior results in advanced wound care products compared to conventional methods further develops market penetration. Apart from that, government-initiated programs aimed at making better health care services available and enhanced reimbursement policies for wound care products promote market growth. Increased focus on research and development (R&D) activities by key industry players increases the rate of new-age product launches aligned to the requirements of the Japanese population, hence also driving the market. For instance, on March 13, 2024, Japanese researchers designed a new age bioelectronic wound dressing, combining hydrogel with microelectronics, to facilitate faster healing with minimal chances of infection. This innovation monitors the wound environment and delivers precise electrical stimulation, enhancing tissue repair. The breakthrough highlights Japan's leadership in merging biotechnology and electronics to address healthcare challenges.

Japan Wound Care Market Trends:

Increased Adoption of Advanced Wound Care Products

The increased adoption of advanced wound care products, such as hydrogels, hydrocolloids, and silver-based dressings, supports the overall Japan wound care market growth. A study published in June 2024 in the Journal of Clinical and Translational Research examined the effectiveness of a new dressing containing silver nanoparticles for chronic ulcers. This advanced dressing heals the wound up to several fold times faster than usual and can offer promising results as a new concept in the chronic management of wounds. Such products offer greater retention of moisture and better antimicrobial action than common wound care products. Therefore, demand for advanced wound care products is expected to rise as Japanese healthcare providers want better results from patients. The desire to minimize healthcare-associated infections and achieve quick healing is motivating to focus on products that offer advanced functionalities like infection control and tissue regeneration.

Growing Role of Telemedicine and Digital Tools

Japan has been investing in digital health technologies, which include telemedicine platforms, mobile health applications, and wound care monitoring systems. These tools enable patients to receive remote consultations, monitor their wound healing process, and gain timely interventions. Healthcare providers can manage several patients through digital platforms efficiently, enhancing accessibility and the continuity of care, especially for patients in rural areas or elderly patients who have mobility problems. This improves patient care in general and optimizes the outcomes of treatments. For example, on June 4, 2024, Infosys and Nihon Chouzai, the biggest dispensing pharmacy chain in Japan, announced a collaboration to enhance healthcare access in Japan through cutting-edge online medication. As a part of this partnership, Infosys designed NiCOMS, a mobile telemedicine application that allows patients to receive remote medication guidance from registered pharmacists, thus not requiring them to visit pharmacies in person.

Rise of Personalized Wound Care Solutions

The rise of personalized wound care solutions, which cater to the individual needs of patients, significantly influences the Japan wound care market share. With advancements in biotechnology and regenerative medicine, products such as bioengineered skin substitutes and negative pressure wound therapy system are gaining popularity. For example, on April 1, 2024, Smith+Nephew, a prominent medical device manufacturer with over 25 years of experience in Japan, launched the RENASYS EDGE Negative Pressure Wound Therapy System for home-based chronic wound care. The compact system is designed for patient comfort and ease of use while ensuring effective treatment. Through partnerships with SunMED and First Nation Group, the system's availability will be expanded across the U.S. These products promote faster wound healing by stimulating tissue regeneration and addressing specific wound types, such as diabetic ulcers or burns. Such options are especially valued in the treatment of chronic and non-healing wounds, where traditional methods may be less effective.

Japan Wound Care Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan wound care market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, wound type, and end user.

Analysis by Product Type:

- Advance Wound Care Products

- Foam Dressing

- Hydrocolloid Dressing

- Film Dressing

- Alginate Dressing

- Hydrogel Dressing

- Collagen Dressing

- Others

- Surgical Wound Care Products

- Sutures

- Staplers

- Tissue Adhesive, Sealants and Hemostats

- Anti-effective Dressing

- Traditional Wound Care Products

- Medical Tapes

- Cleansing Agent

- Active Wound Care Products

- Biological Skin Substitutes

- Topical Agents

- Wound Therapy Devices Products

- Negative Pressure Wound Therapy

- Oxygen and Hyperbaric Oxygen Equipment

- Electric Stimulation Devices

- Pressure Relief Devices

- Wound Assessment and Monitoring Devices

- Others

Advanced wound care products, such as hydrocolloids, foams, alginates, and hydrogels are some of the major products that contribute to Japan wound care market. They are preferred for managing chronic and complex wounds as they maintain a moist healing environment, reduce infection risks, and improve healing efficiency. The increasing trend of the geriatric population, along with rising diabetes and venous diseases, will drive demand in Japan for such innovative solutions. Growth in the market is further seen due to advancements in technologies related to negative pressure wound therapy and bioengineered skin substitutes.

