Japan Textile Market Size, Share, and Trends and Forecast by Raw Material, Product, Application, and Region, 2025-2033

Japan Textile Market Size and Share:

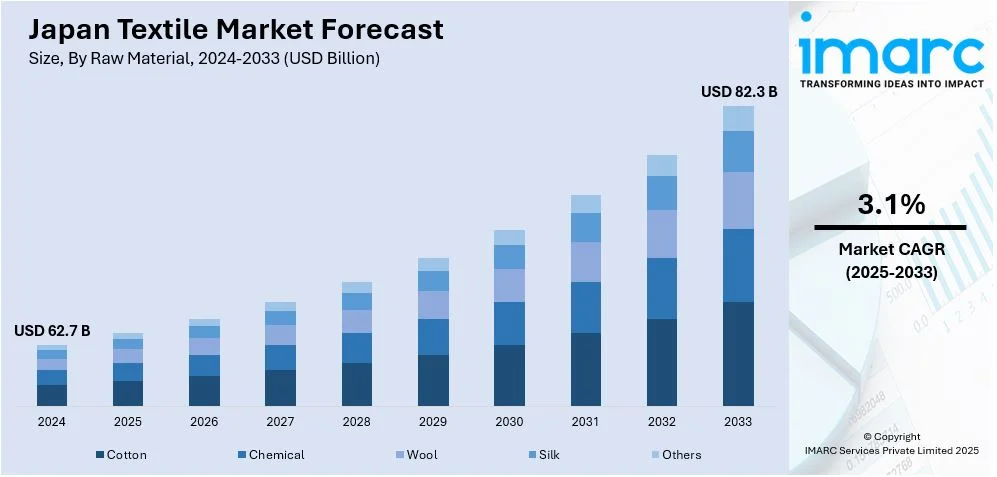

The Japan textile market size was valued at USD 62.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 82.3 Billion by 2033, exhibiting a CAGR of 3.1% from 2025-2033. The market is propelled by the rising demand for sustainable textiles, technological advancements in textile manufacturing, increasing focus on fashion and design innovation, growth in domestic and international textile exports, and shifts in consumer preferences toward high-quality materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 62.7 Billion |

| Market Forecast in 2033 | USD 82.3 Billion |

| Market Growth Rate (2025-2033) | 3.1% |

The Japan textile market share is stimulated by innovation and consumer needs for sustainable and functional textiles. Textile manufacturing advancements such as smart textiles and eco-friendly production methods continue to shape this industry. The strong e-commerce infrastructure also facilitates exports for textile companies to effectively reach international consumers. As per a report published by the IMARC Group, the Japan e-commerce market is projected to reach USD 667.4 Billion by 2032, exhibiting a CAGR of 11.60% during 2024-2032. Besides this, the geriatric population in Japan has created a strong demand for textiles in healthcare applications, such as antimicrobial fabrics and wearable technology, which supports market growth.

Other than this, urbanization and changing lifestyles in the country are driving the Japan textile industry. As individuals are relocating to city centers, demands for fashionable yet functional and space-saving home textiles have increased. According to Worldometers, in 2024, 92.9% of the population of Japan lives in urban areas. In addition to this, demand for clean fabrics with minimalist style has increased and are popularly used in furnishings of homes due to their style appeal. Such changes in lifestyle habits have led to the capitalization of these shifts by manufacturing companies through improved usability in textiles, versatile designs, and multi-functional properties. Thus, such consumption pattern shifts fuel the continued expansion of the textile industry.

Japan Textile Market Trends:

Technological advancements and innovation

Technological innovation is a significant driver of the Japan textile market growth. Manufacturers in Japan have, for many years, led in the technological development of producing textiles, leading to high-performance fabrics and functional textiles. There are also newer materials under development that are becoming very fashionable, such as smart fabrics, which include technology, healthcare applications, sports products, and textile designs for general use. These textiles hold unique features, including moisture-wicking, UV protection, and temperature regulation, as desired by consumers who want multi-functional clothing. The adoption of automation and digital technologies within manufacturing has also resulted in increased productivity and quality improvements in textile manufacturing, enabling Japanese companies to remain competitive globally.

Sustainability and eco-conscious consumer demand

Sustainability is significantly influencing the Japan textile market. Environmental concerns are growing worldwide. As a result, Japanese customers are more mindful of the environmental consequences of the choices they make in purchasing clothes. This change in consumer behavior in Japan has called for more eco-friendly fabrics such as organic cotton, wool, and synthetic fibers that decompose. Japanese companies are responding with sustainable practices such as waste reduction in production, water-efficient technologies, and circular fashion models where the textiles are recycled or reused. The growing need for sustainability in the fashion industry also propels the market toward adopting environmentally conscious business models, from design to manufacturing and distribution, thus further fueling the shift to a greener textile market.

