Japan Wine Market Report by Product Type (Still Wine, Sparkling Wine, Fortified Wine and Vermouth), Color (Red Wine, Rose Wine, White Wine), Distribution Channel (Off-Trade, On-Trade), and Region 2025-2033

Japan Wine Market Size:

The Japan wine market size reached USD 30.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.5% during 2025-2033. There are various factors that are driving the market, which include rising focus on health and wellness and changing dietary preferences of consumers, the wide availability of products via various channels like online and offline stores, and the thriving tourism sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.2 Billion |

| Market Forecast in 2033 | USD 48.8 Billion |

| Market Growth Rate (2025-2033) | 5.5% |

Japan Wine Market Analysis:

- Major Market Drivers: One of the key market drivers is rising marketing and promotion activities by industry players. In addition, the increasing number of cafes, restaurants, and other food service establishments is acting as a growth-inducing factor.

- Key Market Trends: The market demand is impelled owing to numerous primary trends, which include the rising focus on health and wellness and the wide availability of products via various distribution channels.

- Competitive Landscape: Some of the major market players in the Japan wine industry are provided in the report.

- Challenges and Opportunities: One of the key challenges hindering the market growth is cultural preferences. On the other hand, the increasing need for premium beverage options among consumers and collaborations and partnerships among key players represent some recent opportunities.

Japan Wine Market Trends:

Rising Focus on Health and Wellness

Globalization and exposure to various cultures are leading to a rise in the adoption of Western dietary habits such as drinking wine among Japanese consumers. They are becoming conscious about their health and looking for a lower alcoholic drink. Wine is seen as a more beneficial alcoholic beverage in comparison to options such as beer and spirits. Red wine is commonly linked to health advantages because of its antioxidants like resveratrol, that can provide cardiovascular benefits when consumed moderately. It additionally decreases unhealthy cholesterol, maintains heart well-being, and lowers the chance of developing cancer. This trend is causing a rise in the popularity of wine among the general population in the country. Moreover, individuals are increasingly realizing the consequences of consuming beverages with a high alcohol content on their health, leading them to choose wine. The health and wellness market size in Japan is projected to exhibit a CAGR of 3.96% during 2024-2032, as stated by the IMARC Group.

Wide Availability of Products Via Various Channels

As per the International Trade Administration, the business-to-consumer (B2C) e-commerce sales of goods grew by 5.37% in 2022 as compared to 2021 in Japan. Wine is widely available via online and offline stores in Japan. People are preferring products via online channels owing to their enhanced convenience and flexibility as they allow consumers to browse and purchase wines at any time and from any location with just a few clicks. This is especially attractive to individuals with hectic schedules who may not be able to go to brick-and-mortar stores. Online platforms typically offer a greater variety of wines than traditional offline stores. People have the opportunity to discover a wide variety of products from both local and global manufacturers including unique and specialized items that may not be easily found in nearby shops. Online channels offer access to extensive product details, reviews, and ratings from other individuals, assisting shoppers in making well-informed buying choices. The transparency and accessibility of information can foster trust and confidence when buying wine online. Moreover, these platforms provide home delivery options for individuals to have their wine orders conveniently delivered to their home.

Thriving Tourism Sector

According to the Japan National Tourism Organization (JNTO), the estimated number of international travelers to Japan in March 2024 was 3,081,600. Japan attracts millions of tourists every year, many of whom come from countries with well-established wine cultures. This exposure to different wines during their visits can influence their preferences. Apart from this, the rising consumption of wine in cafes, hotels, pubs, clubs, restaurants, and other food service establishments is contributing to the growth of the wine market in Japan. People are also consuming these beverages during social gatherings and events.

Japan Wine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at country and regional levels for 2025-2033. Our report has categorized the market based on product type, color, and distribution channel.

Breakup by Product Type:

- Still Wine

- Sparkling Wine

- Fortified wine and Vermouth

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still wine, sparkling wine, and fortified wine and vermouth.