Surgical wound care products include sutures, staples, adhesives, and surgical dressings, among others. Being a country that is advanced in terms of medical infrastructure, Japan has a high rate of surgical procedure performance. All these products ensure the proper closure of the wound immediately after surgery. The innovative development of surgical technology, including the use of laparoscopic and robotic procedures, increases demand for specialized wound closure solutions. Investment in antimicrobial and absorbent dressings is further emphasized by the need for infection prevention and quicker recovery, as this aligns with Japan's emphasis on minimizing healthcare-associated complications and enhancing overall care standards.

Traditional wound care products, such as gauze, cotton, and bandages, remain a staple in Japan's wound care market due to their affordability and widespread availability. These products are typically used for minor injuries and home-based care, especially in rural or resource-poor settings. Although the shift towards advanced wound care solutions is increasing, traditional products remain significant in the market. Their cost-effectiveness makes them an attractive choice for basic wound management, especially for less severe cases, ensuring they maintain relevance alongside newer technologies.

Analysis by Wound Type:

- Chronic Wounds

- Diabetics Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Others

- Acute Wounds

- Surgical Traumatic Wounds

- Burns

Chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, represent a significant area of focus in Japan's wound care market due to the aging population. These wounds require advanced therapy with a long time for healing and, therefore, demand NPWT, advanced dressings, and biological products. In addition, the growing prevalence of diabetes and vascular diseases is on the increase and will increase demand for innovative solutions. The emphasis on reducing healthcare expenditure and improving patient outcomes results in better chronic wound management and serves as a rationale for investment in research, new product development, and access to treatments.

Acute wounds resulting from surgical procedures, trauma, or burns are a crucial segment in Japan's wound care market. Acute wounds are associated with high levels of risk and may result in complications if proper treatment is not received on time. It requires treatment through antimicrobial dressings, sutures, staples, and surgical sealants. Due to Japan's advanced development of minimally invasive surgical techniques, there has also been an increase in acute wound products. The country's commitment to high standards of healthcare and the efforts to integrate advanced technologies into wound management practices support the growth of the market.

Analysis by End User:

- Hospitals and Clinics

- Long-Term Care Facilities

- Home Care Setting

- Others

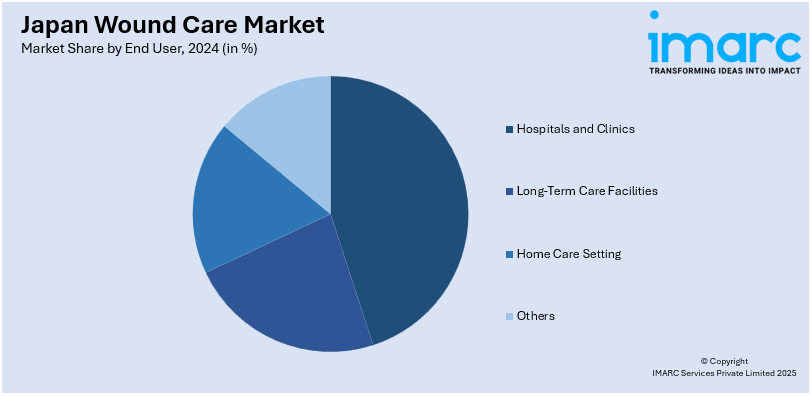

Hospitals and clinics play a significant role in Japan's wound care market, as they handle complex and acute cases. Hospitals and clinic facilities are well-equipped with diagnostic tools and have highly skilled medical professionals who ensure proper wound management. Most patients with severe injuries, surgical wounds, and chronic conditions such as diabetic ulcers are treated in these facilities. The availability of advanced technology and specialized wound care units in hospitals allows for newer therapy modalities, such as negative pressure wound therapy and bioengineered skin substitutes, to be adopted in growing this market and improving patient outcomes.