Export opportunities and global market expansion

The textile industry of Japan is also experiencing a rise in export opportunities with a growing global demand for good quality Japanese textiles. Japan has made a mark in the textile market by producing high-quality textiles, particularly silk, denim, and technical textiles. This position makes Japan the number one export-oriented country in terms of textiles worldwide. In addition, the strong e-commerce infrastructure in Japan has helped textile manufacturers reach a wider market. The increase in demand for functional and fashionable textiles worldwide has also contributed to this growth, as Japanese companies are catering to international markets with both traditional and innovative textile products. The high-quality, durable fabrics produced at competitive prices make Japanese textiles very attractive, and, thus, contribute to the growth of the overall market.

Japan Textile Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan textile market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on raw material, product, and application.

Analysis by Raw Material:

- Cotton

- Chemical

- Wool

- Silk

- Others

Cotton remains one of the most important raw materials for the Japan textile market, given its versatility, comfort, and widespread use in clothing and home textiles. Cotton imports to Japan come primarily from major producing countries because the local production is limited. Organic cotton demand has also increased in response to environmental pressure that places importance on green products, encouraging overall expansion.

The chemical category in Japan's textile market is propelled mainly by the rise in demand for synthetic fibers such as polyester, nylon, and acrylic. People use such textiles due to their durability, cost-effectiveness, and easy maintenance. Furthermore, increasing demand for functional textiles such as moisture-wicking or UV-protective materials propels the chemical sector, where more investment in technology and research can be seen.

Wool is one of the vital raw materials used in Japan. Some of the popular garment items in this category are high-quality suits, coats, and knitwear. The country imports fine wool, which is sourced mainly from Australia. Consumers desire wool for textiles as they consider it to be warm, soft, and more of a natural fiber. It also possesses a sustainability aspect, which further cements it as a product in eco-friendly fashion..

Analysis by Product:

- Natural Fibers

- Polyesters

- Nylon

- Others

Natural fibers include cotton, wool, and silk, which hold a significant amount of the Japan textile market share. These hold comfort, breathability, and sustainability. The rising consumer environmental awareness has also led to higher demand for eco-friendly textiles made of these fibers. Furthermore, they are particularly in demand in high fashion and premium home textiles due to their luxurious touch and durability.

Polyester is widely used in the Japan textile market. It is also considered to have durability, easy maintenance, and versatility. Polyester is the most common fiber used in apparel and home textiles, amongst others. It is an economical option, and, thus, largely used in the textile world since it can even be mixed with other fibers. Innovations in recycled polyester and eco-friendly product creation have further enhanced its demand.

Nylon is a key product in the Japanese textile market due to its strength, elasticity, and abrasion resistance. The raw material is frequently used for making activewear and sportswear, besides being applied in various industrial textiles. Rising demand for performance-based textiles, particularly for active and outdoor apparel, continues to grow the nylon segment. Furthermore, lightweight and moisture-wicking characteristics also make it appropriate for technical textiles.

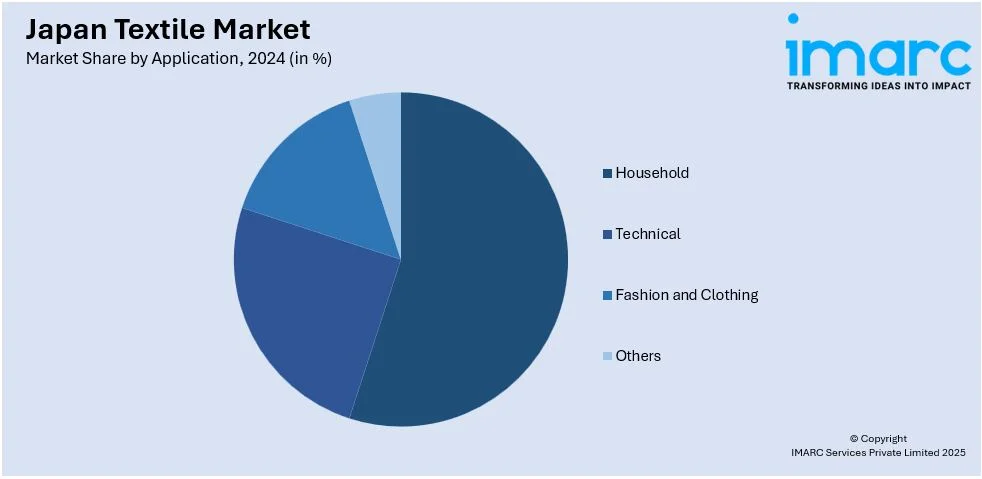

Analysis by Application:

- Household

- Technical

- Fashion and Clothing

- Others

The household segment of the Japan textile market involves products such as bedding, curtains, and upholstery. Japanese consumers desire quality textiles to use at home that would emphasize comfort and beauty. Due to these preferences, there has been an increasing demand for household textiles that are functional and eco-friendly, such as antimicrobial and easy-care materials.

