Japan Watch Market Report by Type (Quartz, Mechanical), Price Range (Low-Range, Mid-Range, Luxury), Distribution Channel (Online Retail Stores, Offline Retail Stores), End User (Men, Women, Unisex), and Region 2025-2033

Japan Watch Market Size:

The Japan watch market size reached USD 6.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.6% during 2025-2033. The growing focus on both traditional and smartwatch, change in user preferences, increasing demand for quartz timepieces due to their affordable pricing, and rise in brick-and-mortar stores are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.6 Billion |

|

Market Forecast in 2033

|

USD 9.8 Billion |

| Market Growth Rate 2025-2033 | 4.6% |

Japan Watch Market Analysis:

- Major Market Drivers: The market is experiencing steady growth as Japanese craftsmanship and cutting-edge watchmaking technology are becoming well-known. Furthermore, the need for premium, long-lasting, and inventive watches among people is bolstering the market growth.

- Key Market Trends: The industry is being shaped by the incorporation of smart technologies into conventional timepieces and the growing demand for environment-friendly materials. The trend of refinement and exclusivity is reflected in the desire for premium and limited-edition timepieces.

- Competitive Landscape: There are several well-known brands in the market that compete with up-and-coming local designers. The sector is characterized by intense competition, constant innovation, and an emphasis on both high-end and inexpensive segments by corporations. Brands must always improve their offers to sustain market share due to the dynamic nature of the industry.

- Challenges and Opportunities: International trade policies and economic changes provide obstacles. Nonetheless, there are plenty of chances to reach a wider audience by developing digital sales channels and taking advantage of the worldwide trend of eco-friendly and smartwatch technology.

Japan Watch Market Trends:

Innovation and Craftsmanship

The increasing focus on innovation and exceptional craftsmanship by watch manufacturers play a major role in supporting the Japan watch market growth. Japanese watchmakers are well-known for their accuracy and ongoing innovations, integrating state-of-the-art characteristics and enhanced functionalities into their watches. These advancements cater to a diverse range of user preferences, like solar-powered mechanisms, kinetic energy systems, and advanced smartwatch capabilities. Blending old-fashioned watchmaking methods with contemporary technology produces top-notch, dependable, and fashionable timepieces. For instance, in July 2022, Casio released a new G-Shock watch that took cues from NASA's orange spacesuits, highlighting creative design elements such as Tough Solar Technology and Multi-Band 6 Atomic Timekeeping. This design showcased Casio's skill by including features that resemble a spacesuit like the black dial and blue accents.

Artificial Intelligence (AI)-Enhanced Manufacturing Processes

The integration of artificial intelligence (AI) into manufacturing operations plays a significant role in improving production processes. AI technology is employed to improve accuracy and effectiveness in manufacturing, guaranteeing top-notch results with lower rates of mistakes. The G-Shock G-D001, an AI-designed gold watch with a sophisticated, organic design that decreased weight and improved shock resistance, was introduced by Casio in December 2023. The final product was created by human designers and artisans, refining the AI-generated model. Machine learning (ML) algorithms enhance different phases of production, such as material selection and assembly, by anticipating problems and recommending enhancements. AI-powered technology automates tasks to make operations more efficient, ultimately cutting down on production time and costs. This technological progress allows producers to fulfill the increasing need for luxury and affordable watches without compromising on quality and creativity, reinforcing Japan's standing in the international watch market.

Marketing and Promotional Strategies

The growing emphasis on effective marketing and promotional tactics by key players are offering a favorable Japan watch market outlook. Companies spend large amounts of money on advertising across different platforms to connect with a wide range of people. Working with influencers and sponsorship of popular event helps to increase the visibility and attractiveness of a brand. In August 2022, Casio introduced exclusive G-Shock watches for streetwear label Places+Faces and fans of beloved anime One Piece, showcasing a dedication to merging durability with modern cultural influences. These models adhered to G-Shock's design aesthetic of strength and robust build, attracting a broad range of fans. Moreover, loyalty programs and personalized marketing campaigns aid in maintaining current buyers by showing them that they are appreciated. Additionally, promotions and discounts during festive seasons or holidays increase sales and draw in new clientele. Through utilizing creative marketing strategies and consistently interacting with users, companies can effectively remain prominent in the market.

Japan Watch Market Segmentation:

IMARC Group provides an analysis of the key Japan watch market trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, price range, distribution channel, and end user.

Breakup by Type:

- Quartz

- Mechanical

Quartz accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes quartz and mechanical. According to the report, quartz represented the largest segment.