One variety of wine that is carbonation-free is called still wine. It comes in red, white, and rosé variants that are easily accessible. It is usually fermented until it reaches a consistent, non-fizzy state without adding any more carbon dioxide. Wine's sweetness, acidity, tannin content, and flavor profiles can vary depending on a variety of factors including grape varietal, winemaking techniques, and geographic conditions.

Sparkling wine contains carbon dioxide bubbles that give it an effervescent or fizzy quality. Carbonation can be added purposefully using carbonation procedures, or it can occur spontaneously during fermentation in a restricted environment. It is made using a variety of methods like carbonation, Charmat, and traditional methods. It can be produced from numerous ingredients and comes in a variety of forms, ranging from sweet to dry.

Fortified wine and vermouth have flavors and aromatics added with a variety of herbs, botanicals, and spices through maturation in the barrel. They are used in cooking to add enhanced flavor to dishes and can also be enjoyed on their own over ice or as an aperitif.

Breakup by Color:

- Red Wine

- Rose Wine

- White Wine

A detailed breakup and analysis of the market based on the color have also been provided in the report. This includes red wine, rose wine, and white wine.

Red wine is an alcoholic drink with a deep red color that comes from dark-colored grapes. To produce red wine, winemakers ferment crushed grapes, including the grape skin. Yeast grows and takes in the natural sugars, converting them into alcohol. The grape skin gives red wine some of its color and flavor. Tannins are a group of naturally occurring chemicals found in plant cells present in wine, form during fermentation and are responsible for the bitter and pleasant taste of this wine. Moreover, red wine may reduce the risk of Alzheimer's disease or other forms of dementia.

Rose wine can be made from a variety of red grape varieties. It is created by shortening the duration of skin contact, giving rise to a paler hue. It ranges in color ranging from light pink to deep salmon, depending on the locale, winemaking methods, and type of grape used. Vibrant fruit flavors including strawberry, raspberry, watermelon, and citrus are present.

Both white and certain dark-skinned grape types can be used to make white wine. Acidity and refreshing citrus and tropical fruit flavors are present. White wine comes in a range of varieties ranging from crisp and light wines like Sauvignon Blanc and Pinot Grigio.

Breakup by Distribution Channel:

- Off-Trade

- On-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes off-trade and on-trade.

Off-trade usually means places like liquor stores, supermarkets, and other places where one cannot consume the beverage right away. These outlets offer a wide variety of alcoholic beverages including beer, wine, spirits, and ready-to-drink (RTD) cocktails, allowing consumers to browse and select from a diverse range of products.

On-trade involves places that sell beverages for immediate consumption on the premises like bars, restaurants, and pubs. Consumers visit on-trade establishments to socialize, dine out, or enjoy entertainment while consuming alcoholic beverages. The beverages are served and consumed on-site, either at the bar or at tables within the establishment. On-trade establishments often focus on providing a unique and enjoyable drinking experience for consumers.