The demand for technical textiles in Japan is currently high because of the specialized requirements for various industries such as healthcare, automotive, and electronics. The technical textiles demand is satisfied using advanced properties such as functional textiles, which include medical textiles, fire-resistant fabrics, and conductive textiles. In comparison with other markets, Japan is highly advanced in technical textile development, particularly in wearable technology and protective clothing.

The clothing and fashion in Japan is considered one of the most substantial markets for the textile industry. Being a highly innovative and fashion-oriented country, both traditional and modern clothing rely extensively on using varieties of fabrics such as luxurious silk and functional synthetic fibers. Consumers desire the best possible style with increasingly environmental-friendly and eco-sensitive products that reflect current global trends.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

The Kanto region, including the metropolitan areas surrounding Tokyo, forms the central hub for Japan's textile industry. In terms of volume, design, and innovation, it leads production because of a huge consumer market and proximity to international markets. The region hosts a highly heterogeneous textile market. It contains more fashion textile enterprises and technical textile companies than others in response to demand both locally and abroad.

The Kinki region, which encompasses Osaka and Kyoto, is famous for its glorious textile heritage, particularly in silk and traditional fabrics. It continues to dominate the market through high-quality, handcrafted textiles and innovations in textile manufacturing. The Kinki region also accommodates several textile exporters, thus making it a vital player in Japan's textile trade.

The Central or Chubu region hosts cities such as Nagoya and is a major force in the Japan textile industry. This region excels in producing industrial and technical textiles. It also has significant manufacturing bases that focus on automobiles, machinery, and electronics, all of which require textile products. Its location between Tokyo and Osaka further fuels the growth of the textile industry, increasing both production and exportation.

Competitive Landscape:

The key players in the Japan textile Market are driving growth through strategic actions. These include major investments by companies into high technologies and smart textiles integrating the Internet of Things and eco-friendly materials in order to comply with the rapidly growing requirements for sustainability. In line with this, leading manufacturers in the textiles space are going toward innovation and designing functional textiles, such as sportswear, healthcare, and fashion. Collaborations between textile companies and fashion brands are improving designs and quality, thus increasing consumer demand. Companies are also strengthening their presence in the international market by exporting high-quality textiles. Further, digital platforms for sales and marketing are also expanding consumer access, further boosting the growth of the industry.

The report provides a comprehensive analysis of the competitive landscape in the Japan textile market with detailed profiles of all major companies.

Latest News and Developments:

- 16 December 2024: Japan’s Hagihara and Mitsui are collaborating to enhance the recycling of blue tarpaulins. For this endeavor, Mitsui Chemicals is developing a technique for distinguishing products manufactured by Hagihara Industries and those produced by other companies while gathering blue tarps for recycling. Mitsui and Hagihara hope to contribute to the development of a circular economy with this partnership.

- 7 December 2024: A group of private companies and local authorities in Japan have created the first toilet paper worldwide utilizing materials such as used diapers. Seven retail outlets in the southern Miyazaki Prefecture and the Osumi district of the Kagoshima Prefecture are providing this recycled toilet paper presently.

- 29 October 2024: Kahei Co., Ltd. has adopted the BioPTMG of the Mitsubishi Chemical Group, a plant-derived polyol containing a biomass content of over 92%, for usage in its bio-synthetic leather goods, such as bags. It will be provided under Triple A Co., Ltd.’s sustainable “tonto” brand. BioPTMG reduces CO2, minimizes petroleum usage, and offers versatility and resilience, which aligns with the environment-conscious goals of Kahei.

- 13 October 2024: A recycled BOPP film that can be mass-produced has been created by Mitsui Chemicals TOPPAN and RM Tohcello. To create this film, the printed film waste of TOPPAN is gathered and transported to the Nagoya Works of Mitsui Chemicals, where the waste is converted into pellets. RM Tohcello then transforms them into film. The recycled film is suitable for use in procedures such as laminating, printing, pouch-making, and packaging.

Japan Textile Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Cotton, Chemical, Wool, Silk, Others |

| Products Covered | Natural Fibers, Polyesters, Nylon, Others |

| Applications Covered | Household, Technical, Fashion and Clothing, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan textile market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan textile market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan textile industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Textile refers to any fabric or material made through weaving, knitting, or felting fibers. It encompasses a wide range of products, from clothing and upholstery to industrial fabrics. Textiles can be made from natural fibers such as cotton and wool, or synthetic fibers such as polyester, offering diverse applications across industries.

The Japan textile market was valued at USD 62.7 Billion in 2024.

IMARC estimates the Japan textile market to exhibit a CAGR of 3.1% during 2025-2033.

The strong domestic manufacturing capabilities, government support for textile innovation, growing interest in functional textiles, expansion of e-commerce in textile sales, and increased investment in eco-friendly production processes are the primary factors driving the Japan textile market.

The textile capital industry in Japan is centered in the city of Kyoto, known for its long-standing tradition of silk production. Kyoto has historically been a hub for high-quality textile manufacturing, particularly in silk weaving, and continues to influence the textile market in Japan through innovation and craftsmanship in both traditional and modern textiles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)