Long-term care facilities in Japan are significant for patients with chronic conditions requiring ongoing wound management. Pressure ulcers and diabetic foot ulcers are common among the residents, so prevention and treatment strategies must be effective. These facilities focus on cost-effective wound care products such as hydrocolloid dressings and antimicrobial solutions that bring long-term benefits. Training programs for staff in wound care enhance the quality of services. Long-term care facilities contribute to the changing wound care industry by making specialized goods more in demand as the need for geriatric care keeps growing.

Home care settings assume importance in the wound care market of Japan with the growing need for outpatient and home-based care among the geriatric population. Products like foam dressings, alginate dressings, and portable wound care devices are fast gaining popularity because they are convenient and effective. Home care services minimize hospitalization expenses but allow the patient to return home and enjoy the comfort of their surroundings, enhancing their quality of life. The increased availability of telemedicine also aids this trend by allowing monitoring and guidance remotely by healthcare providers. This shift is in alignment with home-based care policies set by the government and is expected to fuel demand for wound care products in this market segment.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, encompassing Tokyo and the surrounding prefectures, represents a critical market in Japan's wound care industry due to the population density and developed healthcare infrastructure. As the nation's political and economic hub, the region faces high demand for the latest in wound care products due to its aging population and concentration of healthcare facilities. Urbanization and technological innovation in this region make it a great ground for research and development to introduce advanced wound care solutions. The Kanto region is an important one that helps determine the national trend, and it also acts as a testing ground for innovative medical products.

The Kinki region, including Osaka, Kyoto, and Kobe, plays a significant role in Japan's wound care market because of its historical significance and strong economic presence. As a manufacturing hub and medical research center, Kinki promotes alliances between industries and healthcare institutions as it seeks innovative technologies in the wound care line. With an increased elderly population as well as an enhanced focus on developing healthcare facilities, this region has an exponentially growing demand for specialized treatments ranging from advanced dressing to negative pressure wound therapy.

The Chubu region, strategically located between Kanto and Kansai, contributes significantly to Japan's wound care market through its diverse economic base and varied demographics. This region hosts both urban centers like Nagoya and rural areas, necessitating a range of wound care solutions to meet different patient needs. Chubu's industrial prowess, particularly in biotechnology and healthcare manufacturing, supports the development and distribution of innovative wound care products.

The Kyushu-Okinawa region is subtropical with unique healthcare challenges and holds immense potential in the wound care market. The aging population and the prevalence of chronic conditions like diabetes drive the need for advanced wound care solutions. Kyushu's strong medical research infrastructure supports the longevity focus and traditional healthcare approaches of Okinawa. Together, both offer a modern, traditional approach to wound management. The diversity in this region also necessitates solutions. As such, it has become a leading market for innovation and testing for Japan's wound care sector.

Tohoku, the epitome of rurality, recovering from the 2011 earthquakes and tsunami- in which the focus has to be put on the importance of access within the wound care market. Aging demography demands the provision of portability as well as cost-effectiveness. Recovery investments made into the region are aimed at improving health infrastructures and offering opportunities for the introduction of advanced wound care products. Tohoku serves as a reminder of the need for resilient and adaptable healthcare systems that can cater to remote areas while addressing disaster-related medical challenges

The Chugoku region, with its mix of industrial cities like Hiroshima and rural communities, plays a strategic role in Japan's wound care market. The region's aging population increases the prevalence of chronic wounds, while its industrial base supports the manufacturing and distribution of medical products. Hiroshima stands as a testament to resilience in the advancement of healthcare technologies within the region. The rural parts of Chugoku point towards the need for equal access to wound care services, and mobile health units and telemedicine solutions could be developed to bridge the urban and remote population gap.