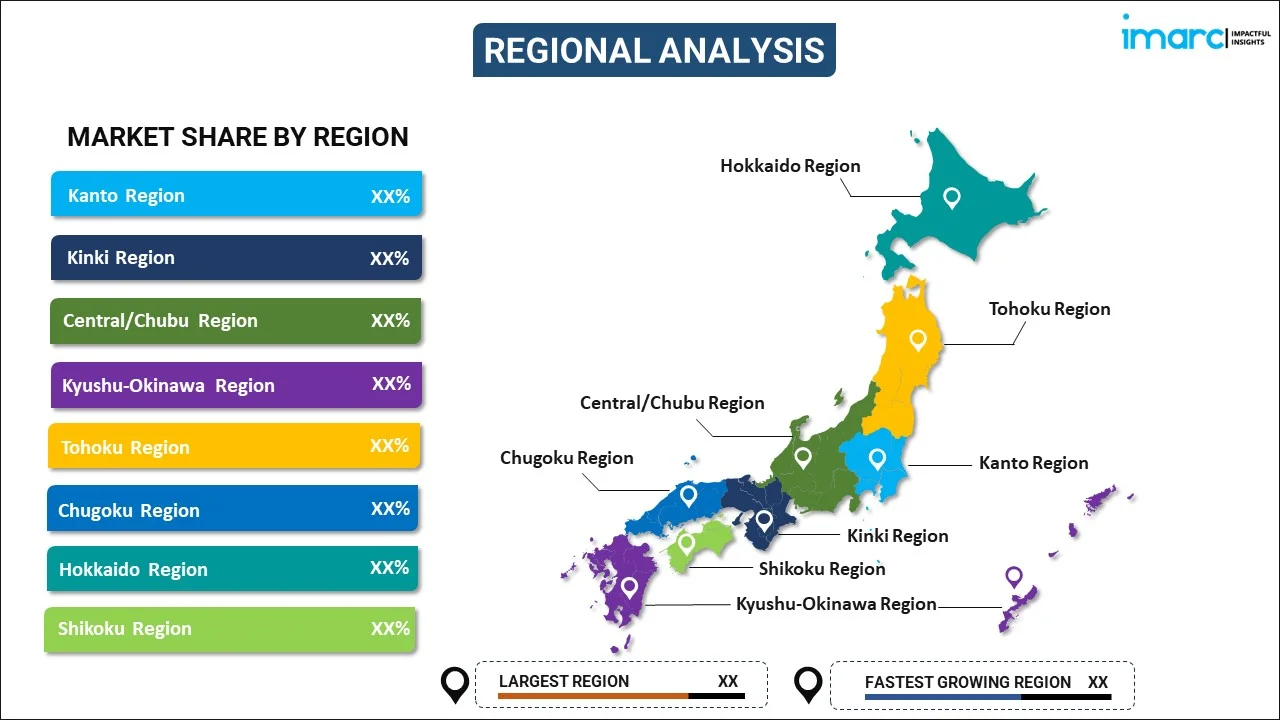

Breakup by Region:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major markets in the country, which include Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

The wide availability of wine in the Kanto Region via online and offline stores is propelling the market growth. In addition, changing consumer tastes and preferences is impelling the market growth.

Furthermore, the Kinki Region is renowned for its vibrant food culture, including traditional dishes like sushi, tempura, and kaiseki cuisine. Particularly red and white wines segment in Japan are often enjoyed alongside these meals as a complement to the rich flavors and textures of the local cuisine.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- Players in the market are expanding their production facilities to increase their output and fulfill the needs of consumers. They are also introducing new and diverse flavors to grab the attention of a wider consumer base. Besides this, top industry players in the market are engaging in collaborations, partnerships, and mergers and acquisitions (M&As) with other stakeholders to enhance their product portfolio and market presence. For instance, on 2 April 2024, Mercian Corporation (Mercian) collaborated with Viña Concha y Toro (Concha y Toro) to introduce the “Pacific Link Project”, that aims at producing wines together.

Japan Wine Market News:

- 31 December 2023: Funabashi Coq Winery released three new wines, including x, a wine in which the grape variety is kept secret. The winery aims to make wine more easily accessible to a wider range of individuals. The winery was opened in 2021 in a residential area of Funabashi, Chiba Prefecture.

- 5 March 2022: Mercian Corporation (Mercian), a leading wine importer and producer in Japan owned by Kirin, launched of a new wine brand called ‘Mercian Wines’.

Japan Wine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still Wine, Sparkling Wine, Fortified Wine and Vermouth |

| Colors Covered | Red Wine, Rose Wine, White Wine |

| Distribution channels Covered | Off-Trade, On-Trade |

| Regions Covered | Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, Shikoku region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan wine market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan wine market?

- What is the breakup of the market on the basis of product type?

- What is the breakup of the market on the basis of color?

- What is the breakup of the market on the basis of distribution channel?

- What are the various stages in the value chain of the market?

- What are the key driving factors and challenges in the market?

- What is the structure of the Japan wine market, and who are the key players?

- What is the degree of competition in the Japan wine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan wine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan wine market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan wine industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)