Japan Urea Market Report by Grade (Fertilizers Grade, Feed Grade, Technical Grade), Application (Nitrogenous Fertilizer, Stabilizing Agent, Keratolytic, Resin, and Others), End Use Industry (Agriculture, Chemical, Automotive, Medical, and Others), and Region 2026-2034

Market Overview:

Japan urea market size reached USD 3,278.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,060.4 Million by 2034, exhibiting a growth rate (CAGR) of 4.94% during 2026-2034. The increasing demand for agricultural activities due to numerous factors, such as weather conditions, crop prices, and government agricultural policies, coupled with the inflating usage of urea-based fertilizers to enhance crop yields, is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,278.8 Million |

| Market Forecast in 2034 | USD 5,060.4 Million |

| Market Growth Rate 2026-2034 | 4.94% |

Urea is a chemical compound with the formula CO(NH2)2. It is a white, crystalline substance that is highly soluble in water and is found in the urine of mammals, including humans. Urea plays a crucial role in the body's nitrogen metabolism, as it is a waste product of protein metabolism and is excreted through urine. In agriculture, urea is widely used as a nitrogen fertilizer because it provides a concentrated source of nitrogen essential for plant growth. Urea also has various industrial applications. It is used in the manufacture of plastics, resins, and adhesives and as a component in many skincare products, owing to its moisturizing properties. In laboratories, urea is used in biochemical research as a denaturant for proteins and as a buffer in various chemical reactions. Overall, urea has a significant impact on agriculture, biology, and industry due to its versatile properties and roles in different fields.

Japan Urea Market Trends:

The urea market in Japan is influenced by a multitude of factors, and understanding these drivers is crucial for stakeholders. Firstly, the rising regional population and changing dietary habits are propelling the demand for agricultural products, creating a parallel surge in urea consumption. Moreover, the increasing focus on biofuels and renewable energy sources has led to a higher demand for urea in the production of nitrogen-based fertilizers, subsequently driving market growth. Additionally, government initiatives promoting sustainable farming practices and subsidies on fertilizers have further boosted urea sales. Furthermore, the expansion of the automotive industry has significantly contributed to the urea market, as urea is a key component in selective catalytic reduction (SCR) systems used to reduce emissions in diesel engines. Additionally, the industrial sector's reliance on urea for various processes, including the production of adhesives and resins, also plays a pivotal role in shaping market dynamics. This complex interplay of diverse factors is expected to drive the urea market in Japan during the forecast period.

Japan Urea Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on grade, application, and end use industry.

Grade Insights:

- Fertilizers Grade

- Feed Grade

- Technical Grade

The report has provided a detailed breakup and analysis of the market based on the grade. This includes fertilizers grade, feed grade, and technical grade.

Application Insights:

- Nitrogenous Fertilizer

- Stabilizing Agent

- Keratolytic

- Resin

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes nitrogenous fertilizer, stabilizing agent, keratolytic, resin, and others.

End Use Industry Insights:

- Agriculture

- Chemical

- Automotive

- Medical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes agriculture, chemical, automotive, medical, and others.

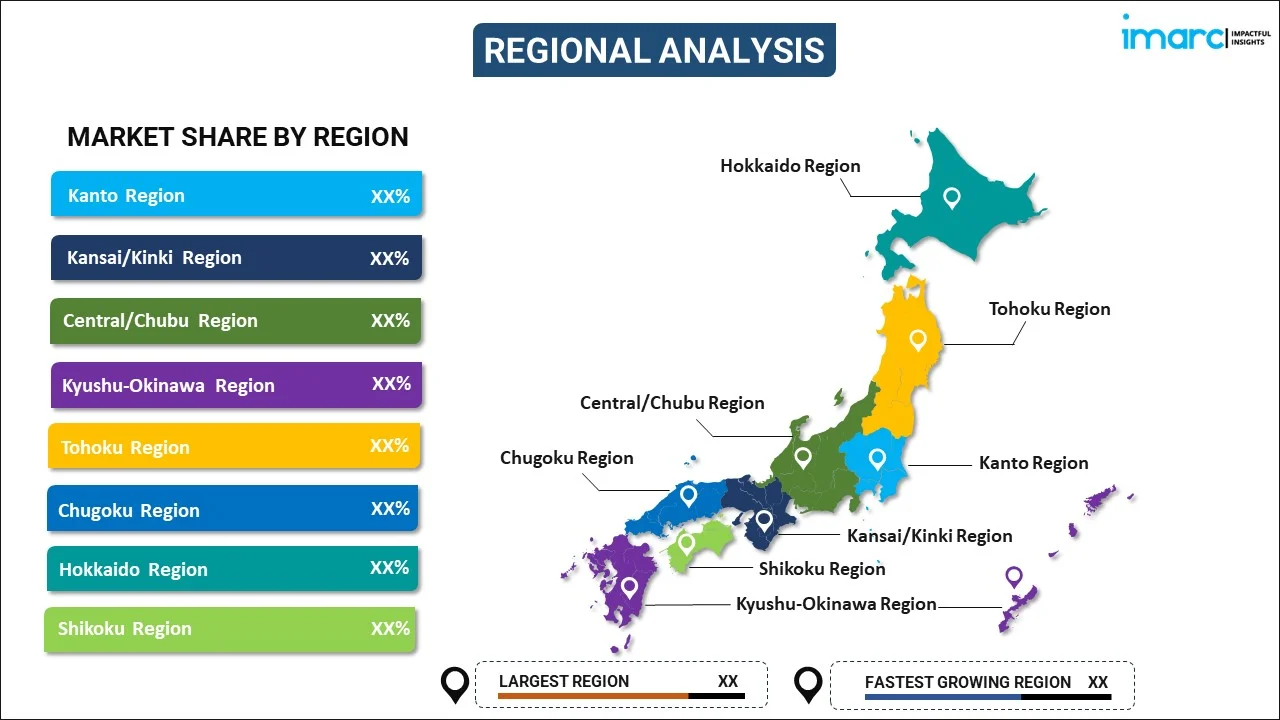

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Urea Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Fertilizers Grade, Feed Grade, Technical Grade |

| Applications Covered | Nitrogenous Fertilizer, Stabilizing Agent, Keratolytic, Resin, Others |

| End Use Industries Covered | Agriculture, Chemical, Automotive, Medical, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan urea market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan urea market?

- What is the breakup of the Japan urea market on the basis of grade?

- What is the breakup of the Japan urea market on the basis of application?

- What is the breakup of the Japan urea market on the basis of end use industry?

- What are the various stages in the value chain of the Japan urea market?

- What are the key driving factors and challenges in the Japan urea?

- What is the structure of the Japan urea market and who are the key players?

- What is the degree of competition in the Japan urea market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan urea market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan urea market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan urea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)