Quartz dominates the market due to its affordability, precision, and low maintenance requirements. People highly prefer quartz watches because they are known for their precise timekeeping, which is achieved by the oscillation of quartz crystals controlled by electronic circuits. This industry profits from the technical knowledge of Japanese makers, who have refined the manufacturing method to provide dependable and fashionable watches at different price ranges. The broad appeal of quartz watches spans across different user demographics, ranging from budget-conscious buyers to those seeking functional and fashionable accessories, ensuring its continued prominence in the watch demand in Japan. In 2023, the size of the world market for quartz reached US$ 7.6 billion. IMARC Group projects that the market will reach US$ 12.2 billion in 2032.

Breakup by Price Range:

- Low-Range

- Mid-Range

- Luxury

Low-range represent the leading market segment

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range, mid-range, and luxury. According to the report, low-range accounted for the largest market share.

Low-range holds the biggest market share due to a strong need for cost-effective yet dependable watches. This section appeals to a wide range of buyers, such as students, young professionals, and budget-conscious shoppers who value practicality and long-lasting quality more than extravagant features. Japanese companies have done a great job in creating affordable watches that are of high quality, providing a range of styles and characteristics to attract different preferences. In April 2024, Seiko introduced the new 5 Sports SNXS collection, inspired by their designs from the 1970s and EDC lifestyle, providing well-made, flexible, and reasonably priced timepieces.

Breakup by Distribution Channel:

- Online Retail Stores

- Offline Retail Stores

Offline retail stores hold the biggest Japan watch market share

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline retail stores. According to the report, offline retail stores represented the largest segment.

Offline retail stores are the most dominant distribution channel, driven by the conventional shopping choices it offers buyers. Brick-and-mortar stores provide buyers with a hands-on shopping experience where they can examine, test out, and compare watches prior to buying them. This section features a range of retail stores like department stores, specialized watch shops, and authorized brand boutiques, which offer individualized customer support and establish confidence with buyers. Furthermore, the presence of popular brands in prominent shopping areas not only increases brand awareness but also attracts more customers. For instance, in September 2023, Casio strengthened its offline retail network by launching its inaugural G-SHOCK store in Kurla, Mumbai, thus improving its successful distribution strategy.

Breakup by End User:

- Men

- Women

- Unisex

Men exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and unisex. According to the report, men accounted for the largest market share.

Men represent the largest segment as per the Japan watch market data, showing a high demand for timepieces that blend functionality and style to male preferences. Men frequently look for watches that can be both functional add-ons and symbols of their social status, resulting in an increased demand for watches with intricate styles, cutting-edge capabilities, and strong endurance. This section includes a variety of styles, ranging from casual and athletic to luxurious and sophisticated, to suit different events and individual preferences. This fresh series combines fast-paced thrills with elegant sophistication. Craftsmanship, technological innovation, and brand prestige play a major role in men's watches, leading to ongoing dominance in this market segment.