Hokkaido offers both opportunities and challenges in the Japan wound care market, mainly because of its harsh climate and sparse population. Healthcare needs in the region are driven by an aging demographic and logistical complexities in reaching remote communities. Outdoor and agricultural activities in Hokkaido increase the incidence of acute injuries, further increasing the demand for effective wound care solutions. Its research focus, particularly in biomedicine and environmental adaptation, supports the development of innovative products suited to its conditions, making it a crucial area for testing and implementing advanced wound care technologies.

The Shikoku region contributes to the Japan wound care market through its focus on local healthcare solutions tailored to its aging and dispersed population. Its rural and semi-urban landscape requires greater accessibility and affordability of wound care products. Shikoku's strong focus on community-based healthcare promotes preventive care, reduces the number of chronic wounds, and improves the quality of life. Its adaptability for innovation in telemedicine and portable wound care solutions has shown a need for portable and accessible technologies that ensure Japan's entire geography is covered comprehensively.

Competitive Landscape:

The market in Japan is highly competitive and driven by the advanced healthcare infrastructure, an aging population, and increasing chronic conditions such as diabetes. Companies are focused on innovative solutions such as hydrocolloids, foam dressings, and bioactive products to address complex wounds. The collaboration between healthcare providers, research institutions, and manufacturers drives product development and clinical efficacy. Emerging trends in digital health integration are smart dressings with monitoring capabilities, among others. Strict regulatory standards and the need for cost-effective, high-quality solutions further shape the market. The growth is further supported by increased healthcare spending and expanded wound care education initiatives.

The report provides a comprehensive analysis of the competitive landscape in the Japan wound care market with detailed profiles of all major companies.

Latest News and Developments:

- July 31, 2024: AVITA Medical entered into a partnership with Regenity Biosciences to develop a collagen-based dermal matrix that it projected would receive 510(k) clearance in the fourth quarter of 2024. The company strives to create innovative solutions for wound care through integration with its RECELL technology. Regenity Biosciences will manufacture the product, while AVITA will exclusively market and distribute it in the U.S., Europe, Australia, and Japan.

- July 18, 2024: Bactiguard and Zimmer Biomet introduced the ZNN Bactiguard trauma nail to Japan at the 50th Annual Meeting of the Japanese Society for Fracture Repair in Sendai, following its 2023 approval by Japan's Pharmaceutical and Medical Devices Agency.. The ZNN Bactiguard trauma nail uses proprietary infection prevention technology aimed at preventing post-operative infections in orthopedic procedures.

- December 15, 2023: Tokyo University of Science develops a new hydrogel for wound healing, utilizing seaweed-derived alginate and carbonated water. This hydrogel has low adhesion and swelling properties that prevent the expansion of wounds during healing. It is sustainable and has high therapeutic efficacy, which makes it one of the most promising advancements in wound care solutions.

- July 11, 2024: AMS BioteQ obtained its first-class medical device sales permit for its SIPSIP Foam Wound Dressing in Japan, marking Taiwan's first-ever cotton-based dressing to be allowed for sale there. This product provides anti-adhesion, high absorbency, and tissue regeneration capabilities. It caters to the needs of elderly patients and diabetic patients. The company is negotiating with Japanese distribution agents and plans to expand into the Japanese Rakuten e-commerce market to increase sales further.

Japan Wound Care Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Wound Types Covered |

|

| End Users Covered | Hospitals & Clinics, Long-Term Care Facilites, Home Care Setting, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan wound care market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan wound care market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan wound care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Wound care refers to the medical management of wounds to promote healing and prevent infection. It involves cleaning, dressing, and protecting the wound site using specialized products like bandages, ointments, and advanced dressings. Wound care is crucial in treating injuries, surgical incisions, burns, ulcers, and other skin conditions, aiming to accelerate healing, reduce pain, and minimize scarring.

The Japan wound care market was valued at USD 745.71 Million in 2024.

IMARC estimates the Japan wound care market to exhibit a CAGR of 4.30% during 2025-2033.

The key factors driving the Japan wound care market include an aging population, increasing incidences of chronic wounds like diabetic ulcers, rising awareness about advanced wound care products, and advancements in wound treatment technologies. Additionally, growing healthcare expenditure and improvements in hospital infrastructure are fueling the demand for effective wound care solutions in Japan.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)