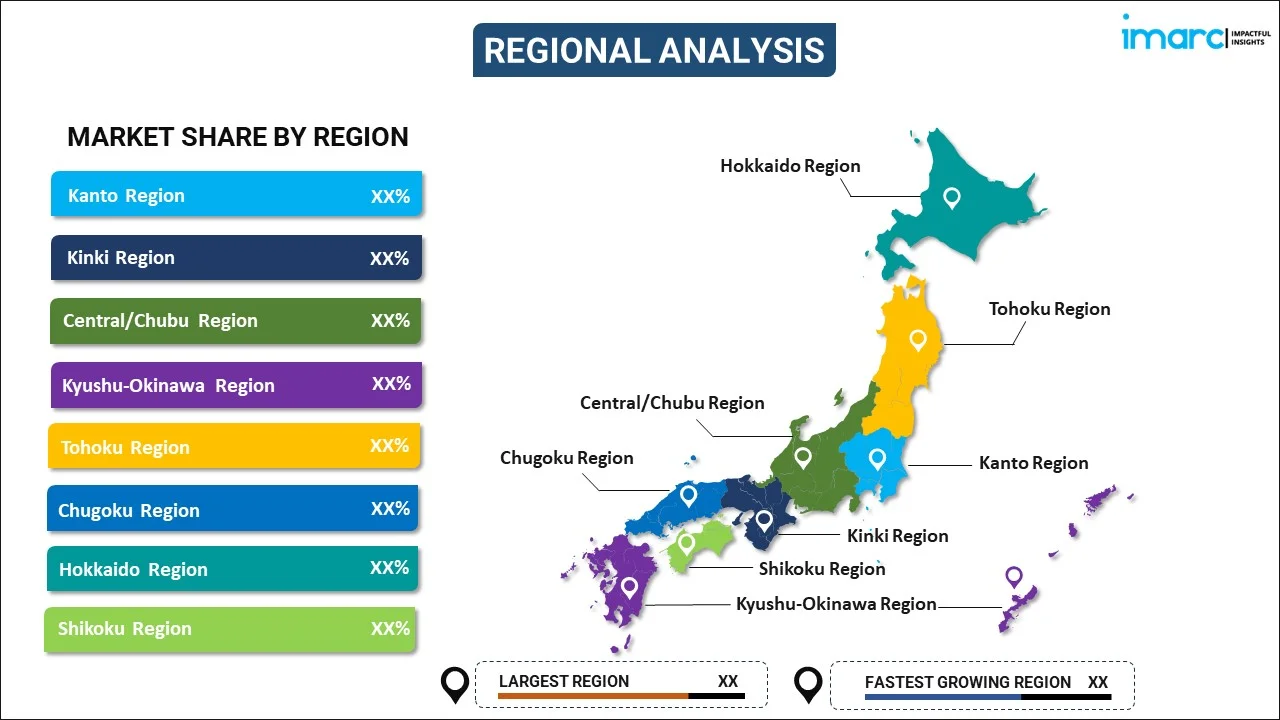

Breakup by Region:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major markets in Japan, which include Kanto, Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku region.

Kanto region, including Tokyo, is one of the most influential market for watches. Being the center of economic and cultural activity, Tokyo influences a considerable amount of consumer spending on luxury and innovative watches. The market for luxury watches in Japan is expected to increase at a compound annual growth rate (CAGR) of 5.6% from 2024 to 2032, as per the IMARC Group. Kanto is a crucial region for brand exposure and market entrance due to the abundant presence of retail outlets, boutique stores, and wealthy clientele, generating high demand.

Kinki region, encompassing Osaka, is a major market characterized by its vibrant economy and high population density. Osaka, famous for its bustling commercial scene and stylish shoppers, plays a key role in driving sales of luxury and mid-priced watches. Many retail stores and a thriving retail environment contribute to the successful market performance in this area.

Chubu region, including Nagoya, serves as an important industrial and commercial center. This area has a wide range of buyers with different preferences, resulting in an equal need for inexpensive, moderately priced, and expensive watches. The prime position and strong economy of the region make it an important market for watchmakers and sellers.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market.

- Major players in the watch market in Japan are using their technological knowledge and strong history to stay ahead in the market. Prominent companies are prioritizing innovation by combining traditional skills with modern technology to cater to a variety of user needs. Increasing focus on sustainability and energy-efficient designs is accompanied by improvements in smartwatch features to meet the demands of technology-savvy individuals. For instance, in May 2024, Casio unveiled the eco-friendly G-SHOCK G-5600SRF, featuring a recycled resin bezel and band, solar charging, and Surfrider Foundation branding, to promote ocean protection. The watch is water-resistant to 200 meters and includes various functionalities like a stopwatch and alarm. These businesses are also improving their online visibility to access a wider range of buyers, all while reinforcing their traditional retail strategies to offer customized user interactions. This strategy helps them stay up-to-date and competitive in a rapidly changing market.

Japan Watch Market News:

- December 2023: Grand Seiko and Watches of Switzerland unveiled three exclusive 62GS timepieces inspired by Jōdogahama Beach's starry skies and featuring distinct dial colors and hi-beat movements.

- August 2023: Casio and Stasto Sand Stones introduced a collection of miniature, non-functional watch rings in various retro designs, available from Japanese gashapon machines.

- October 2023: Minase and Fratello launched the M-3 "Nori," a sophisticated watch a 39mm stainless steel case, available exclusively on Fratello's online shop. This non-limited edition features a modified Sellita SW200-1 movement and a khaki green nubuck strap.

Japan Watch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Kanto, Kinki, Central/ Chubu, Kyushu-Okinawa,Tohoku, Chugoku, Hokkaido, Shikoku, Kanto, Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan watch market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan watch market?

- What is the breakup of the market on the basis of type?

- What is the breakup of the market on the basis of price range?

- What is the breakup of the market on the basis of distribution channel?

- What is the breakup of the market on the basis of end user?

- What are the various stages in the value chain of the Japan watch market?

- What are the key driving factors and challenges in the Japan watch market?

- What is the structure of the Japan watch market, and who are the key players?

- What is the degree of competition in the market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, Japan watch market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan watch market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan watch industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)